Published

🏠🌿 Do cannabis dispensaries lower property values? 🌿🏠

No, property values actually grow faster in cities with dispensaries. In states where recreational cannabis is legal, cities with dispensaries have seen home values rise $67,359 more than cities without them since 2014.

States With Recreational Weed | Biggest Changes in Home Values | Cities With Dispensaries | States With Medical Weed | Cannabis Sales Revenue for 2023 | Tax Revenue and Cannabis | How States Spend Cannabis Money

Buying property in states with legal weed sounds like a half-baked investment strategy. But new research from Real Estate Witch shows it can get your home value high.

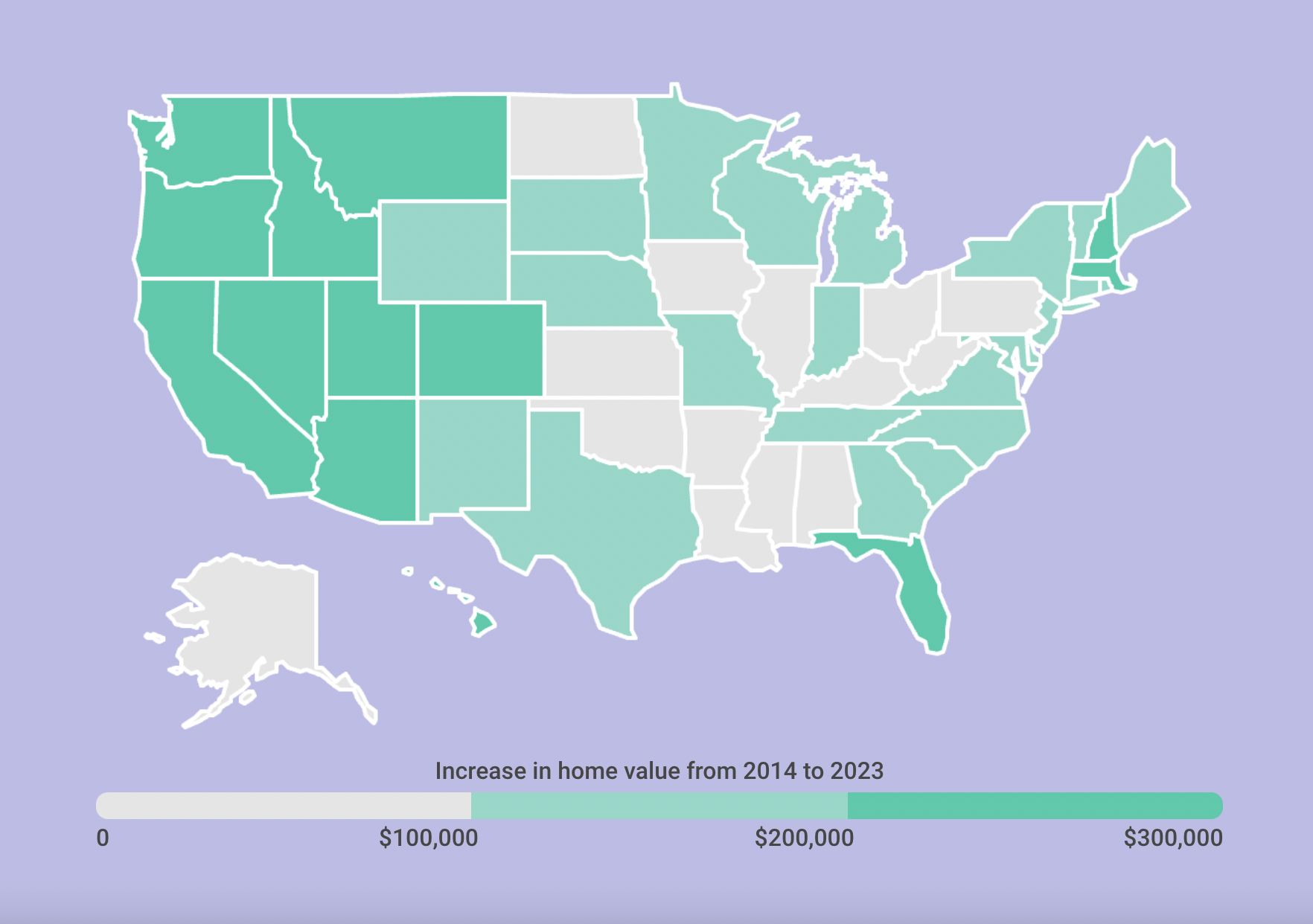

Home values in states with recreational cannabis have outpaced home values in other states by $48,983 over the past decade, according to an analysis of property values from 2014 to 2023.

It’s clear that demand is high for homes in states with legal weed. A majority of Americans who live in states where cannabis is illegal (51%) say they’re considering moving to a legal state, according to a 2022 study.

A rapid rise in property values shows just how eager Americans are to live in cannabis-friendly states. The typical home in a state with legal weed has seen its value appreciate by $185,075 since 2014, compared to $136,092 in states without legalized recreational cannabis.

Today, homes in legal states are worth $122,287 more than homes in states without recreational cannabis.

Those gains in home value appreciation trickle down to the local level as well. Cities with recreational dispensaries report $67,359 higher increases in home values than cities where recreational weed is legal but dispensaries are not available.

Just under half of U.S. states have legalized recreational cannabis — 23 states and Washington, D.C. Medical cannabis is also becoming more popular, with 37 states giving medicinal weed the green light as of October 2023.

To better examine the relationship between cannabis and home values, Real Estate Witch partnered with Leafly, the leading online cannabis discovery marketplace and resource for cannabis consumers. Read on to learn more.

Cannabis and Home Value Statistics 📈

- Home values climbed an average of $48,983 more in states with recreational cannabis, compared to states without recreational cannabis, from 2014 to 2023. Jump to section 👇

