Published

Who should use HomeGo? | HomeGo reviews | Pros and cons | Top HomeGo alternatives | FAQs

HomeGo buys houses for cash in markets across the U.S. Like other cash buyers (a.k.a. We Buy Houses for Cash companies), HomeGo purchases houses in any condition and can close within a couple weeks of making an offer — much faster than the month or two it takes to close on a traditional sale.

But that speed and convenience will likely cost you. Cash buyers like HomeGo usually only pay 50–70% of a home’s after-repair value, which means HomeGo may offer only $210,000 (or less) on a home valued at $300,000.

HomeGo and other cash buyers are best for sellers who need to get rid of their house ASAP, or when listing a home with a local agent simply isn’t an option. It’s not your best choice if your goal is to make as much money as possible in a sale.

Before committing to HomeGo or another buyer, we recommend comparing offers from multiple cash buyer companies to get the best price and terms.

Our team can present you with multiple competing offers from the top cash buyers in our network. You can also request a professional estimate of your home value, so you can compare offers to what your house is worth on the open market. Get tailored cash offers from top local buyers — with no added fees or commissions!

What is HomeGo and is it legit?

HomeGo is a legitimate cash home-buying company based in Irving, TX. The company operates in 23 states and most major cities, including Atlanta, Austin, Dallas, Denver, and Phoenix.

HomeGo purchases properties in any condition, including houses with major condition issues, including:

- A leaky or damaged roof

- Structural issues or foundation problems, like cracking or sagging walls

- Flood, fire, or termite damage

The company also buys houses in financial distress, including those on the brink of foreclosure, and homes with unpaid tax liens.

Speed and convenience are the top reasons to consider HomeGo. It provides homeowners with a same-day offer and can close as fast as seven days, with no realtor fees, closing costs, or contingencies.

How HomeGo works

HomeGo’s process is fairly straightforward. After submitting your address online and setting up an appointment, HomeGo sends a partner real estate agent to view, inspect, and value your property to determine an offer price.

HomeGo’s offer price factors in the total repair and improvement costs required for HomeGo to resell your home on the open market. If you accept HomeGo’s offer, the company can close on the transaction in a few weeks, sometimes as fast as seven days.

How much does HomeGo pay for houses?

| After repair value | Offer price (70% ARV) |

|---|---|

| $300,000 | $210,000 |

| $250,000 | $175,000 |

| $200,000 | $140,000 |

HomeGo buys your home directly from you, so it doesn’t charge any realtor commissions or closing costs. But you may not be happy with its offer price. Like other cash buyers, the company only offers 70% or less of your home’s after-repair value (ARV).

Your home’s ARV is its estimated fair value after all repairs and improvements have been made to it. Investors use ARV to determine how much they should offer on a house after factoring in all expenses.

Offering 70% or less of a property’s ARV ensures that HomeGo will earn a reasonable profit at resale. But it’s hard to know if HomeGo’s repair costs and ARV estimates for your home are fair or accurate and if you’re getting a bad deal or not.

You can be confident you’re getting a fair price for your house by receiving a home valuation from a local realtor. Our team of real estate agents can also help you determine how much you’d make selling to HomeGo vs. your other options.

Who does HomeGo work best for?

Homeowners who need to sell fast

HomeGo says it makes same-day offers on 100% of homes and closes in as fast as seven days. That’s extremely fast compared with the usual one to two weeks it takes to get an offer and a 30- to 45-day closing time frame on a traditional home sale.

This lightning-fast speed makes HomeGo an attractive option for sellers who need to sell ASAP, whether it’s due to an impending foreclosure, a divorce requiring a speedy sale, or relocating for a new job.

Homes in poor condition

HomeGo buys homes in any condition – from those that need minor repairs to those in total disrepair.

While HomeGo conducts a visual walk-through of your property, they’ll still make you an offer and won’t back out due to any issues discovered during their inspection.

That’s good news for homeowners who simply can’t afford to make repairs needed to sell the house on the open market, or those nervous about buyers backing out of a deal due to a poor home inspection.

