Published

Xome is an innovative online auction platform for real estate – think Ebay, but for houses.

But if you’re a bargain hunter who thinks you can swoop in at the last moment and get a cheap home for a minimum bid, keep in mind Xome doesn’t provide a “pure” auction process – bids aren’t totally binding, and bid inflation can occur (which we’ll go into in more detail below).

Still, every home seller dreams of a bidding war, and an auction is arguably the best way to make that happen. Xome also provides some significant financial incentives for both buyers and sellers – a zero commission transaction for sellers, and the possibility of a home buyer’s rebate for buyers.

So how well does Xome’s auction platform work?

Read on for a complete rundown of how Xome operates, Xome’s pros and cons, a survey of some real Xome reviews, and a comparison of Xome to their primary competitors.

Table of Contents

- What Is Xome?

- Xome Fees and Pricing

- Xome Pros and Cons

- Xome Reviews (and Complaints)

- Xome Competitors

What Is Xome?

Launched in 2015, Xome’s home office is in the Dallas suburb of Lewisville, Texas, with satellite offices in Seattle, Orange County, Denver, Pittsburgh, and India. Xome aims to provide a complete, start-to-finish real estate experience, offering customers mortgage and title services, marketing help, notary signings, and more.

Xome is known for their auction platform, but they’re more than just a simple real estate auction company.

Xome for Sellers

Let’s take a look at Xome’s standard seller package, the “Super Seller.” This package provides the seller with an MLS listing with coverage on popular real estate sites like Realtor.com, Zillow, and Trulia, and a real estate agent. That agent will handle open houses and showings and guide you through the selling process.

Xome advertises the “Super Seller” package as coming with a 0% fee— but if you read the fine print, this isn’t always the case. We’ll go into that in more detail below.

On top of all that, the seller will have their property posted onto Xome’s auction platform. So while the auction is a big part of the Xome seller experience, it’s really a supplement to a traditional, full service sale experience. So how does it all work?

First, the seller contacts Xome, and submits information about their home.

Xome will contact them within a business day, and once they sign their auction agreements, they get to the pricing.

Xome will ask them to specify two prices: the reserve price, which is the minimum price they’ll accept, and the listing price, which is what Xome will bid up to on the seller’s behalf.

This is what we meant when we said that Xome doesn’t offer a “pure” auction – it’s Xome policy to bid up a seller’s auction behind the scenes. Ostensibly, this is to tap into the competitive nature of the auction, and keep the bids coming, but from a certain perspective, it could be seen as price inflation. To their credit, they’re open about what they’re doing, so it’s not being done dishonestly or secretly.

Once this is done, Xome builds up interest in the property by listing it on the MLS, as well as various real estate sites. They also conduct showings.

When the auction starts, bids come in. Once the auction is over – Xome auctions typically last three to six days – the seller decides if they want to accept the winning bid. This is another unconventional aspect of the Xome auction experience; the bids aren’t binding. That means that if the seller isn’t happy with the final bid, they don’t have to accept it. This is good for sellers, but not so good for bargain hunters hoping to scoop up an underpriced property.

If the seller accepts the bid, they proceed to closing. One notable thing here— the seller doesn’t pay any commission. The buyer pays 5% to cover commissions (Xome requires buyer’s agents to take only 2% commission) and a 1% service fee.

Xome for Buyers

So what’s it like for Xome buyers?

First, Xome buyers have to sign up for an account. When they find a property they like, they either purchase it outright (some Xome properties are sold, via the website, without an auction), or register for the property’s auction.

When a buyer registers for an auction, a $1,000 hold is placed on their bank account or credit card. This hold is released at the end of the auction, if you’re unsuccessful in your bid, or after you submit your earnest money, if you win.

Next, you’ll bid on the property. If you win, and the seller accepts your bid, you’ll receive a purchase agreement via email at the close of the auction. Keep in mind that Xome will add 6% onto the purchase price, for commissions and a service fee.

Once you sign the purchase agreement, you go through closing just as in a conventional sale.

Xome Fees and Pricing

Xome’s seller package was formerly $599, but is now free. That’s a potentially great deal for a full service selling experience— if you can actually secure that 0% commission rate. Xome doesn’t actually guarantee that you won’t pay anything, and their contract explicitly states that “the commission may vary by transaction and through negotiation.”

One Xome customer describes in a Better Business Bureau complaint that towards the end of the deal their Xome agent notified them that they were, in fact, expected to pay agent commissions. Xome sellers should be sure to ask upfront what the commission costs will be once they’ve given their home details.

