Published

Calculate your budget | How to get a mortgage | Mortgage types | What’s in your mortgage payment | Homeownership costs | FAQ

If you make $36,000 per year, you’ll likely be able to afford a home that costs between $144,000 and $195,000. The exact amount you’ll be able to afford will depend on your debts, credit score, location, down payment, and other variables. For example, you might expect a down payment of around $39,000 and closing costs of around $7,800.

🔑 Key takeaways

- On a $36,000 salary, the total cost of all of your monthly debts shouldn’t exceed $1,080.

- Of that $1,080 budget, you should spend no more than $840 per month on housing costs, including mortgage payments.

- Be sure to factor in additional costs of homeownership to your budget, such as down payment, property taxes, and home insurance.

A great real estate agent can help you find a home within your budget. Find a top local agent and get cash back!

Calculate your budget

Financial experts recommend using the 28/36 rule to calculate your housing budget. This means that you shouldn’t spend more than 28% of your gross monthly income on housing and no more than 36% on total debts.

✍Quick note

Your gross income is the amount you make before taxes or deductions.

To calculate your housing budget, first divide your annual salary by 12 months to get your monthly gross income. Then, multiply your gross monthly income by 0.28 (or 28%).

On $36,000 a year, you shouldn’t spend more than $840 per month on housing. This amount should cover your monthly mortgage payments, HOA fees, property taxes, and other housing-related expenses.

To calculate your budget for total monthly debts, simply multiply your monthly gross income ($3,000) by 0.36 (or 36%).

On a $36,000 annual salary, your total monthly debts shouldn’t exceed $1,080. This is the total amount you should allot for all debts, including your mortgage payments, student loans, car payments, and credit card payments.

This will leave you with $1,920 per month for all other expenses, including food and other costs of living.

🖐 What if I don’t have any debt?

You should still spend just 28% of your monthly income on housing. Buying a home requires years of commitment, and it’s important to have funds for emergencies and unexpected expenses.

Even if you could theoretically afford to spend 50% of your monthly income on housing costs, most lenders wouldn’t approve.

» READ: How Much Should I Spend on a House?

Consider your down payment

The standard amount for a down payment is 20% of the home’s total cost. For example, a 20% down payment for a $195,000 house would be $39,000.

While you’re not required to make a 20% down payment, there are benefits in doing so:

- You won’t have to pay private mortgage insurance (PMI).

- Your monthly mortgage payments will be less expensive.

- You’ll be able to afford a more expensive home.

If you can’t afford a 20% down payment, there are other options:

- Check your local homebuying program. HUD offers local programs and resources that can help make homeownership more affordable, like down payment assistance, tax credits, and more.

- See if you’re eligible for a government-backed FHA, USDA, or VA loan.

FHA and USDA loans might allow you to pay as little as 3.5% down. If you’re a veteran or active service member, VA loans don’t require you to make a down payment at all.

A smaller down payment can be a great option if you want to buy a home sooner rather than later. However, you’ll likely end up paying more interest on your home.

How to get a mortgage

The 28/36 rule, or or the debt-to-income (DTI) ratio, caps your total housing expenses at 28% of your gross monthly income on total housing expenses — and your total debt at 36%. Lenders often use this DTI ratio as a framework to determine a loan amount.

To calculate your DTI ratio, add up all your monthly debts, divide this sum by your gross monthly income, and multiply that total by 100 to get a percentage.

For example, if you make $3,000 per month, and you owe $300 per month for your credit card and car payments, your DTI ratio would equal 10%.

With a DTI ratio higher than 40%, your lender may deny your loan or raise your interest rates. If your current DTI ratio is above 36%, consider waiting to buy a house until you can pay off some of your debts.

Review your credit score

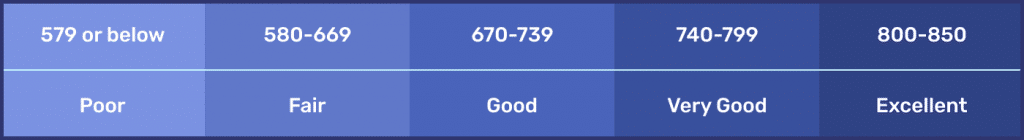

Lenders will look at your credit score to see if you’ve reliably paid off debt in the past. The higher your score, the lower your interest rates will typically be.

For conventional loans, most lenders require credit scores of at least 620.

Credit scores are generally measured by this scale:

If you don’t have the best credit score, some types of mortgages might still work for you.

