Published

How does it work? | Should I trust it? | Redfin accuracy rate | Pros and cons | How to use it | Alternatives

The Redfin home value estimator is one of the most accurate home value estimators online. But when we tested it, its estimates were still often off by thousands of dollars.

Redfin provides a free estimate based on your property’s key features (bedrooms, bathrooms, square footage) and the price similar homes in your area are selling for. It’s useful for a ballpark estimate of your home’s worth.

If you’re setting a list price, you need a more accurate estimate than a Redfin estimate. Setting the right list price is essential for getting the highest sale price for your home.

For the most accurate estimate, get a free comparative market analysis (CMA) from a local realtor. The agent will visit your home in person and account for upgrades and local market factors that an online estimator can’t.

How Redfin’s home value estimator works

Expert Review

Redfin Home Value Estimator

- Fast, free, and easy to use

- Frequent home value updates

- Relatively low error rates

Redfin’s home value estimator provides homeowners with a free home value estimate within seconds. Its home values are accurate compared to some of its peers, but we found them to be far less accurate than a comparative market analysis (CMA) from a real estate agent. We discovered that Redfin frequently uses outdated or irrelevant comparable sales to determine a home’s estimated value.

- Fast, free, and easy to use for a quick home value estimate

- Accurate compared to several of its peers

- Home values updated daily or weekly

- Useful homeowner dashboard

- Often uses outdated or irrelevant comparable home sales

- Your home’s information may need to be updated

- Fewer homes covered compared to Zillow

- Home renovations and additions may not add value to your estimate

- Homeowners who are thinking about selling and just want a quick ballpark home value estimate

- Home buyers who are interested in purchasing a house and want to learn if the home is fairly priced

Like other home value estimators, Redfin uses recent sales data from your local multiple listing service (MLS): the system most brokers and realtors use to market and sell homes.

Redfin claims it uses more than 500 data points about your market, neighborhood, and your home to determine your property’s value.

Those data points include your home’s key features, such as its bedrooms, bathrooms, and total square footage. Redfin then estimates its value based on the recent sales of similar off-market and on-market properties.

Redfin’s home value estimates are updated daily for active listings, and weekly for off-market homes, making it one of the most up-to-date home value websites.

