Published

What is Zillow Offers? | How much does Zillow Offers pay? | Zillow Offers fees | How it works | Locations | Zillow Offers reviews | Alternatives | Zillow Offers vs. Opendoor

✍️ Editor’s Note

On Nov. 2, 2021, Zillow announced that Zillow Offers would permanently shut down. While Zillow is no longer purchasing homes, there are other ways to get quick, all-cash offers on your house:

- Get a free cash offer comparison from Clever Offers

- Sell to an iBuyer

- Sell to a leading cash buyer

For the most competitive cash offers — with no added fees or commissions — we recommend Clever Offers.

Our top alternatives to Zillow Offers

| Company | Customer Rating | Type | Best for | Service Fee | |

|---|---|---|---|---|---|

|

Best overall

Clever Offers |

5/5

|

Cash offer network

|

Multiple offers, legitimate cash buyers

|

None

|

Compare Offers |

Opendoor |

4.2/5

|

iBuyer

|

Higher offers for homes in good condition

|

5%

|

Learn More |

Offerpad |

4/5

|

iBuyer

|

Flexible selling options with plenty of perks

|

5%

|

Learn More |

Service Fee

Customer Rating

Time to Close

Our take

Details

Eligibility

Clever Offers provides a hassle-free way to compare offers from leading investors across the U.S. The 5-star rated company can help you source up to 10 competing cash offers from investors in their network — sparking competition and helping you make a more informed decision. Read our full Clever Offers review.

Pros

- One source for multiple competing offers

- Buyers are screened for experience and proven success at closing deals

- Clever stays with you to ensure a smooth closing and resolve any issues that arise

Cons

- Some offers may be low

- Alternative deal types may have longer closing timelines

- Cash offer options may be limited in some areas

- Clever’s Offers helps you find and compare multiple offers from legitimate cash buyers, ranging from local investors to nationwide iBuyers.

- Buyers are screened for experience, financials, and a track record of recently closed deals.

- In addition to cash offers, you can explore creative financing options like novation and subject-to agreements to help you maximize profit or preserve your credit if you’ve fallen behind on your mortgage.

- You can also request a pricing opinion from a local realtor, so you can compare offers against a realistic sale price.

- Clever offers full support during the selling process, including resolving any concerns or issues that arise with buyers.

- Clever’s service is free to home sellers – buyers pay Clever a small percentage of each deal closed.

- If you opt to list your home instead, you can get exclusive savings through their top-rated agent network.

Locations: Clever Offers is available nationwide.

Purchase criteria: Almost any property is eligible, regardless of condition.

Service Fee

Customer Rating

Time to Close

Our take

Eligibility

Details

Opendoor pays much closer to market value than traditional house flippers while still offering the benefit of fast closings and no repairs. For that convenience, you’ll need to contend with stricter purchase criteria, repair deductions, and a service fee of 5%. Read our full Opendoor review.

Pros

- Pays closer to market value than traditional home flippers

- No need to make repairs or prep your home for sale

- Choose your closing date and change it if needed

Cons

- Final offers can be significantly lower than the initial estimates

- Stricter purchase criteria than traditional home flippers

- Repair deductions and 5% service fee can eat into profits

Locations: Opendoor is currently available in 50+ major markets in AL, AZ, CA, CO, FL, GA, ID, IN, KS, MA, MI, MN, MO, NV, NJ, NM, NY, NC, OH, OK, OR, SC, TN, TX, UT, VA, WA, and Washington, DC.

Offer criteria: Only single-family homes and townhomes built after 1930, valued between $100,000 and $600,000 (up to $1.4 in some markets), and on a maximum lot of 1–2 acres (depending on market). Must be owner-occupied without any serious issues.

- iBuyer providing cash offers on homes in 50+ markets across the U.S.

- Initial offers are made within 48 hours of submitting property information online

- Final offer is provided after a brief inspection, which can be done in-person or by phone/video

- Sellers have the option to accept cash offer or list with an Opendoor partner agent, using the cash offer as a backup

- Cash offer comes with a 5% service fee, plus variable repair costs, on top of traditional closing costs

- You can choose a closing date 14–60 days after receiving your final offer

- Listing option comes with a traditional realtor commission of ~6%

- Backup cash offer is good for 60 days

- Option to rent back your home for a daily fee if extra move out time is needed

Service Fee

Customer Rating

Time to Close

Our take

Eligibility

Details

Offerpad pays more for homes than traditional house-flippers and also offers great perks, including free local moves and flexible closing windows of 8–90 days. However, customers claim it charges high fees for repairs uncovered during the home inspection. Read our full Offerpad review.