Choose your mortgage type

| Loan type | Down payment amount | Credit score | Best for... |

|---|---|---|---|

| Conventional fixed-rate loans | 20% | 620+ | Home buyers with an average credit history, who can have the same interest rate for the entire duration of the loan |

| Conventional fixed-rate loans | <20% + PMI | 620+ | Home buyers with an average credit history, who can have the same interest rate for the entire duration of the loan |

| FHA loans | 3.5% + | 580+ | Borrowers with a poor credit history, including first-time buyers and seniors. Lenders may require PMI |

| FHA loans | 10% + | <580 | Borrowers with a poor credit history, including first-time buyers and seniors. Lenders may require PMI |

| VA loans | N/A | 580+ | Veterans and active duty service members, who tend to be offered more competitive interest rates |

| USDA loans | N/A | Varies by lender | Low- or moderate-income buyers in less populated or rural regions, so long as their income doesn't exceed 115% of the median household income for the area |

Exact down payment and credit score requirements will vary by lender.

If you pay less than 20% down, you’ll often have to add private mortgage insurance (PMI) until you have paid off 20% of your home. PMI protects the lender in case you default on your loan, raising your overall costs.

Length of your loan

15-year and 30-year mortgages are most common for home buyers. The loan length you select will affect your monthly mortgage payments and how much interest you’ll pay overall.

For instance, your monthly payments will be higher for a 15-year loan, but you’ll pay significantly less in interest. You would also build equity in your home faster compared with a 30-year mortgage plan.

💡 Quick tip

If your goal is to build equity with a starter home, a 15-year mortgage would be your best option. A 20-year loan is a good middle ground if a 15-year loan is out of reach.

What’s in your mortgage payment

| 🏡 Mortgage = principal + interest + taxes + insurance |

Principal

The principal is the amount of money you still have to pay after you make a down payment on a house. If you make a smaller down payment, paying off your principal will take longer.

Interest

Interest refers to the amount you owe to your lender each month. The average interest rate is about 3%, but rates will depend on your DTI ratio, credit score, and local market factors.

Taxes

Property taxes are generally covered by your monthly mortgage payments through an escrow account. A portion of your monthly loan payment will be deposited into the escrow account to cover property taxes and insurance fees.

The amount you’ll pay will vary by the value of your house and location. For example, the average rate in New York is 1.72% (about $3,300 for a $195,000 house), whereas the average rate in Colorado is just 0.51% (about $1,000).

Insurance

Buyers need to get home insurance in order to qualify for a loan. The cost of home insurance can vary depending on your location, the age and condition of your house, crime rates, and other factors.

Houses in regions prone to earthquakes or hurricanes often have the highest home insurance costs.

Research your location

Your money will stretch further in the Midwest and the Southeast compared with the East or West Coasts. Property taxes and average mortgage interest rates are lower in states like Iowa, Michigan, and Oklahoma, making homeownership more feasible for buyers in these areas.

Even though the U.S. is still largely a seller’s market, some locations offer affordable homes and relatively low ongoing costs.

Additional costs of homeownership

Include these costs in your monthly housing budget to make sure you don’t strain your financial well-being.

Utilities

Your home utilities might include water, heating and cooling, electricity, gas, internet or cable, and trash and recycling. Your realtor might be able to provide you with copies of the current homeowner’s utility bills to help you estimate what your own costs would be.

HOA fees

If your desired neighborhood has an HOA (homeowners association), make sure to budget for monthly fees. Most neighborhoods with HOAs require monthly payments that go toward community amenities, property maintenance, and repairs.

HOA fees average $200 to $300, but they can range anywhere from $100 to $1,000.

Maintenance or repairs

Owning a home requires consistent upkeep, especially if you don’t have an HOA that takes care of maintenance. Start budgeting for homeownership with the 1% rule: save 1% of your home’s total purchase price for ongoing repair costs.

If you purchased a $150,000 home, you should budget a minimum of $1,500 for maintenance.However, you may need to budget more if the house is:

| 🏠 Over 30 years old |

| ⛈ Located in a wet, humid, or stormy climate |

| 🛠 Built with lower-quality materials, like aluminum siding or asphalt shingles |

Frequently asked questions

Can I afford to buy a house on a $36,000 salary?

Yes! If you have a good credit score, live in an area with low property taxes, and have little to no debt, your money will stretch further. For example, you may be able to afford a $190,000 single-family home in Iowa, but only a $145,000 condo in New York. » More

How much should my mortgage cost per month?

Generally speaking, you should spend no more than 28% of your gross monthly income on housing. If you earn $3,000 a month, you can afford to pay $840 per month (28% of $3,000) for your mortgage.

Recommended reading

20 Ways to Save Money When Buying a Home: There are several ways to save when purchasing your house. Learn our top 20 money-saving secrets here!

Do I Need a Real Estate Agent?: Wondering whether or not you should work with an agent during your home search? Check out our guide here to see if it’s the right move for you.

Leave a Reply