Published

Zillow accuracy rate | How does it work? | Pros and cons | Zestimate vs. CMA | How it compares to other estimators

What is a Zestimate?

Zillow’s automated valuation model (AVM) provides users with a home’s fair market value based on public and user-submitted data. The company publishes Zestimates for more than 100 million homes nationwide.

Its website claims it uses state-of-the-art statistical and machine learning models to examine hundreds of data points for each home. But we found many of its estimates to be inaccurate or outdated.

A licensed realtor can provide you with the most accurate valuation. A real estate agent evaluates your home, values its upgrades and renovations, and compares it to the most recent sales in the area.

Zillow home value estimator: How accurate is it?

Median error rate

| Home type | Error rate |

|---|---|

| On-market | 2.4% |

| Off-market | 7.5% |

Zestimates for half of all off-market homes are within 7.5% of their selling price, and half aren’t. So your home value estimate could be off by tens of thousands of dollars.

Zillow’s accuracy also depends on your local housing market. Its Zestimates are far less accurate in states and cities with fewer home sales and active listings.

For example, Zillow’s error rate for off-market homes is just 5.2% in Vermont. But its error rates are much higher in states with fewer available Zestimates.

Zillow’s least accurate states

| State | Error rate |

|---|---|

| New York | 11.1% |

| West Virginia | 10.7% |

| Pennsylvania | 10.3% |

| Michigan | 10.1% |

| Maine | 9.9% |

Ultimately, Zestimates are more accurate in markets where Zillow has access to more home sales data.

Like other home value estimators, Zillow’s error rate is much lower on active listings. New listing data — such as square footage, bedrooms, and bathrooms — might have been inputted or updated by a real estate agent and incorporated into the Zestimate algorithm.

Home value accuracy tool

Our tool breaks down the Zestimate accuracy. It provides a range of what your home might be worth based on Zillow’s national median error rate of about 7% (for off-market homes).

Use the slider to enter an online estimate of your home’s current value. The tool provides a low-end and high-end value estimate based on Zillow’s median error rate.

Consider that your market may have a higher or lower error rate than Zillow’s national average.

How accurate is Zillow vs. an appraisal?

| Factors | Zestimate | Appraisal |

|---|---|---|

| Who completes it? | Computer | Licensed appraiser |

| What does it cost? | Free | $350–500 |

| How long does it take? | Instant | 1–2 weeks |

| How accurate is it? | Somewhat | Very |

A Zestimate is considered less accurate than a professional home appraisal.

It’s a computer-generated home value estimate based on publicly available data, while an appraisal is a property valuation completed by a state-licensed appraiser.

Appraisals are more hands-on than home value estimators. The appraiser usually visits the house in person for an inspection, noting any value-adding features or upgrades.

A Zestimate is based on an algorithm that incorporates public and user-submitted data. It’s not created by a real estate professional like an appraisal is, so errors are more common.

Zillow even states on its website that the Zestimate “is not an appraisal and can’t be used in place of an appraisal.”

Zillow home value estimator: Pros and cons

Pros

- Fast and easy to use

- Accuracy comparable to other estimators

- Home values updated frequently

- Useful owner dashboard

Cons

- Listing data is often inaccurate

- Renovations don’t change a home’s value

- Often uses the wrong comps

Fast, free, and easy to use

Zillow’s website makes it easy to get a free home value estimate within seconds.

You don’t need to enter your contact information to get your estimate, either. Most of Zillow’s on-market and off-market properties have a Zestimate directly on their listing page.

However, you do need to provide your full name and phone number to claim your home and edit its facts on Zillow.

Accuracy comparable to other estimators

Zillow’s error rate for on-market homes is 2.4%, and for off-market homes it’s 7.5%. Its accuracy is comparable to other estimators, including Redfin, which has an error rate of 2.1% for on-market homes and 6.4% for off-market homes.

However, like Redfin and its competitors, Zillow’s accuracy rates vary widely by location and are much lower in states with more recent home sales.

