Published

What’s included in the report? | Example CMA report | How to get a free CMA | How to do a CMA yourself

What is a comparative market analysis in real estate?

A comparative market analysis (CMA) gives a home value estimate based on recent sales of similar properties in the area. It’s typically completed by a real estate professional using property data from the multiple listing service (MLS).

A CMA report is one of the most valuable tools in the home sale process.

- It gives sellers an idea of their home’s fair market value to help them set a listing price.

- It helps buyers determine a fair and competitive offer on a home.

To create a CMA and determine a fair list price, a real estate agent compares a home to recently sold properties and current listings that are similar in size, location, and construction type. They compare factors like number of bedrooms and bathrooms, square footage, lot size, age, condition, desirable features and upgrades, and neighborhood amenities.

You can get a rough estimate of a home’s value without an agent by using a popular real estate website like Zillow, but the numbers won’t be as accurate as a CMA.

A local real estate professional has access to more property data from the MLS, leading to a more thorough and trustworthy analysis.

» Get a free, no-obligation CMA from a top local realtor

What’s included in a CMA report?

A well-prepared CMA report should include:

- A description of the property being valued, including any notable selling points like the quality of finishes, recent upgrades, and other considerations that might impact its value (e.g., a corner lot or a new HVAC unit)

- A summary of the property’s technical features, including its address, number of bedrooms and bathrooms, square footage, lot size, and year built

- Active and pending listings of comparable properties

- How much similar homes have sold for recently (low, average, median, and high sale prices)

- How long it took each home to sell after listing (i.e., “days on market”)

- Each home’s final sale price vs. its initial listing price

- Which concessions (if any) each seller made, such as paying for the buyer’s closing costs or a home warranty

A realtor’s selection criteria for comps may vary based on the type of property they’re valuing. But generally, they try to include properties that are the same size, are in the same neighborhood, and have sold recently.

Realtors may have to look outside the neighborhood for properties that are comparable to a home with special features. These features can include an ocean view, an extra-large lot, or a rare architectural style.

In addition to data, a realtor may include their opinion about the property’s value, including anything that could make the home attract a different price than others in the area. They may also add notes on market conditions and trends that could affect their pricing recommendation.

How an agent does a comparative market analysis

To develop a high-quality CMA report, an agent performs a detailed analysis of the property and the local real estate market.

Pricing a home too low leaves a lot of money on the table for the seller, and pricing too high could make the property harder to sell. Here’s the steps an agent takes to price a property fairly and competitively.

1. Assess the subject property

An agent first considers the subject property, including it location and the real estate market in that area. Apart from the house itself, the characteristics of the immediate and surrounding neighborhood can add or detract from the property value.

For example, a home located in a neighborhood with coffee shops, parks, and grocery stores may be more valuable than a home without these amenities nearby.

Similarly, a highly-rated school in town can increase home prices in surrounding neighborhoods. Proximity to a commercial construction site or industrial part of town can drive home prices down.

2. Analyze comps

Once an agent has noted the features the original property, they’ll gather a list of similar properties, called “comps,” that have recently sold or been listed nearby. To draw an accurate price comparison, the agent will look for properties that closely match the subject based on the following:

- Location: The realtor finds the address of each comparable home and its distance from the subject property (in miles).

- Status and date of sale: They note the current status of each home (active, pending, or closed) and the date of each home sale. Usually, CMAs include active listings and homes that have sold in the past three months.

- Property age and condition: The realtor adds when each property was built and a brief description of its current condition (poor, average, or good).

- Interior square footage: They include garages or any add-ons, with value adjustments based on their size.

- Lot size: They use tax records to find the approximate acreage or lot size of each property.

- Upgrades, amenities, and special features: These features can include a kitchen upgrade, in-ground pool, finished basement, storm shelter, or garage.