- Recreational cannabis is legal in 23 states and Washington, D.C. Those jurisdictions have seen property values rise by $185,075 since 2014, compared to $136,092 in states without recreational cannabis.

- The typical home in a recreational state is worth $417,625 — 41% more than in non-recreational states ($295,338).

- In the past decade, home values increased $67,359 more in cities with recreational dispensaries than in cities where recreational cannabis is legal but dispensaries are not available. 👇

- Cities in recreational states with dispensaries have seen home values grow $168,292 since 2014, compared to $100,933 in cities that don’t have dispensaries.

- Medicinal cannabis is also associated with higher increases in home values. States with medicinal cannabis have seen home values increase $29,289 more than states without medicinal cannabis since 2014. 👇

- States with medicinal cannabis have seen home values climb $166,609 since 2014, compared to $137,320 in other states.

- Today, the typical home in a medicinal weed state is worth 21% more than a home in a non-medicinal state.

- In states with legal recreational cannabis, weed sales are projected to bring about $25 billion in overall sales revenue in 2023 — over $1 billion per legal state. 👇

- Much of that revenue is collected as taxes. In 2022, the 12 states that reported a full year of recreational cannabis tax revenue averaged an additional $307 million per state, totaling $3.7 billion in tax money. 👇

- California alone earned an additional $1.1 billion in tax revenue in 2022.

Home Values Soar in States With Legal Recreational Weed

America’s green wave keeps growing. The cannabis market has been booming since the last time we analyzed the relationship between cannabis and home values in 2021.

Since then, sales of recreational cannabis have started — or have been scheduled to start — in at least 12 more states. Plus, Ohio will vote on legal recreational weed in November, potentially making it the 13th.

States that haven’t legalized recreational cannabis are missing out on a range of economic benefits, with one of the biggest being a rapid appreciation in home values.

From 2014 to 2023, home values climbed an average of $48,983 more in states with recreational cannabis, compared to states without recreational cannabis.

It’s not surprising that states across the U.S. have seen significant increases in property values, given that the value of real estate generally increases over time. But the growing gap between home values in legal and illegal states sticks out like a green thumb.

