Published

How do agents get paid? | Why do sellers pay? | Can sellers refuse to pay? | What if the house doesn’t sell? | How much realtors make | How to save on commissions

Real estate agents get paid a commission, or a percentage of the home’s final sale price, at the close of a sale.

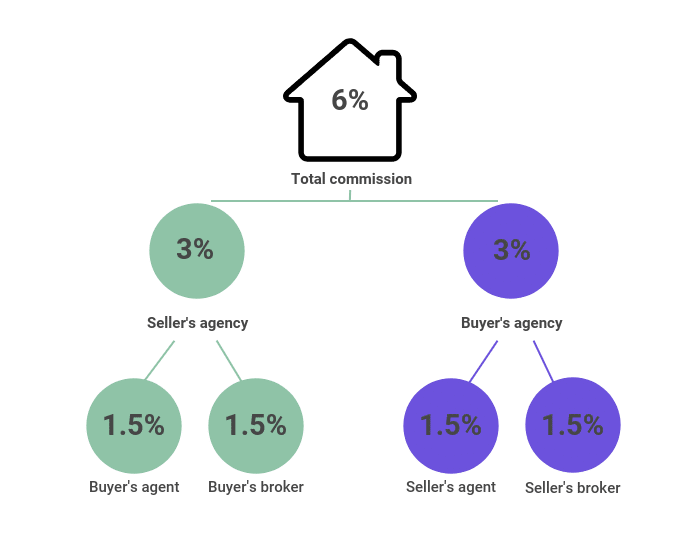

Real estate commission averages 5.49% nationwide and is shared between the seller’s and buyer’s agents. Since agents don’t receive a fixed salary, they only earn money if the property sells.

Sellers are generally responsible for paying these commission fees. But, it’s possible to negotiate realtor fees or shop around for competitive rates, as commission percentages can vary by location.

Concerned about the high costs of selling your home? Real Estate Witch can help. We connect you with premier local agents and offer a special 1.5% listing fee deal with top brokers like RE/MAX and Keller Williams. This exclusive rate provides a significant saving opportunity compared to the national average commission of 2.83%.

How do real estate agents actually get paid?

Realtors earn their commission at the close of a home sale following these three steps:

- Closing process. At the home sale’s closing, the seller’s title company, escrow service, or attorney finalizes the closing statements and issues commission checks to each agent’s brokerages.

- Brokerage payment. These commissions get paid first to the agents’ brokerages. The brokerage then divides the commission and gives part to the agent.

- Commission distribution. The seller’s brokerage handles the distribution of the buyer’s brokerage’s share. After deducting any applicable fees, the remaining commission gets paid to the agents via check or direct ACH deposit into their bank accounts.

This process ensures that realtors get paid for helping complete the home sale.

Also, remember that realtor commission is separate from the closing costs the seller pays. Closing costs, ranging from 1-3% of the sale price, cover expenses such as transfer taxes and attorney fees. Therefore, the total cost to sell a house can exceed 8%.

Why do sellers pay the buyer’s agent commission?

Sellers cover the buyer’s agent commission due to regulations set by the National Association of Realtors (NAR). Its participation agreement mandates that brokers participating in Realtor-affiliated MLS platforms must compensate buyer’s agents.

This rule ensures buyer’s agents are motivated to show their clients the homes listed on the MLS. Given that over 86% of homes sell through the MLS, this practice has become the norm in the real estate industry.

The only exception to this rule occurs when the buyer doesn’t have an agent, which is rare. One industry study found that the vast majority of buyers (89%) engage the services of a buyer’s agent to help navigate the home-buying process.

Can sellers refuse to pay the buyer’s agent?

Refusing to pay a buyer’s agent the agreed-upon commission, especially if this commitment is documented in a written contract or listing agreement, is generally not a good idea. Such refusal can result in breaches of contract and may even lead to potential lawsuits.

Also, offering a competitive fee to the buyer’s agent in a real estate transaction can benefit sellers.

A higher commission, such as 2.5-3%, can entice more realtors to showcase your property to prospective buyers, enhancing your listing’s visibility and potentially increasing the number of property showings.

More showings can lead to more offers and speed up the selling process. However, offering lower compensation (such as a 1-1.5% commission) or none at all may decrease the likelihood of home showings and receiving offers, as it diminishes the incentive for buyer’s agents to present your property to their clients.

Other commission models

Besides the traditional commission structure, there are alternative models through which realtors earn their income:

Desk rent model. Some agents pay their brokerage a fixed “desk rent” rather than a split commission. This arrangement allows them to keep 100% of the commission from each sale while still affiliating with a brokerage that oversees their professional conduct.