Home values are updated often

Zillow’s home values are updated multiple times per week, except on rare occasions, like if the company is making changes to its Zestimate algorithm.

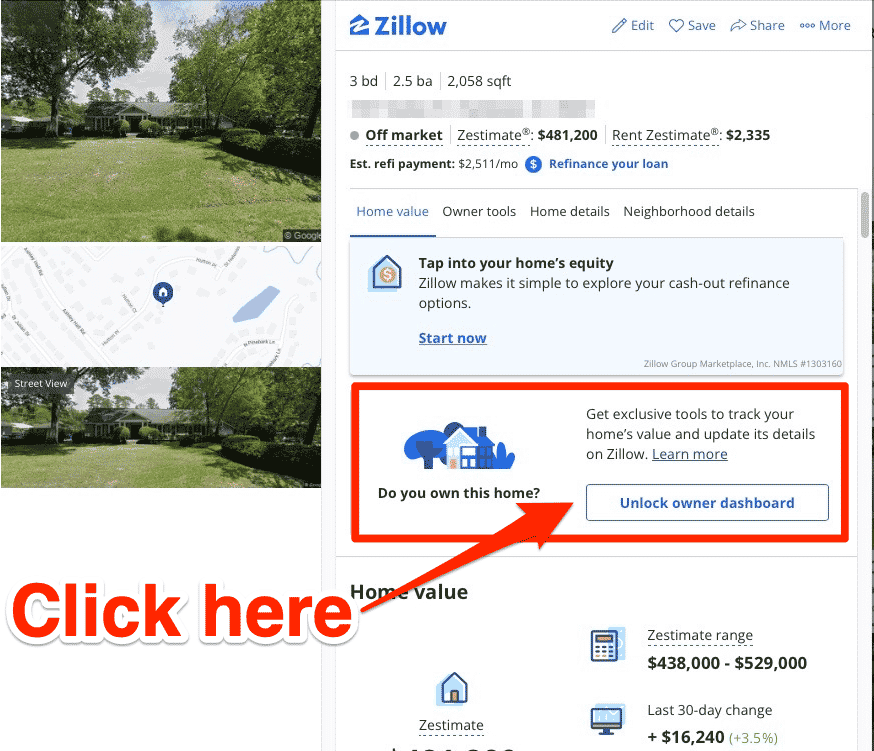

Useful homeowner dashboard

Zillow provides more than just a home value estimate. Its owner dashboard provides useful sales information, including a home value chart, a list of your home’s comps, and an estimated net proceeds calculator.

