Published

Contingent meaning | What are contingencies? | Common contingencies | Are contingent sales the norm? | Should you waive contingencies? | Contingent statuses | Contingent vs. pending | Can you make an offer? | FAQs

Contingent meaning

In real estate, “contingent” indicates a seller has accepted a buyer’s offer on their house, but the offer includes certain criteria — called contingencies — that must be met before the sale can be finalized.

For the parties involved in the transaction, contingencies allow time to work through any unknowns that need to be resolved before the deal is solid enough to move forward.

Often, contingencies are used to ensure:

🏚 The property’s condition

📈 The property’s actual value compared to the asking price

💰 The buyer’s ability to get financing if they’re applying for a mortgage

But what does contingent mean for other buyers who are interested in the home? Is a contingent house off the market?

Not necessarily! While it’s not quite in the same ballpark as a home with no offers on the table, a contingent property may still be within reach.

Whether you’re thinking about making an offer on a contingent home, or wondering which contingencies to include in an offer yourself, understanding contingencies and their implications is key to making an informed offer.

What are contingencies?

When a buyer submits an offer on a house, their real estate agent will likely recommend including contingencies that allow them to get their financing in order, inspect the home, and make sure it has a clean title before moving forward with the transaction.

If the buyer encounters a deal breaker before the contingency period has ended, they can back out of the agreement without losing their earnest money — the deposit a buyer makes on a home once the seller accepts their offer.

Most contingencies are there to protect buyers from making a bad purchase.

However, contingencies also protect sellers from being stuck in a contract indefinitely if a buyer can’t follow through on their offer.

For example, a contract might specify, “The buyer has seven days to inspect the property” or “This agreement is conditioned upon the buyer’s ability to obtain a loan up to 90% of the purchase price by the closing date.”

If a contingency isn’t met by the established deadline, one or both parties can terminate the contract, creating an opportunity for another buyer to swoop in and purchase the home.

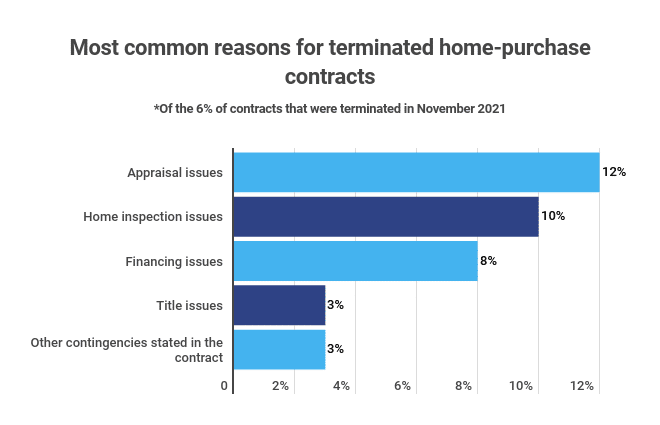

Source: National Association of Realtors® Realtors Confidence Index Survey, December 2021

Common home buying contingencies

Contingencies make it easier for buyers to back out of a deal without losing their earnest money deposit when they hit a snag on the home-buying journey.

However, contingencies also add complexity to a real estate transaction, increasing the likelihood that a home purchase will fall through — thus leaving the door open to other buyers.

⚠️ Approximately 6% of home purchases fell through in December 2021.

Below are the most common contingencies in real estate.

🔢 Appraisal contingency

Usually required by a lender before they will approve a mortgage, an appraisal contingency protects both the buyer and the lender from overpaying on a home.

The lender engages a certified appraiser to compare the home to similar properties in the market to give an unbiased opinion of its value.

If an appraiser deems the home’s value to be at or above the asking price, the contingency is cleared.

If the appraiser concludes the home’s value is below the asking price, the buyer can try to renegotiate the sale price, put more money down to cover the gap in value, or back out of the deal without penalty.

» LEARN: How Do Appraisals Work?

How common are appraisal contingencies?

Appraisal contingencies are included in approximately 79% of home-purchase contracts and accounted for 11% of terminated home sales in December 2021.

🔎 Inspection contingency

An inspection contingency allows the buyer to hire a professional inspector to thoroughly inspect the property and negotiate the cost of repairs or back out completely based on the findings.

In some cases, a buyer might order additional inspections to check for termites and other pests or environmental concerns like radon, asbestos, or lead paint.