Pros

- You can close in just eight days (15 in FL and GA)

- You can stay in your home for three extra days past your closing date at no charge.

- Sellers get free local moves and a 3-day free extended stay after closing

Cons

- Strict purchase criteria compared to traditional house flippers

- Repair deductions can greatly reduce your final offer

- 1% cancellation fee for backing out after accepting the final offer

Locations: Offerpad is available in 24 major markets across AZ, CO, FL, GA, IL, IN, KS, MO, NV, NC, OH, SC, TN, and TX.

Purchase criteria: Offerpad buys single-family homes, condos, townhomes, and homes in gated and age-restricted communities. Must be in good condition, built after 1950, valued at no more than $1 million (depending on market), and on a lot under one acre. Cannot have significant title or structural issues.

- iBuyer making all cash offers on homes in 23 U.S. markets

- Sellers can choose to accept a cash offer or list with an Offerpad agent

- Initial cash offers made within ~24 hours of submitting information online; final offers made after a home inspection

- Flexible closing window of 8–90 days (minimum 15 days in FL and GA)

- Company offers free local moves and 3-day grace period for extra move out time

- Cash offer comes with a 5% service fee and variable repair costs, on top of traditional closing costs

- 1% cancellation fee if seller back out after accepting a final offer

- Listing option comes with standard realtor commission (~6%) and includes free services like deep cleaning, handyman help, and landscape/pool cleanup

- Discounts available for bundled services, such as applying for a loan through Offerpad Mortgage

If you’re curious what a cash buyer would pay for your house, we recommend starting with a free service like Clever Offers.

With Clever Offers, you can compare up to 10 competitive offers from local, regional, and national cash buyers.

Simply tell Clever’s team about your property, and they’ll send you tailored offers from vetted cash buyers in your area. You can compare offers to see which one is the best deal and either accept or walk away — no strings attached.

If you want to compare cash offers with your estimated home value, Clever will also connect you with a real estate agent who can provide a free comparative market analysis. When you know what your home is worth, you have more leverage to negotiate with cash buyers, and you’re more likely to sell for a price you’re happy with.

Clever Offers is free, and there’s no pressure to move forward with an offer if you don’t like the price. See what buyers will offer for your home.

What was Zillow Offers?

Zillow Offers, at a glance

| Criteria | Details |

|---|---|

| 💰 Total Zillow Offers fees | 9.5–22% |

| 📍 Locations | 47 cities in AL, AZ, CA, CO, FL, GA, ID, IN, MN, MO, NV, NJ, NY, NC, OH, OK, OR, SC, TN, TX, UT, VA, DC |

| ⏱️ Initial cash offer | 48 hours |

| 🤝 Closing timeline | 1 week to 3 months |

| ☎️ Contact | Phone: 1 (833) 963-3377 | Email: [email protected] |

In 2018, Zillow launched Zillow Offers to compete with companies like Opendoor, the nation’s largest iBuyer. Through Zillow Offers, Zillow made near-instant cash offers on homes — which it bought directly from sellers for the purpose of reselling at a higher price.

Until it stopped buying homes in November 2021, Zillow Offers was the second-largest iBuyer based on transaction volume and was available in 47 metro areas across the nation. Like its competitors, Zillow Offers promised a quick and hassle-free experience, with no need to list or show your home.

After you sold your home to Zillow, the company would repair and list it on the open market — typically for more than what it paid.

However, Zillow Offers fees were typically more than other iBuyers and could have taken a significant slice of your proceeds. Also, the scarcity of third-party Zillow Offers reviews made it difficult to evaluate whether past customers had a good experience.

» JUMP TO: Zillow Offers reviews | Zillow Offers fees

Why did Zillow Offers shut down?

On Nov. 2, 2021, Zillow announced it was leaving the iBuyer business because of problems with its home-buying model. CEO Richard Barton said Zillow had simply overbid on too many homes, and the company was stuck with thousands of properties worth less than what they paid.

