Published

How Chase home values work | Should I trust it? | Chase accuracy rate | Pros and cons | Real example | Alternatives | FAQ

Editor’s take

Pros and cons

Overview

The Chase home value estimator is one of the least accurate estimators we tested. It tends to underestimate a property’s value, and it doesn’t stack up against estimators like Zillow and Redfin. For the most accurate estimate, get a comparative market analysis (CMA) report from a local realtor.

Pros

- Fast, free, and easy to use

- Easy to view comparable home sales

- You can edit a home’s key information directly on the tool

- Changing a home’s information automatically updates its value

Cons

- Often uses outdated or irrelevant comparable home sales

- Your home’s information may need to be updated

- Unlike Redfin and Zillow, Chase does not publish median error rates

Chase’s home value estimator calculates a free home value estimate within seconds. It estimates value based on a property’s key information (beds, baths, square footage) and what similar homes in the area are selling for.

It’s very easy to use, and you can change a home’s key facts directly on the tool. Editing a home’s information — like its beds, baths, and square footage — will automatically update its value.

While we found the tool somewhat useful, we discovered that Chase and other home value estimators frequently use outdated or irrelevant comparable sales to determine a home’s estimated value, which means they’re estimates aren’t accurate.

How accurate is the Chase home value estimator?

We found the Chase home value estimator to be less accurate compared to its peers. It often underprices homes, even though Chase claims its valuations are based on millions of home records in its database.

Chase’s disclaimer warns: “The data and valuations are provided as is without warranty or guarantee of any kind … . The accuracy of the valuations are estimated based on available data and do not constitute an appraisal.”

Home value estimators like Chase’s are usually not accurate or reliable enough to make a major financial decision like setting a list price on a home. But they can still be useful for an idea of what your property is worth.

We recommend using a few of the most accurate home value estimators for a more accurate picture of your home’s value. You can compare values from tools like Zillow’s Zestimate and the Redfin Estimate.

How can I get the most accurate estimate?

You can get a much more accurate home value estimate by requesting a CMA from a realtor.

A CMA (comparative market analysis) is a report that a real estate agent completes using their local market expertise and professional judgment. This report is usually free, with no obligation to hire the agent.

Unlike home value estimators, a real estate agent visits the home in person to get the most up-to-date details, hand-selects the best comparable sales, and accounts for renovations and upgrades.

Getting an accurate estimate from a CMA can help you set a competitive listing price, which can lead to more profit from your sale.

» Learn more about CMAs | Request a free CMA from a local realtor

How does Chase’s home value estimator work?

Like other home value estimators, Chase calculates a home’s estimated value by pulling recent local home sales.

The company claims it’s the largest source provider of property and mortgage data, collecting and managing data from more than 10,000 government and proprietary sources. Its database is updated daily.

Chase’s data points include information from a property’s tax records, such as its bedrooms, bathrooms, square footage, and year built. Chase then determines the home’s estimated value by comparing it to similar, recent home sales in the area.

Intuitive user interface

We found Chase’s home value tool to be easy to use on a web browser.