In states where recreational cannabis is legal, home values have risen by $185,075 since 2014. In the 27 states where recreational cannabis hasn’t been legalized, home values have risen by $136,092 in the same timespan.

The typical home in states with legal recreational cannabis is worth $417,625 in 2023 — 41% more than the typical home in states without recreational weed ($295,338).

Additionally, the gap in property values has widened over the past decade. In 2014, home values in recreational states were worth $73,303 more than homes in non-recreational states. Now, they’re worth $122,287 more.

The table below shows how much average property values have risen in each state over the past decade, according to the Zillow Home Value Index.

| State | Legal Status | Net Home Value Increase Since 2014 | 2014 Typical Home Value | 2023 Typical Home Value | Home Value Increase by Percentage | Recreational Dispensaries | Total Dispensaries |

|---|---|---|---|---|---|---|---|

| Alabama | Medical only | $88,752 | $130,089 | $218,840 | 68% | 0 | 9 |

| Alaska | Recreational legalized | $93,391 | $259,906 | $353,297 | 36% | 165 | 193 |

| Arizona | Recreational legalized | $238,081 | $187,060 | $425,141 | 127% | 203 | 1,355 |

| Arkansas | Medical only | $75,794 | $117,923 | $193,717 | 64% | 0 | 35 |

| California | Recreational legalized | $359,104 | $375,004 | $734,108 | 96% | 754 | 6,484 |

| Colorado | Recreational legalized | $293,032 | $246,011 | $539,044 | 119% | 679 | 1,766 |

| Connecticut | Recreational legalized | $117,935 | $240,508 | $358,443 | 49% | 17 | 44 |

| Delaware | Recreational legalized | $141,477 | $222,586 | $364,063 | 64% | 2 | 16 |

| District of Columbia | Recreational legalized | $182,762 | $438,328 | $621,089 | 42% | 4 | 17 |

| Florida | Medical only | $228,544 | $158,740 | $387,284 | 144% | 0 | 613 |

| Georgia | Medical CBD oil only | $174,842 | $137,680 | $312,522 | 127% | 0 | 22 |

| Hawaii | Medical only | $370,502 | $467,233 | $837,734 | 79% | 0 | 18 |

| Idaho | Illegal | $279,351 | $171,792 | $451,143 | 163% | 0 | 0 |

| Illinois | Recreational legalized | $88,930 | $153,645 | $242,575 | 58% | 162 | 244 |

| Indiana | Medical CBD oil only | $107,639 | $117,382 | $225,021 | 92% | 0 | 3 |

| Iowa | Medical CBD oil only | $78,523 | $127,752 | $206,275 | 61% | 0 | 3 |

| Kansas | Illegal | $91,745 | $120,639 | $212,384 | 76% | 0 | 0 |

| Kentucky | Medical CBD oil only | $84,347 | $107,521 | $191,868 | 78% | 0 | 2 |

| Louisiana | Medical only | $48,062 | $154,245 | $202,307 | 31% | 0 | 17 |

| Maine | Recreational legalized | $183,778 | $183,872 | $367,650 | 100% | 104 | 466 |

| Maryland | Recreational legalized | $132,636 | $262,445 | $395,082 | 51% | 77 | 166 |

| Massachusetts | Recreational legalized | $244,303 | $320,086 | $564,389 | 76% | 303 | 527 |

| Michigan | Recreational legalized | $114,119 | $116,006 | $230,125 | 98% | 478 | 1,505 |

| Minnesota | Recreational legalized | $141,567 | $184,128 | $325,695 | 77% | 2 | 19 |

| Mississippi | Medical only | $65,199 | $110,870 | $176,068 | 59% | 0 | 76 |

| Missouri | Recreational legalized | $104,692 | $126,256 | $230,948 | 83% | 163 | 300 |

| Montana | Recreational legalized | $239,828 | $204,722 | $444,550 | 117% | 189 | 458 |