Ideally, comps are pulled from the same neighborhood. If that isn’t possible, an agent will pick comps from areas with similar qualities or adjust for major differences between the comps and the subject property.

| Subject property | Comparable property 1 | Comparable property 2 | Comparable property 3 | |

|---|---|---|---|---|

| Distance from subject in miles | 0.8 | 1.7 | 1.1 | |

| List price | $225,000 | $200,000 | $225,000 | |

| Original list price | $225,000 | $200,000 | $225,000 | |

| Sold price | $250,000 | $215,000 | $234,000 | |

| Status | Closed | Closed | Closed | |

| Days on market | 3 | 6 | 2 | |

| Adjustments (+/–) | ||||

| # of bedrooms | 2 | 2 | 2 | 2 |

| # of baths | 1 | 2 | 1 | 1 |

| Total square feet | 1,150 | 1,156 | 1,272 | 1,080 |

| Lot size dimensions | 60 x 190 | 251 x 94 | 127 x 257 | 48 x 148 |

| Approx. acres | 0.3 | 0.3 | 0.7 | 0.2 |

| Year built | 1935 | 2004 | 1930 | 1922 |

| Total adjustments | +$30,100 | |||

| Adjusted price | $235,118 | $250,000 | $245,100 | $234,000 |

3. Adjust for differences

When looking at the differences between the subject and comparable properties, an agent will make pricing adjustments based on each property’s location, quality of finishes, recent upgrades, number of rooms, lot size, and any other factors that might influence the value of a home. The comp’s final adjusted price essentially shows what it would be valued at were it situated in the same location as the subject property.

| List price | Days on market | Sold price | Total adjustments | Adjusted price | |

|---|---|---|---|---|---|

| Property 1 | $225,000 | 3 | $250,000 | — | $250,000 |

| Property 2 | $240,000 | 0 | $245,000 | — | $245,000 |

| Property 3 | $225,000 | 2 | $234,000 | — | $234,000 |

| Property 4 | $215,000 | 2 | $226,000 | — | $226,000 |

| Property 5 | $219,900 | 14 | $220,000 | $16,000 | $236,000 |

| Property 6 | $225,000 | 7 | $215,000 | $8,600 | $223,600 |

| Property 7 | $195,000 | 5 | $215,000 | $12,900 | $227,900 |

| Property 8 | $200,000 | 6 | $215,000 | $30,100 | $245,100 |

| Property 9 | $185,000 | 1 | $215,000 | $8,600 | $223,600 |

| Property 10 | $199,000 | 6 | $210,000 | $33,600 | $243,600 |

| Property 11 | $208,000 | 1 | $208,000 | $23,500 | $231,500 |

4. Offer pricing analysis and recommendations

The pricing analysis typically includes a summary of closed listings with notes on price adjustments. After adjusting for differences, a realtor will offer a pricing recommendation based on the adjusted low, average, median, and high sold prices of the chosen comps. The goal is to give buyers or sellers a sense of what a fair, competitive list or offer price would be based on similar recent home sales.

The pricing recommendation is generally presented as a range, which enables sellers and buyers to adjust their list or offer price depending on their goals.

For example, motivated sellers may price at the lower end of the range to drive interest in their property and close quickly. In a competitive market, a buyer may make an offer toward the higher end of the range to give them the best chance of securing the property.

| 1 | 2 |

|---|---|

| Low | $228,064 |

| High | $242,172 |

| Recommended | $235,118 |

Example CMA report

Here’s a visual example of the information agents include in a CMA report.