In the months leading up to the shutdown, from July to September 2021, Zillow Offers lost more than $420 million. This loss effectively erased all of Zillow Offers’ profits from the 12 months prior to July 2021.

What if Zillow already agreed to purchase my home?

When Zillow Offers announced the shutdown, it said that sellers who signed a purchase agreement before Nov. 2, 2021 should expect their sale to close as planned.

However, weeks later Zillow cancelled 400 of the remaining 8,172 contracts because they had closing dates in 2022. Zillow returned the earnest money and offered payments for sellers who agreed to terminate their contract by Nov. 30, 2021. Zillow said it didn’t expect to cancel any more contracts.

If you have a home under contract with Zillow Offers, log in to your Zillow Offers account or contact Zillow directly for more information.

How much did Zillow Offers pay for houses?

Zillow uses a home valuation tool called a Zestimate to gauge a home’s worth on the open market. In most markets, your home’s Zestimate served as the initial cash offer for eligible homes. However, your final proceeds could have been thousands less once repair costs and service fees were factored in — plus, Zestimates can be off by an average of $5,500–19,800.

Inaccurate Zestimates may have been part of what led to Zillow Offers’ downfall. Real estate analyst Mike DelPrete notes that Zillow was overpaying by about $65,000 per home just before it got out of the iBuying business. DelPrete sees this as a problem with Zillow’s execution, not with iBuying in general. As the market cooled off, other iBuyers like Opendoor and Offerpad began to pay less for homes and managed to avoid huge losses like Zillow.

Zillow had extremely high fees

Altogether, Zillow Offers fees could have added up to as much as 22% of your home’s sale price — much more than you’d pay selling on the open market. So even though Zillow made very competitive offers, the high fees that home sellers had to pay made the final offer far less than fair market value.

For a $400,000 home, we found Zillow Offers could cause you to lose up to $76,200, compared to what you might have earned on the open market.

| Cost | Zillow Offers | Listing on the open market |

|---|---|---|

| 🏡 Sale price | $394,400 | $400,000 |

| 💵 Total fees | 9.5–22% | $37,468–86,768 | 6% | $24,000 |

| 💰 Closing costs | 1–3% | $3,944–11,832 | 1-3% | $4,000–12,000 |

| Final proceeds | $295,800–352,988 | $364,000–372,000 |

We found Zillow Offers reviews from customers who declined their cash offer — and later earned thousands more by listing on the open market.

» LEARN: How to determine the fair market value of your home

Zillow Offers fees

The biggest drawback to using Zillow Offers was its costly fees, which were as much as 9.5–22% of a home’s sale price.

Additionally, the service was designed to aid Zillow’s in-house agents, whose clients might have wanted the speed and certainty of a cash offer. If you had already signed with an agent, you would have had to pay their commission — which could have been as much as 3% of your sale price — just for submitting an online form.

Below, we broke down the cost of selling to Zillow Offers vs. listing your home on the open market.

| Cost | Zillow Offers | Traditional cost to sell |

|---|---|---|

| 🤝 Service fee | 1.5–9% (average: 7.5%) | - |

| 💵 Realtor commission | 0–3% | 6% |

| 🏡 Selling costs | 6% | - |

| 💰 Closing costs | 1–3% | 1–3% |

| 🛠️ Repairs | 1–2% | 1–2% |

| Total fees | 9.5–22% | 8–11% |

As you can see, Zillow Offers’ fees could have swallowed a significant portion of your proceeds. Zillow Offers also charged almost double its competitors’ rates — for example, Opendoor has a flat rate of 5%.

By contrast, you could earn thousands more by listing on the open market. Our friends at Clever can match you with agents from major brokerages such as RE/MAX, Coldwell Banker, and Keller Williams. Even better, you’ll get top-rated service AND save thanks to pre-negotiated low rates of just 1.5% in listing fees.

How Zillow Offers worked

Selling your home to Zillow Offers was simple, with just a few steps:

- Request a Zillow cash offer online. This was as simple as entering your property’s full address and providing basic information about your home’s age and features.