That being said, in a typical Xome sale, it’s buyers who bear the financial costs. Xome adds a 5% “Buyer’s Premium” onto every winning bid for commission, plus a 1% service fee. In addition, the standard closing costs will have to be paid.

Xome Pros and Cons

Xome’s unconventional auction platform offers some interesting value, but that value comes with some definite drawbacks. Let’s weigh the pros and cons of working with Xome.

Pros for Buyers

Ease

Xome offers an easy online experience that allows you to bid on a home on your computer or smartphone. That alone is a massive advantage from the conventional method, which is essentially a protracted game of phone tag between multiple people.

Potential for Savings

Even though sellers have to approve the winning bid, the auction format does have potential for big savings.

Cons for Buyers

It’s Expensive

In a conventional sale, the seller pays the full 6% real estate commission out of the sale proceeds, but with Xome, the buyer has to pay 6% on top of the sale price. That 6% goes to agent commission, and Xome’s service fee. Buyers should keep that in mind when they’re making their bids; if they win, the price will essentially be marked up 6% right off the bat.

Potential Xome buyers should also pause here and consider that a traditional home purchase costs the same 6%. If they’re getting a great deal— here defined as at least 6% below a reasonable list price— or are simply in love with Xome’s platform, then Xome makes sense. Otherwise, they’d very likely be better served if they purchased a home through the traditional process.

The Card Hold

Having a $1,000 hold on your credit card just to participate in an auction is a pretty significant inconvenience. And if you’re interested in multiple properties, each auction you want to bid on requires a separate $1,000 hold.

Bids Aren’t Binding

Let’s say you and one other buyer are interested in a property. After several days of back-and-forth bidding, you outbid him by a few hundred dollars just before the close of the auction. You won, right?

Well, not necessarily. The seller doesn’t have to accept any bid, so if your maximum bid isn’t high enough for them, they can simply reject it. You’re not just bidding against other buyers, you’re also bidding against what the seller’s expectations are.

Xome Inflates Bids

This is one of the more controversial aspects of Xome’s business model. Xome bids up properties, on the seller’s behalf, to drive up the price. That means that you’re not only bidding against other buyers, you’re bidding against the company itself— whose bids, mind you, aren’t actually real – as they drive the price up towards a predetermined number.

Pros for Sellers

No Commission

Most discount real estate companies offer a reduced commission, but Xome is one of the few that offers zero commission for sellers.

Full Service – for Free

Xome sellers get an MLS listing and a real estate agent to conduct open houses, negotiate the price, and guide them through closing. That’s a full service sale experience, paid for by the buyer.

Auction Format Has Potential for a Bidding War

Anyone who’s ever fixated on an item on Ebay, and ended up bidding way too much because they couldn’t bear to lose, knows that an auction can easily lead to a bidding war.

Cons for Sellers

The 0% Seller Fee Comes With an Asterisk (Literally)

One of Xome’s biggest selling points is that Xome sellers pay nothing, which is the opposite of the traditional setup, in which the seller pays commission to their listing agent and the buyer’s agent.

But Xome’s 0% fee isn’t actually guaranteed. On Xome’s Super Seller homepage, the 0% commission has an asterisk, which takes you to the terms and several pages of fine print. A survey of Xome’s reviews online clearly shows that some sellers have been asked to pay commission, and that Xome’s 0% seller fee depends on local market conditions and negotiations— i.e., if the buyer refuses to pay, the seller might be asked to.

Less Competition Equals Lower Price

If you sell with Xome, your pool of potential buyers is limited to Xome users. Since home price is driven by competition, that means your sale price will likely be lower than it would’ve been if you’d pursued a conventional sale.

Buyers Will Try to Negotiate Down

Buyers always want a lower price, of course, but this downward pressure will be even more pronounced in a Xome sale because they’re paying 5% commission, plus a 1% service fee. Essentially, it’s highly likely they’ll try to recover some of that 6% through price negotiations.

In fact, there are some Better Business Bureau complaints about Xome that specifically mention sellers who ended up getting stuck with paying some or all of the commission, after this was negotiated between the agents. Let’s look at some of those Xome reviews in the next section.

Xome Reviews (and Complaints)

Xome has somewhat mixed reviews online, with a B- grade from the Better Business Bureau, and a rating of 3 out of 5 stars at review site Highya. Let’s survey some real Xome reviews to see if any patterns emerge.