| Nebraska | Illegal | $110,004 | $134,359 | $244,363 | 82% | 0 | 0 |

| Nevada | Recreational legalized | $241,953 | $183,828 | $425,781 | 132% | 98 | 330 |

| New Hampshire | Medical only | $213,724 | $217,397 | $431,121 | 98% | 0 | 11 |

| New Jersey | Recreational legalized | $180,784 | $285,733 | $466,517 | 63% | 48 | 99 |

| New Mexico | Recreational legalized | $118,901 | $164,601 | $283,503 | 72% | 159 | 392 |

| New York | Recreational legalized | $172,897 | $265,172 | $438,069 | 65% | 120 | 204 |

| North Carolina | Illegal | $160,423 | $153,650 | $314,074 | 104% | 0 | 0 |

| North Dakota | Medical only | $57,264 | $198,590 | $255,854 | 29% | 0 | 11 |

| Ohio | Medical only | $93,878 | $116,019 | $209,897 | 81% | 0 | 125 |

| Oklahoma | Medical only | $81,335 | $112,954 | $194,289 | 72% | 0 | 2,150 |

| Oregon | Recreational legalized | $258,226 | $232,163 | $490,389 | 111% | 369 | 1,416 |

| Pennsylvania | Medical only | $93,776 | $156,552 | $250,328 | 60% | 0 | 203 |

| Rhode Island | Recreational legalized | $192,999 | $221,843 | $414,842 | 87% | 4 | 42 |

| South Carolina | Illegal | $137,647 | $143,950 | $281,596 | 96% | 0 | 0 |

| South Dakota | Medical only | $130,422 | $162,418 | $292,841 | 80% | 0 | 41 |

| Tennessee | Medical CBD oil only | $163,013 | $139,702 | $302,715 | 117% | 0 | 7 |

| Texas | Medical CBD oil only | $156,178 | $146,680 | $302,858 | 106% | 0 | 29 |

| Utah | Medical only | $290,304 | $221,964 | $512,268 | 131% | 0 | 11 |

| Vermont | Recreational legalized | $149,435 | $227,906 | $377,341 | 66% | 41 | 50 |

| Virginia | Recreational legalized | $130,883 | $229,140 | $360,023 | 57% | 2 | 24 |

| Washington | Recreational legalized | $320,091 | $250,239 | $570,330 | 128% | 2,199 | 3,506 |

| West Virginia | Medical only | $51,766 | $102,363 | $154,129 | 51% | 0 | 25 |

| Wisconsin | Medical CBD oil only | $122,805 | $156,194 | $278,999 | 79% | 0 | 7 |

| Wyoming | Illegal | $118,641 | $214,999 | $333,640 | 55% | 0 | 0 |

States With the Biggest Changes in Home Values Since 2014

Of the 10 states with the largest increases in home values since 2014, seven have legalized recreational cannabis. Two others, Hawaii and Utah, have legalized medicinal cannabis.

Only Idaho has no form of legal cannabis of the 10 states with the highest growth in home values.

| Rank | State | Legal Status | Net Home Value Increase Since 2014 | 2014 Typical Home Value | 2023 Typical Home Value |

|---|---|---|---|---|---|

| 1 | Hawaii | Medical only | $370,502 | $467,233 | $837,734 |

| 2 | California | Recreational legalized | $359,104 | $375,004 | $734,108 |

| 3 | Washington | Recreational legalized | $320,091 | $250,239 | $570,330 |

| 4 | Colorado | Recreational legalized | $293,032 | $246,011 | $539,044 |

| 5 | Utah | Medical only | $290,304 | $221,964 | $512,268 |

| 6 | Idaho | Illegal | $279,351 | $171,792 | $451,143 |

| 7 | Oregon | Recreational legalized | $258,226 | $232,163 | $490,389 |

| 8 | Massachusetts | Recreational legalized | $244,303 | $320,086 | $564,389 |

| 9 | Nevada | Recreational legalized | $241,953 | $183,828 | $425,781 |

| 10 | Montana | Recreational legalized | $239,828 | $204,722 | $444,550 |

While states with the largest increases in home values are more likely to allow recreational weed, the inverse is also true. Of the 10 states with the smallest increases in home values, nine have not legalized recreational cannabis.