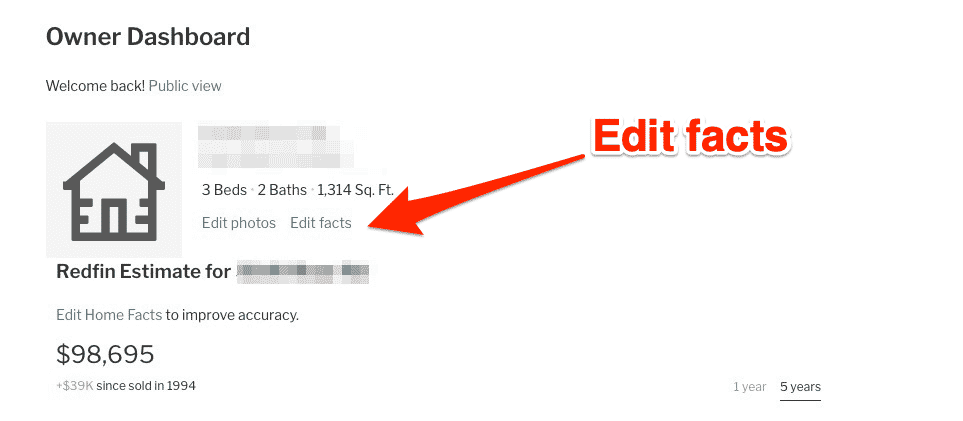

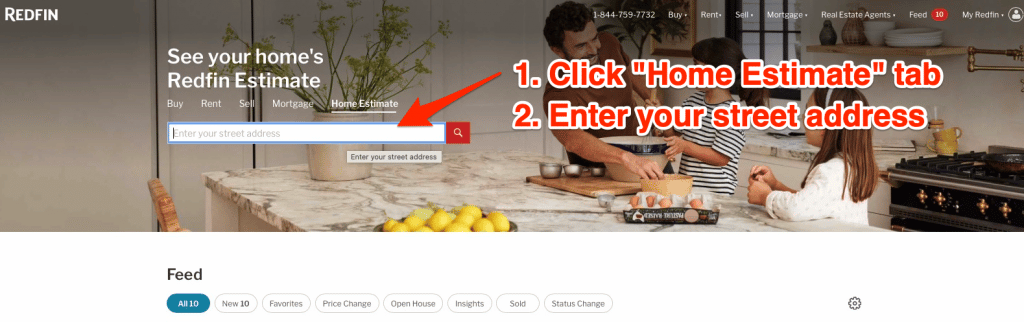

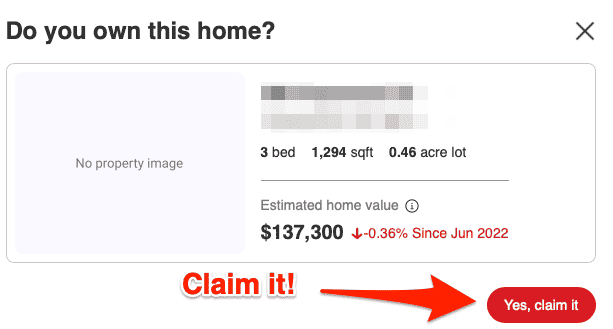

Useful owner dashboard

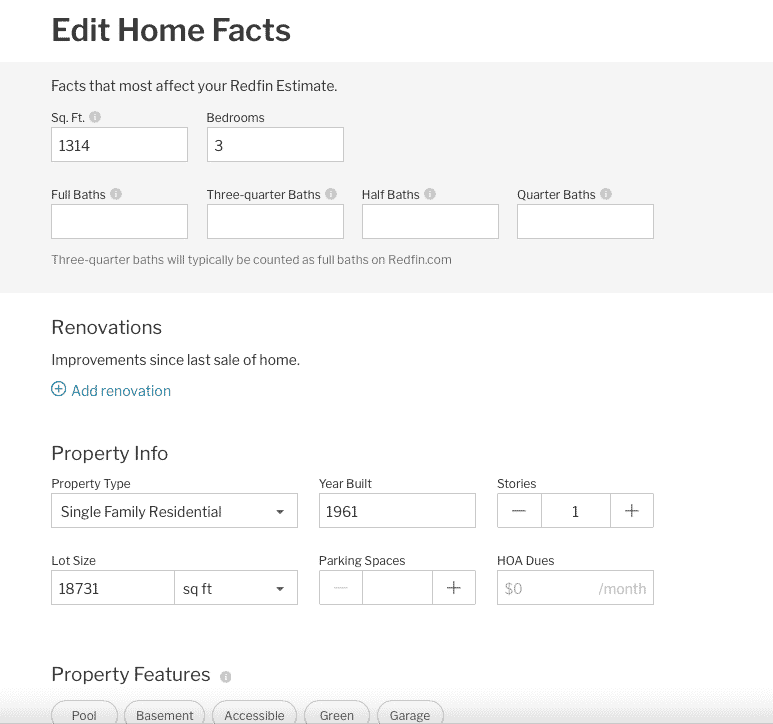

You claim your home on Redfin’s owner dashboard, where you can edit its key facts, including property type, beds, baths, square footage, lot size, and year built.

Redfin likely doesn’t know about any major improvements or repairs you’ve made since buying the house. It probably also isn’t aware of any special features that may add to its value (such as hardwood floors, solar panels, etc.) You can add most of those features here.