If your home is in good condition and you want to sell for closer to fair market value, consider working with an iBuyer instead. Companies like Opendoor and Offerpad will likely pay closer to fair market value for your home compared to HomeGo.

HomeGo reviews

| Average Rating (0 - 5) | Total Reviews | |

|---|---|---|

| Weighted avg. | 3.9 | 120 |

| BBB | 3.4 | 46 |

| 4.1 | 74 |

HomeGo is accredited by the Better Business Bureau, where it has an A+ rating. It has received mostly positive reviews from its customers, with an average rating of 3.9 out of 5 stars based on 120 reviews from the BBB and its Facebook page.

HomeGo’s positive reviews tout its quick and painless process. Multiple HomeGo sellers report receiving an offer in a day and closing on the sale within a few weeks, without having to make any repairs.

HomeGo complaints

Like other popular cash home buyers, HomeGo is not without its complaints. The company has 55 complaints through the Better Business Bureau website, less than its peers Offerpad (104 complaints) but far more than WeBuyHouses.com (three).

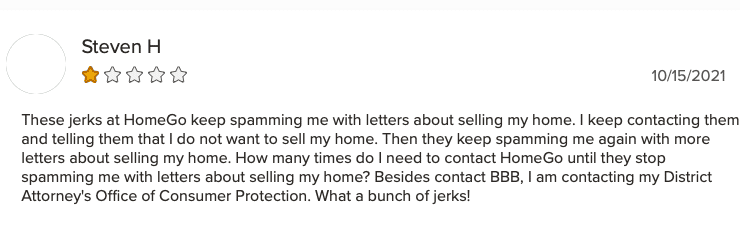

However, HomeGo’s most common customer complaints are centered around unsolicited mail and text messages, and not its actual business dealings.

Several reviewers say HomeGo uses aggressive marketing practices and sends out solicitations with images of the homeowner’s property. Some homeowners also report receiving mail from HomeGo even after requesting to be unsubscribed from their mailing list.

HomeGo has been very communicative in its responses, with a 100% response rate to its complaints on BBB. Homeowners can unsubscribe from its marketing by emailing [email protected] or visiting homego.com/unsubscribe.

HomeGo pros and cons

✅ Sell your house fast

You can get an offer and close on a sale within two to three weeks (sometimes in as fast as a week). That’s a much quicker process than selling with a real estate agent, which can take one to two months from start to finish, or even longer in a buyer’s market.

There’s also no risk of HomeGo backing out of the contract due to a poor home inspection or low appraisal (neither is required), or due to last-minute buyer’s remorse.

HomeGo pays cash for your house, so there’s zero risk of the financing falling through before closing, which can happen in a traditional sale.

✅ No pre-listing repairs or preparation

HomeGo will buy your house in its current condition, so you don’t need to spend a dime to get it ready for sale.

Since you’re not marketing your home to the public, you don’t need to worry about cleaning your home, maintaining the yard, or getting it professionally staged.

✅ Flexible moving date

HomeGo claims to offer sellers a closing date in as fast as seven days, but that doesn’t mean you have to move out of your home immediately. The company says you can stay longer if necessary.

You can even stay in for several months (or longer) with HomeGo’s lease-back program, where HomeGo rents back the house to you until an agreed-upon moving date.

⛔️ Lowball offer

We buy houses companies like HomeGo usually offer sellers 70% or less of the home’s ARV to ensure a profit is made after factoring in all expenses. Using our previous example, HomeGo might only offer you $210,000 (or less) on a home worth $300,000.

If your home is in relatively good condition and doesn’t need much work, you’re likely better off listing on the open market with a realtor or selling to an iBuyer.

⛔️ No seller representation

Although HomeGo may use the services of real estate representatives, these pros DON’T legally represent you. Therefore, they may not have your best interest in mind as a seller.

You can still expect everything to be above board: a licensed agent will evaluate your house and make you an offer on behalf of HomeGo, and an affiliated real estate broker may transact home purchases.