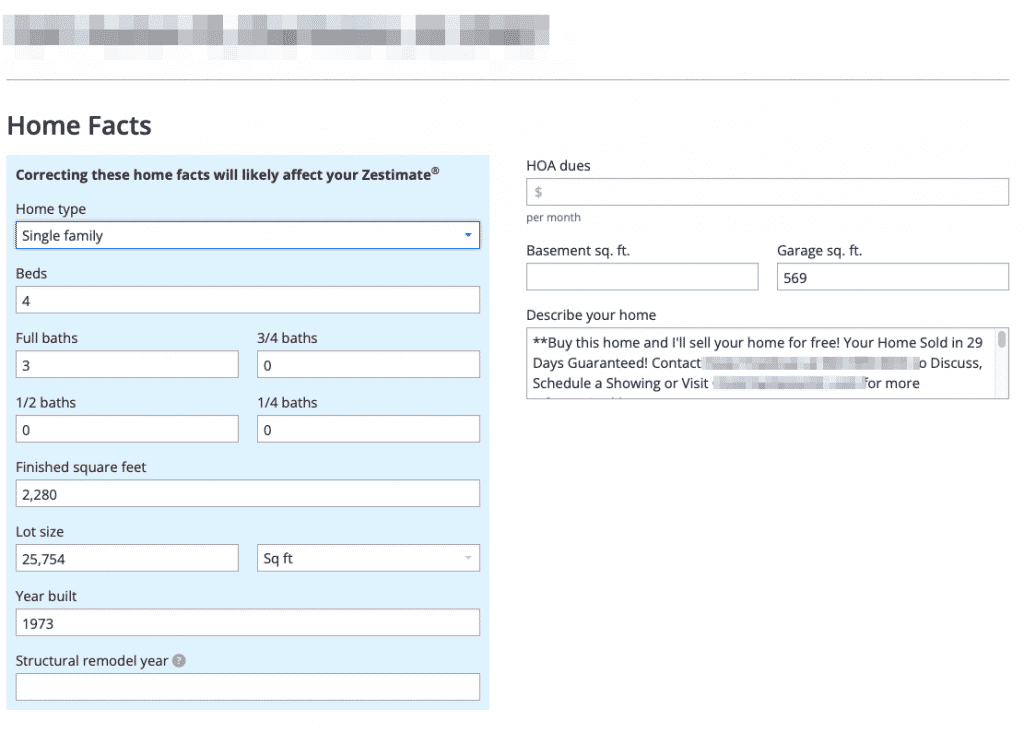

You can also correct your home’s key information — such as its beds, baths, and square footage — to get a more accurate estimate.

Inaccurate or outdated data

Zillow’s home value estimates are only as accurate as its available housing data. Zillow relies on data from the multiple listing service, tax records, and its users, and that data can be outdated or flat-out wrong — especially on off-market properties that haven’t sold in a long time.

Several of our test properties had incorrect or missing data compared to their tax records. For example, several of the homes we tested had the wrong square footage or the incorrect number of bedrooms or bathrooms.

However, these inaccuracies are pretty common with all home value estimators, not just Zillow’s.

It’s up to homeowners to update their property tax records and edit their home facts on Zillow to reflect the most up-to-date information.

Renovations aren’t factored into your home’s value

Home value estimators like Zillow often fail to give homeowners credit for additions, remodels, or major home repairs.

The company allows users to add a structural remodel to a home’s key information. But there’s no option to add other major home improvements that boost a home’s value, like a kitchen or bath remodel. Your home’s Zestimate doesn’t reflect those home improvements unless reported to your local tax assessor.

