Published

» Jump to: How Realtor home values work | Accuracy rate | Pros and cons | How it compares

Realtor.com is one of the oldest, largest, and most active real estate listing websites, with over 100 million active users. It’s also one of many sites offering a free home value estimator, providing its users with a free home value estimate within seconds.

But does Realtor.com’s decades of industry experience translate into accurate home values? And can you trust it to make a financial decision, like setting a fair list price on a home?

We tested its home value tool, comparing it to other top home value websites, including Zillow, Redfin, and Bank of America.

Your most accurate and trustworthy home value estimate will come from a local realtor or appraiser. However, home value websites like Realtor.com are still useful for a quick idea of what your home might be worth in today’s market. Check out our full review of Realtor’s home value estimator for more details.

Realtor home value estimator: How does it work?

Expert Review

Realtor home values

- Fast and easy to use

- Multiple home value estimates

- No sales info. provided

Realtor.com home values compare favorably to its peers. The real estate listings website generates its home values from three data providers: Collateral Analytics, CoreLogic, and Quantarium.

However, Realtor.com still falls well short of a home value from a professional real estate agent or appraiser. There’s no way to view which comparable sales it chooses to determine your home value, and its estimates likely don’t factor in your home’s renovations or upgrades.

Pros

- Fast and easy to use

- Receive multiple home value estimates

- Useful homeowner dashboard

Cons

- No home sales information provided

- You can’t fix incorrect home values

- Home renovations and repairs not considered

- Homeowners or home buyers looking for multiple home value estimates to compare to estimates found on other websites, like Zillow and Redfin

Realtor.com provides its users with an automated valuation model (AVM): a computer-driven way to determine home value.

Determining its home values are local tax assessment records, recent sale prices of comparable properties, and other factors, including key property features (beds, baths, interior square footage, etc.)

Its website provides three home value estimates from independent valuation providers – Collateral Analytics, CoreLogic, and Quantarium.

According to Realtor, each valuation provider applies a unique approach and methodology to determine fair market value.

Collateral Analytics: The firm is part of Black Knight, Inc., a financial services company that provides software, data, and analytics to the mortgage and real estate industries.

CoreLogic: The property intelligence platform provides data, analytics, and information for several industries, including real estate. CoreLogic gets its data from public sources and third-party data aggregators.

Quantarium: The artificial intelligence company serves the real estate, banking, mortgage, and insurance industries. The company claims its Quantarium Valuation Model (QVM) provides the most accurate home value estimates.

How to get a Realtor home value

Its home value estimator is one of the easiest to use in the industry. View our step-by-step guide on how to use its tool.

Our example uses an off-market, single-family home in Milwaukee, Wisconsin.

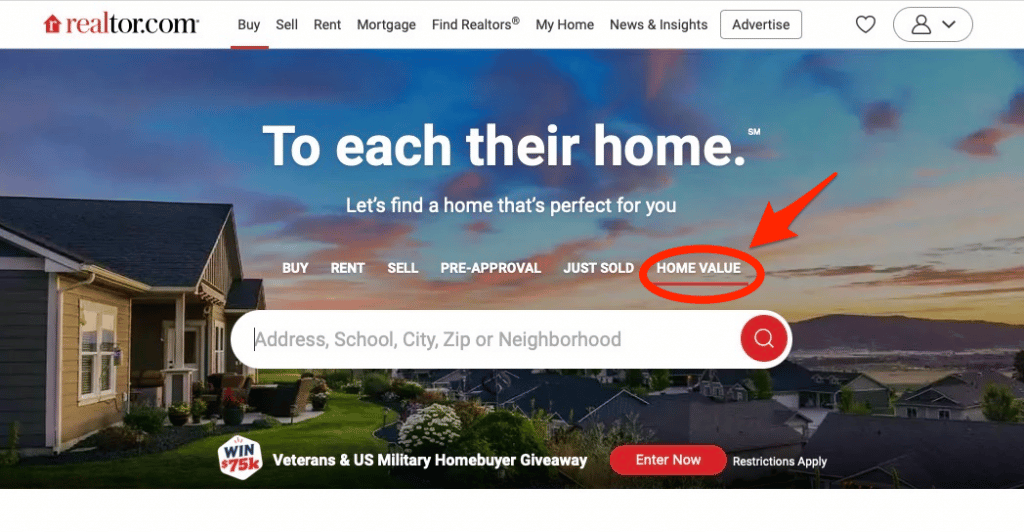

1. Click home value and type in an address

Visit the Realtor.com main website, click home value, type in the property address, and hit enter.