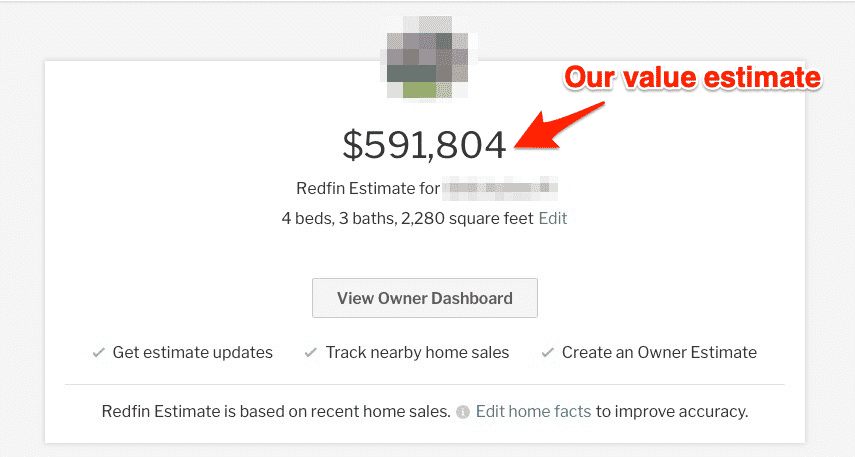

We plugged a random property into Redfin’s estimator: a 2-story colonial home located in South Carolina. It has four beds, three baths, and 2,280 sq. ft. Redfin determined a fair value of $591,804.

Edit square footage for a new home value

Providing the most accurate square footage information could help improve your Redfin value estimate.

Redfin’s square footage for our property was short by 300 square feet, based on the home’s tax records.

After providing the correct square footage, our home’s estimate increased by nearly $20,000, as a larger house is worth more to buyers.

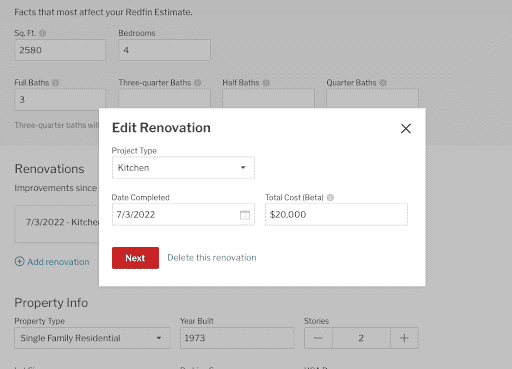

Adding renovations didn’t increase our value

We also added a major home renovation (a $20,000 kitchen remodel) to see if the change impacted our home value estimate. Unfortunately, it did not boost our home’s value.

I expected our home value estimate to jump to at least $630,000 (up from $611,531) based on the cost of this renovation.

Instead, our home’s value estimate fell to $597,090 — a $14,441 decrease in its value — with no explanation. Kitchen remodels generally carry a high return on investment, so I was surprised to see our estimate fall in value.

This value disparity highlights one of the biggest drawbacks of a home value estimator: they often fail to give homeowners proper credit for renovations or improvements.

Ultimately, only a local real estate expert knows how much value to assign to your home’s upgrades, and will provide you with the most accurate home value estimate.

» Find top-rated local agents!

Should I trust Redfin’s home value estimate?