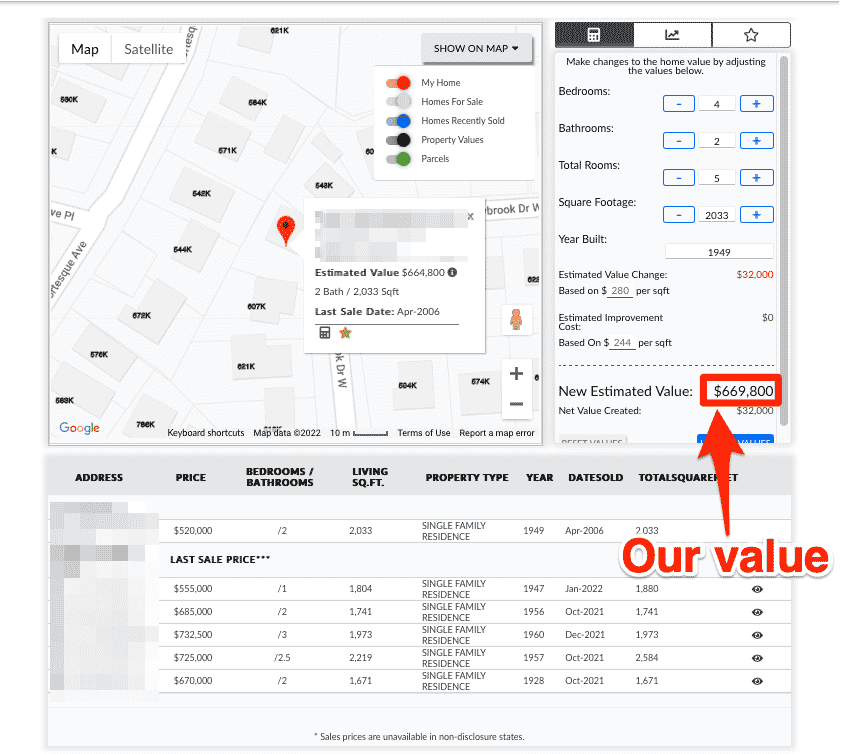

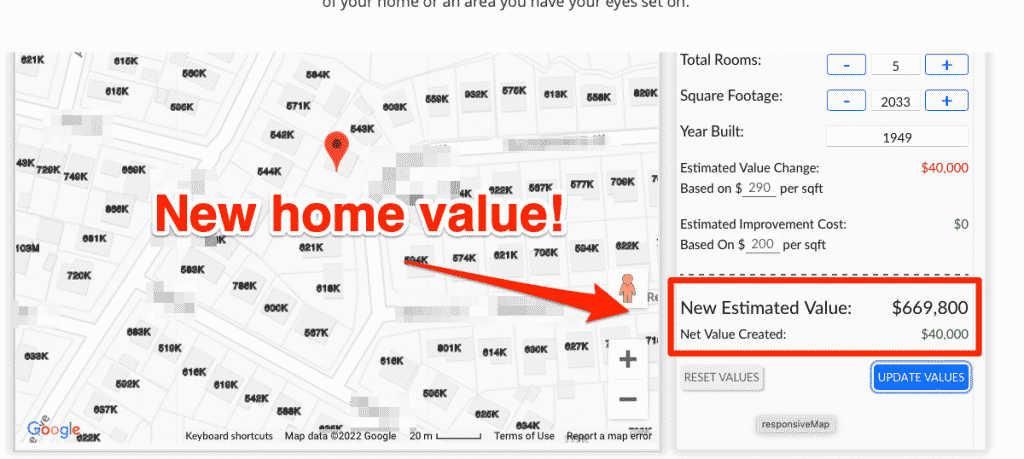

After plugging in a test property — a 3 bed, 2 bath single-family home in a suburb of New York City — we quickly received an estimated value of $669,800 on the top right corner of the screen.

It was easy to adjust the home’s key facts and get an updated home value based on our changes. For example, adding a bedroom increased our subject property’s value by $8,000.

Editing a property’s interior square footage also changes its value.

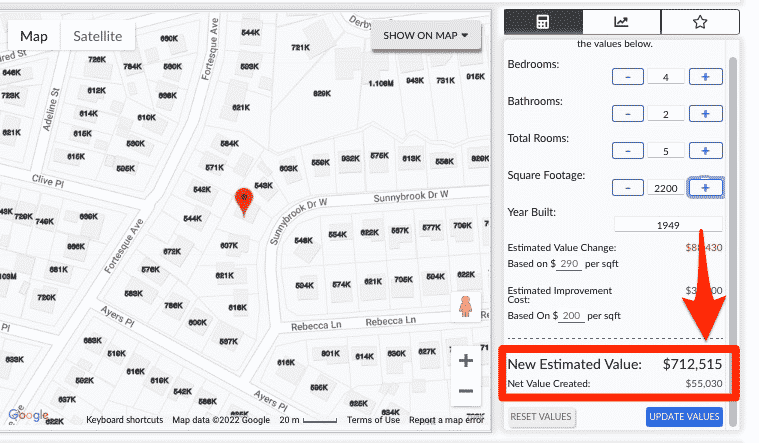

Chase estimates that each square foot is worth $280 in the property’s market. Increasing our home’s square footage to 2,200 improved its value by close to $43,000, for a new value of $712,515.

No option to add renovations or repairs

Like other online home value estimators, Chase likely doesn’t know about any major improvements or repairs made to a property unless it’s reflected on its tax records.

It also isn’t aware of any special features that may add to a home’s value, like an inground swimming pool, energy-efficient appliances, a finished basement, or a converted attic.

Some home value estimators let you add in those renovations or special features. We didn’t see this option with Chase. We were only able to update a home’s beds, baths, square footage, and year built.