» LEARN: Who Pays for a Home Inspection?

How common are home inspection contingencies?

An inspection contingency is included in approximately 81% of home purchase contracts and accounted for 8% of terminated home sales in December 2021.

💰 Financing contingency

A financing or loan contingency gives the buyer time to secure a loan to pay for the home purchase.

If a buyer can’t get financing by the closing date, they can back out of the deal without losing their earnest money.

» READ: How Much Should I Spend on a House?

How common are financing contingencies?

Approximately 87% of home purchases are executed with a mortgage attached, and financing contingencies accounted for 8% of cancelled contracts in 2021.

🏡 Home sale contingency

A home sale contingency allows a buyer to sell and secure the proceeds from their current home before having to close on the new one.

A home sale contingency can fall under one or two subcategories:

- Sale and settlement contingency: This means a buyer wants to purchase the home they put in an offer on, but needs to sell their current home before purchasing the new one.

- Settlement contingency: This means a buyer already has a purchase contract in place on their prior home, but needs the deal to go through before they’re able to close on the new one.

How common are home sale contingencies?

Home sale contingencies are relatively rare in real estate. They were included in only about 6% of home purchase contracts in 2020.

When accepting a contract with a home sale contingency included, a seller has two options:

- Take the home off the market and hope the buyer sells their current home on time.

- Keep the property on the market and offer the buyer a first right of refusal if a better offer comes along — basically allowing them 72 hours to either remove the contingency and follow through with the home purchase, or use the contingency to exit the deal.

A seller can also include their own contingency clause stating they will only sell their current home once they secure a new one.

📜 Clear title contingency

A clear title contingency allows the buyer to investigate any liens or disputes involving the property in question. The title company that manages the transaction handles the investigation.

If the seller can’t furnish a clean title — the document showing a property’s current and previous ownership — the buyer may back out without penalty.

» LEARN: How to Research a House’s History Before You Buy

How common are clear title contingencies?

A clean title contingency is included by default in a standard home-purchase contract and accounts for about 4% of cancelled home sales.

⚠️ HOA contingency

An HOA (homeowners association) contingency allows the buyer to review any homeowners association documentation to ensure they’re aware of the rules and fees set forth by the HOA.

HOAs are private institutions that manage planned real estate developments, including townhomes, condos, and many newer subdivisions.

In addition to collecting fees to oversee communal assets like club houses, tennis courts, pools, community parks, and gated entries, HOAs set and enforce community rules, manage community finances, and oversee maintenance and upkeep.

Depending on the cost of maintenance and amenities covered by the fees, some HOAs can charge upwards of $1,000 per month. Additionally, some HOAs have strict rules about parking, use of public property, exterior renovations, and allowing short-term rentals.

Therefore, it’s best to know the HOA bylaws before you enter into a home-purchase contract. You can even request them from the seller before submitting an offer.

» READ: 48 Surprising Things Your Homeowners Association Can Ban

How common are HOA contingencies?

HOA and other contingencies accounted for less than 3% of home sale contingencies in 2020.

📦 Early move-in contingency

An early move-in contingency allows a buyer to occupy the property and rent it from the seller while both parties finalize the home purchase.

While moving into the home while still under contract could make a home buyer more reluctant to walk away, most agents advise sellers not to accept this kind of contingency. In most cases, the potential hassle of having to evict the buyer and maintain a vacant property if the contract falls through simply isn’t worth it.

How common are early move-in contingencies?

Like HOA contingencies, early move-in and other contingencies not involving financing, inspections, prior home sales, or appraisals are present in less than 3% of contracts.

Are contingent home sales the norm?

As of December 2021, 81% of home purchase agreements included a home inspection contingency, and 79% came with an appraisal contingency attached.

However, in competitive markets, where several buyers often compete for the same property, real estate agents may advise their clients to waive certain contingencies to make their offer more attractive to a seller.

For example, if a buyer has a credit score above 760 and at least 20% cash to put towards a down payment — typical requirements to get approved for the best interest rate by most mortgage lenders — their agent might recommend waiving the financing contingency. This can be especially attractive to a seller who’s had a previous offer fall through due to a financing issue.

In some instances, an agent might also suggest waiving the appraisal contingency, since the prior home sale data that an appraisal is based on may not match current asking prices in a hot market, where bidding wars can rapidly drive up home values.

