Published

What is a home appraisal? | Do I need an appraisal? | Who does the appraisal? | Appraisal management companies | Different types of home appraisals | Appraisal cost | Appraisal reports | Appraisal inspections | Appraisal vs. CMA | FAQs

An appraisal is a professional valuation of the worth of your home or property. Independent appraisers prepare a written document, which includes a comparison to other homes in the area.

The buyer’s lender will usually require an appraisal for any home sale where the buyer is getting a mortgage. In other words, appraisals are required for most home sales.

A typical home appraisal costs $250–500.

Key takeaways

- The buyer pays for the home appraisal.

- Mortgage lenders hire appraisers.

- Appraisers are independent, licensed third parties.

- A home appraisal is necessary for all government-backed mortgages and most conventional mortgages.

- Cash buyers aren’t required to get an appraisal, though they can if they want to.

💰 SAVE: Find a top agent, get cash back when you buy

What is a home appraisal?

A home appraisal is essentially a detailed breakdown of a property. A licensed appraiser gathers information about a property and values it based on their findings.

Most home appraisals contain the following elements:

Description of the property and surrounding area

The appraiser’s report will include relevant notes about the area around the property. For example: a brief description of amenities (pool, gym clubhouse), the general condition of neighboring houses, etc.

Analysis of comparable properties

The appraisal will contain specific information about similar properties nearby.

For example, if the home being appraised is a four-bedroom, single-family home, the appraisal report will probably contain a brief description of nearby four bedroom homes, including their square footage, lot size, condition, and year built.

Market trends in the area

How the appraiser defines the “area” will depend on the location of the house. If it’s in a large city, the appraiser will probably find enough homes within a mile or two. In a rural area, they may have to pull from homes farther away, or even include the entire town.

Current real estate activity

The appraisal report will note the prices of comparable homes that were bought or sold nearby. Most of the time, appraisers try to keep this information as recent as possible (i.e., in the last three months). In rural areas, though, they may need to go back further.

Almost all home appraisals are given in the form of a written report.

» READ: 20 Ways to Save Money When Buying a Home

Do I need an appraisal?

Most of the time, you’ll need an appraisal whenever you borrow money to purchase or refinance a home. There are a handful of exceptions, but most mortgage lenders require an appraisal for a home sale.

Lenders want to make sure your home’s value is equal to or greater than the amount of money they loan you. They want to avoid the risk of lending you more than they might get for selling the property if you default on the loan.

When I’m buying a new house

Most mortgage lenders require an appraisal when you’re buying a new home. If you have government-backed financing, you’ll definitely need an appraisal. If you have conventional financing, you’ll probably need an appraisal.

You’ll also need an appraisal if you’re buying a home at a discounted price from friends or family (known as a “gift of equity”).

You don’t need to get an appraisal if you’re buying a home with cash, although you can if you want to.

When I’m refinancing

It’s up to your mortgage lender to decide if you need to get an appraisal for a refinance. However, your lender will probably require an appraisal if you want to:

- Stop paying private mortgage insurance (PMI). If your house has appreciated in value since you bought it, you might be able to stop paying PMI. You’ll need to get a new appraisal to remove it, though.

- Take out money against your loan. You’ll need an appraisal for most cash-out refinances or home equity loan applications.

- Get a better interest rate. If interest rates have changed or your home value has increased, you might be able to get a lower interest rate when you refinance. An appraisal will prove to the lender that the home has appreciated.

Read below to see when you might not need an appraisal as a refinancer.

When I’m selling with an agent and want a pre-listing appraisal

A pre-listing appraisal takes place before a home goes on the market. It can allow sellers to set an accurate listing price for their home.

This type of appraisal may be a good idea in a situation where it’s difficult for the agent to perform a comparative market analysis.

| You may want to get a pre-listing appraisal if... | You may not want to get a pre-listing appraisal if... |

|---|---|

| Your home is in a rural area with few comparable homes around. | There are lots of comparable properties around, and it won't be difficult for the realtor to set a listing price. |

| Your home is very different from the surrounding properties (for example, it's much larger or has a different sized lot). | It's a hot market and many homes are selling for over market value. |

| You've done extensive renovations and need to find out the home's new value and square footage | You haven't done extensive renovations. |

While typical appraisals are paid for by the buyer, pre-listing appraisals come out of the seller’s pocket. In most cases, the buyer’s lender will still order their own appraisal, so the seller will simply be out that money.

» MORE: 1% Listing Fees: A Way To Save Thousands Or A Huge Scam?