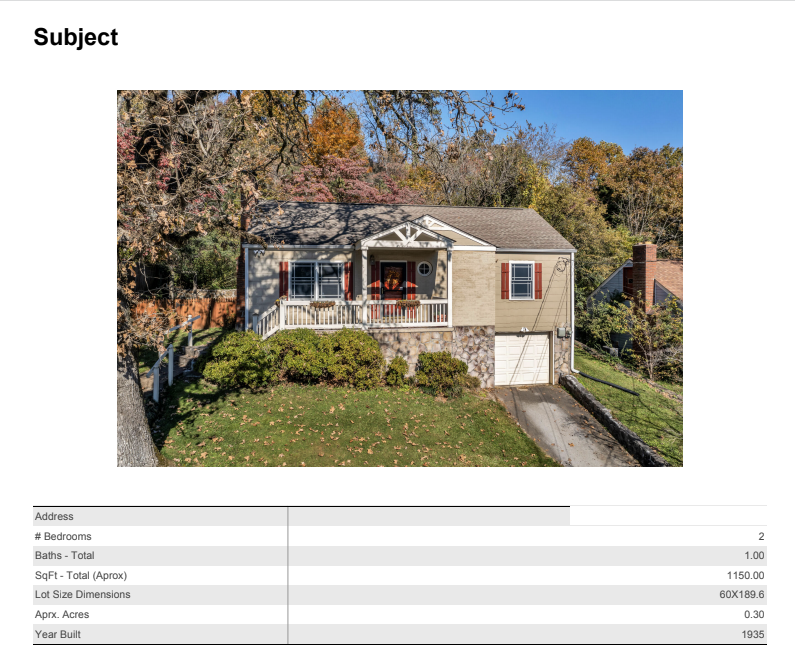

Subject and comparable properties

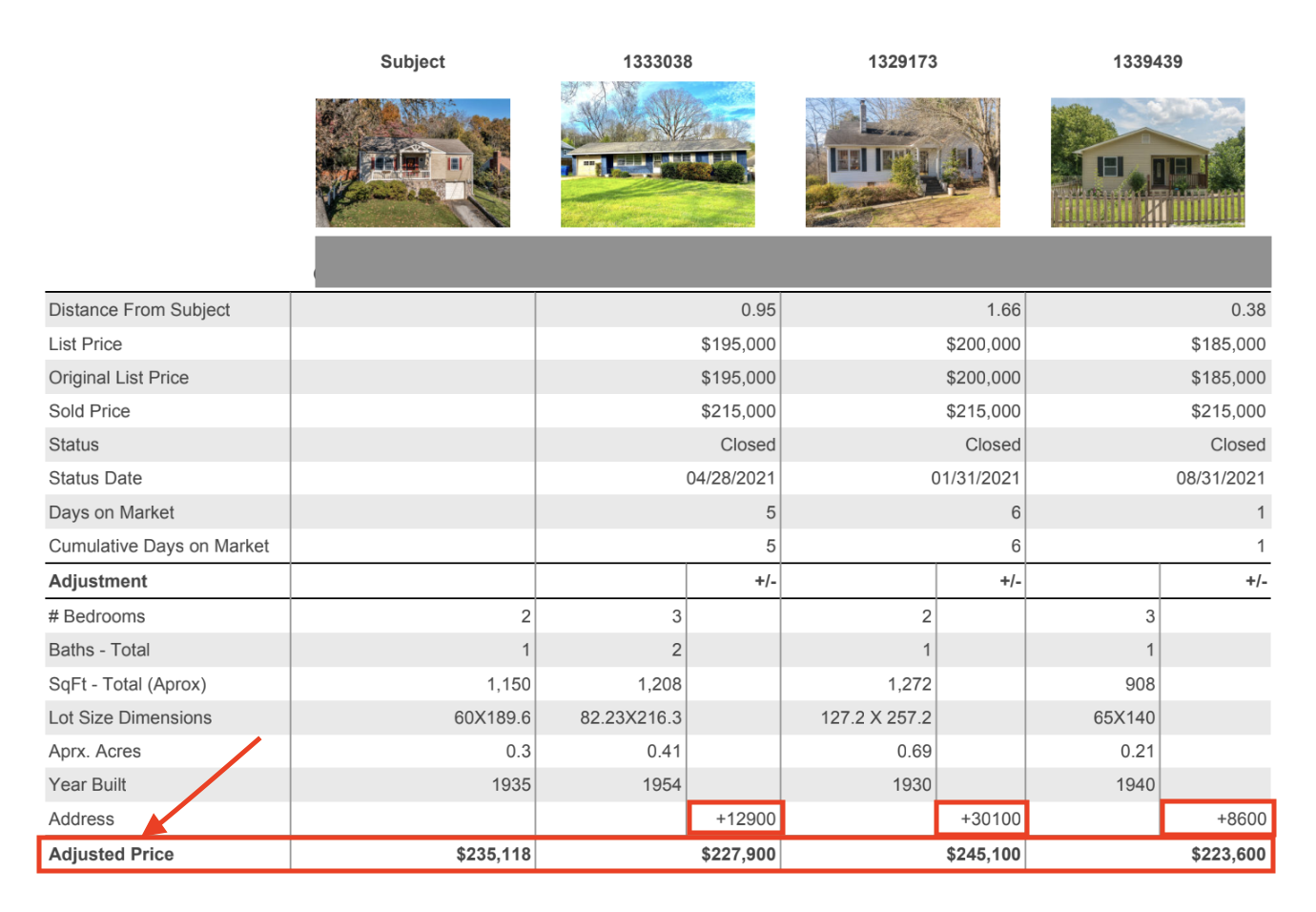

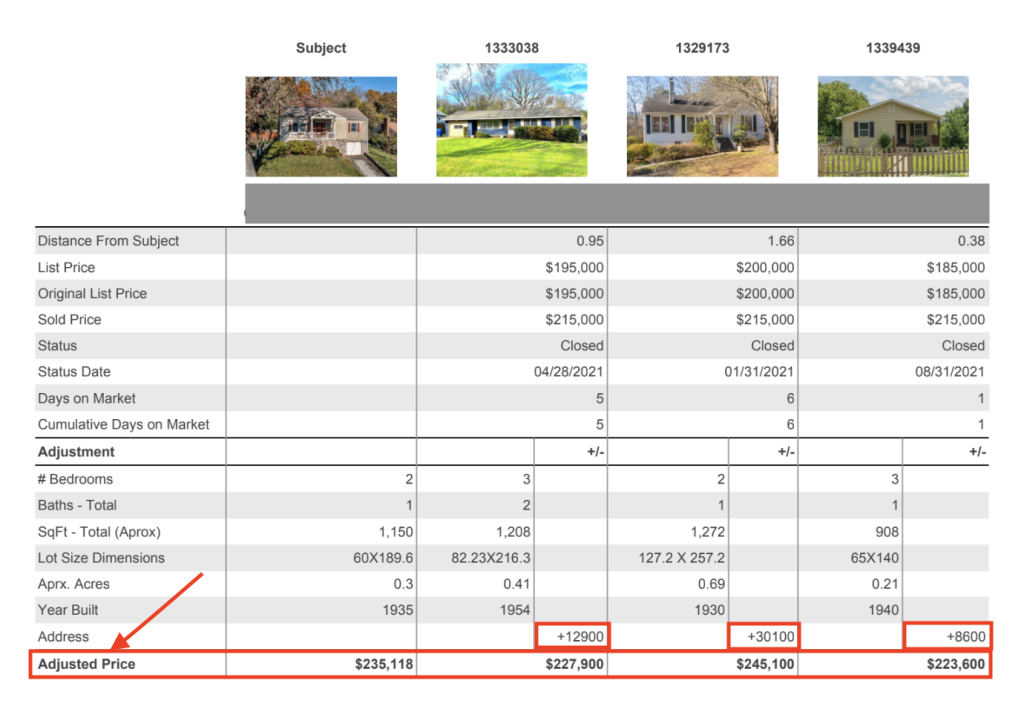

This section of the CMA report summarizes how the characteristics of various comparable properties stack up against the subject property.

Pricing adjustments reflect differences between the subject property and comparable properties in terms of age, location, lot size, square footage, and the number of bedroom and bathrooms.

Price analysis

The price analysis section of a CMA report shows the listing, sale, and adjusted prices for comparable properties in order to give buyers and sellers an idea of a reasonable asking price.