Home value estimators like Chase’s often fail to give homeowners credit for renovations, repairs, or special features.

We highly recommend speaking with a real estate agent for a more accurate home value estimate. Only a local professional knows how much value to assign to a home’s upgrades and key features.

» LEARN: How to get a free, accurate CMA report

Chase’s home value estimator: Should I trust it?

We dug deeper to learn how Chase determined our subject property’s fair value.

Chase says that its proprietary home valuation method is based on millions of home records in its database. But we didn’t find its value estimator to be that trustworthy based on how it chose its comparable home sales (or “comps”).

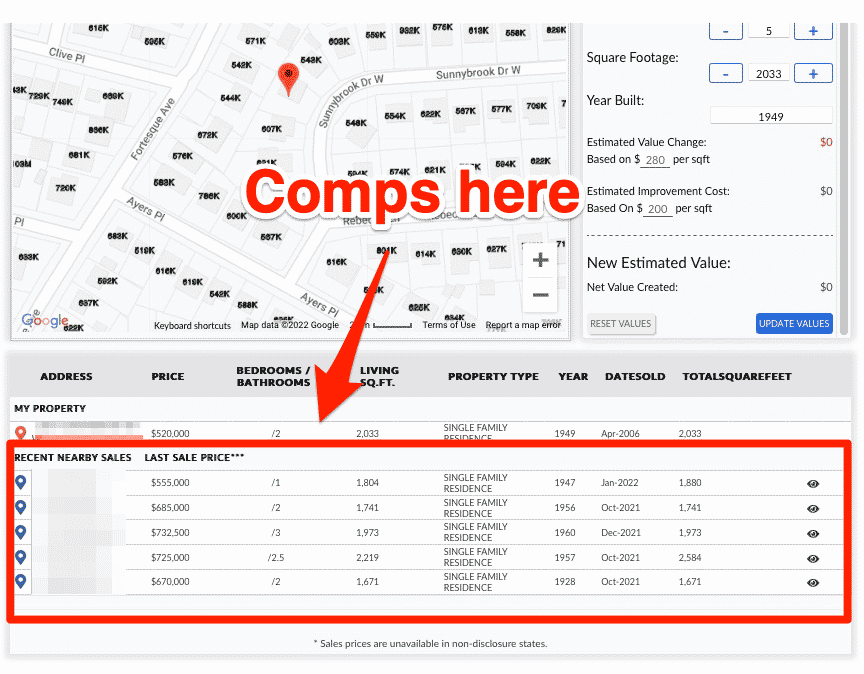

Comps are recent home sales that most closely match the subject property’s location, size, condition, and features. Averaging the sale prices of comps is the primary way a real estate professional determines a home’s fair value.

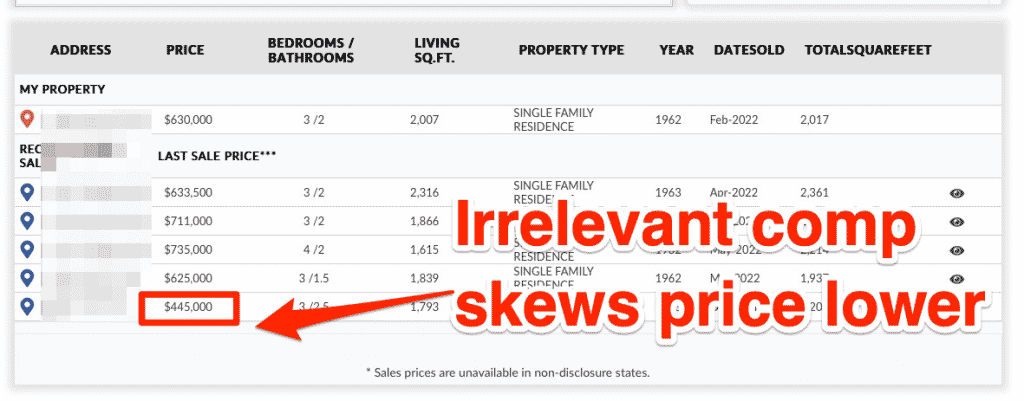

You can see which comps Chase uses by scrolling down below the Google map. Under “my property” you can see addresses under “recent nearby sales.”