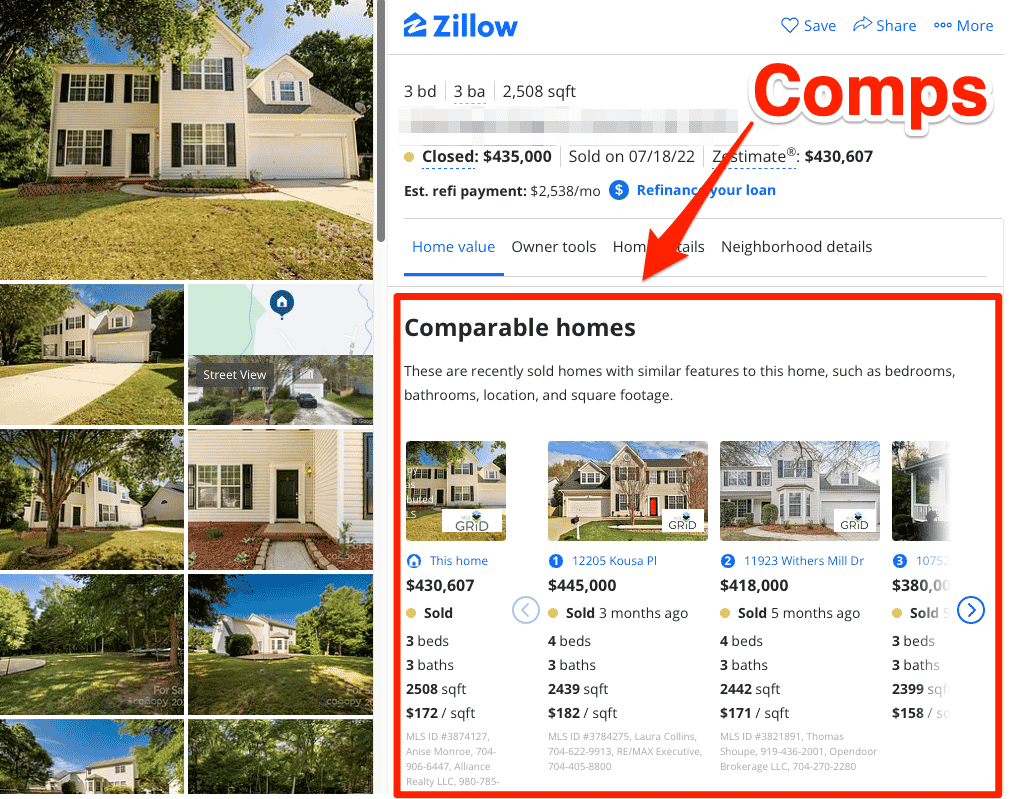

Comps are often irrelevant or outdated

Like other home value sites, Zillow does not always use the most recent or relevant home sales data to determine its estimates.

We tested several off-market properties and found that their comps included multiple homes that sold more than six months ago.

Zillow also regularly uses home sales located more than 1 mile away from the subject property and in different neighborhoods.

A comparative market analysis (CMA) report and a home appraisal rarely ever use comps that have sold six months or longer from the date of the report, as the data is considered outdated.

A real estate agent or appraiser also pulls data directly from their local multiple listing service (MLS), which has the most accurate and up-to-date sales information, while Zillow often relies on tax records or user-submitted data.

» Connect with a top-rated local agent for a more accurate home value estimate

How Zillow’s home value estimator works

Zillow’s access to housing data is a key advantage over its peers. It has data on over 110 million homes and publishes Zestimates on 104 million of them, with home values updated multiple times per week.

The company incorporates data from county and tax assessor records, as well as hundreds of multiple listing services (MLS) and real estate brokerages. Its data includes:

- Home characteristics: Beds, baths, square footage, and location

- On-market data, including listing price and days on market

- Off-market data obtained through publicly available records

- Current market trends in your area

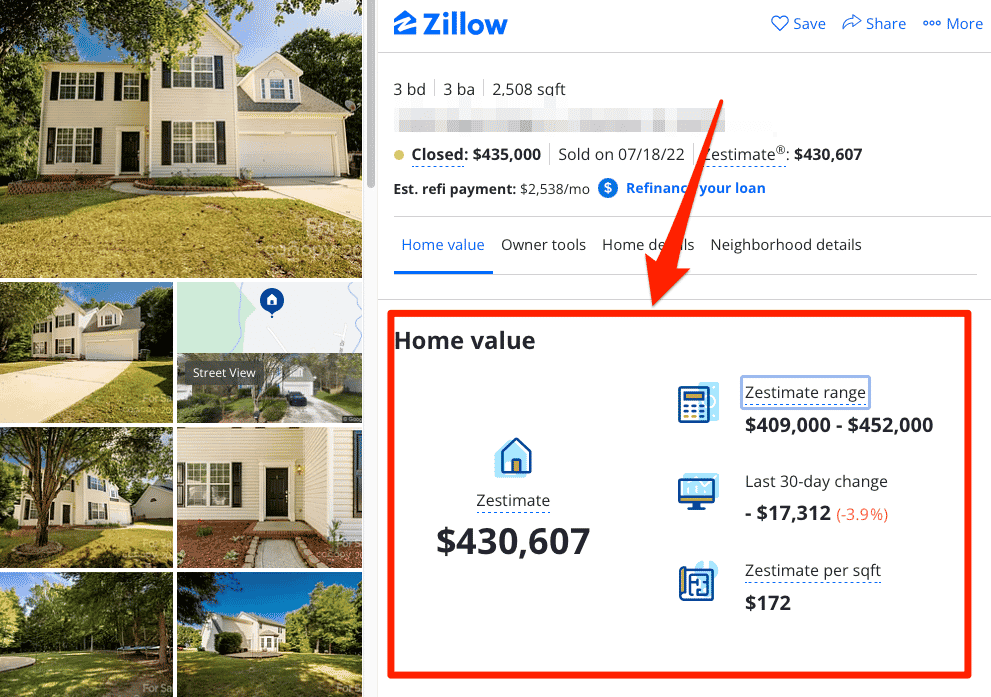

All of this data provides users with a Zestimate, a high and low estimated market value, and the value per square foot of a property.