- Receive an initial cash offer. After your request, Zillow Offers contacted you within 48 hours. If your home qualified, your Zestimate (Zillow’s home valuation tool) served as the initial Zillow cash offer.

- Schedule a home inspection. Zillow’s inspectors identified any repairs or defects that impacted your property’s value.

- Review the final offer. The offer was reduced by the amount Zillow deemed necessary for repairs.

- Close the deal. Closing occurred in as little as seven days, or up to 90 days for sellers who needed extra time.

Where did Zillow Offers buy houses?

Before it shut down in November 2021, Zillow Offers was available in 47 cities throughout the U.S.

| State | Cities |

|---|---|

| Arizona | Phoenix, Tucson |

| California | Los Angeles, Riverside, Sacramento, San Diego |

| Colorado | Colorado Springs, Denver, Fort Collins |

| Florida | Jacksonville, Miami, Orlando, Tampa |

| Georgia | Atlanta |

| Minnesota | Minneapolis-St. Paul |

| Nevada | Las Vegas |

| North Carolina | Charlotte, Raleigh |

| Ohio | Cincinnati |

| Oregon | Portland |

| Tennessee | Nashville |

| Texas | Austin, Dallas-Fort Worth, Houston, San Antonio |

Buying a Zillow-owned home

After Zillow Offers purchased homes, it listed them on the open market for more than what it paid the previous seller.

Buying Zillow-owned homes was relatively streamlined compared to a conventional transaction:

- You submitted an offer for the property and got a reply within 48 hours.

- Your closing date was based on your schedule.

- Homes were recently repaired and vacant, so you could move in right away.

- The sale wasn’t contingent on a seller’s ability to close on their next property.

- Zillow paid a standard buyer’s agent commission.

However, there were some drawbacks to buying a home from Zillow, including the unwillingness of Zillow to negotiate over the sale price or repairs.

Other Zillow services

Zillow still offers additional in-house services that can streamline your transaction, whether you’re buying or selling a home:

- Zillow Home Loans: Zillow partners with a network of mortgage lenders, allowing buyers to get pre-qualified for loans at competitive rates.

- Zillow Closing Services: Zillow’s in-house closing services allow the company to hold the buyer’s deposit in escrow, arrange the exchange of funds, conduct a title search, and provide title insurance.

⚡ Quick tip

If you sold your home to Zillow Offers, you weren’t required to use Zillow Home Loans or Zillow Closing Services. In fact, you may have been able to get better rates by looking at other lenders!

When it comes to getting the best mortgage rate, we recommend shopping around in almost all circumstances.

Zillow Offers reviews

One of the biggest downsides of working with Zillow Offers was that there were so few verified customer reviews on third party websites. Instead, most reviews focused on Zillow’s agents, website, or app. That made it difficult to determine past customers’ experience with Zillow’s cash offers.

While the Zillow website did have testimonials, they were curated by Zillow — so we didn’t consider them objective.

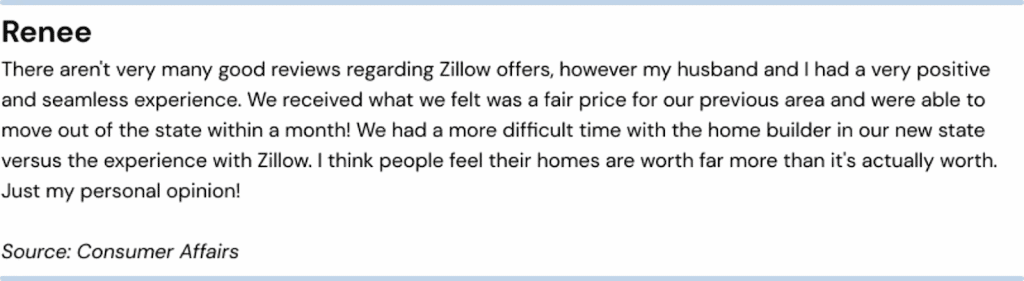

We were able to find a positive Zillow Offers review from a customer who found the process to be a quick, simple alternative to a traditional home sale:

