Published

Redfin vs. Zillow accuracy | How home valuation estimators work | How to fix an inaccurate Redfin or Zillow estimate | How to get the most accurate estimate | FAQ

Redfin and Zillow’s home value estimators provide a rough estimate of what a home might be worth. Redfin Estimates are typically more accurate than Zillow Zestimates, although both tools have a large margin of error.

If you just want a general idea of what your house is worth, we recommend trying several online home value tools to compare pricing estimates. This will help you get a more accurate home value estimate — especially if tools like Redfin and Zillow contain inaccurate or outdated information.

If you want the most accurate home value estimate, you can get a free comparative market analysis (CMA) from a licensed realtor. The agent will perform a visual inspection of your property, value its upgrades and renovations, and compare it to the most recent sales in the area.

» Request a free CMA from a top realtor, find out what your home is really worth

Redfin vs. Zillow estimate accuracy

| Redfin | Zillow | |

|---|---|---|

| On–market error rate | 2.09% | 2.4% |

| Off-market error rate | 6.43% | 7.49% |

| Home data updated | Daily for on-market, weekly for off-market | Multiple times a week |

| Homes covered | 92 million | 104 million |

Redfin and Zillow are the only two real estate websites we tested that provide users with a median error rate.

Based on company data, Redfin Estimates are generally more accurate than Zillow Zestimates. Redfin has a median error rate of 6.43% for off-market properties, while Zillow is at 7.49%.

To put Redfin’s 6.43% error rate in perspective, a home with a $300,000 value estimate could really be worth $281,000–319,000.

Many home sellers look at Zillow or Redfin for their home value before refinancing or listing it for sale. But both companies are relatively poor at evaluating these off-market homes.

Active listings are more accurate

Redfin and Zillow are much better at estimating the value of homes already listed for sale. These homes have more detailed information available, often provided by the homeowner or their realtor.

For these on-market homes, Redfin’s national median error rate is 2.09% and Zillow’s is 2.4%.

If you see a for-sale listing with a $300,000 Zestimate, the home may sell for $293,000–307,000.

How accurate are Redfin’s Estimates?

Redfin Estimates are a good starting point for estimating home values. But like Zillow, they are typically less accurate than a home valuation from real estate agents or a professional real estate appraiser.

Redfin home values cover 92 million homes across the United States. It uses more than 500 data points about your market, neighborhood, and home to determine a value estimate.

Its estimates have a median error rate of 6.43% for off-market properties and 2.09% for active real estate listings. So your Redfin Estimate is likely tens of thousands of dollars off the mark.

I have found Redfin to typically be on the high side and inaccurate. As I understand, Redfin fishes for sellers, so they put their numbers higher to get the clients.”

— Susan Aviles, real estate agent based in Charleston, South Carolina

Based on Redfin’s nationwide accuracy data, if your Redfin estimate is $400,000 and your house is off the market, its fair market value is probably $374,000–426,000. But it will be outside of that range half the time.

Estimates also vary based on your state. Redfin value estimates are far more accurate in states with more home sales, such as California (5.82% median error rate) than Maine (10.76%).

» MORE: Redfin Home Value Estimator Review

How accurate are Zillow’s Zestimates?

Zillow home values are slightly more accurate than Redfin for off-market properties and active listings. Its Zestimates have a median error rate of 7.49% for off-market homes and 2.4% for active listings.

Zillow also covers more properties (104 million) than Redfin (92 million).

However, Zillow home values are far from perfect, as its home value estimates may still be off by tens of thousands of dollars. They’re not a substitute for an evaluation from a real estate agent or appraiser.