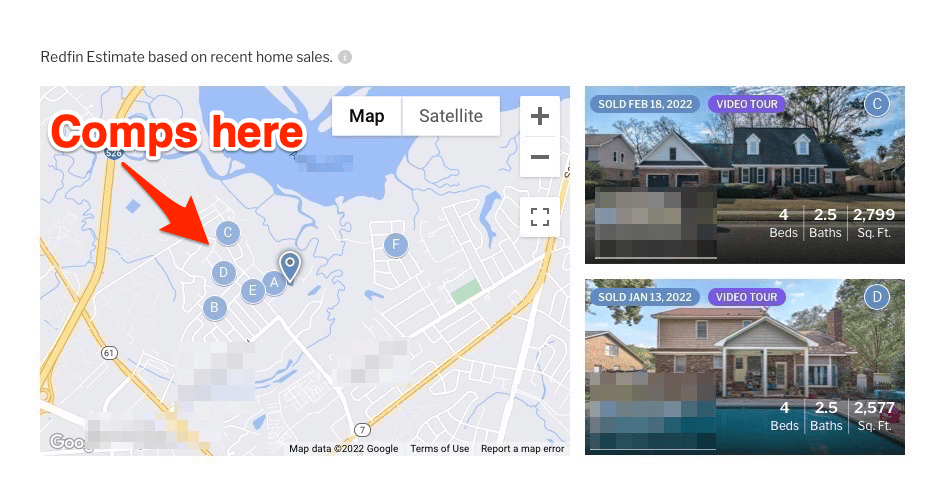

We dug deeper to see how Redfin determined our home’s fair value by viewing its choices of comparable home sales or “comps” for short.

Comps are recent home sales that most closely match the subject property’s location, size, and condition. Real estate agents, brokers, and appraisers use comps as the primary way to determine a home’s value.

Overall, we didn’t find Redfin’s home value estimate to be that trustworthy, as it frequently used outdated or irrelevant comps.

How to view Redfin comps

You can see which comparable sales Redfin uses on its owner dashboard, which appears after claiming your home.

There’s a map with letters on a Google Map at the bottom of your owner dashboard. Each letter represents a comparable home sale, with each listing posted to the right.

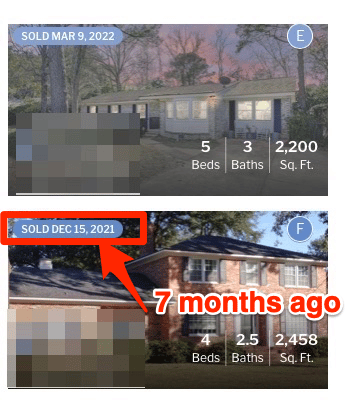

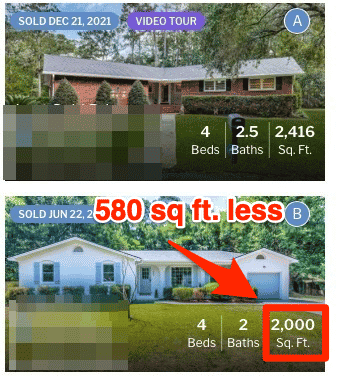

We were surprised to learn that Redfin used multiple home sales from more than 6 months ago. Real estate professionals typically use comparable sales that closed within the past 1–3 months, especially in a market with plenty of recent sales.

Several comparable homes had a sale date of December 2021 or seven months after this article was originally published. The local real estate market has changed drastically since then.

We also found plenty of recent home sales to choose from in the subject property’s market, so a lack of good comps wasn’t an issue.

In addition, one of Redfin’s comps is a house with just 2,000 square feet, or 580 sq. ft. less than the subject property. Real estate professionals generally try to stay within 200–300 sq. ft. or less of a subject property’s size.

A real estate agent or appraiser likely will not have used this sale, given that its interior living space is 580 square feet smaller than the subject property. So, our subject property’s value might be higher than Redfin’s estimate.

In addition, the subject property is a two-story, colonial-style home, while Redfin chose multiple single-story ranch homes for its comps.

How accurate are Redfin estimates?

Redfin median error rate

| Home type | Error rate |

|---|---|

| Off-market | 6.47% |

| On-market | 2.09% |

Redfin claims that it has a median error rate of 6.47% for off-market homes and 2.09% for on-market homes. On average, most home value estimators have a similar median error rate of 2–7%.

That error rate means your home value estimate may be off by tens of thousands of dollars — especially on pricier homes.

Redfin’s accuracy also depends on where you live and is far less accurate in some states.

For example, Redfin’s median error rate for off-market homes is just 3.91% in Colorado. But that figure balloons to 11.07% in Maine, a state with more homes in rural areas, and fewer home sales.