When you’re selling FSBO (and you want a price evaluation)

If you’re selling your home for sale by owner (FSBO), you may want to get the home appraised to help you set a listing price. Price setting is usually a free service performed by a real estate agent, so FSBO sellers will need to do it on their own.

You can also get a broker price opinion (BPO) from a real estate broker. This is generally a faster process, and less expensive than appraisals at around $50–100. However, not all brokers are willing to do this for FSBO sellers.

» MORE: How to Sell Your House For Sale by Owner in 2021

When don’t I need an appraisal?

In the case of traditional financing, you may not need an appraisal if all of the following conditions are met:

- You’re refinancing an existing loan.

- Your loan is below $400,000.

- Your lender is willing to skip the appraisal.

If the threshold of $400,000 sounds high to you, you’re not wrong! Seventy-two percent of mortgage transactions fall under $400,000, according to The Mortgage Reports.

But most lenders still want you to get an appraisal, because knowing the house’s value protects their interest in your loan. And if your lender isn’t willing to skip the appraisal, you can’t opt out.

In short: Don’t count on skipping the appraisal process.

When you’re buying a home with cash

You don’t need an appraisal if you’re buying a home with cash. This is because you’re not dealing with a mortgage lender. But you might still want to get a home appraised as a cash buyer.

| Reasons to get an appraisal | Reasons not to get an appraisal |

|---|---|

| You can ensure you're not overpaying. | You can close on the home more quickly. |

| You may be able to add an appraisal contingency to your contract. | You may have an edge in a competitive real estate market. |

| You've done extensive renovations and need to find out the home's new value and square footage | You haven't done extensive renovations. |

Getting a home appraised gives lenders reassurance that your home is worth their money. As a cash buyer, you may want the same reassurance.

When you don’t need appraisal as a refinancer

Most lenders require an appraisal when you refinance, but you can skip the appraisal in a few situations.

If you’re refinancing a conventional mortgage, check if your home qualifies for an appraisal waiver.

If you’re refinancing a government-backed mortgage, you may be able to skip the appraisal if:

- You’re refinancing using the same loan type. For example, you bought your home with a VA loan, and you’re refinancing with a VA loan.

- You qualify for an FHA or USDA streamline. You need to already have that type of loan and be current on your mortgage payments to be eligible.

- You qualify for an interest rate reduction refinance loan (IRRRL) through the VA. To be eligible, you must have lived in the home covered by the loan at some point (either you currently live there or you used to in the past).

What is an appraisal waiver?

An appraisal waiver allows buyers to decline an appraisal — usually to close on a home more quickly or to save money.

A home’s eligibility for an appraisal waiver is determined by Fannie Mae requirements. You might be eligible for an appraisal waiver if your home is:

- a one-unit property, such as a condominium

- a principal residence or second home with a loan-to-value ratio below 80%

- in a rural location with a loan-to-value ratio below 97%

- recently constructed with an existing prior appraisal

You may also be eligible if you’re doing a cash-out refinance.

Even if your home is eligible, it’s up to the lender’s discretion whether to offer an appraisal waiver. Lenders usually look at a buyer’s credit score, debt-to-income ratio, and other factors related to the property to determine whether to offer a waiver.

The buyer always has the right to request an appraisal, even if they’re offered a waiver by the lender.

» MORE: How (and Why) to Calculate Your Home Equity

Who does the appraisal?

All appraisers must hold a state license or certification. It’s important for the appraiser to be an objective third party without any interest in the outcome of the real estate transaction. This allows them to create an unbiased opinion on the value of your home.

The appraiser’s job is to make sure all members of the real estate transaction — buyer, seller, and lender — are getting a fair deal.

⚠️ What if the appraiser lives far away?

Some home buyers and homeowners worry that an appraiser from a different geographical area might not have the knowledge or expertise to judge the property.

But the area where the appraiser actually lives isn’t pertinent. The main question is whether the appraiser is competent.

Some appraisers only work in limited areas because their knowledge and access to data is limited to that area. Others work across a larger area, and they are qualified to do so.

In short: Don’t be concerned if your appraiser comes from far away.

If you have reason to suspect that the appraiser isn’t qualified, however, that’s a good reason to raise a concern with your lender.

» LEARN: How Can I Lower My Closing Costs?

What is an appraisal management company (AMC)?

An AMC is a company hired by the mortgage lender to manage the appraisal process. The company manages networks of independent appraisers, acting as a middleman between lenders and appraisers.

While lenders aren’t required to use AMCs, many of them do. Using an AMC allows lenders to ensure appraisers work independently without any influence from the lending company.