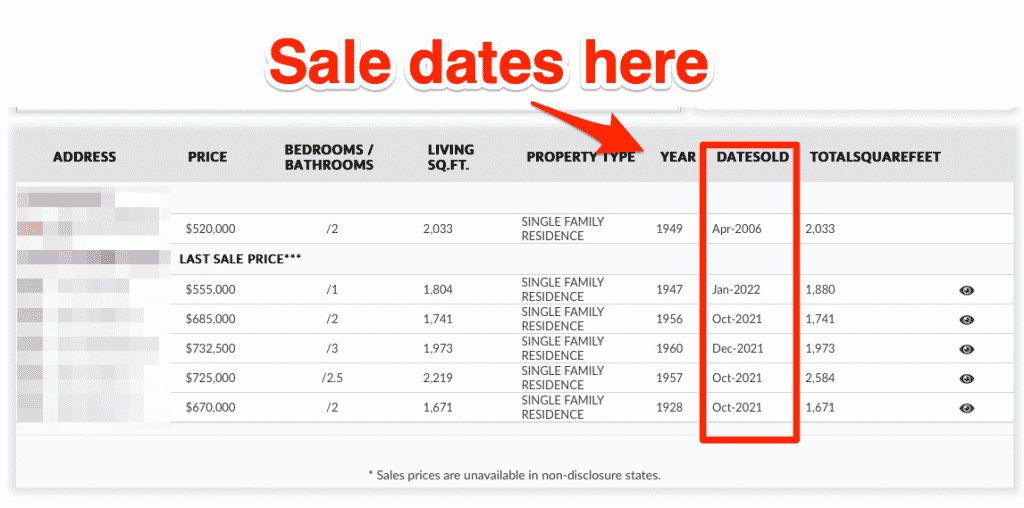

Real estate agents, brokers, and appraisers typically only choose comparable sales that closed within the past few months from the date of the home valuation. In rare cases, a real estate professional might go past six months, like in rural areas with few recent sales.

Chase used multiple outdated home sales

Several comparable home sales closed more than six months ago. Three of its five comps last sold in October 2021, or nine months from the date of this article’s original publication.

These home sales are likely too outdated to use for a reliable home value estimate.

There’s also one questionable comp used in its valuation. The bottom home sale only has 1,671 sq. ft. and was built in 1928, compared to our subject property, which has over 2,000 sq. ft. and was built in 1949.

A real estate professional might not have used this comp for a few reasons:

- The home’s interior living space is 300 square feet smaller than the subject property.

- It’s 21 years older than the subject property, and might not be in the same condition.

- The home is also located a half mile from the subject property, in a different neighborhood, and on a busier street.

Poorly-chosen comps are the primary reason why home value estimators like Chase are generally less-trustworthy compared to a comparative market analysis report from a local real estate professional.

How accurate are Chase’s home value estimates?

| Tool | Median error rate |

|---|---|

| Chase | N/A |

| Zillow | 7.49% |

| Redfin | 6.47% |

Unlike its peers Redfin and Zillow, Chase does not publish a median error rate, so it’s hard to determine its accuracy compared to peers.

The national median error rate for off-market homes is 6.47% at Redfin and 7.49% at Zillow. This means that roughly half of all off-market homes are within 6.47–7.49% on these two sites, while half are not.

That means your home value estimate could be off by tens of thousands of dollars on either site. For example, at a 7% error rate, a $500,000 home may truly be worth $465,000–535,000.

» MORE: Zillow vs. Redfin home value estimator

Chase home value estimator: Pros and cons

Pros

- Fast and easy to use

- You can edit your home facts

- Easy to view comparable sales

- Home values frequently updated

Cons

- Inaccurate or missing information

- Often uses outdated sales

- Home value estimates can’t be saved

- No option to add home renovations

Fast and easy to use

Chase was able to provide us with a free home value estimate within seconds. Unlike some other home value websites, you don’t need to enter your contact information to get an estimate.

Editing home facts changes your estimate

We found it easy to adjust our subject property’s key facts, and doing so gave us an updated home value.

For example, adding an extra bedroom increased our home’s value by $8,000, while increasing our home’s square footage to 2,200 improved its value by close to $43,000.

Easy to view comparable sales

Chase’s value estimator makes it easy to view which comparable sales it has chosen. It lists the subject property address and details, followed by 3-5 comps, as well as information on each property including its last sale price and date sold.

Home values are frequently updated

Chase claims that its home sale data is updated daily to “reflect the most current property and mortgage transaction data available nationwide.”

Inaccurate or missing housing information

Several of the properties we tested had incorrect or missing information compared to their tax records.