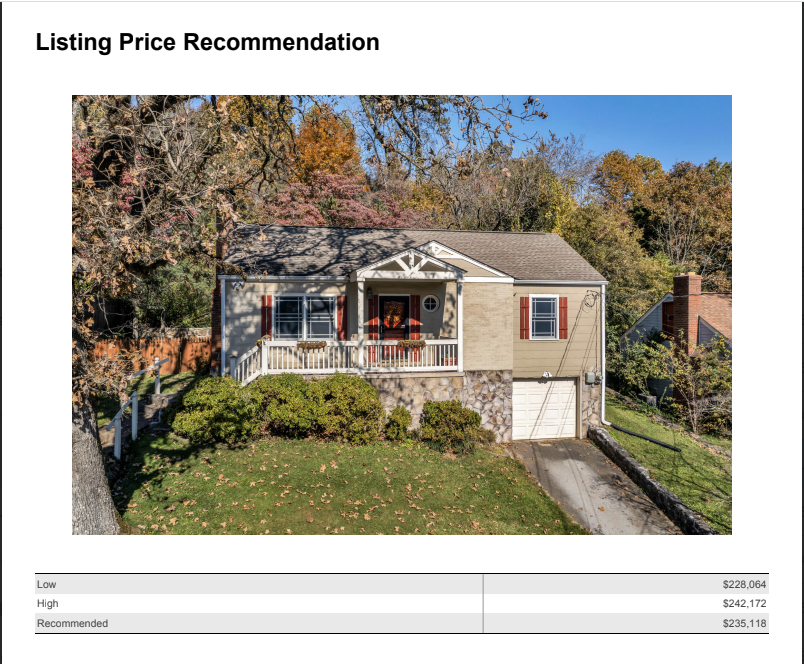

Listing price recommendation

The listing price recommendation includes a recommended price based on the selected comps. The low and high recommendations help sellers and buyers position their listing or offer price competitively.

How to use a CMA report

Real estate agents use CMA reports in different ways depending on their client’s needs. They commonly use CMAs to help sellers price their home fairly and competitively within their local market.

Sometimes realtors use CMAs when representing buyers. A CMA can help justify a low offer when a buyer feels a home is priced above market value. It can also help buyers determine a competitive offer.

A listing agent can also use a CMA to persuade an appraiser to re-evaluate their findings when the appraisal values a property below the contract price.

While CMAs can provide a helpful snapshot of comparable properties, they have limitations. Real estate markets can change quickly. A CMA may not offer an accurate representation of prices in a market where home values are rapidly rising and buyers are throwing money at properties because of limited inventory.

A local agent’s market expertise and negotiating savvy can help make up for a CMA’s limitations.

How to get a comparative market analysis for free

Most realtors provide a free comparative market analysis during an initial listing appointment with a home seller. Buyers can also ask their agents for a CMA to help determine a fair price for an offer.

CMA reports are a way for the agent to win your business by showing you that they know their stuff. The quality and accuracy of a CMA can vary by agent, though, so don’t assume the first one you get is 100% precise.

We can match you with multiple local agents, so you can interview several candidates and compare their valuation estimates. Ideally, you want to find an experienced real estate agent who can back their pricing opinions with data.

Can I do a comparative market analysis myself?

You can do a comparative market analysis yourself using data from Zillow, but the information you can access for free is not as thorough as the data realtors can access.

Krysten Grewell, a licensed realtor, explains that agents have access to “software and built-in MLS tools that list the values to give for various adjustments, like an extra bedroom or a pool.” They also have in-depth knowledge of the local real estate market.