A buyer or refinancer shouldn’t notice any difference in the appraisal process if their lender uses an AMC. Appraisers hired through AMCs are still held to the same quality standards and are required to have the same licensing.

Different types of home appraisals

The type of appraisal you get will depend on whether you’re applying for a mortgage or refinancing, or just looking to set a listing price for your home. If you’re buying or refinancing your mortgage, your lender will usually order a full appraisal.

Full appraisal

A full appraisal occurs when the appraiser inspects the entire property, including the surrounding areas (such as the neighborhood, apartment complex, or any comparable properties nearby).

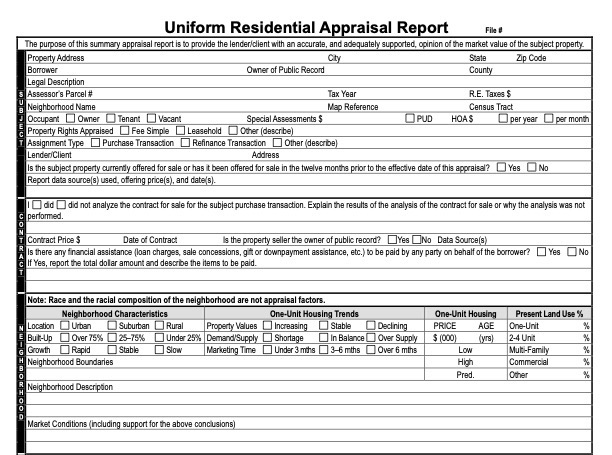

A full appraisal is most commonly used. It’s conducted by a licensed appraiser and may take up to two weeks to complete. It may be referred to as a 1004 appraisal after the form used for the appraisal.

Drive-by or exterior-only appraisal

For a drive-by appraisal, the appraiser only takes pictures of the outside of the home. At $100–150, it’s generally cheaper than a full appraisal.

However, a drive-by appraisal isn’t used very often for mortgages or refinances. It’s normally only used for appraisal reviews or second lien mortgages. It may be referred to as a 2055 appraisal after the form that’s used.

What’s an appraisal review?

An appraisal review is essentially a double-check. If there’s an issue with the first appraisal, the lender may order an appraisal review. That means another appraiser will review the work of the first appraiser.

When would you need an appraisal review? Thankfully, you don’t have to decide – that’s up to the lender.

Appraisals for conventional mortgages must be run through the Uniform Collateral Data Portal (UCDP). On the UCDP, the appraisal report goes through a series of checks, culminating in an overall score. The lower the score, the better the appraisal. If the score is too high, it will trigger an appraisal review — or in some rare cases, a second appraisal.

A poor score (meaning a high score) has nothing to do with the home. It reflects on the appraiser. If the appraiser’s report appears to be inaccurate (due to outdated comps, for example) the lender may order an appraisal review.

Rental analysis appraisal

A rental analysis appraisal is used in addition to a full appraisal for investment properties. The appraiser compares the potential rental income of a home to comparable homes in the area.

This may be referred to as a 1007 appraisal after the form that’s used.

Hybrid appraisal

A hybrid appraisal is similar to a full appraisal, except that the person who visits the property is different from the person who completes the report.

The person who conducts the walk-through doesn’t have to be a licensed appraiser. It might be a different licensed appraiser, or it could be a real estate agent, a property inspector, or a trainee.

Hybrid appraisals are a way of speeding up the appraisal process by freeing up licensed appraisers to spend more time on the report and analysis. It can also allow more accessibility into the appraisal profession, in case an appraiser can’t perform a physical walk-through.

Hybrid appraisals are fairly new and the appraisers who conduct them may not be covered by their insurance companies, so not all appraisers offer them.

Desktop appraisal

This type of appraisal can be done online, often for free. One well-known desktop appraisal is Zillow’s Zestimate tool.

A desktop appraisal can be a good tool for sellers and real estate agents when determining a listing price. However, it’s rarely accepted by mortgage lenders as it’s not a traditional appraisal.

» MORE: Redfin vs. Zillow: Estimators, Listing Portal & Agents

Broker price opinion (BPO)

A BPO is when a licensed broker gives their professional opinion on the value of a home. BPOs can be used to set a listing price, and they’re often used to support canceling mortgage insurance for a home loan.

However, a BPO can’t be used as a replacement for a traditional home appraisal.

🚨 Note on BPOs

BPOs and automated valuation model (AVM) appraisals can’t be used on their own as a replacement for home appraisals because they’re not USPAP compliant. They’re often used to set a listing price for a home.