For example, our subject property and every comparable home was missing its number of bedrooms (we had to enter that information manually).

One of the comps also had the wrong number of bathrooms listed (it was off by a half bathroom).

However, these inaccuracies are not exclusive to Chase, as we’ve found them pretty common among the home value estimators we tested.

Uses outdated comparable sales

We found that Chase frequently uses outdated comparable home sales to determine its home value estimates.

On our test property, three of the five comps most recently sold 9 months ago.

In addition, one of the comps was smaller than the subject property than 300 sq. ft., and was built more than 20 years earlier.

Home value estimates can’t be saved

One of the most frustrating parts of using Chase’s home value estimator is that you have to start over every time you refresh or exit the website. Chase does not save any edits you make to your valuation, including changing a home’s information.

There’s also no option to get updates on your home’s valuation over time. For example, Redfin provides users with an owner dashboard that regularly updates home values to reflect current market conditions.

No option to add in home renovations

We didn’t see any way to add in custom home renovations or repairs. Certain home improvements — like a new kitchen, updated bathrooms, and new flooring — typically raise a home’s value.

Chase home value estimator: How to use it

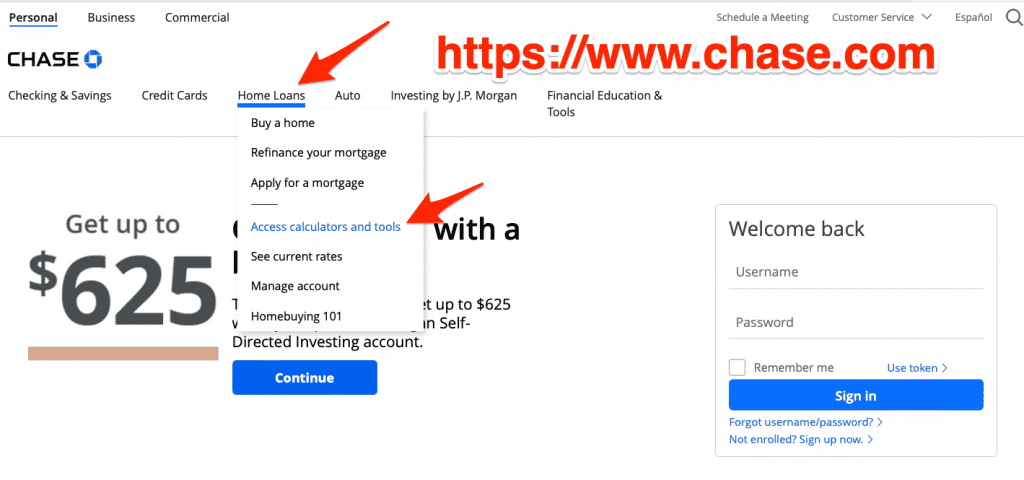

1. Visit Chase’s website

Chase’s home value estimator can be found on its main website. Click “home loans” and then the tab “access calculator and tools.”

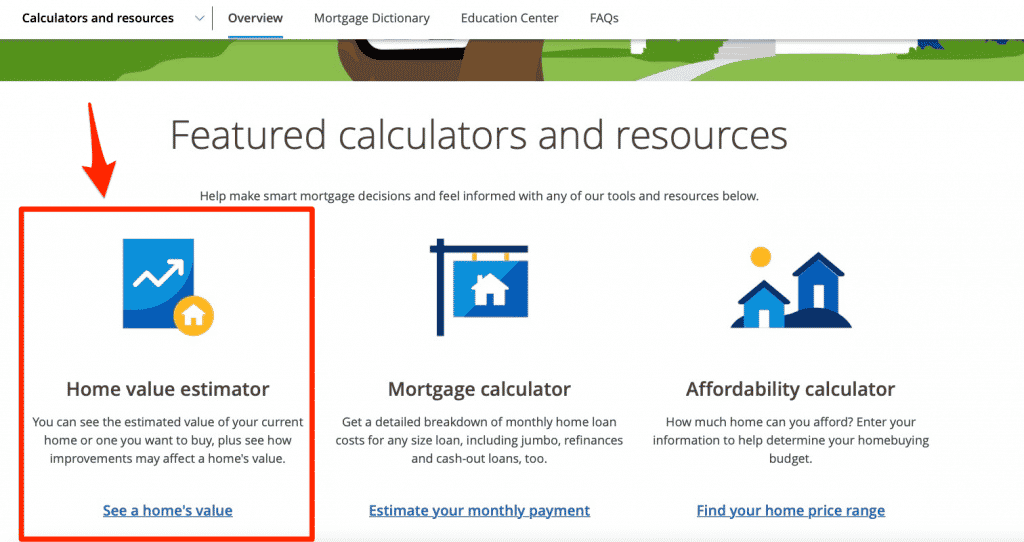

That brings you to Chase’s calculator and resources page. A link to its home value estimator is found in the bottom left corner of the screen. Click “See a home’s value.”