Removing an appraisal contingency usually means that a buyer will have to come up with extra cash in order to cover any gap between the asking price and the appraisal value, since a lender will typically only loan the amount a home appraises for, minus any down payment.

If a buyer has the extra savings to put down, or is confident that the home will appraise for the full offer price, waiving the appraisal may help them secure a home in a tight market.

Even in an ultra-competitive market, however, you want to put some serious thought in before tossing out contingencies.

❓ Should you waive contingencies to get a house?

As a rule, only waive a contingency if you can fully accept the risk AND it will give your offer a better chance of being accepted.

That said, these contingency protections are there for a reason, and not every home buyer has the luxury of waiving them. Buying a home is a huge investment, and most people need the assurance that they’re making a solid purchase.

❗ Contingencies you DON’T want to waive

Contingencies that you probably don’t want to remove include title and inspection contingencies.

While title issues are rare, accounting for only 4% of cancelled contracts, a buyer waiving the title contingency takes on too much risk should there be a lien on the property or a dispute as to its true ownership. You might find yourself caught in a lengthy and expensive court process.

The same risk surrounds the inspection appraisal, which exists to protect buyers from purchasing a money pit. Every home has its issues, and you don’t want to find out about a leaky roof or major crack in the foundation after you make the purchase.

The one exception for removing an inspection contingency may be if you’re buying a fixer upper and know going in that the house needs a ton of work. Still, contingency clause or not, it’s probably worth having some kind of inspection done to know exactly what you are getting into.

As an alternative to waiving contingencies, some agents recommend putting extra earnest money down to show the seller that you’re serious about the purchase, even with contingencies in place. That way, if the deal falls through after the contingencies have expired, the seller gets to keep the deposit.

Common contingent statuses

Given the various contingencies that can affect a real estate transaction, the word “contingent” won’t always mean the same thing from one listing to the next.

In fact, several details can vary under a contingent listing status.

Some of the more common designations you might see associated with a contingent listing include:

📌 Active contingent

If a home is listed as active contingent, it means a seller has accepted an offer but is still marketing the property to other buyers.

Can you still make an offer?

You can usually still see the property and submit a backup offer at this point.

📌 Active option contract

Used specifically in Texas, an active option contract status means a seller has accepted an offer but the buyer is exercising their option period, a set timeframe (usually 7–10 days) at the beginning of a contract, where a buyer can cancel for any reason without losing their earnest money deposit.

Can you still make an offer?

Yes. If you’re looking to make an offer, this is probably the time that a contract is most likely to fall through.

📌 Contingent no show

This designation means a seller has accepted an offer and taken the property off the market while contingencies are worked through.

Can you still make an offer?

No. While great for the current buyer, for someone still looking to make an offer, it means the seller isn’t currently showing the property or accepting backup offers.

📌 Contingent with kick-out

This contingency allows a seller to continue to market their house when a contract is contingent on the buyer’s sale of their current home.

Under the terms of the contract, if a better offer comes along, the seller will give the original buyer a certain amount of time — typically 72 hours — to either remove the home sale contingency or use the contingency to back out of the contract.

Can you still make an offer?

Yes. If you’re interested in a contingent property that has a kick-out clause attached, this might be the perfect time to swoop in with a shiny offer.

📌 Contingent no kick-out

This status means that a home sale is contingent on the buyer being able to sell their current home, but the seller doesn’t have the option to accept another offer unless the buyer cancels or a contingency isn’t met.

Can you still make an offer?

Not unless the contract falls through. A no kick-out clause is a great situation for the initial buyer, but not so much for someone still in the market and looking to make an offer on the home.

📌 Contingent short sale

A short sale happens when a lender, usually a bank who owns the property, is willing to accept less than the amount still owed on the mortgage. The name is a bit misleading, though, since a short sale can be quite a lengthy process — often lasting up to 120 days.

A short sale contingency offers the lender the option to keep the property on the market while a contract is in place, giving them extra protection in case the original buyer isn’t able to get financing or resolve another contingency.

Can you still make an offer?

Yes. For someone interested in placing a backup offer on the home, however, placing a secondary offer on a short sale can start a long waiting game that may not amount to anything in the end.

📌 Contingent probate

A probate sale happens when an owner dies without designating a beneficiary for their home.