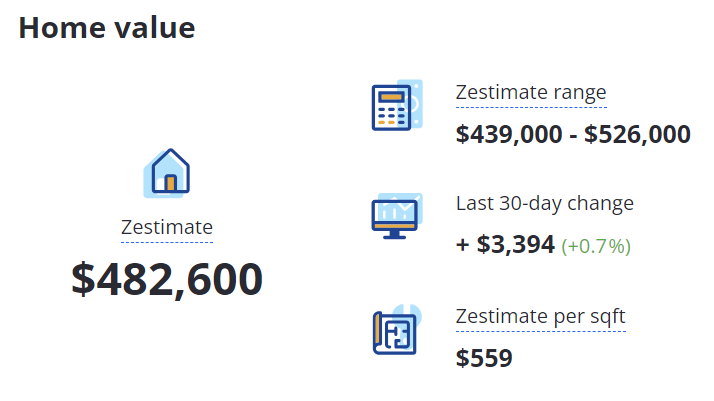

The Zestimate Range, which accounts for this margin of error, gives a range of what Zillow thinks the house is worth.

You can find the Zestimate Range by scrolling down to the “Home value” section of the Zillow listing.

Why Zestimates are misleading

According to Zillow, just half of all home values fall within its Zestimate Range.

In the example above (a random off-market property in Utah), the Zestimate Range is $439,000–$526,000 — a difference of $87,000! And there’s a 50% chance the home is worth more than $526,000 or less than $439,000.

In other words, there’s no way to tell how much this home is truly worth. Setting a list price based on its Zestimate range is likely a huge mistake.

Zillow [estimates are] not as close as a professional appraisal or a CMA from a qualified realtor who knows the area. Zillow doesn’t adjust for renovations, age of the roof or HVAC, and possible impediments such as busy roads, power lines, and unpopular floor plans or views.”

— Susan Aviles

In addition, Zillow Zestimate accuracy varies widely by location. For example, its off-market Zestimates in California have a median error rate of 6.44%, compared to 11.97% in Maine.

Zillow’s website lists its median error rates for states and metro areas.

» MORE: Zillow Home Value Estimator Review

Home value estimate accuracy calculator

Redfin, Zillow, and other popular real estate websites can’t give you a precise home value. But you can use the calculator below for a range of your home’s estimated value.

Plug in your Zestimate or Redfin Estimate along with the estimate’s median error rate. The calculator displays a value range that accounts for this expected margin of error.

Remember, Zillow and Redfin base their estimates on a median error rate. So there’s still a 50% chance that your home’s fair value falls outside this range.

It’s worth comparing your Zillow and Redfin home values with other popular home value estimators. Each tool uses its own algorithm and often pulls different comparable home sales, resulting in a wide range of home values.

How does a Redfin or Zillow estimate compare to an appraisal or a CMA?

Pre-listing appraisals and comparative market analyses (CMAs) are much more accurate than Redfin Estimates and Zestimates.

These evaluations involve a real estate professional actually examining your property. An appraiser or real estate agent usually inspects the home’s condition and gathers accurate information, including features that may not appear in tax records or old MLS listings.

An online estimator uses public data sets to make assumptions about your home. While Zillow and Redfin can likely find basic home facts like square footage and number of bedrooms, they won’t know much about your home’s condition.

When you get a CMA or appraisal, the estimate also accounts for critical factors like the age of your heating and cooling system, the desirability of your neighborhood, and the quality of interior modifications like a refinished kitchen.

How Redfin Estimates and Zillow Zestimates work

Like other similar tools, Redfin and Zillow calculate a home’s estimated value using public data, like tax records, recent property sales from the multiple listing service (MLS), and local market trends.

The estimator considers all that information and uses it to approximate the value of features of your home. The more data an estimator has about your property and similar homes in your area, the more accurate its estimate is.

For example, if a home sold within the past few months, the property facts from its MLS listing are likely still accurate.

How to fix an incorrect Redfin or Zillow estimate

If you believe your Redfin Estimate or Zillow Zestimate is inaccurate, you can edit your home facts on either site.

If an estimate has inaccurate or outdated information, updating your property information should improve its accuracy.