Louisiana, where cannabis is limited to medical use, has seen the smallest growth in home values since 2014. Illinois is the lone recreational weed state to rank among the bottom 10. There may be other factors at play in that state, as a recent survey from Home Bay found Illinois is the No. 1 state people are moving away from.

| Rank | State | Legal Status | Net Home Value Increase Since 2014 | 2014 Typical Home Value | 2023 Typical Home Value |

|---|---|---|---|---|---|

| 1 | Louisiana | Medical only | $48,062 | $154,245 | $202,307 |

| 2 | West Virginia | Medical only | $51,766 | $102,363 | $154,129 |

| 3 | North Dakota | Medical only | $57,264 | $198,590 | $255,854 |

| 4 | Mississippi | Medical only | $65,199 | $110,870 | $176,068 |

| 5 | Arkansas | Medical only | $75,794 | $117,923 | $193,717 |

| 6 | Iowa | Medical CBD oil only | $78,523 | $127,752 | $206,275 |

| 7 | Oklahoma | Medical only | $81,335 | $112,954 | $194,289 |

| 8 | Kentucky | Medical CBD oil only | $84,347 | $107,521 | $191,868 |

| 9 | Alabama | Medical only | $88,752 | $130,089 | $218,840 |

| 10 | Illinois | Recreational legalized | $88,930 | $153,645 | $242,575 |

Cities With Dispensaries Report Higher Increases in Home Values

There’s a notion that dispensaries hurt property values, but the data shows cities in recreational states that have dispensaries report better home-value growth than cities without dispensaries in legal states.

Since 2014, home values increased $67,359 more in cities with recreational dispensaries, compared to cities where recreational marijuana is legal but dispensaries are not available.

Specifically, cities with recreational dispensaries have seen home values grow $168,292 since 2014, compared to $100,933 in cities that don’t have dispensaries in legal states. That’s great news for homeowners in iconic weed-friendly cities, such as Portland or Denver.

That’s consistent with our previous finding that 69% of Americans say they would buy a home within a 1-mile radius of a cannabis dispensary.

In the past, young adults might have put more weight on living close to bars or clubs. But perceptions about the safety of alcohol compared to cannabis have pulled a 180 in recent decades. The majority of Americans say they consider cannabis safer than tobacco, alcohol, prescription painkillers, and other types of drugs.

States Without Medicinal Cannabis Have the Lowest Home Value Appreciation

Despite the economic benefits of recreational cannabis, some states haven’t given the full go-ahead to ganja, opting to stick with medicinal cannabis.

Overall, 37 states and Washington, D.C., have at least legalized medical cannabis. Those states also have better returns on home values than the 13 illegal states that are passing instead of puffing.

States with medicinal cannabis have seen home values increase $29,289 more than states without medicinal cannabis since 2014. Specifically, those states have seen home values climb an average of $166,609 since 2014, compared to $137,320 in other states.

Today, the typical home in medicinal states is worth $337,360. That’s 21% more than the typical home value in the other 13 states that have not legalized medicinal cannabis ($281,343).

Home values aside, states that move to legalize medical cannabis are tapping into an enormous market. The latest numbers suggest about 4 million Americans use medical cannabis. What’s more, the Marijuana Policy Project says that total is a “significant undercount,” given some states do not have mandatory registries.

Recreational Cannabis Is Projected to Bring in $25 Billion in 2023

The states that have legalized recreational cannabis keep seeing green. The recreational weed market is projected to generate about $25 billion in sales by the end of 2023.

The commodification of cannabis isn’t only generating profit; it may also play a role in keeping unemployment at bay. A report from Leafly found that marijuana supports over 428,000 American jobs. That number has grown at a remarkable rate of at least 27% per year since 2017.

California is projected to reap the most rewards from cannabis sales in 2023, producing a staggering $4.9 billion, according to reporting from Reuters.

