Published

Per sale earnings | Annual earnings | Hourly earnings | States with highest earners | How agents get paid | Are commissions negotiable? | How much a broker makes

Real estate agent’s earnings come from commissions, not salaries, and vary based on several factors, including the number of homes sold, average commission rate, and expenses.

Here’s the most recent data on what agents typically earn:

- Per sale. Seller’s agents and buyer’s agents earn an average of $9,793 and $9,205 respectively, from a sale at the national median home price of $346,048. However, these amounts are often shared with their sponsoring broker, reducing their take-home pay.

- Annual salary. The median yearly income for real estate agents is $52,030, or about $25 per hour. According to the U.S. Bureau of Labor Statistics, brokers with additional responsibilities and licensing earn a bit more, with a median of $62,190.

- Hourly wage. The mean hourly wage for all real estate agents is $31.66.

Real estate commissions, traditionally ranging from 5–6% of the home’s sale price and averaging around 5.49% nationwide, are a standard part of selling a home. However, these rates aren’t set in stone, and you can negotiate realtor fees.

Recent court cases have also highlighted real estate commission practices, leading to a $2 billion lawsuit against major real estate firms and the National Association of Realtors (NAR). These events spark discussions on changing commission rules, potentially impacting agent earnings.

👉 Looking for low commission real estate agents near you? Fill out this short form to get matched with top local agents offering a 1.5% listing fee!

How much do real estate agents make per sale?

When selling a home, listing agents charge an average commission of 5.49% of the sale price. This commission is usually shared with the buyer’s agent.

- Seller’s agents. On average, they earn a commission rate of 2.83%, which amounts to $9,793 for a home sold at the U.S. median price.

- Buyer’s agents. They earn an average commission rate of 2.66% per sale, or $9,205.

However, agents don’t keep the entire commission; they share a part with their brokerage.

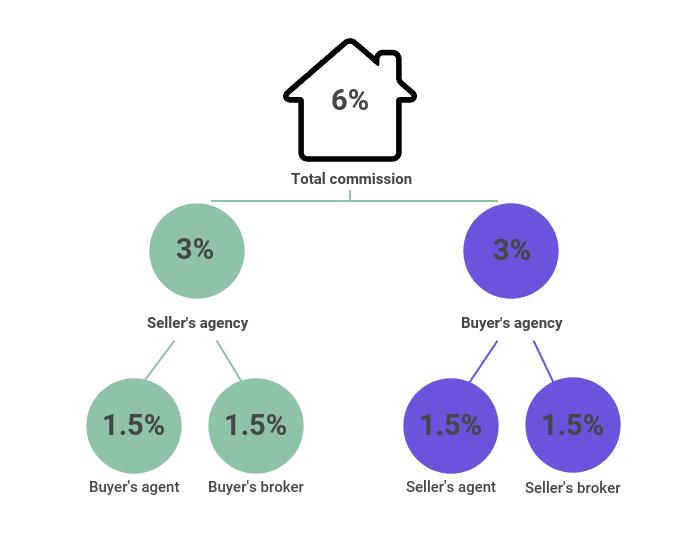

With a common 50/50 real estate commission split between agents and their brokers, the distribution of a typical commission looks like this:

In this scenario, after splitting the commission with their brokerage, each agent would take home $4,853 and $4,561, respectively.

How much do real estate agents make a year?

Have you ever wondered about real estate agent salaries? Here’s a detailed breakdown based on industry data and government statistics to give you a clearer picture.

The average real estate agent is involved in about 12 residential transactions each year. Splitting their efforts evenly between buyers and sellers—6 transactions each—an agent’s annual earnings would be:

- Commission for representing sellers: $29,118

- Commission for representing buyers: $27,366

After deducting the share from their brokerage, an agent makes approximately $56,484 annually, assuming they work with the national average home price and commission rate.

The U.S. Bureau of Labor Statistics provides a slightly different perspective, noting the median annual wage for real estate agents is $52,030. This figure suggests an almost even split, with half of all agents earning above this amount and the other half making less.

A real estate agent must complete approximately 12 transactions yearly to earn the national median income. To break into the top 10% of agents earning $113,200 or more, they must sell about 20 homes.

Also note that real estate agents are usually independent contractors – not salaried workers. So, they usually don’t get the same benefits as those workers do, like health insurance, 401(k), or paid time off.

How much do real estate agents earn per hour?