Salaried agents. Certain brokerages, like Redfin, offer their agents a base salary complemented by bonuses for each home sold.

This model involves a smaller commission on sales but provides agents with a steady income, mitigating the unpredictability of commission-based earnings.

🏛️ Realtor commission structures may be changing

Significant changes to realtor commission structures might be on the way, sparked by intense debate and legal challenges, particularly targeting the National Association of Realtors (NAR).

In a case from November 2023, NAR, along with prominent real estate firms like HomeServices of America and Keller Williams Realty, were found guilty of coercing sellers into paying high commissions.

This verdict suggests a potential overhaul in how commissions are handled, with a notable shift possibly requiring buyers to cover their agents’ commissions directly.

In anticipation of or response to these legal battles, NAR made a pivotal change in September 2023. It revised its interpretation of the Participation Rule to allow listing brokers to offer $0 commission while remaining compliant with NAR regulations.

Stay tuned for more updates on realtor commission changes.

Do agents earn any money if a home doesn’t sell?

Agents usually don’t earn money if a home doesn’t sell because they work on a commission basis, without a salary from their brokerage, except for those at Redfin.

A standard listing agreement outlines a specific period for selling the home. The agent usually doesn’t receive payment if the sale doesn’t occur within this timeframe. The home seller is also free to list with another brokerage.

However, there are rare exceptions where a client might owe a fee, such as if a buyer withdraws from a signed agreement of sale, or if a seller’s failure to disclose significant defects leads to a sale falling through.

How much do real estate agents make?

Real estate agents earn an average of 5.49% on home sales nationwide, split between the seller’s agent (2.83%) and buyer’s agent (2.66%), according to data from Clever Real Estate. That translates into total commission of nearly $22,000 on a $400,000 home sale.

How do commission splits work?

Commission splits between realtors and their brokerages are a significant part of a realtor’s expenses, akin to how home sellers handle closing costs.

The split isn’t always 50-50; it varies based on the agent’s experience and negotiation with their brokerage. For example, newer agents might see a 30-70 split not in their favor, while seasoned agents could keep 80-90% of their commission, sometimes nearing the full 100%.

So, if a seller’s agent earns a $11,000 commission from a $400,000 sale, a 50/50 agreement with their brokerage means the agent would take home $5,500.

Beyond this split, realtors also face regular expenses, including MLS dues, contributing to their overall cost of doing business.

Can you save on realtor commissions?

Exploring more cost-effective alternatives to a traditional realtor can lead to big savings.

Negotiate realtor fees

One often overlooked strategy is negotiating the commission directly with your realtor. The market’s competitiveness and your home’s desirability can give you leverage in these discussions.

Engaging in negotiation can reduce costs without sacrificing the support and expertise of a professional agent, ensuring a smoother transaction without the full traditional fee.

Unfortunately, most home sellers don’t successfully negotiate a lower rate with their agent. One industry study found that only 2 in 10 home sellers discussed commission rates with their agents and managed to negotiate a reduced fee.

» LEARN: How to negotiate realtor fees in 7 steps

For sale by owner (FSBO)

Opting to sell your home without a realtor eliminates the need to pay a listing agent’s commission, potentially saving significant amounts. This route requires you to handle marketing and paperwork independently, which can be labor-intensive.

To attract buyer’s agents, offering a buyer’s commission of 2-3% is advisable, although this may vary by market.

Utilizing a flat-fee MLS service can list your property on the MLS for a minimal fee, enhancing visibility without the hefty cost of selling with a realtor.

Discount brokers

Discount real estate brokers can be an attractive option for sellers looking to save on listing commissions, offering rates as low as 1-2%. This fee reduction can decrease the overall cost of selling your home.

However, agents working for some discount brokerage firms may juggle a larger client load to compensate for their reduced income, which could result in a less personalized service experience.

Opting for a full-service discount broker is key to ensuring you don’t compromise on service quality while benefiting from lower fees. For example, Clever Real Estate offers sellers a competitive flat 1.5% listing fee.

FAQs about how agents get paid

Who pays for real estate agents?

The seller of the home pays for both their own agent (the listing agent) as well as the buyer’s agent. Agents are paid once the house is sold.

How does commission work?

The average total real estate agent commission on a sale ranges from 5-6% by state and averages 5.49% nationwide. This is split between the buyer’s agent and their broker as well as the listing agent and their broker. The brokers get paid first, and then give the agents their cut.

Do agents get paid if the house doesn't sell?

Not usually. Most listing agreements specify a start date and an end date. If the house doesn't sell within that time frame, the agent doesn't collect commission.

Leave a Reply