If you want a realtor’s professional advice and expertise, you’ll need to find your own agent and sign an exclusive listing agreement. (Need some help? Our team can match you up with experienced, local agents for objective, professional advice.)

⛔️ Limited markets

HomeGo isn’t available nationwide. The cash buyer currently serves 33 markets across 21 states. Many Northeast and Midwest markets aren’t covered.

HomeGo alternatives

HomeGo is just one of several companies that buy houses for cash. Here’s how it compares to its competition.

| Company | Fastest closing (days) | Distressed properties | Availability (# of markets) | Rating (out of 5) |

|---|---|---|---|---|

| HomeGo | 7 | Yes | 33 | 3.43 |

| We Buy Houses | 7 | Yes | 50 | 4.6 |

| Offerpad | 8 | No | 25 | 3.7 |

| Opendoor | 14 | No | 47 | 4.3 |

| Mark Spain Real Estate | 21 | No | 7 | 4.34 |

We Buy Houses

Fastest closing

- Offer in 24–48 hours

- Close in 7 days

- No closing costs

We Buy Houses has numerous positive reviews from customers, and the brand carefully vets real estate investors who want to obtain a license. It’s also able to close in just seven days, which is faster than most cash buyer companies.

Although We Buy Houses investors won’t pay what you’d get on the open market, working with one is more likely to be successful than if you were to try and find a local real estate investor on your own.

Pros

- You get an offer in 24–48 hours.

- The company carefully vets real estate investors.

- You can close in just seven days.

Cons

- There’s little to no room for negotiation after the initial offer.

- Investors have some freedom to price homes as they see fit, so offers may be better in some regions than others.

- The company pays less than fair market value for homes.

We Buy Houses has over 2,700 offices across 50 states, plus Washington, DC.

We Buy Houses is a cash buyer that claims it can close on a home sale in as fast as a week. Like other cash home buyers, the company typically offers between 50% and 70% of a home’s ARV.

With an average customer rating of 4.6 out of 5 stars, We Buy Houses has slightly more positive reviews than HomeGo. However, each office is independently owned and operated by a local real estate investor, so your experience may vary.

The company also covers more areas than HomeGo, with over 2,700 offices across 49 states and Washington, DC.

Offerpad

Fast closing

- 6% service fee

- Close in just 8 days

- Great customer service

Offerpad can provide home sellers with a fast cash offer and quick closing (as little as eight days). We noticed that most recent Offerpad reviews are positive, with home sellers noting that Offerpad reps were friendly and helpful throughout the selling process.

Pros

- You can close in just eight days.

- There’s no need to repair or prep the home.

- Home sellers have an extended stay option.

Cons

- Some customers report high repair costs that reduced their final offer.

- Free local moves are available only within a 50-mile radius.

Offerpad is available in 25 metro areas across AL, AZ, CA, CO, FL, GA, IN, KS, MO, NV, NC, OH, SC, TN, TX.

Customer reviews of Offerpad are mostly positive, with an average rate of 4 across 2,656 reviews.

As an iBuyer, Offerpad‘s business model is slightly different than the cash buyer one. The company tends to make cash offers much closer to your home’s fair market value. While it charges a 5% service fee, you’ll likely still net more money than in a sale with HomeGo.

However, Offerpad won’t buy your house unless it meets its criteria, and it usually doesn’t purchase homes with significant repair issues.

Offerpad is currently available in just 25 markets and doesn’t cover many Northeast or Midwest states.

Opendoor

Best tech

- 5% service fee

- Available in 50+ cities

- Choose your close date

In comparison to other iBuyers, Opendoor offers the best value because the fees are capped at 5% and it pays close to fair market value for homes. Sellers should be aware that Opendoor deducts repair costs from their final offer, and the company no longer allows home sellers to handle repairs on their own.

Pros

- You get a free, no-obligation offer.

- You can choose when you close.

- With late checkout, you can stay in your home up to 17 days after closing.

- Opendoor is available in 50+ markets and continuing to expand.

Cons

- You have no control over repair costs.