What are comparable sales?

Like other home value estimators, real estate agents, and professional appraisers, Zillow also factors comparable sales or “comps” into its valuations.

Comps are recent home sales that are most similar to the subject property, factoring in its location, beds, baths, condition, and square footage.

Zillow usually includes up to five comps in its Zestimate. Each comp includes information impacting the subject home’s value, such as sale price, sale date, and square footage.

Useful homeowner dashboard

Zillow has one of the most useful homeowner dashboards of any home value estimator, as it includes:

- A chart of how your home’s value has changed over time

- A list of comparable home sales, with key property information

- Your estimated home equity, based on your property’s current value and remaining mortgage balance

- An estimated net proceeds calculator to show you what you might earn in a home sale

To claim your home, create a free Zillow account (if you don’t have one yet), and click “unlock homeowner dashboard” on its listing page.

You can then update any incorrect or missing information. If you feel your home value estimate is way too low, there’s likely a good reason why.

For example, we noticed a 500-foot shortage in Zillow’s finished square feet for our test property. Updating that information should lead to a higher Zestimate.

Besides finished square feet, you can also update your home’s beds, baths, lot size, year built, HOA dues, and basement or garage square footage.

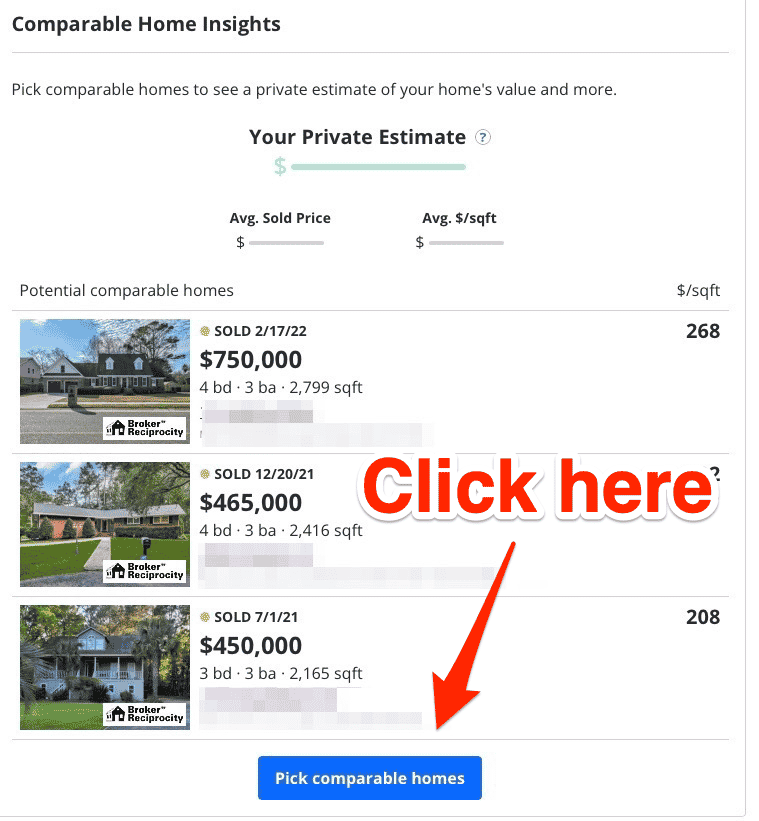

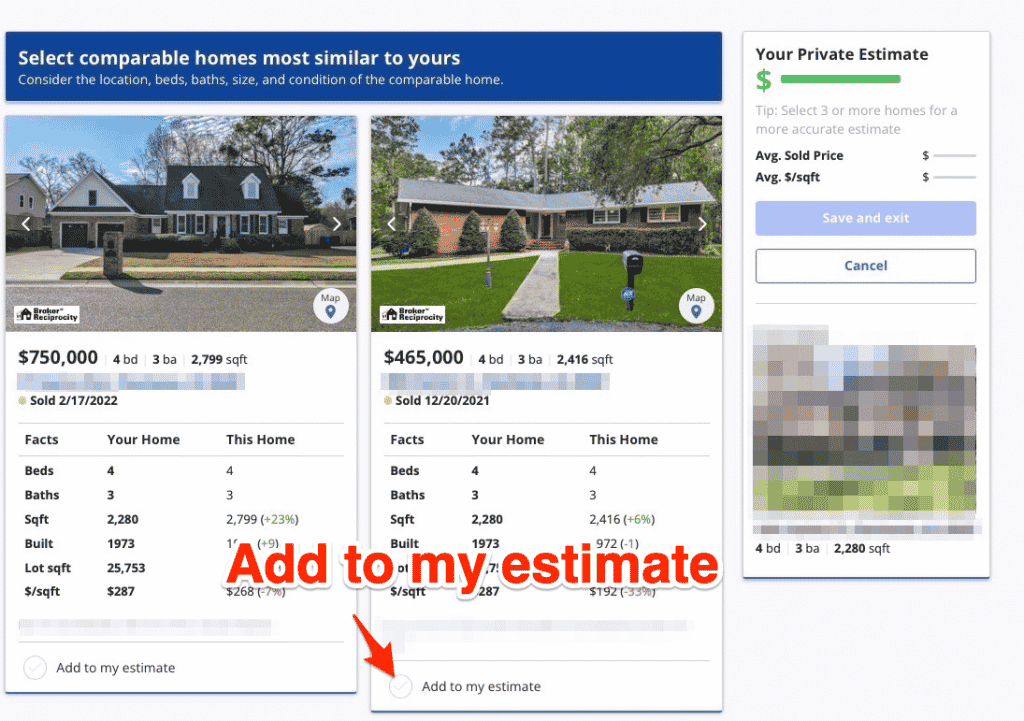

Choose your comps

Another useful feature is the ability to pick your comparable home sales to receive a “private estimate,” which should be more accurate than its automated estimate.

Simply click “pick comparable homes” on your homeowner dashboard to get started.

It brings you to a new screen with a list of eight to 10 recent home sales in your area, including each home’s key information (beds, baths, square feet, and sale price per square feet).