Real estate agents have a mean hourly wage of $31.66, as reported by the U.S. Bureau of Labor Statistics.

As a buyer or seller, you won’t directly pay for the hours your agent works on your transaction. Instead, agents receive their compensation through commission after a sale is completed. The hourly wage is simply an estimate, offering a perspective on what a realtor might earn, breaking down their total work time into an hourly figure.

How do realtors actually get paid?

Most real estate agents get paid a commission each time they assist a buyer or seller with a sale.

The commission amount — including the percentage to the buyer’s agent — is specified in the listing agreement between the home seller and their listing agent.

When a home sale closes, commissions are deducted from the proceeds and distributed to the buyer’s and seller’s agents’ brokerages through the escrow or title company.

Each broker then disburses the proper share to their agent, according to their agreed-upon commission split, which starts at 50/50 and graduates to 70/30 or better as agents grow their sales numbers.

Real estate agents typically work as independent contractors, not as salaried employees. This means they often don’t receive the same benefits that come with traditional employment, such as health insurance, 401(k) retirement plans, or paid vacation time.

Some agents (like those who work for Redfin) get a base salary from their brokerage and earn a smaller commission from each sale — but most work only on commission.

» LEARN: How real estate agents get paid

How much does a realtor make on a $500,000 sale?

As home prices increase, so do the commissions realtors earn. Here’s a closer look at the potential earnings from a $500,000 home sale, based on average national commission rates:

- Seller’s agent. Before the brokerage split, the commission is $14,150. After dividing with their brokerage, the seller’s agent takes home $7,075.

- Buyer’s agent. It starts with a commission of $13,300, but after the split with their brokerage, it reduces to $6,650.

From such a sale, the total commission paid by the homeowner reaches $27,450. This figure doesn’t account for seller closing costs, which can add 1-3% to the home’s sale price, covering expenses like transfer taxes and attorney fees.

This earnings boost is why focusing on clients with high-priced or luxury homes can benefit realtors. By securing deals within this market segment, they can boost their commission earnings with the same level of effort.

States where real estate agents earn the most

| State | Annual wage |

|---|---|

| District of Columbia | $96,070 |

| New Hampshire | $94,810 |

| New York | $93,950 |

| New Jersey | $82,090 |

| Colorado | $79,610 |

Source: U.S. Bureau of Labor Statistics 2022 Data

In states with a high average final sale price – like New York or Colorado – agents might sell fewer homes annually. Yet they may still surpass the national median income for realtors, thanks to these larger commission checks from higher home prices.

Realtor commission can be negotiated

Most people don’t realize they can negotiate commissions with their real estate agent.

On average, U.S. home sellers spend $18,800 (the equivalent of 5.49% on a typically priced home) on realtor commissions — making them the biggest expenses you’ll pay when selling a home.

However, commission rates aren’t standardized across the industry.

If you’re open to initiating the discussion, there’s a chance your agent may offer you a discount on their commission. Yet, it’s worth noting that a study found that only about 22% of recent home sellers actually talked about commission rates with their agent and successfully negotiated a lower fee.

Fortunately, an alternative to negotiation involves partnering with an agent who offers competitive rates from the start.

Discount real estate brokers are becoming a preferred option for sellers aiming to reduce expenses without sacrificing the quality of service or engaging in negotiations themselves. These brokers provide reduced listing fees, allowing sellers to keep a larger part of their home’s sale price.

How much does a real estate broker make?

Brokers — who complete extra licensing requirements to either work independently or hire other agents under them — earn an average annual salary of $86,930.

In addition to keeping 100% of the commission from their own deals, brokers earn a percentage of the commission brought in by the agents who work for them.

Many brokers split commissions 50/50 with their agents, so if the commission from the sale is 3%, they make 1.5%.

Other brokers may not collect commissions but instead earn a salary for taking on a brokerage’s day-to-day operations and keeping a firm in compliance with state and national real estate laws.

» MORE: Real Estate Agent vs. Real Estate Broker

Methodology

We used publicly available data from the United States Bureau of Labor Statistics to source information about the annual earnings of real estate agents across the country.

The salary information in our customized data tables intentionally excludes real estate brokers. Brokers often act as both agents and brokerage managers, so their earnings are generally higher and their compensation structure includes a salary or a percentage of the brokerage’s overall sales.

Average commission numbers and total take home pay were sourced from Clever Real Estate’s 2024 survey of real estate agents in all 50 states.

Leave a Reply