Redfin’s accuracy for off-market homes

| State | Median error |

|---|---|

| Colorado | 3.91% |

| Virginia | 5.58% |

| California | 5.97% |

| Florida | 6.48% |

| Maine | 11.07% |

| Vermont | 11.89% |

Redfin’s accuracy for off-market homes varies widely by state.

Ultimately, Redfin’s home value estimator works best in markets with plenty of recent home sales, as it has access to more home sales data.

Like other estimators, Redfin’s data is far more accurate for homes currently listed for sale.

Redfin home value accuracy tool

Use our tool to see how much your property may be worth based on Redfin’s national median error rate of 6.47% (off-market homes).

Keep in mind that 6.47% is Redfin’s median error rate for all markets, and your market may have a higher or lower error rate.

Redfin home value estimator: Pros and cons

Pros

- Fast and easy to use

- Accurate compared to peers

- Home values updated frequently

- Useful owner dashboard

Cons

- May use outdated or irrelevant sales

- House information may not be accurate

- Fewer homes compared to Zillow

- Renovations don’t add value

Fast and easy to use

Redfin provides homeowners with a free home value estimate within seconds.

You don’t need to insert your contact information to get your home value estimate. Most on-market and off-market properties come with a Redfin Estimate directly on the listing page.

However, you do need to provide and verify your email address to claim a home and edit its facts.

Accurate compared to peers

Redfin’s median error rate for on-market homes is 2.09%, which is on the low-end compared to its peers, ranging from 2–7%. Currently, Redfin is more accurate than Zillow, which has a median error rate of 2.4%.

However, Redfin is far less accurate for off-market homes, with a national error rate of 6.47% and as high as 12% in some markets.

» MORE: Zillow vs. Redfin: Which Estimator Is More Accurate?

Home values are updated frequently

Redfin says its home value estimates are updated daily for homes currently listed for sale and weekly for off-market homes.

Useful owner dashboard

After claiming your home, Redfin’s dashboard will display useful local sales information, including your market’s average sale price, days on market, and sale-to-list price.

You can edit your home’s key information, which may impact its value. For example, we changed our test home’s square footage and received a slightly higher valuation.

Uses outdated or irrelevant comparable sales

Like other home value estimators, Redfin does not always use the best, or most recent, home sales data.

With our test property, we found that Redfin used multiple home sales that closed more than 6 months ago; the real estate market has changed quite a bit over that timeframe.

In addition, Redfin’s comps included several one-story, ranch-style homes with far less interior square footage compared to our two-story, colonial-style subject property.

The bottom line: Redfin’s estimate may be far higher or lower than your home’s actual fair market value.

House information may not be accurate

Several of the properties we tested had incorrect information compared to their tax records.

For example, one subject property’s square footage was short by 300 sq. ft., while another had the wrong number of bathrooms.

However, these inaccuracies are not exclusive to Redfin and are pretty common among home value estimators.

Fewer homes are covered compared to Zillow

Redfin’s home value estimator covers 92 million homes across the United States. While that cover more than half of the entire real estate market, it is approximately 12 million fewer homes covered compared to Zillow.

Home renovations don’t add value to estimates

We added a major kitchen remodel ($20,000) to our subject property, but Redfin’s home value estimate didn’t reflect the change. In fact, our home value estimate fell after making the edit.

Redfin home value estimator: How to use it

Home value estimators vs. CMA

We put Redfin’s tool to the test, comparing its home value estimate with our own based on publicly-available comparable sales data.

For our example, we used a random off-market, single-family home in Summerville, South Carolina. The subject property has three bedrooms, three baths, and just over 2,000 square feet of living space.

Redfin has determined that this off-market house has an estimated value of $470,249.