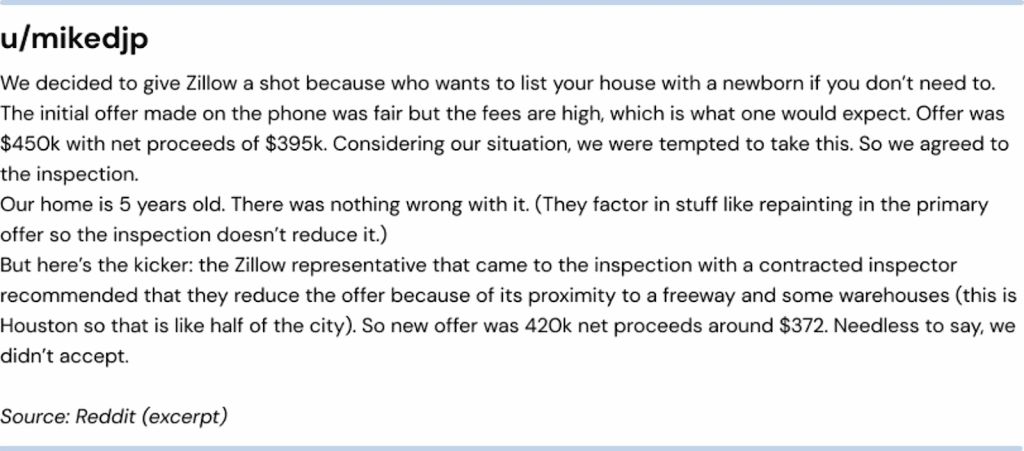

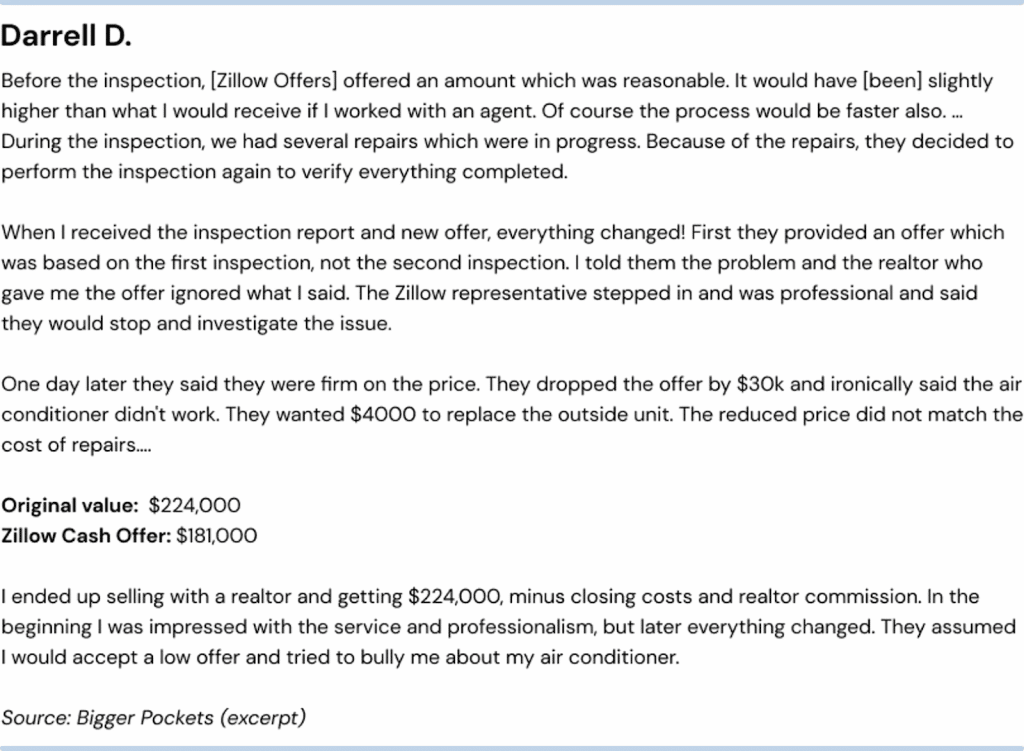

However, Zillow Offers complaints focused on issues with its low offer prices and expensive repairs.

For example, one customer decided not to sell their home to Zillow because the final cash offer dropped by thousands of dollars after their inspection:

Similarly, another Zillow Offers complaint focused on exorbitant repair costs that would have slashed the seller’s proceeds:

Zillow Offers vs. alternatives

Low commission real estate agents vs. Zillow Offers

Now that Zillow Offers is shut down, you might want to consider listing your home with a low commission real estate company.