That said, conducting your own comparative market analysis can be a good place to start your buying or selling process. Here’s how to do it:

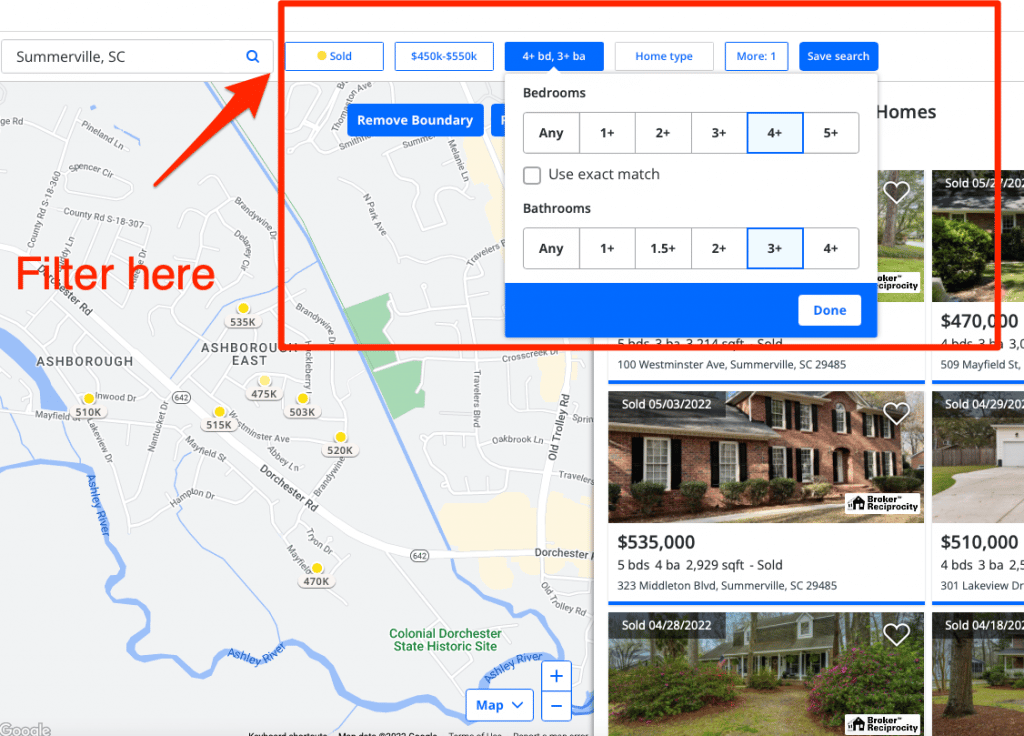

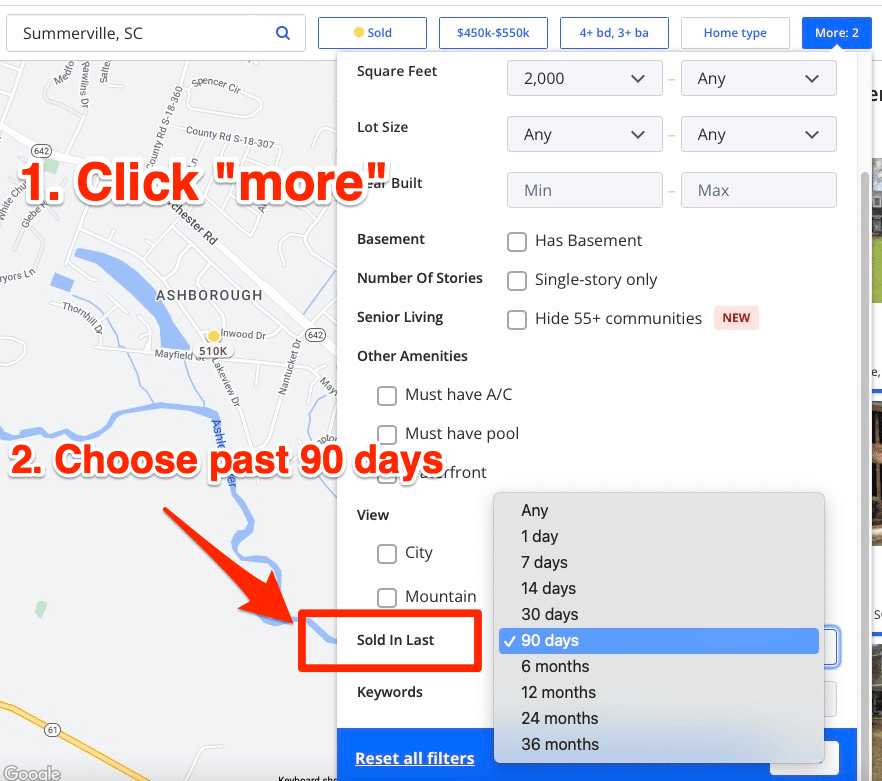

1. Find recent home sales

Filter sold homes on Zillow by price, beds and baths, and square feet. Ideally, choose comparable properties within the same neighborhood, subdivision, or town — and no further than 1–2 miles away.

2. Choose at least 3 similar properties

Find properties similar to the subject property (called “comps”) by looking for homes that:

- Are about the same age and condition

- Are about the same size (within 200–300 square feet)

- Have similar features and finished (based on photos)

3. Calculate the averages, and adjust by square footage

Add up the sale prices, and divide by the number of comps to find the average home value. Next, divide each comp’s sale price by its square footage.

Tip: Most buyers value a home based on price per square foot.

Based on three comps, a subject property in South Carolina has an initial estimation of $509,333. When you multiply the average price per square foot ($192) by the subject property’s square footage (2,591), you get an estimated fair market value or adjusted price of $497,472.

Other ways to see how much your house is worth

But you can supplement the figures you get from a CMA using a home value estimator website, appraisal, or broker price opinion.

CMA vs. home value estimator

Online home value estimators are useful for a quick ballpark estimate of your home’s value.

However, they shouldn’t be used in place of a CMA report to set a listing price on your home. A home value site pulls recent home sales data based on an algorithm. It could select outdated or irrelevant comps, or fail to give homes credit for their upgrades.

For instance, a randomly chosen “subject property” has a Zestimate of $475,000 — while a comparative market analysis of that property values it at $497,00. That’s a difference of more than $22,000!

A real estate agent hand-selects comps and makes thoughtful adjustments, generally making CMAs far more accurate and detailed than online home value estimators.