We ran the numbers with our own CMA report, which returned a current estimated value of $437,388. Our figure is an average of the three most recent, relevant comparable home sales in the area.

| Property | Sale price | Beds | Baths | Sq. ft. |

|---|---|---|---|---|

| Subject | N/A | 3 | 3 | 2,009 |

| Comp #1 | $460,000 | 3 | 3 | 2,306 |

| Comp #2 | $426,165 | 3 | 3 | 2,584 |

| Comp #3 | $426,000 | 3 | 3 | 1,920 |

| Average | $437,388 | 3 | 3 | 2,205 |

We also put the subject property on a few other popular home value websites. Here’s how the numbers compare to our estimate and the other estimators.

| Source | Value |

|---|---|

| Our estimate | $437,388 |

| Chase | $470,000 |

| Redfin | $470,249 |

| Zillow | $476,800 |

| Bank of America | $491,539 |

| RocketHomes | $505,000 |

| Average value | $475,163 |

Why do the home value estimates vary?

The subject property’s value ranges from $437,388 to $505,000, or a $67,612 difference in price. The subject property’s fair value likely falls somewhere between our estimate and Redfin’s.

Our CMA estimate came in much lower than automated estimators — we carefully selected our comparable home sales, using only recent home sales and similar properties.

We found that several estimators, such as RocketHomes and BankofAmerica, use several irrelevant sales that inflated the home’s estimated value.

Several estimators also use active listings instead of recent sales to determine their estimates. For example, RocketHomes uses a new listing that is 2.4 miles away from the subject property and listed for sale at $539,000.

Real estate agents and appraisers rarely ever use active listings to determine a home’s fair value and try to stay within 1 mile or so of the subject property.

How Redfin’s home value estimator compares

Redfin vs. Zillow

Redfin’s home value estimator is pretty similar to Zillow. However, Zillow’s estimator is currently more accurate for both on-market and off-market homes.

Zillow’s estimator also covers more properties compared to Redfin’s, which isn’t available in many rural areas or markets with relatively few recent home sales.

» MORE: Redfin vs. Zillow breakdown

Redfin vs. Realtor

Realtor claims its value estimator uses data from mortgage lenders, which it says makes it more accurate compared to its peers.

However, unlike Redfin, Realtor doesn’t publish a median error rate, so it’s hard to compare its accuracy.

We also ran several subject properties through Realtor’s estimator and found them to be slightly less accurate compared to Redfin, Zillow, and our estimates.

Redfin vs. Chase

Chase is one of a few major banks offering a free online home value estimator, and its website makes it fast and easy to get a quick estimate.

The bank claims that it uses “millions of home records” in its database to determine your home’s value estimate.

However, we tested its estimates on multiple properties and found them to be mostly inaccurate, as it regularly uses outdated or irrelevant sales data.

» LEARN: Why Chase’s home value estimator falls short

Alternatives to Redfin’s home value estimator

Compare estimates from multiple sites

Home value estimators have seperate algorithms and often pull different comparable home sales.

Given the wide range of home value estimates we received, it’s a good idea to plug your address into multiple estimators, compare your estimates, or calculate an average value.

» MORE: What are the best home value estimators?

Request a free CMA from a real estate agent

Redfin is useful for a quick ballpark home value estimate, but it’s not a substitute for a professional CMA report from a local, experienced real estate agent.

Real estate professionals have the best understanding of recent home sales, current market trends, and how to value homes in your local market.

Realtors can also give you credit for any upgrades or repairs you’ve made since purchasing your home.

» GET A CMA: Connect with a top-rated local agent

Order a pre-listing appraisal

Appraisals are ordered by home buyers during the sales process. But you can order one before listing your home to help you determine its fair value.

An appraisal will likely provide you with the most accurate home value estimate. However, you have to pay for an appraisal ($350–500), and it can be a time-consuming process (1–2 weeks or longer).

» LEARN: Should I get an appraisal before selling?

Redfin home value estimator: FAQ

Is Redfin's home value estimator accurate?