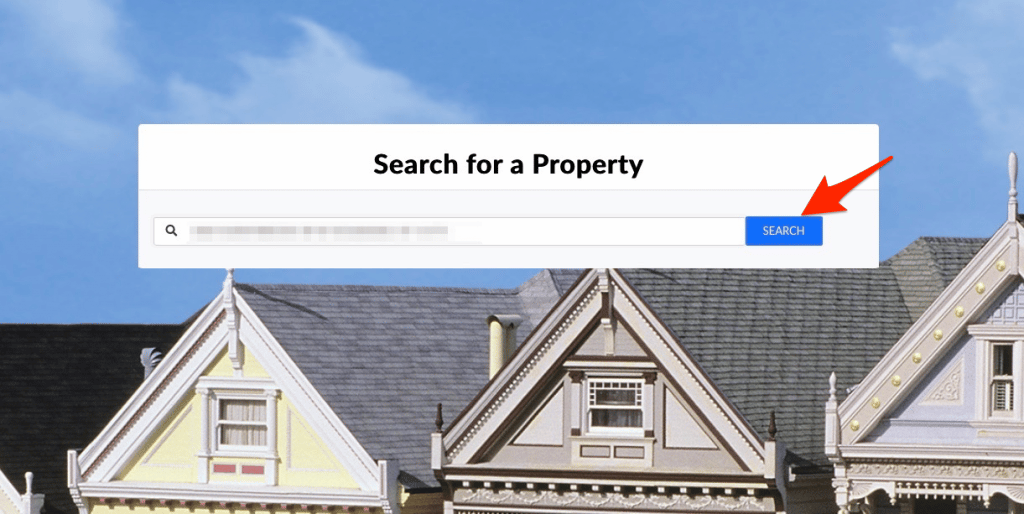

2. Enter your property address

Chase’s property search bar is in the center of the screen. Start typing in the property address, and Google should automatically populate the field with addresses. Select the right address and then click “search.”

3. View your home’s value

Chase posts a Google Map of your subject property’s location, and your home’s estimated value in the top right corner of the screen.

Clicking the info tab after “estimated value” brings up a frequently asked questions page, which contains responses to questions such as “how is an estimated home value calculated?” and “where does your data come from?”

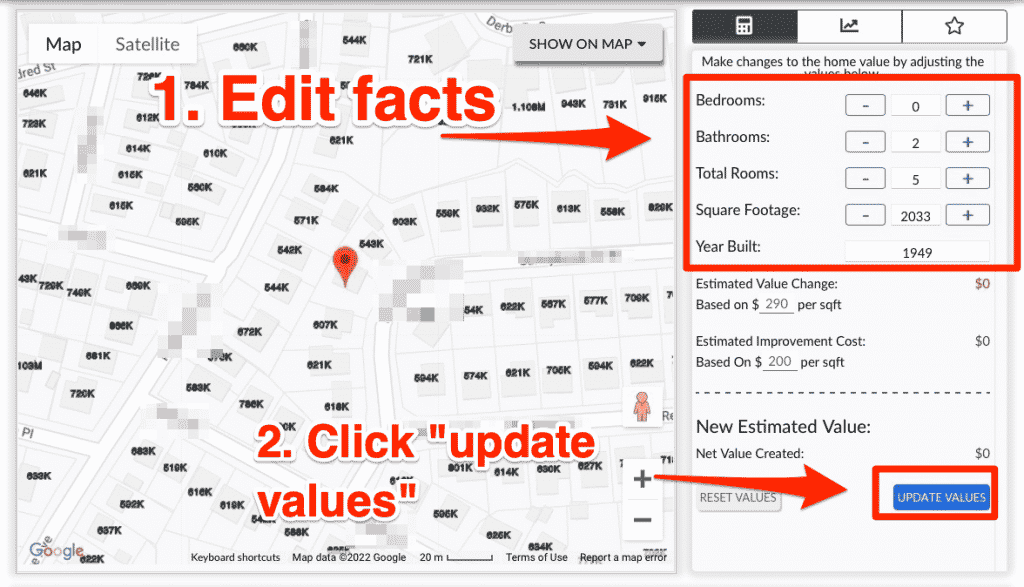

4. Edit your home’s key information

Based on our analysis, Chase likely won’t have the correct information for your home or comparable properties. But you can manually edit a home’s information for a more accurate value estimate.