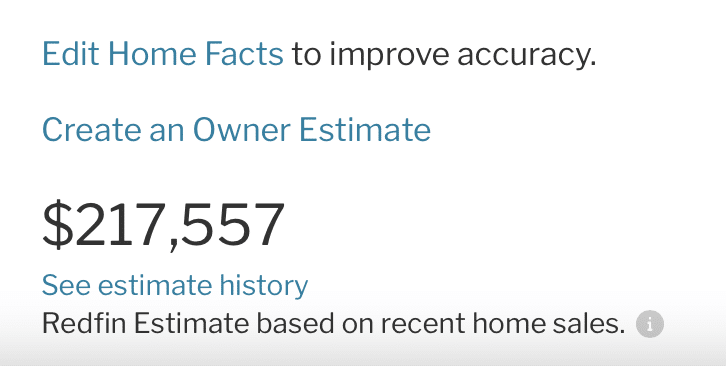

On Redfin, visit the page of your property, and click “Edit Home Facts.”

This process involves proving that you are the property owner, so you must provide your contact information to Redfin.

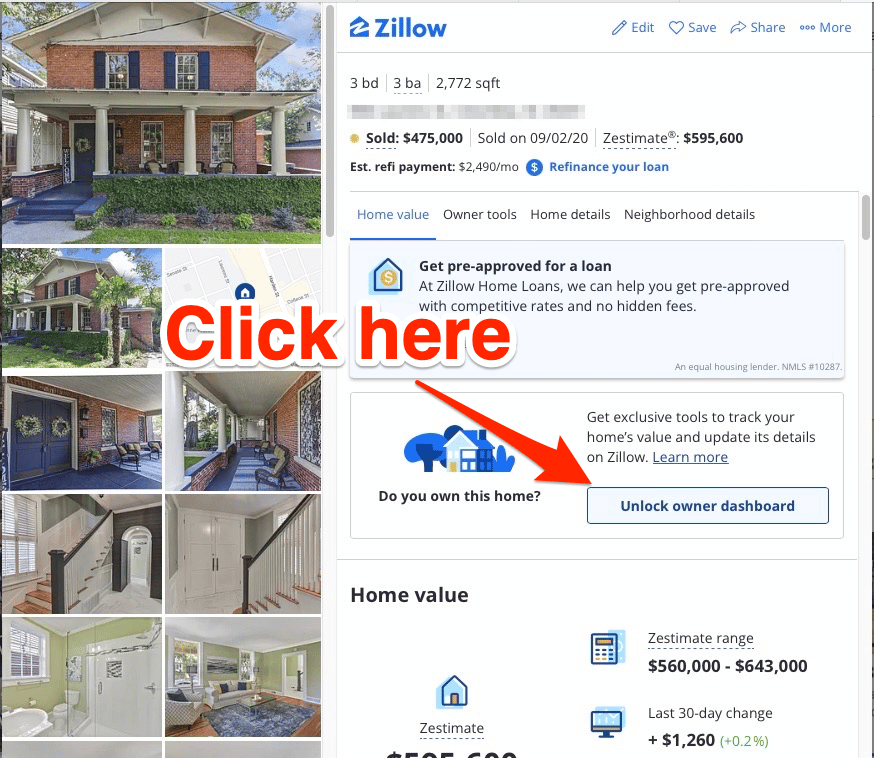

On Zillow, create a free account, and click “unlock homeowner dashboard” on your home’s listing page to make edits. You can edit your home’s beds, baths, finished square feet, lot size, and year built, among other information.

Should I update my property information on Redfin and Zillow before selling?

If you or your agent thinks updating your property information on Redfin and Zillow could help sell it faster, then it’s worth considering.

For example, if an estimator has incorrect data about your home that’s causing a low estimate, a buyer who sees that estimate may want to make a lower offer on your home.

If Zillow calculates our estimate based on two bedrooms when your home has three, then correcting that data should raise your Zestimate — and give buyers a better idea of what your home is really worth.