- There’s strict criteria for purchasing homes (e.g., no structural damage, no homes pre-1930).

Opendoor is currently available in 47 major markets in AL, AZ, CA, CO, FL, GA, ID, IN, MN, MO, NV, NJ, NY, NC, OH, OK, OR, SC, TN, TX, UT, VA, DC.

Customer reviews of Opendoor are mostly positive, with an average rating of

4.2 across 3,419 reviews.

Like other iBuyers, Opendoor generally pays more for homes than most cash buyers, but it typically doesn’t buy houses in poor condition.

The critical difference between Opendoor and Offerpad is availability and closing flexibility:

- Opendoor is available in more locations (47 markets vs. 25)

- Offerpad provides a longer closing date window (8–90 days vs. 14–60)

Mark Spain Real Estate

Fast sale

Mark Spain Real Estate

- Experienced home buyer

- Highly-rated reviews

- Available in limited markets

Mark Spain Real Estate buys homes for cash for sellers who need to sell ASAP without issues. Most types of homes qualify, except those with foundation or permitting issues. However, Mark Spain is available in a limited number of markets, and multiple reviewers claim that they received offers well below fair market value.

Pros

- Close in as fast as 3 weeks

- No need to repair or prep home

- Experienced, professional staff

Cons

- Some customers report lower-than-expected offers

- Homes located in flood zones, or those with foundation or permitting issues, won’t qualify

- Limited number of markets

Mark Spain Real Estate is available in 18 markets across seven states (Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee, and Texas).

Mark Spain Real Estate’s reviews are mostly positive, with an average rating of 4.4 out of 5 stars based on more than 1,400 reviews across the Better Business Bureau, Facebook, Google, and Yelp.

Mark Spain is a real estate brokerage offering cash for homes to homeowners located in major metro areas in the Southeast United States (AL, FL, GA, NC, SC, TN, TX).

While Mark Spain pays cash for homes, it doesn’t purchase homes in poor condition — including homes with foundation issues or unpermitted additions — or in financial distress.

The company also takes a bit longer to close than its competitors, with closing in as fast as 21 days. That’s only a few weeks faster than how long it takes to close in most real estate markets.

Sell with a realtor

Listing your house with a local realtor will take longer to get an offer and close on the sale (typically two to three months, depending on your market). But you’ll also have a much better shot at selling at your home’s fair market value.

Need help deciding which route to take? Our team can match you with top-performing agents at name-brand brokerages, like Keller Williams and Century 21. They’ll provide you with a free home valuation to determine what your home is worth, and can help you get the best possible offer on your property — whether it’s through a cash buyer or listing it for sale.

FAQs

Is HomeGo a reputable company?

Yes, HomeGo LLC is a cash home buyer with its headquarters in Irving, Texas. The company is accredited by the Better Business Bureau, where it has received an A+ rating. HomeGo has received mostly positive customer reviews, but its service works best for homeowners who value speed and convenience over getting the most money.

How does HomeGo compare to Opendoor?

Opendoor is an iBuyer and usually offers more for properties compared with cash home buyers like HomeGo. Unlike HomeGo, however, Opendoor typically doesn't buy houses in physical or financial distress.

What locations does HomeGo serve?

HomeGo is currently available in 33 markets across 21 states in the U.S. Unfortunately, HomeGo doesn't cover most Northeast and Midwest markets.

What are common HomeGo complaints?

The most common HomeGo complaints are about its unsolicited mail, with many reviewers saying that HomeGo sends out marketing mail containing the homeowner's property information and photos pulled from Google. HomeGo's response is that the property data featured in its mailers is public information.

Related reading

Companies That Buy Houses for Cash Reviewed. If you’re looking to sell your home extremely fast, you have options. Learn more about these cash home buying companies.

What is an iBuyer? We vetted the top iBuyer companies to help home sellers choose the best fit.

Opendoor Reviews. Opendoor pays more for houses compared to other cash buyers, but it’s not an option for everyone. Learn more here.

Leave a Reply