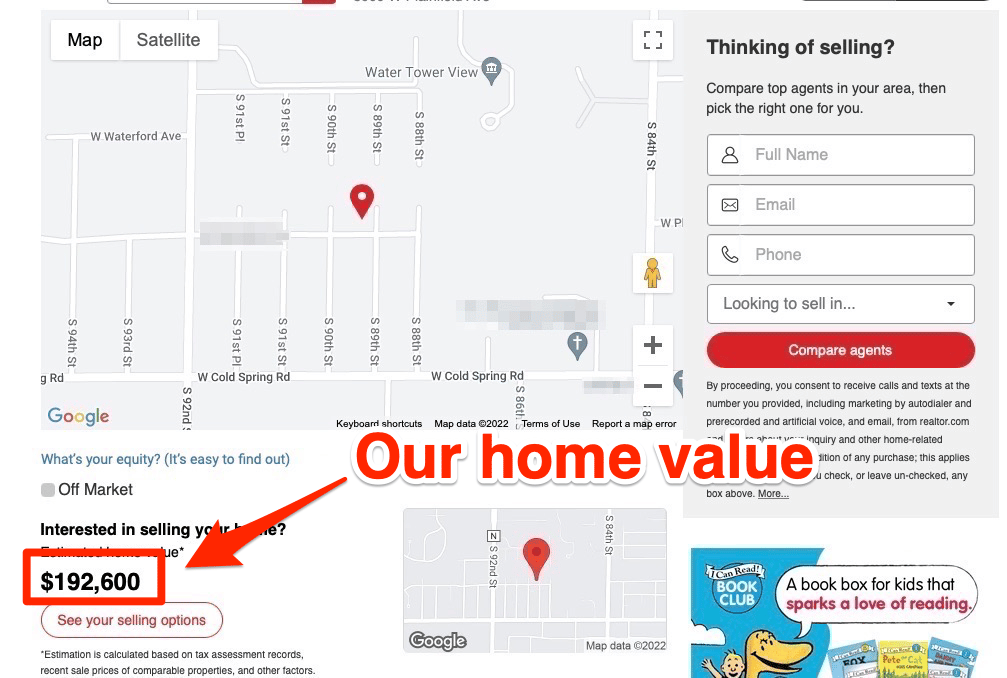

2. View your estimated home value

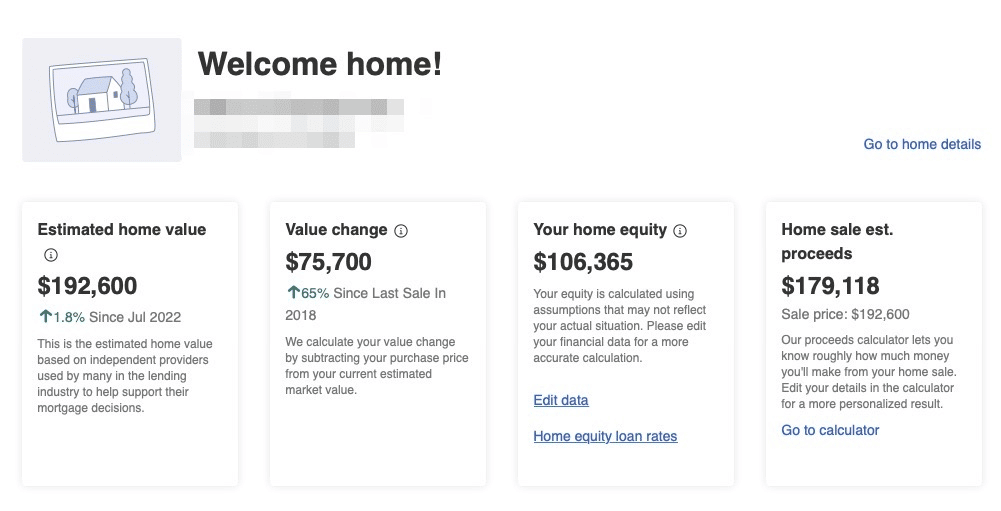

We plugged our test property into the estimator. Realtor.com determined our home has an estimated home value of $192,600, found below the Google Map.