Overall, the 10 states expected to earn the highest revenues from cannabis by the end of 2023 are:

- California ($4.9 billion)

- Michigan ($2.7 billion)

- Illinois ($2 billion)

- Massachusetts ($1.78 billion)

- Colorado ($1.6 billion)

- Missouri ($1.56 billion)

- Arizona (1.36 billion)

- Washington state ($1.2 billion)

- Washington, D.C. ($1.2 billion)

- New Jersey ($1.09 billion)

The table below shows projected recreational cannabis sales for each state, ordered by date of legalization.

| State | Start of Recreational Cannabis Sales | Projected Sales in 2023 |

|---|---|---|

| Minnesota | Effective 2025 | N/A |

| Virginia | Effective 2024 | N/A |

| Maryland | July 2023 | $477 million |

| Delaware | April 2023 | $39 million |

| Missouri | February 2023 | $1.56 billion |

| Connecticut | January 2023 | $297 million |

| New York | December 2022 | $391 million |

| Rhode Island | December 2022 | $251 million |

| Vermont | October 2022 | $212 million |

| New Jersey | April 2022 | $1.09 billion |

| New Mexico | April 2022 | $650 million |

| Montana | January 2022 | $346 million |

| Arizona | January 2021 | $1.36 billion |

| Maine | October 2020 | $413 million |

| Illinois | January 2020 | $2 billion |

| Michigan | December 2019 | $2.70 billion |

| Massachusetts | July 2018 | $1.78 billion |

| California | January 2018 | $4.90 billion |

| Nevada | July 2017 | $867 million |

| Alaska | October 2016 | $98 million |

| Oregon | October 2015 | $941 million |

| Washington state | July 2014 | $1.20 billion |

| Washington, D.C. | July 2014 | $1.20 billion |

| Colorado | January 2014 | $1.60 billion |

Generally, the earlier a state legalizes cannabis, the better the results. States that legalized recreational use before 2020 are projected to pull in about $1.7 billion in sales revenue in 2023, compared to about $660 million in states that legalized in 2020 or later.

States With Legal Cannabis Averaged an Additional $307 Million in Cannabis Tax Revenue in 2022

The players in the cannabis industry aren’t the only ones getting high returns. A healthy slice of the money they generate ends up going to states via taxes.

Twelve states had operational weed markets for the duration of 2022. Those states averaged $307 million per state in cannabis tax revenue that year — totaling $3.7 billion.

Again, California leads the way. The Golden State racked up $1.1 billion in tax revenue, the most in the country, followed by Washington state at $511 million. All together, nine of the 12 states that sold recreational cannabis for the full year made over $100 million in revenue.

| Rank | State | 2022 Marijuana Tax Revenue* |

|---|---|---|

| 1 | California | $1,113,465,374 |

| 2 | Washington | $511,123,712 |

| 3 | Illinois | $466,816,883 |

| 4 | Michigan | $341,410,107 |

| 5 | Colorado | $325,103,684 |

| 6 | Arizona | $255,997,918 |

| 7 | Massachusetts | $248,987,059 |

| 8 | Oregon | $170,572,100 |

| 9 | Nevada | $152,334,798 |

| 10 | Montana | $45,734,127 |

| 11 | Alaska | $28,690,918 |

| 12 | Maine | $27,349,661 |

How Legal States Spend Their Cannabis Tax Revenue

Legalizing cannabis is often referred to as a “win-win” because of the benefits that tax revenue from sales can have on local communities.

The funds from legal weed purchases often go toward public programs and policies that aim to improve the quality of life for residents. From there — the theory goes — more people will move to the area, some of whom will pay cannabis taxes, and continue a cycle of civic investment and improvement.

Data on the way states allocate their recreational cannabis tax revenue is open to the public, allowing citizens to see where their tax benefits are flowing.

For example, California reports allocating 60% of revenue to programs that prevent and address substance use among adolescents. The remaining 40% is split in half, set aside for environmental protection and law enforcement.