More about Zillow’s home value estimator

CMA vs. appraisal

You can get an appraisal before listing your home if you want a more detailed home valuation from a licensed pro.

Since the appraiser has no stake in your home sale, their home value report may be more accurate and objective. An appraisal also typically takes more of a property’s unique features into account than a CMA.

However, a pre-listing appraisal has several drawbacks to consider:

- Appraisals are expensive ($400–500).

- It can take weeks to complete, which can push back your sales timeline.

- A home buyer’s loan officer will order another appraisal as part of the underwriting process, and they will not accept your pre-listing appraisal.

CMA vs. broker price opinion (BPO)

A BPO is similar to a comparative market analysis in that it’s also a home valuation report created by a licensed real estate agent. But realtors and sellers typically use a CMA to help determine a list price, whereas banks and lenders use a more concise BPO as an alternative to an appraisal or as a way to assign a value to a foreclosed home.

A BPO is usually a bit cheaper than an appraisal and typically costs $150–250.

Sellers without an agent can pay for BPOs to determine a fair listing price. And homeowners may order them to convince their lenders to remove private mortgage insurance from an existing mortgage.

Related reading

How to Find a Real Estate Agent: Expert Tips: Learn how to find the best real estate agent to help you determine your home’s fair market value through a CMA report, and get expert home sale tips.

Seller’s Net Sheet Guide: Learn how much money you may walk away with in your home sale with a seller’s net sheet. We provide a free net sheet template and calculator to help you estimate your potential sale proceeds.

Best Home Value Websites: Free home value websites like Zillow and Redfin can give you a ballpark idea of your home’s fair value. We rank the most popular home value estimators.

Redfin Home Value Estimator Review: Can Redfin’s free home value estimate tool be trusted? Our review breaks it down.

Leave a Reply