Determining the value estimate is the property tax records, recent sale prices of similar properties in the area, and other factors not disclosed, according to Realtor.

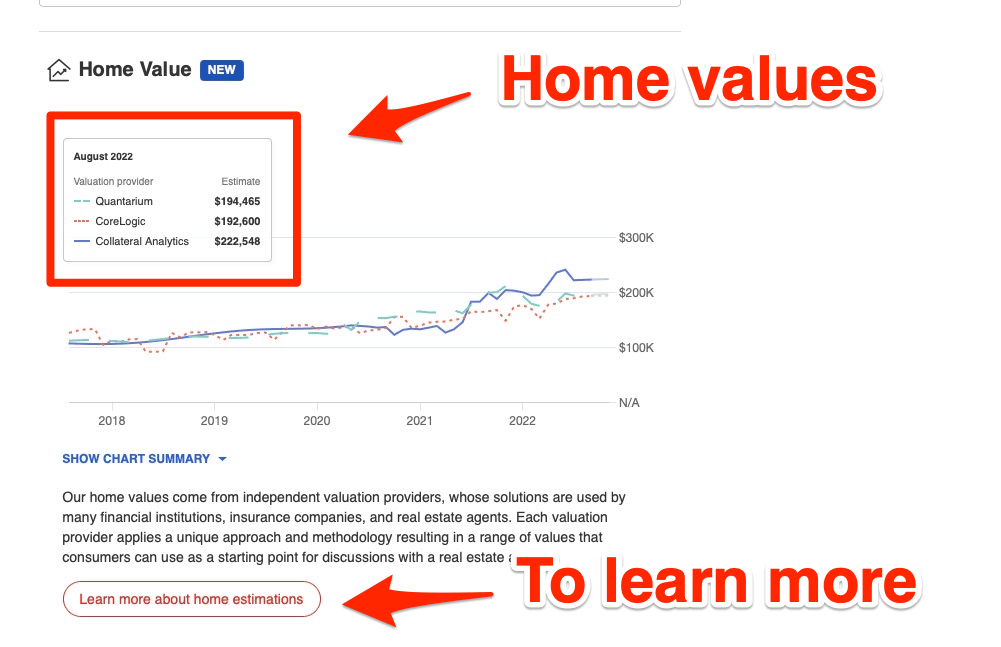

3. View three separate home value estimates

Realtor.com provides three home value estimates from independent valuation providers Collateral Analytics, CoreLogic, and Quantarium. You must scroll down to the home value section to view these estimates.

Our test property has a valuation of $192,600, $194,465, and $222,548, or an average value of $203,204.

Note: It appears that Realtor.com’s previous home value estimate of $192,600 is the one provided by CoreLogic. There’s no explanation why it displays CoreLogic’s value up top.

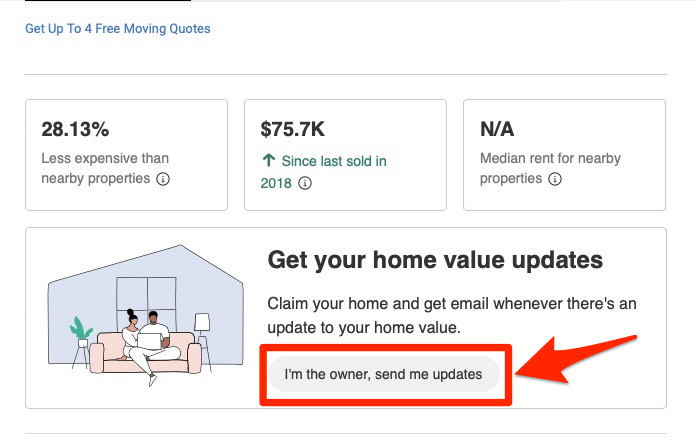

4. Claim your home for updates

Claim your home on its website for regular home value updates from Realtor.

The homeowner dashboard also has information on your estimated home equity and potential home sale proceeds, should you decide to sell.

Realtor.com home value accuracy

| Estimator | Error rate |

|---|---|

| Zillow | 6.9% |

| Redfin | 7.67% |

| Realtor.com | N/A |

Unlike Zillow and Redfin, Realtor.com does not provide users with a median error rate, making it hard to measure its accuracy.