In this case, it’s up to the state to administer the sale and it may continue to accept backup offers while the original contract runs its course.

Similar to a short sale, a probate sale can drag on for some time. The American Bar Association advises that a typical estate takes 6–9 months to settle.

Can you still make an offer?

Yes. But if you’re interested in submitting a backup offer on a contingent probate sale, you might want to think again. It may not be worth putting your house hunt on hold to wait for the outcome.

☎ However, if a listing doesn’t state specifically whether a seller is accepting backups, check with the listing agent, or better yet, have your agent do it for you.

👉 An experienced agent will be able to advise you on the odds of winning the house and help you craft a strong offer should you decide to move forward.

» NEED A SAVVY AGENT? Connect with a top-rated agent in your area!

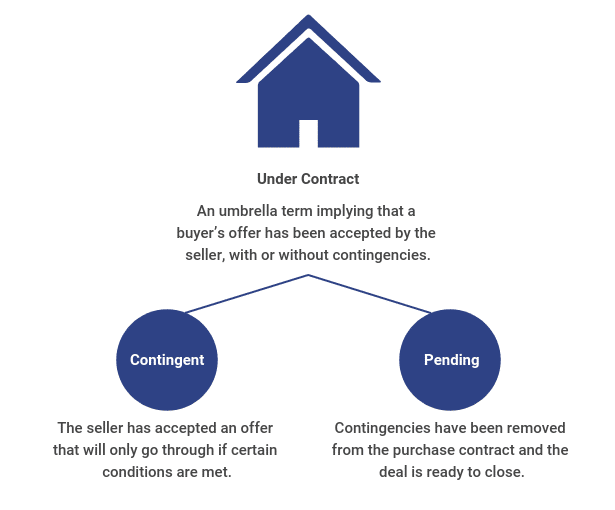

Contingent vs. pending

Once a seller accepts an offer and the home goes under contract, the terms contingent and pending represent milestones on the way to closing the deal.

Contingent typically means that an offer has been accepted but the contingencies haven’t yet been met, so the deal may still go south.

Pending, on the other hand, usually indicates that the contingencies have been addressed and the parties are simply waiting to sign the closing paperwork and exchange keys.

However, just like contingent sale, a sale that’s pending can be so under different conditions. As a result, you might occasionally come across listings with the following pending designations:

📌 Pending – taking backups

This generally signifies that a deal has hit a snag in its final stages — possibly due to financing or appraisal issues — and the seller is accepting backup offers in case the contract falls through.

📌 Pending – short sale

Like a contingent short sale, a pending short sale implies that a lender or financial institution is in the process of reviewing a real estate sale. However, a pending short sale may be further along in the process and may not be open to other offers.

📌 Pending – more than 4 months

While rare, a listing that’s pending for more than four months may mean that there’s a delay due to construction issues (if it’s a new home sale), stalled negotiations, or a major life event like divorce or a death in either party’s family. Sometimes, a listing agent might simply forget to mark the sale as closed in the MLS.

Online listings: Does contingent mean the same thing on Zillow, Realtor, and Redfin?

The term “contingent” can take on a slightly different meaning depending on the market and platform where it’s listed. To understand why, it’s helpful to know how listings statuses work.

Before a listing shows up on a real estate website, the listing agent will first plug the property information into their local Multiple Listing Service (MLS), an online database where brokers share their current listings with other agents.

There are more than 800 MLSs throughout the country. Each database is privately owned and maintained by the real estate professionals in that market.

Once a broker posts a property to their MLS, third-party listing sites like Zillow, Realtor, and Redfin pull in the information.

While contingent broadly means that a buyer and seller are still working through the contingencies written into their contract, some MLSs only apply this term in certain situations — like when a contract is contingent on a previous home sale or bank approval (if it’s a bank owned property).

Below are examples of contingent listing statuses applied by two different MLSs, one based in Texas and the other in San Diego.