However, if the current estimate is accurate or even higher than you expect, talk to your agent. Your agent can tell you whether it’s worth updating your property information or if the home facts are fine as-is.

How do I get the most accurate home estimate?

The best way to estimate your home’s value is to get a professional home valuation from a top local real estate agent.

An experienced agent will examine your home to assess its features and conditions. This evaluation, along with their on-the-ground knowledge of your local market, enables them to give you an accurate picture of what your home is really worth.

If you’re ready to get a free professional home evaluation, we can connect you to a top local realtor from a trusted brokerage like Berkshire Hathaway or RE/MAX.

Redfin vs. Zillow estimates: FAQ

Are Redfin Estimates or Zillow Zestimates more accurate?

Nationally, Redfin is slightly more accurate than Zillow. However, their accuracy varies from city to city and state to state, and Zillow is more accurate in some areas. Both estimates are reasonably precise for homes currently on the market but are much less accurate for homes not currently listed for sale. Learn more about the accuracy of these estimates.

Why did my Zestimate or Redfin Estimate drop?

Zillow and Redfin factor recent home sales into your home's estimate. If a similar property in your area recently sold at a relatively low price, this could cause your estimate to drop. Learn more about how Zestimates and Redfin Estimates work.

My Zestimate or Redfin Estimate is low — what should I do?

You can contact Redfin or Zillow and submit corrected data for your property. However, you must verify your status as the property owner, which gives Redfin or Zillow your contact data, and they may begin to contact you regarding their services.

Can I remove my Zestimate or Redfin estimate?

No. Zestimates and Redfin Estimates are based on publicly available data, which means they’re able to present estimates of property values based on that data. If you’re concerned about a low estimate, your best approach is to submit corrected data to Redfin or Zillow.

Will my Zestimate or Redfin Estimate affect my ability to refinance?

No. Lenders do not consider your Redfin Estimate or Zestimate when evaluating your refinance application. Your lender wants an extremely accurate assessment of your property's value, not a ballpark estimate. They'll typically hire a professional real estate appraiser to perform a thorough in-person inspection. This appraisal will determine how much you can borrow and whether you will need to pay mortgage insurance.

How are Zestimates and Redfin Estimates calculated?

Redfin and Zillow calculate your home estimate using publicly available data on your property and nearby propertiesThis estimated value is based on attributes of properties that have recently sold in your area. Learn more about how online real estate estimators work.

How close are appraisals to Zillow Zestimates and Redfin Estimates?

Lending institutions consider appraisals more accurate than estimates because appraisers go into much greater detail in their evaluation. Professional appraisers examine a home directly and identify smaller factors that may adjust the value of a home.

How do Trulia’s estimates compare to Redfin Estimates and Zillow Zestimates?

Trulia’s estimates are usually identical to Zillow Zestimates. Trulia is a subsidiary of Zillow, and both sites appear to use the same algorithm for estimations.

Related articles

Best Home Value Websites: Redfin’s Estimator and Zillow’s Zestimate might be popular, but what other estimator options are out there? Read on to learn more about other home value websites, such as Realtor.com and RE/MAX.

Redfin Home Value Estimator Review: Just how accurate and trustworthy is Redfin’s home value estimator? We put its tool to the test, comparing it against other popular estimators. Learn more about how its free home value tool works, the pros and cons, and how to use it.

Zillow Home Value Estimator Review: How does the popular real estate website’s home value tool compare to its peers? We break down its Zestimate accuracy rates and if you should trust it.

Redfin Reviews: Find Pros, Cons, and Better Alternatives: Redfin is a full-service discount brokerage. It offers services similar to a traditional realtor at a discounted price. Do lower rates mean inferior service quality? Read Redfin reviews from real customers to learn more!

What Is a CMA in Real Estate? A CMA is a far more accurate home valuation method than an online home value estimator. Learn what’s included in a CMA report and how to get one for free.

Leave a Reply