Zillow’s off-market property home values carry a median error rate of 6.9%, while Redfin’s is 7.67%. In other words, half of all off-market homes sell for within 6.9% of Zillow’s home value estimates and sell for within 7.67% of Redfin estimates, while half do not.

For example, an off-market home valued at $500,000 could really be worth between $465,500 – $534,500 on Zillow, or between $461,500 – $538,500 on Redfin.

Realtor test property results

| Source | Value |

|---|---|

| HomeLight | $175,000 |

| Chase | $181,100 |

| Zillow | $192,400 |

| PennyMac | $192,461 |

| Redfin | $194,887 |

| Realtor.com | $203,204 |

| Bank of America | $215,056 |

| RocketHomes | $222,000 |

| Average value | $196,129 |

Realtor.com determined that our test property has a fair market value of $203,204 after averaging its three home value estimates from Collateral Analytics, CoreLogic, and Quantarium.

We plugged the home into the most popular home value websites to see how the numbers compare.

Why do home value estimates vary?

Each estimator uses a different algorithm and pulls property information from various sources to determine home values.

Our test property’s valuation ranged from $175,000 (HomeLight) to $222,000 (RocketHomes), with an average value of $196,129.

Our analysis found that several estimators, including Chase and Zillow, use outdated comparable home sales to determine their estimates, while others use active listings.

Realtor.com home values: The bottom line

Realtor home values provide a decent starting point. We like that it gives users three separate home value estimates, which may help you get a more accurate view of a property’s fair value.

Your most accurate home value estimate will come from a local real estate pro.

Unlike home value websites, a realtor views your home in person, fact-checks key home information, and gives you credit for renovations and upgrades.

Realtor.com home value estimator: Pros and cons

Pros

Fast and easy to use

Realtor.com’s home value estimator is one of the easiest to use out of all the estimators we tested. We received a home value estimate within seconds without providing our contact information.

Multiple home value estimates

Unlike many of its competitors that provide a single home value, Realtor.com provides its users with three home value estimates.

Providing home values from multiple sources may help you get a more accurate, complete view of a home’s potential value.

Useful owner dashboard

Realtor lets you claim your home, edit its information, and receive regular email updates when its value changes.

Cons

No home sales information provided

Realtor.com provides three home value estimates but doesn’t disclose how the values are determined. Unlike other estimators, you can’t view comparable home sales information.

Collateral Analytics provided a much higher home value estimate ($222,548) for our test property compared to Core Logic ($192,600), with no explanation.

No option to fix incorrect home values

If your home value is flat-out wrong, you’re stuck with that inaccurate valuation. Editing your home’s information does not impact its valuation. Unlike Zillow’s home value estimator, there’s no option to choose your own comparable sales on Realtor.

No home renovations considered

Like other popular home value websites, Realtor’s home values do not factor in any recent upgrades or renovations unless the information is updated in the property’s tax records.

How Realtor’s home value estimator compares

Realtor vs. Zillow

Zillow Zestimates are among the most accurate home values in the industry and slightly more accurate than Redfin values.

Unlike Realtor.com, Zillow lets its users view and edit each home’s comparable sales to receive a private value estimate.

Realtor vs. Redfin

Redfin’s home value estimator also compares favorably to Realtor.com, mainly because it provides more information on how it generates its home values.

With an off-market median error rate of 7.67%, Redfin values are slightly less accurate than Zillow (6.9%), although the accuracy varies widely by market.

Realtor vs. Chase

Realtor home values are a superior option compared to Chase Bank’s, which often uses outdated or irrelevant comparable home sales data. Our analysis shows that Chase home values often fall short of other estimators.

Realtor vs. Ownerly

Realtor is a better choice. Ownerly is the only home value website charging its users a fee, and most public Ownerly reviews are negative. Realtor provides more value to their users without any fees.

Related reading

Best Home Value Estimator Revealed. Free home value websites are useful for a quick ballpark home value estimate. We rank the most popular home value estimators.

Redfin vs. Zillow. We compare and rate the two best home value estimators on the market. Learn how they work and which would you should trust.

What is a CMA in Real Estate? Learn more about the home valuation method used by realtors, and how to get a free CMA from a professional.

Why HomeLight Home Values Miss the Mark. Learn why HomeLight is not a good option for a free home value estimate and your alternatives.

Leave a Reply