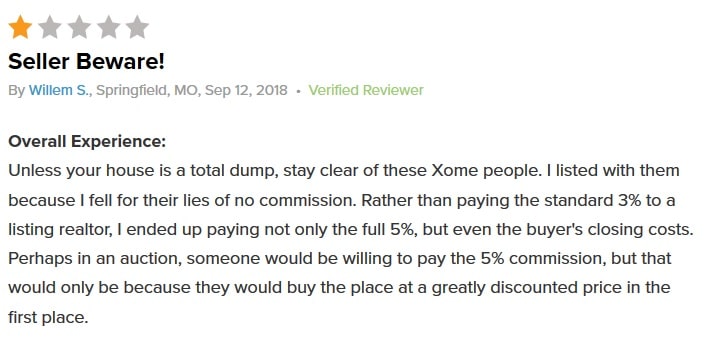

A Seller Gets Stuck with Commission

This negative review from Highya is from a seller who ended up having to pay commission after the buyer successfully negotiated the commission onto the seller’s side of the deal. They also point out a fundamental contradiction in Xome’s business model— that buyers will probably only be willing to pay the commission if they’ve underpaid for the property.

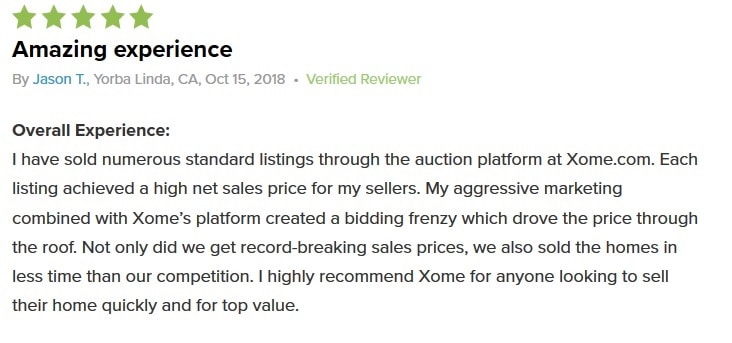

Synergy

This positive review suggests that Xome works best when it’s supplemented by real world marketing efforts. This agent whipped up interest in the property offline, and directed buyers to Xome, where they engaged in a bidding war.

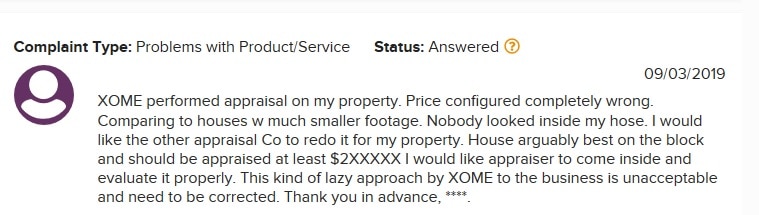

An Unsatisfactory Appraisal

This negative review from the Better Business Bureau claims that their Xome appraiser sorely undervalued their home. While this could be due to any number of factors, one possibility is that Xome’s generalist approach to real estate – the “one stop shop” model – may offer a lower level of quality than a selection of independent specialists.