Low commission real estate companies allow you to list on the open market while also saving thousands on commission fees. Lower selling costs keep more money in your pocket — plus, there’s always a chance that competition on the open market can drive your sale price up, too.

Our team researched the best low commission real estate companies to help you choose the best fit for your sale.

» LEARN: Top Low Commission Real Estate Companies

Zillow Offers vs. other iBuyers

Like other iBuyers, Zillow Offers:

- Made fast offers and closed on your timeline

- Handled any necessary repairs

- Eliminated the uncertainty of selling to an individual buyer

While some Zillow Offers reviews said the process was seamless, others were shocked by lowball offers and expensive repair costs. And Zillow Offers’ fees could double those of competitors like Offerpad and Opendoor.

Opendoor is the largest iBuyer in the U.S. and still makes fast cash offers on homes like Zillow Offers once did. Similarly, Offerpad operates in 20+ markets and offers interesting perks like free local moves.

Overall, Opendoor charges comparable fees, but serves more locations, and has stronger customer reviews than Offerpad.

» MORE: Offerpad vs. Opendoor

Zillow Offers: Future Outlook

| ✅ Pros | ❌ Cons |

|---|---|

| Free, no-obligation cash offer | Expensive repair fees limited profits |

| Flexible closing dates (7–90 days) | Low offers may have been thousands below fair market value |

| No repairs or upgrades | Little opportunity to negotiate the sale price or repairs |

| No need to prepare, list, or show your home to prospective buyers | Not all homes and locations were eligible |

In February 2023, Zillow announced that it would be partnering with Opendoor to allow Zillow users in Raleigh and Atlanta to request an instant offer from Opendoor alongside an estimate of their home’s market value selling with a Zillow Premier Agent.

The Zillow/Opendoor partnership has since expanded to 45 markets, including major cities in Texas, California, Florida, Arizona, Nevada, and New York. Now, homeowners who want to avoid the hassles of a traditional home sale can quickly gauge what Opendoor would offer for their home vs. how much they could earn selling on the MLS with a Zillow agent.

Before selling your home to an iBuyer, we recommend comparing multiple options — including less-known options available through local investors. You should also check your Zestimate against at least 1–2 local realtors’ opinions of what your home is worth in its current condition. If you have a realistic idea of your home price, you can make a better decision about whether selling to an iBuyer is worth the cost.

Frequently asked questions

How did Zillow Offers work?

If you wanted to sell your home to the now-closed Zillow Offers, the process was very simple. You submitted your information online to get an initial cash offer within 48 hours, then scheduled an inspection. After the inspection, Zillow adjusted its offer to account for repairs. If getting top-dollar for your home is a top priority, consider selling with a discount real estate broker who charges low commission rates. If you need to sell quickly, Opendoor offers much lower service fees than Zillow Offers.

Does Zillow buy homes?

Until November 2021, Zillow made cash offers on homes through Zillow Offers, its iBuyer service. However, its fees were as high as 22% — double competitors' rates. If you want to sell fast and save thousands on fees, we recommend working with a low commission real estate company.

Why did Zillow Offers shut down?

The company was losing too much money overpaying for homes. Zillow admitted there were problems with its buying model, causing it to overpay for homes from July through September 2021. The company ended up losing $420 million and owning thousands of homes worth less than what it paid.

Is Opendoor better than Zillow Offers?

Opendoor is a better option for sellers who want to save money on fees. Opendoor buys homes for a flat 5% fee, while Zillow’s fees ranged anywhere from 9.5–22% of the offer price. Read our complete review of Opendoor.

Related reading

Opendoor, Reviewed and Explained: In our in-depth review of Opendoor, you’ll learn how the iBuying process works — and whether Opendoor might be a good choice for your home sale.

What Companies Offer the Lowest Real Estate Commission Fees?: With so many low commission real estate companies on the market, there’s no reason to pay the traditional 6% commission. Learn how to get the best price without sacrificing on service.

Read This Before You List Your FSBO on Zillow: Thinking of attempting a DIY sale on Zillow? We researched how it works and the biggest risks you’ll face.

Leave a Reply