You can edit a home’s beds, baths, total rooms, square footage, and year built.

You can search our property’s tax records for the most up-to-date information and then change the info. In the right-hand corner of the screen.

5. View your new home value estimate

Finally, select “update values” to receive your new value estimate and net value created, which appears right above the tab.

Chase home value estimator vs. our CMA

We put Chase’s home value tool to the test, comparing its estimate with our own based on publicly-available comparable sales data.

For our example, we used a random off-market, single-family home in a suburb of Charlotte, North Carolina.

- The home has 3 beds, 2 baths, and 1,905 sq. ft.

- Chase has determined that this off-market house has an estimated value of $651,600.

We ran the numbers with our own CMA report and determined the home has an estimated value of $671,667. Our figure is based on an average of the three most recent, relevant comparable home sales in the area:

| Property | Sales price | Beds | Baths | Sq. ft. |

|---|---|---|---|---|

| Subject | N/A | 3 | 2 | 1905 |

| Comp #1 | $650,000 | 3 | 2 | 1658 |

| Comp #2 | $630,000 | 4 | 2 | 1834 |

| Comp #3 | $735,000 | 4 | 2 | 1730 |

We think Chase’s home value estimate of $651,600 is too low. One reason is due to Chase using an irrelevant comparable sale – one home sale of $445,000 skews its estimate lower.

We searched that home’s last listing, and it looks like it was sold as a fixer-upper. The photos show that it’s far more outdated than other homes in its area, which is why it sold for more than $100,000 less than any other home.

What is the best home value estimate website?

We plugged the property address into several other home value websites to see how the valuations compared and averaged the home’s value from all six sources.

| Estimator | Value |

|---|---|

| Chase | $651,600 |

| Bank of America | $653,869 |

| RocketHomes | $659,000 |

| Our estimate | $671,667 |

| Zillow | $679,300 |

| Redfin | $712,356 |

| Average value | $671,299 |

Why the large value difference in value?

The subject property’s estimated valuation ranged from $651,600 (Chase) to $712,356 (Redfin), a $60,757 difference!

Our CMA estimate came in $671,667, close to the average estimate ($671,299). We carefully selected our three comparable sales:

- We only used recent home sales (past 1–3 months), while several estimators used home sales from more than 6 months ago. For example, Chase used two home sales from October 2021 (nine months ago).

- Our comps stayed within a few hundred sq. ft. of the subject property, while several estimators used homes that were larger by 300 sq. ft. or more.

- We scrolled through property photos to view upgrades and renovations, only choosing properties in a similar condition.

Ultimately, a local real estate agent, broker, or appraiser knows your market much better than an automated home value estimator.

» MORE: Find an agent for a true home value estimate

How Chase’s home value estimator compares

Chase vs. Zillow

Chase’s home value estimator does not compare favorably to Zillow’s Zestimate.

Zillow’s property value estimation tool has the lowest median error rates for both on-market (1.9%) and off-market properties (6.9%), while Chase has yet to make its figures available.

We found Zillow’s owner dashboard easier to use. It also provides more insights into the value of a home, including how prices are changing over time, price per square foot, and an estimated net proceeds calculator to see what you might walk away with in a sale.

Zillow also likely covers more homes than Chase, as Zillow claims to have home valuations for 104 million homes across the country.

» MORE: Is Zillow’s Home Value Estimator Accurate?

Chase vs. Redfin

We think Redfin’s home value estimator rates higher than Chase’s for several reasons.

Like Zillow, Redfin also publishes its error rates for both on-market (2.61%) and off-market (7.67%) properties.

We found Redfin’s estimator to be slightly more accurate compared to Chase, and on par with Zillow’s, based on our analysis of several properties.

Like Chase, Redfin’s homeowner dashboard is fast and easy to use. However, Redfin allows you to save a home’s information and receive regular home value updates, while Chase does not.