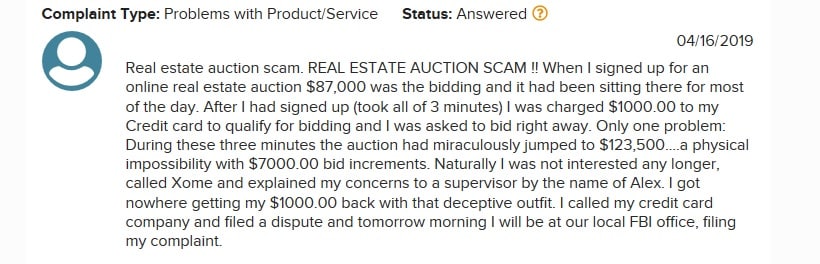

Price Manipulation

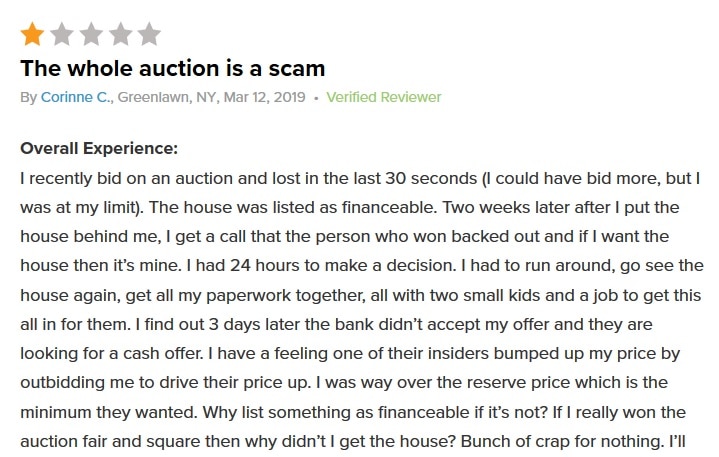

While Xome is fairly open about the fact that they bid up properties on behalf of the seller, it can be off-putting to a buyer when they see it happening right in front of them. This kind of “false bidding” can seem disingenuous or even dishonest, and undercuts the idea of the auction as a pure competition.

Another Clumsy “Ghost Bid”

The experience this bidder describes definitely sounds like a Xome proxy bidder drove the price as high as possible and then turned around and offered the property to the highest maximum bidder. Again, Xome is pretty open about doing this, but in practice, it can seem dishonest.

Xome Competitors

So how does Xome compare to their main competitors? Let’s do a side-by-side with two of their biggest rivals.

Xome vs. Auction.com

Auction.com is a lot like Xome; they provide an online platform where bidders can compete for properties, and require the buyer to pay the commission.

That being said, there are a few crucial differences. First, Auction.com is slightly cheaper than Xome; Auction.com’s transaction fee is 5% or $2,500, whichever is greater, and Xome’s is 6% total. One percent may not sound like a lot, but for a home valued at the U.S. median value of just under $257,000, that comes to $2,570.

Auction.com also has a special focus on foreclosed homes, so if you’re trying to buy a foreclosure, Auction.com probably has the edge there.

When it comes to the problem of underbidding, Auction.com has come up with their own unique, if inelegant, solution. While Xome bids up the properties themselves so that they’re guaranteed to meet their reserve price, reviews on Highya suggest that Auction.com simply ends the auctions if the price doesn’t hit a certain level – essentially “disappearing” those listings.

So with each company, you could end up asking yourself a lot of questions after an auction is over; at Xome, you’ll wonder if the person you were bidding against was actually real, and at Auction.com, you’ll wonder where the listing you were watching disappeared to.

In some sense, both companies present an auction model that tries to insulate the seller from risk. All things being equal, Auction.com should probably have a small edge just for being slightly less expensive.

Xome vs. Clever Real Estate

Xome and Clever Real Estate don’t seem very similar at first; one is an online auction platform, and one matches local agents with sellers. But on a fundamental level, both are offering a more efficient, less expensive real estate experience. So, how do they compare?

For buyers, the answer is obvious. Xome inflates prices and actively bids against their buyers; they also charge them 6% on top of the sale price. On the other hand, a Clever buyer’s agent works for the buyer, never against them, and they’re paid by the seller — meaning that Clever doesn’t add to the buyer’s already significant financial burden. On the contrary, Clever offers qualified buyers cash back (in states where it’s legal).

Clever is the clear favorite for buyers.

It’s a similar comparison for sellers. While Xome offers the possibility of a bidding war to sellers, the reality is that Xome’s small community of bidders makes that bidding war less likely than if the property was exposed to the larger buying public. A Clever agent, on the other hand, is a top-rated local agent with a proven track record. They’ll know exactly how to maximize your home’s appeal, what kind of buyer is likely to be interested in it, and even the best day to put it on the market. Clever doesn’t offer any auctions, but the truth is, they’re much more likely to set off a bidding war, simply because your home will be seen by far more people than it would on Xome’s platform.

The best part is that Clever does it for a low fee: 1.5%. That’s a lot less than you’d pay for a conventional full service sale experience, for a level of exposure that would be very hard to get on a platform like Xome.

Contact Clever today for a free, no obligation consultation!

Recommended Reading

What Companies Offer the Lowest Real Estate Commission Fees?

Almost every real estate company out there claims to offer the lowest fees – but which one offers the best value? Here’s our definitive guide to who actually offers the lowest commission fees.

Everything in a deal is negotiable. But tradition has a huge influence over who pays realtor fees in a typical real estate transaction. Find out who is expected to pay what and how to renegotiate those fees.

How Much Does It Cost to Sell a House?

It takes money to make money, and selling a house is no exception. Here’s our comprehensive guide to how much it costs to sell your home.

Redfin is one of the most influential real estate companies in the U.S., but many people don’t know exactly how they operate. In this definitive guide to Redfin, we demystify the inner workings of a real estate giant.

Leave a Reply