Automated valuation model (AVM) appraisal

An AVM is a type of appraisal that pulls from data and advanced analytics to create an estimate of a property’s value. The AVM may take into account factors such as:

- Tax records

- Sales history

- Comparable homes in the area

- Historical data on the price of the home

- Number of bedrooms and bathrooms

- Large renovations

An AVM takes the job typically done by a human and uses machine learning/computer technology to create a sophisticated valuation.

Pros and cons of AVM appraisals

| Pros | Cons |

|---|---|

| Objectivity and lack of human bias | Can't account for the physical appearance of a home |

| Better accuracy because they use a large amount of data | Data might be incomplete or unreliable |

| Speed. An AVM can generate an estimate in a few seconds, while a full appraisal may take up to two weeks. | Might pull from transactional data that's 3–6 months old, which can make a big difference considering how quickly the real estate market can change |

AVMs aren’t a replacement for appraisals just yet. Your lender or appraiser may use an AVM to inform their appraisal. But because of their drawbacks, AVMs haven’t evolved enough to completely replace the human element.

» MORE: The Most Accurate Home Value Websites (2021 Report)

Average home appraisal cost

A typical home appraisal costs $250–$500, paid by the borrower. Unfortunately, you can’t shop around for an appraiser because they’re hired by your mortgage lender.

💡 Appraisal fee

What the buyer pays their mortgage lender so the lender can hire a licensed appraiser.

Who pays for an appraisal?

The borrower (meaning the buyer or refinancer) pays for the appraisal. However, the mortgage lender is considered the appraiser’s client.

Federal banking regulations stipulate that the lender (or financial institution) must be the appraiser’s client, even though the borrower pays the fee. This protects the independence of the appraisers.

The FDIC outlines strict rules that prohibit the individuals who are involved in selecting the appraiser from being involved in reviewing the appraisal. In other words, if someone on the loan staff chooses an appraiser, that person can’t also review the loan.

❗ Your right to a FREE copy of your appraisal

As a buyer or refinancer, you have the right to receive a copy of all appraisals from your lender without paying an additional fee. This is thanks to the Equal Credit Opportunity Act (ECOA), which entitles a homebuyer to receive a free copy of all home appraisals and any written valuations on a property.

Factors that affect costs

The type of appraisal you get will affect the cost. For example, a full appraisal ($250–500) costs more than a drive-by appraisal ($100–150).

If you’re in a hurry to close the appraiser may ask for a rush fee, which could dramatically increase the price. Rush fees can range from $200–1,000 or even more, depending on market conditions and the availability of appraisers in your area.

Appraisal costs for government-backed loans

Government loan appraisals require additional inspections, because these loans take into account the condition of the property.

If you have an FHA loan, most problems with the property will need to be repaired before closing. For FHA and USDA loans, appraisers must perform certain inspections according to HUD guidelines. For example, they’ll need to check:

- The state of the foundation and roof

- Wiring and electrical systems

- Utility hookups

- Insect infestations

- Health or safety hazards

If you have a VA loan, the VA will order the appraisal. Just like for FHA loans, extra inspections are required and you may need to address repairs before closing. VA inspectors may check:

- Electrical, mechanical, and heating systems

- Condition of the roof

- Any foundation problems, such as cracks or leaks

After the appraisal, a licensed VA reviewer will review the appraisal and issue a Notice of Value (NOV). The lender will then use the NOV to determine your loan amount.

The NOV may also include repairs that need to be addressed before closing.

Can I save money on the appraisal?

There isn’t much you can do as a buyer to save money on your appraisal. Your mortgage lender hires the appraiser, so you can’t shop around for the best quote.

What is an appraisal report?

An appraisal report contains a detailed list of the property’s features and attributes, comparable homes in the area, and any lender-specific requirements.

According to regulations by the Consumer Financial Protection Bureau, lenders must provide borrowers with a copy of the appraisal report three or more days before closing.

💡 A note on appraisal reports

Appraisals are usually provided as a written report. In rare cases, however, the report may be given orally, such as when:

- A party does not want the other party to find a written valuation during a divorce proceeding

- A client doesn’t need an official appraisal, and they’re just looking for a ballpark estimate

- An attorney has hired an appraiser for a client and just wants an oral report to decide if they want to move forward with a full, written report

An appraisal report typically includes:

- Details about the property, including the address, square footage, acreage, number of stories and units

- HOA fees, if applicable

- Price trends in the neighborhood

- What type of utilities are accessible

- Condition of the home, such as the home’s style, appliances, foundation issues, and year it was built

- The appraiser’s opinion of the market value of the home

While there’s no single standardized appraisal report, all reports are required to comply with the Uniform Standards of Professional Appraisal Practice (USPAP).