Across all states, the most popular spending categories include education, infrastructure, law enforcement, and substance abuse treatment — meaning the same dollars spent on weed often go to programs that address more harmful addictions.

The table below shows how states with recreational marijuana markets allocate their money, according to the Tax Policy Center. We’ve also used those allocations to estimate funding for states with available tax data, based on 2022 revenues.

| State | Share | Purpose | Estimated Dollar Amount in 2022 |

|---|---|---|---|

| Alaska | 50% | Recidivism reduction fund | $14,345,459 |

| 25% | Marijuana education and treatment fund | $7,172,730 | |

| 25% | General fund | $7,172,730 | |

| Arizona | 33% | Community colleges (within Smart and Safe Arizona Fund) | $84,479,313 |

| 31.4% | Local law enforcement and fire departments (SSAF) | $80,383,346 | |

| 25.4% | State and local transportation programs (SSAF) | $65,023,471 | |

| 10% | Public health and criminal justice programs (SSAF) | $25,599,792 | |

| 0.2% | Arizona Attorney General, enforcement costs (SSAF) | $511,996 | |

| California | As incurred* | Regulatory and administrative costs | N/A |

| 60% | Youth education, prevention, early intervention, and treatment | $668,079,224 | |

| 20% | Environmental restoration and protection account | $222,693,075 | |

| 20% | State and local government law enforcement account | $222,693,075 | |

| Colorado | 100% | Public school capital construction assistance fund | $325,103,684 |

| Illinois | As incurred | Administrative costs | N/A |

| 35% | General revenue fund | $163,385,909 | |

| 25% | Reinvestment program | $116,704,221 | |

| 20% | Substance abuse prevention and mental health programs | $93,363,377 | |

| 10% | Budget stabilization fund | $46,681,688 | |

| 8% | Transfers to local governments | $37,345,351 | |

| 2% | Drug treatment education campaigns and research | $9,336,338 | |

| Maine | 50% | Law enforcement training programs | $13,674,831 |

| 50% | Public health and safety programs | $13,674,831 | |

| Massachusetts | As incurred* | Administrative costs | N/A |

| Subject to appropriations* | Public and behavioral health | N/A | |

| Public safety | N/A | ||

| Municipal police training | N/A | ||

| Prevention and wellness trust fund | N/A | ||

| Restorative justice, jail diversion, workforce development, and other assistance programs for those impacted by enforcement of marijuana laws | N/A | ||

| Michigan | 35% | K-12 education | $119,493,537 |

| 35% | Repair and maintenance of roads and bridges | $119,493,537 | |

| 15% | Transfers to city governments | $51,211,516 | |

| 15% | Transfers to county governments | $51,211,516 | |

| Montana | Subject to appropriations | Conservation | N/A |

| Substance abuse prevention and treatment | N/A | ||

| Veterans’ services | N/A | ||

| Health care | N/A | ||

| Transfers to local governments | N/A | ||

| General fund | N/A | ||

| Expungement and resentencing of individuals previously convicted of marijuana offenses | N/A | ||

| Nevada | As incurred | Administrative costs | N/A |

| Remainder* | Education programs | N/A | |

| New Jersey | 70% | Impact zone reinvestment | N/A |

| 30% | Administrative costs, law enforcement training, further impact zone investments, general fund | N/A | |

| New Mexico | 2% | Local government transfers | N/A |

| Subject to appropriations | Regulatory costs, tax administration costs, public safety, and expunging past cannabis related offenses | N/A | |

| Remainder | General fund | N/A | |

| New York | 40% | Lottery grants for school districts | N/A |

| 20% | Drug treatment and public education | N/A | |

| 40% | Community grants reinvestment fund | N/A | |

| Oregon | 40% | Schools | $68,228,840 |

| 20% | Drug prevention and treatment and mental health programs | $34,114,420 | |

| 15% | Oregon State Police | $25,585,815 | |

| 5% | Oregon Health Authority | $8,528,605 | |

| 20% | Transfers to local governments | $34,114,420 | |

| Rhode Island | Subject to appropriations | Program administration, revenue collection, and enforcement | N/A |