MLS status definitions

| 📕 METROTEX Association of REALTORS | 📕 San Diego MLS | ||||

|---|---|---|---|---|---|

| Active Contingent | Seller has accepted an offer but has requested that property remain available for showings and Seller will entertain backup offers. Will expire on the original expiration date the agent entered. | Contingent | Offer has been accepted contingent on the sale of the buyer’s property with 72 hour first right of refusal or offer has been submitted to lender or REO (real estate owned property) agent. | ||

| Active Option Contract | Seller has accepted an offer but the Buyer is exercising the option period from the sales contract. Still available for showings and backup offers. Will expire on the original expiration date the agent entered. | Pending | The Seller has accepted an offer. | ||

| Active Kick Out | Property has an offer contingent upon the sale of another property by buyer. Still available for showings and backup offers. Will expire on the original expiration date the agent entered. | ||||

| Pending | Property has an offer (Contract with no contingencies, Kick Outs or Options). The seller requests no further showings and does not want to entertain backup offers. Pending listings do not expire and will stay pending until closed. | ||||

You can see that the Texas-based MLS divides contingent sales into three sub-categories: “Active Contingent,” “Active Option,” and “Active Kick Out.”

In San Diego, however, the term contingent only applies when a prior home sale is involved or in short sale situations requiring bank or lender approval. Otherwise, a property is marked “Pending” once it goes under contract (even with appraisal and inspection contingencies still in place).

To scale back the complexity, real estate listing platforms like Zillow, Realtor, and Redfin may override some of the status information supplied by local MLSs in favor of showing fewer, more consistent listing statuses across their sites.

So while an original MLS listing might show a status such as “Active with Kick Out” or “Contingent – Short Sale,” it may appear as simply “Under Contract,” “Contingent,” or “Pending” on a site like Zillow, Realtor, or Redfin.

When in doubt, check with your real estate agent to get the details on a home you’re interested in. The listing status that appears online might not tell the whole story.

Can you make an offer on a contingent house?

In most cases, you make an offer on a contingent listing.

However, it may make more sense to do so at certain times — like when a home is listed as active contingent or pending – taking backups. These statuses indicate that a seller is actively seeking offers from other buyers.

When a contract is already in place, a backup offer places a buyer next in line in case the original contract falls through.

However, backup offers come with their own pros and cons.

✅ Pros of making a backup offer

- A backup offer puts you in a strong position to land your dream home should the initial offer fall through.

- If accepted, your offer price is locked in — regardless of whether home values continue to climb while the original offer is still on the table.

❌ Cons of making a backup offer

- Your hopes of winning the home may not materialize, since home-purchase contracts only fall through about 6% of the time.

- Even if the initial contract falls apart, you may have other backup offers to contend with.

- If you win in a backup offer situation, you may be up against the same issues that signaled doom for the initial contract. These might be as minor as a stalled negotiation over which appliances convey with the home, to something major, like a foundation issue that showed up during the inspection.

- A backup offer is a legally binding document. If accepted, you’ll be required to deposit earnest money on the home. If a better home comes along while you’re waiting to hear the fate of the original deal, you may have trouble getting your earnest money back in time to make a deposit on a different home.

- A seller could use your backup offer to pressure the original buyer to take action and finalize the sale.

If you decide to submit a backup offer on a contingent house, be sure to enlist the help of an experienced, local agent who can help you tailor your offer based on their knowledge of what it takes to win in your market.

While it’s not a guarantee, submitting a strong backup offer could place you next in line if the original deal goes south.

Contingency FAQs

Can you put an offer on a house that's contingent?

Sure can! When a home goes under contract, but the sale is contingent on certain conditions — like a clean inspection report and an appraisal at or above the offer price — sellers will often solicit backup offers in case the original buyer backs out.

What does contingent mean?

When a home is listed as contingent, it generally means that a signed purchase agreement is in place and the parties are working through whatever conditional clauses were written into their contract.

For a prospective buyer, a contingent status signals the time when an existing offer is at the greatest risk of falling through.

What's the difference between pending and contingent?

A property is considered contingent if the seller has accepted an offer that will only go through if certain conditions are met.

A property is considered pending once contingencies have been removed from the purchase contract and the deal is ready to close.

Recommended reading

20 Ways to Save Money When Buying a Home: There are several ways to save when purchasing your house. Learn our top 20 money-saving secrets!

How to Research a House’s History Before You Buy: Learning about the house’s history can reassure you that you’re making the right decision. Learn how information such as a home’s tax history can provide leverage in negotiations.

Millennial Home Buyer Report: 2022 Edition: The 2021 housing market was the most competitive on record. See what home buyers were willing sacrifice to own a home (and the decisions they regret most).

Leave a Reply