Scroll through each home and choose the most relevant sales by clicking “add to my estimate.” A good target is 2–3 homes that are most similar to yours and those that have sold within the past few months.

Zillow makes choosing your comps easy as it compares your home and its comps line-by-line, listing each home’s key information (beds, baths, square feet, and so on).

You can also view each listing on Zillow to compare interior photos and choose a home that’s similar to yours in condition and upgrades.

Zillow home estimate vs. CMA

We put Zillow’s home value tool to the test, comparing its Zestimate with our own CMA based on publicly available sales data.

For our example, we used a random off-market, single-family home in a popular suburb of Summerville, SC. Our subject property has four beds, three baths, and 2,106 interior square feet.

Zillow determined that this off-market house has an estimated value of $427,500. Its home value estimate is based on its selection of five comparable home sales.

How Zillow’s home value estimator compares to other estimators

Zillow vs. Redfin estimate

Zillow and Redfin are two top home value estimators, providing home values for more than 100 million properties.

Zillow Zestimates have higher median accuracy rates for both on-market and off-market properties and cover more homes in rural areas or markets with fewer home sales.

» MORE: Zillow vs. Redfin breakdown

Zillow vs. Chase

Zillow’s home value estimator also compares favorably to Chase’s. We found Zillow’s homeowner dashboard to be much easier to use and more insightful.

For example, while you can edit your home’s information on Chase, the website won’t save your edits.

Zillow also covers far more homes than Chase, as Zillow currently covers more than 104 million properties, while Chase claims it has millions of records in its database.

» MORE: Chase home value estimator review

Zillow vs. Realtor

Realtor’s home value estimator pulls data from mortgage lenders, which it says makes it more accurate than its competitors.