| Substance use disorder prevention | N/A | ||

| Education and public awareness campaigns, treatment, and recovery support services | N/A | ||

| Public health monitoring, research, data collection, surveillance, law enforcement training and support, and other related uses | N/A | ||

| Vermont | 100% | After school and summer learning programs | N/A |

| Virginia | 40% | Pre-kindergarten programs | N/A |

| 30% | Reinvestment in communities affected by prior drug law enforcement | N/A | |

| 25% | Drug prevention and treatment programs | N/A | |

| 5% | Public health education programs | N/A | |

| Washington | 50% | Basic health | $255,561,856 |

| 31% | General fund | $158,448,351 | |

| 13% | Other | $66,446,083 | |

| 4% | Transfers to local governments | $20,444,948 | |

| 3% | Drug education and prevention | $15,333,711 | |

| Less than 1% | Research | N/A |

Methodology

Data on the number of individual dispensaries comes from Leafly. To determine home values, we used Zillow’s Home Value Index at the state level. For information on legalization across various states and categories (medicinal only versus recreational) we relied on DISA Global Solutions and The Motley Fool. Cannabis tax information was sourced from the Tax Policy Center, while total collected revenue for the 2022 fiscal year was sourced from The Motley Fool. 2023 tax revenue projections and starting years for recreational cannabis sales are from Reuters.

About Real Estate Witch

You shouldn’t need a crystal ball or magical powers to understand real estate. Since 2016, Real Estate Witch has demystified real estate through in-depth guides, honest company reviews, and data-driven research. In 2020, Real Estate Witch was acquired by Clever Real Estate, a free agent-matching service that has helped consumers save more than $160 million on real estate fees. Real Estate Witch’s research has been featured in CNBC, Yahoo! Finance, Chicago Tribune, Black Enterprise, and more.

About Leafly

As the world’s largest cannabis information resource, Leafly helps millions of people discover cannabis each year. Leafly’s powerful tools help shoppers make informed purchasing decisions and empower cannabis businesses to attract and retain loyal customers through advertising and technology services. Learn more at Leafly.com.

More Research From Real Estate Witch

Shocking Real Estate Myths Americans Actually Believe (2023 Data): Buyers paying agent fees, lenders requiring a 20% down payment, and other real estate myths Americans believe in 2023.

What’s Scarier Than a Haunted House? Homeowners Reveal the Frightening Facts (2023 Data): With high home prices and interest rates, ghosts are the least of buyers’ worries. A new survey reveals what’s scarier than a haunted house.

The Best NFL Cities in America (2023 Data): Does your NFL city deserve a spot in the fandom Hall of Fame — or Wall of Shame? We ranked the best NFL cities in America to find out.

Articles You Might Like

7 Best Companies That Buy Houses for Cash: These companies buy houses for cash, helping you sell your home quickly and conveniently — but at a cost!

Offerpad Reviews: See What Real Customers Have to Say: Offerpad promises fast, hassle-free cash offers. How does it compare to Opendoor? Find the truth about this iBuyer’s fees and more!

Discount Real Estate Brokers: Where to Find Savings in 2023: We rank the best discount real estate brokers in every state. Compare fees, services, and savings to learn which company is right for you!

Frequently Asked Questions About Cannabis and Home Values

Do dispensaries lower property value?

No, just the opposite. In recreational states, cities with dispensaries have seen their home values increase $67,359 more than in cities where recreational cannabis is legal but dispensaries are not available. Learn more about cannabis and property values.

Do states that legalize cannabis see increases in property values?

Yes, states that have legalized recreational cannabis have outpaced other states by about $49,000 in home value appreciation over the past decade. Learn more about cannabis and home values.

How much tax money do states make from cannabis?

States that recorded a full year of recreational cannabis sales in 2022 reported an average tax bonus of $307 million per state. Learn more about cannabis and tax revenue.

Leave a Reply