We found Redfin's estimator to be fairly accurate – at least compared to other home value websites. Redfin claims its value estimates have a median error rate of just 2.09% for on-market homes and 6.47% for off-market homes, more accurate than Zillow's Zestimate. Learn more about Redfin's accuracy rates.

However, our research found that a free comparative market analysis (CMA) report provides homeowners with the most accurate home value estimate. A local real estate agent knows the best comparable sales to choose from, how to value a home's upgrades and improvements, and can factor in local market conditions.

Estimators like Redfin and Zillow also rely on outdated sales information and user-submitted data, which can inflate their estimates. An agent matching service can match you up with several quality local realtors for a free CMA report.

Is Zillow's home value estimate more accurate than Redfin's?

Zillow Zestimates are less accurate than Redfin estimates. Zillow has a median error rate of 2.4% for on-market homes and 7.49% for off-market homes. Learn more about the differences between Zillow vs. Redfin.

While Redfin and Zillow home value estimators boast high accuracy rates compared to peers, we found both websites to be fairly inaccurate compared to a realtor-provided comparative market analysis (CMA).

What is the most accurate home value estimator?

Redfin has the lowest median error rate of any home value estimator, but it's off-market valuations are still off by thousands of dollars. Sites like Zillow and Redfin often have the wrong information for your home, or use outdated or irrelevant comparable home sales to determine its value. Learn more about which home value estimator is the most accurate.

How close are appraisals to Redfin's home value estimates?

Redfin is not nearly as accurate as a professional appraisal. It's a rough online estimate of your home's fair value based on public records and it automatically pulls comparable home sales. An appraisal is completed by a licensed professional who can help you determine your home's true market value. Learn more about the pros and cons of getting a pre-listing appraisal.

Why is my Redfin estimate so low?

Redfin may have inaccurate or outdated information about your home. You can edit your home facts to try to increase the estimate. We increased our subject's property square footage, and instantly received a higher home value estimate. But like other home value websites, Redfin might not give you fair credit for any of your home's recent upgrades or renovations.

How often does Redfin update estimates?

Redfin updates its estimates daily for on-market homes and weekly for off-market homes.

Why you should trust us

Real Estate Witch’s mission is to provide accurate, actionable, and practical information you can use to make better decisions on your real estate journey.

To create our home value estimator reviews, we spent several weeks testing out every online home value estimator. We ran home valuations on random properties in multiple markets, comparing our numbers with each home value estimator.

Based on our findings, we believe that free home value estimates like Redfin can provide you with a ballpark estimate of your home’s value. But every home value estimator we tested was off by at least several percentage points, equaling thousands of dollars in home value.

We believe that your most accurate home valuation estimate will come from an experienced, local real estate agent or appraiser.

About the author

Steve Nicastro is a real estate agent, investor, and personal finance writer based in South Carolina. While working as a full-time realtor between 2020 and 2021, he closed 19 transactions, assisting both sellers and buyers.

Steve has completed dozens of CMA reports for prospective home sellers. He knows first-hand how inaccurate home value estimators like Redfin and Zillow can be.

Steve is also an active real estate investor and has experience completing home valuation estimates to analyze flips. He frequently uses sites like Zillow, Redfin, and Realtor.com for quick valuation estimates — but doesn’t rely on them to make a major investment decision.

Related articles

Best Home Value Estimators: Free home value websites like Redfin and Zillow provide a ballpark idea of your home’s fair value. We rank the most popular home value estimators.

Redfin vs. Zillow: Our head-to-head matchup compares the two most popular home value estimators. We explain how they work, their accuracy rates, and how to use them.

Zillow Home Value Estimator Review: How does Zillow’s home value tool rate compare to its peers? We break down its accuracy rates and if you should trust it.

Comparative Market Analysis: Learn more about this home valuation method that is frequently used by real estate agents, and how to get a free CMA from a professional.

Pre-Listing Appraisal: Paying for an appraisal could make sense in certain situations, like if you’re selling without a realtor or own a home that’s hard to value.

Leave a Reply