» MORE: Redfin Home Value Estimator Review

Chase vs. Bank of America

Bank of America’s value estimator is easier to use and more visually appealing compared to Chase’s. For example, it includes a nice price chart for each home to show how its value has changed over time. But we don’t think either is particularly accurate or useful.

Unlike Chase and several other estimators, Bank of America users cannot edit a home’s key information or choose different comparable sales. So you have to go by the information that’s on its website, which isn’t always accurate.

Like Chase, we also found that Bank of America frequently uses outdated or irrelevant sales information – even going back as far as two years to choose a comp in our example.

» MORE: Bank of America Home Value Estimator: Is It Accurate?

FAQ

How accurate is Chase's home value estimator?

We put Chase's value estimator to the test against other popular estimators. We didn't find Chase's home value estimator to be accurate compared to its peers, as it often underprices or overprices its estimates. Learn more about Chase's accuracy rate and how its estimate compares to our own.

Chase often uses outdated or irrelevant home sales information, like homes that sold more than 6 months ago, or sales located miles away from the subject property.

Chase's estimator works best for a quick ballpark estimate of a home's value, and shouldn't be used as a substitute for a CMA report or an appraisal.

Our article breaks down how it compares to a CMA report, and its peers, including Zillow, Redfin, and Realtor.

What is the most accurate home value estimator?

Zillow's Zestimate rates as one of the most accurate home value estimators. It reports a median error rate of just 2.4% for on-market homes, and 7.49% for off-market homes. Zillow has home valuations for 104 million homes across the country. Chase has not yet published an error rate for its home value estimator.

However, Zillow and other estimators are not nearly as accurate compared a CMA report from a local real estate expert, who hand-picks comparable home sales and can give your home credit for any renovations or upgrades you've made. An agent matching service can connect you with experienced local agents for a free CMA report.

How can I estimate my home's value?

There are three primary ways to estimate a home's fair value:

- Use multiple home value estimators: Chase is just one of about a dozen home value estimators. For a more accurate estimate, we recommend pulling your home's value from several websites and getting an average value. Learn more about the best home value estimators.

- Get a CMA report from a realtor: A local real estate agent knows your market best and how to accurately value homes. For example, an agent knows how much value a new kitchen or renovated bathroom adds in your market. They can also price your home based on current market conditions instead of relying on outdated home sales data. Learn how to get a free CMA.

- Order a pre-listing appraisal: For a more professional home value estimate, order an appraisal from a licensed pro. Just keep in mind that pre-listing appraisals are costly and may take a week or longer to complete. They're often not necessary unless you plan to sell without the help of an agent.

Why trust us

Real Estate Witch’s mission is to provide accurate, actionable, and practical information you can use to make better decisions on your real estate journey.

To create our home value estimator reviews, we spent several weeks testing out every online tool, and we ran our own comparative market analysis reports on random properties in multiple markets to compare the numbers.

Based on our findings, we believe that free options like Chase Bank’s tool can provide you with a ballpark estimate of a home’s value. But every estimator we tested (including Chase’s) was off by at least several percentage points, equaling thousands of dollars.

Your most accurate home value estimate will come from an experienced, local real estate agent or appraiser.

About the author

Steve Nicastro is a real estate agent, investor, and personal finance writer based in South Carolina.

He has completed dozens of comparative market analysis (CMA) reports for prospective home sellers, and knows first-hand how inaccurate home value estimators like Redfin and Zillow can be.

Steve is also an active real estate investor and has experience completing his own home valuation estimates to analyze flips. He has used sites like Zillow, Redfin, and Realtor.com for quick valuation estimates.

Related articles

Best Home Value Estimators, Ranked: Free home value websites like Chase, Redfin, and Zillow provide a ballpark idea of your home’s fair value. We rank the most popular home value estimators.

Redfin Home Value Estimator Review: How does Redfin’s value estimator tool compare to Chase and other popular real estate sites? Find out here.

Redfin vs. Zillow Estimator: Our head-to-head matchup compares the two most popular home value estimators: Redfin and Zillow. We explain how they work, their accuracy rates, and how to use them.

What Is a CMA in Real Estate? Learn more about the home valuation method frequently used by real estate agents and brokers. We also discuss how to get a free CMA from a professional.

Pre-Listing Appraisal: Do I Need One? Paying for an appraisal could make sense for some homeowners, especially those planning to sell without a realtor or own a home that’s hard to value.

Leave a Reply