However, unlike Zillow, the company does not currently publish a median error rate, making it hard to compare its accuracy.

We also ran multiple test properties through its estimator and found the home values less accurate than Zillow’s.

How to get an accurate home valuation

Compare home values from multiple sites

Zillow is just one of about a dozen home value estimators. Each pulls different data to determine a home’s value.

Given the wide range of value estimates we received in our example, you can get a more accurate estimate by plugging your address into multiple home value websites and comparing your estimates.

» MORE: What are the best home value estimators?

Request a free CMA report

Zillow is a free, useful resource for a quick home value estimate. But it’s certainly not a substitute for a home valuation from a licensed real estate agent.

Real estate professionals know how to value your home’s upgrades and improvements and which recent home sales are most relevant to your home.

Thankfully, most real estate agents provide homeowners with a free, no-obligation CMA report.

» GET STARTED: Connect with a top-rated local agent

Get a pre-listing appraisal

You can order a professional home appraisal even if you’re not selling your home. It’s a pro analysis of your home’s fair market value, completed by a state-licensed appraiser.

Appraisers go through extensive training to properly value a home based on its size, condition, location, and upgrades.

An appraisal is expensive ($350–500) and often takes several weeks to complete, so keep this in mind when considering your options.

» LEARN: What to know about a pre-listing appraisal

Zillow home value estimator FAQ

Does Zillow provide an accurate estimate of home value?

A Zillow estimate is more accurate than many other real estate websites, with a low nationwide median error rate of just 2.4% for on-market properties. But Zillow home values are often based on outdated comparable properties and incorrect or missing data.

Unlike a CMA from a realtor or an appraisal, Zillow's home values are based on a computer algorithm.

Ultimately, Zillow Zestimates provide a good starting point for a homeowner or home buyer interested in learning more about a property. Readers looking for a more professional, accurate home value estimate can find a local realtor through an agent matching service.

What is the most accurate home value estimator?

Zillow is widely considered the most accurate home value estimator. It has a median error rate of 2.4% for on-market properties and 7.5% for off-market homes, slightly higher than Redfin.

However, this still means that Zillow Zestimates could be off by thousands of dollars, especially compared to a CMA report from a local realtor, or a professional home appraisal.

Should I trust Redfin or Zillow home value estimates?

Home sellers and buyers can use real estate sites like Redfin or Zillow for a quick ballpark home value estimate. But the site's property values aren't always trustworthy and shouldn't be relied upon in a real estate transaction.

Local real estate agents or appraisers are much more likely to provide you with an accurate home estimate, especially when compared to Zillow's Zestimate or a Redfin estimate. For example, a realtor or broker factors in local market conditions, and can give a home credit for its upgrades or renovations.

Learn more about how to get an accurate home valuation.

Why trust us

Real Estate Witch provides accurate, actionable, and practical information you can use to make better decisions on your real estate journey.

To create this review and others, we spent several weeks testing out every home value estimator tool. We also ran comparative market analysis reports on random properties in multiple markets to compare valuations.

Based on our findings, we think free options like Zillow can provide sellers with a ballpark home valuation. But every estimator we tested (including Zillow) was off by thousands of dollars.

Your most accurate home value estimate will come from an experienced local real estate agent or appraiser.

Related reading

Best Home Value Estimators Revealed: Free home value websites Zillow are useful for a quick ballpark estimate of a home’s value, but some are much more accurate than others. We rank the most popular home value estimators.

Redfin vs. Zillow: Check out our head-to-head article on two of the most popular home value websites. We explain how they work, compare accuracy rates, and put each one to the test.

Redfin Home Value Estimator Review: How does Redfin’s home value tool compare to Zillow, Chase, and other popular real estate sites? Our review breaks it all down for you.

Chase Home Value Estimator Review: Chase is one of just a few banks providing home value estimates by pulling recent local home sales. It’s the largest source provider of property and mortgage data, but does that translate into more accurate home values? Find out here.

Leave a Reply