❓ What if the appraisal comes in low?

If the appraisal comes in lower than the buyer’s offer, the lender likely will not approve the buyer for the entire amount. The buyer will have to renegotiate the offer with the seller or pay the difference out of pocket.

» LEARN MORE: How Do Appraisals Work? What You NEED to Know

What is an appraisal gap?

An appraisal gap is the difference between the appraised value of a home and the buyer’s offer. In hot real estate markets (when it’s a seller’s market), an appraisal gap can be written into a buyer’s offer as an appraisal gap guarantee clause.

💡 Appraisal gap guarantee clause

A clause that requires the buyer to cover the gap between the appraised value of the home and the contract offer.

An appraisal gap guarantee clause can make an offer more attractive, especially in a competitive market. It reassures the seller that the offer will still go through even if the appraised value comes back lower than the offer.

What is an appraisal contingency?

An appraisal contingency allows a buyer to walk away from a deal if the home appraises below the purchase price.

Let’s say Daniel has made an offer of $280,000 on a home, but the home appraises for $220,000. Now, Daniel’s bank may not approve him for a large enough mortgage loan, since his offer is higher than the value of the home. With an appraisal contingency, Daniel can back out of the offer.

Usually a number of contingencies are involved when a buyer and seller sign a real estate contract. According to a study by the National Association of Realtors, 46% of contracts feature appraisal contingencies.

» MORE: What is Earnest Money and the Good Faith Deposit?

What is an appraisal inspection?

Appraisals and home inspections are often believed to be the same, but they are different things performed by different professionals.

There’s actually no such thing as an appraisal inspection. During an appraisal, the appraiser walks through the home to complete their report. But this walk-through isn’t considered an inspection, because it’s not as extensive as the one required for a home inspection.

If you have an FHA, VA, or USDA loan, the appraiser may be required to do a more in-depth inspection.

» MORE: How to Negotiate After a Home Inspection and Win

The difference between an appraisal and a home inspection

| Appraisal | Home inspection | |

|---|---|---|

| What it is: | An analysis of a home's value | An evaluation of specific features of the home |

| Who does it: | A licensed appraiser | A licensed home inspector |

| Who pays: | The home buyer | Usually the home buyer, though this can be negotiated |

| What it involves: | Market analysis, and often a brief walk-through to assess the general condition and features of the home | An in-depth walk-through of the home by a licensed home inspector (2-4 hours), followed by a detailed home inspection report |

» MORE: How Much Does a Home Inspection Cost?

Appraisal vs. comparative market analysis (CMA)

CMAs share some similarities with appraisals, but they involve different processes. A CMA helps the realtor to determine the right listing price for a home. Usually, it’s performed by the seller’s real estate agent. Learn more about CMAs in real estate.

| Appraisal | CMA |

|---|---|

| Performed by a licensed appraiser | Performed by a real estate agent |

| Used by the lender to determine the value of a home | Used by the seller/real estate agent to create the best listing price for a home |

| Paid for by the buyer | Usually a free service provided by real estate agents |

| Created based on extensive market research and a brief walk-through | Created by looking at comparable, recently sold properties |

Some factors that go into an appraisal include:

| Some factors that go into a CMA include:

|

Frequently asked questions about appraisals

What is an appraisal?

An appraisal is an objective report prepared by a licensed professional that determines the value of your home or property. Most home buyers are required to get an appraisal before closing on a home.

How much does a home appraisal cost?

A home appraisal usually costs $250–500. The home buyer or refinancer pays the cost of the appraisal. The actual cost of your appraisal may depend on the type of appraisal you need.

What is an appraisal contingency?

An appraisal contingency is a clause written into a real estate contract stating that the buyer can walk away from the deal if the appraisal is below the purchase price.

For example, if a buyer offers $300,000 on a home, an appraisal contingency would allow them to walk away if the appraisal comes back below $300,000.

Related reading

Seller Closing Costs: Here’s Everything You Need to Know: Learn how much sellers can expect to pay in closing costs on their home.

Here’s How to Get a Home Buyer Rebate (And Save Thousands): A home buyer rebate is when a real estate agent gives the buyer some of their commission fee. Learn the pros and cons of accepting a buyer rebate.

How Much Do Realtor Fees REALLY Cost? Realtor fees differ from state to state. This article covers how much you can expect to pay in realtor fees, whether you’re a buyer or seller.

Leave a Reply