Published

What Is Knock.com? | How Knock Home Swap works | Knock GO for home buyers | Knock Nest | Fees | Knock Home Swap reviews | Locations | Alternatives

Knock.com is a mortgage lender that aims to solve the problem of tricky timing when trying to buy and sell a home at the same time.

If you’re a homeowner planning to relocate, you usually have two choices. You could sell your old home first, then hope to quickly buy and move into a new home. Or you could buy a new home first — if you can afford the down payment and closing costs without selling your old house first.

Knock’s innovative Home Swap program provides a solution by offering two types of financing:

- Approval for a new home loan before your old one sells, backed by Knock’s guarantee to purchase the house if it doesn’t sell

- An interest-free bridge loan that covers transaction-related expenses, such as a down payment on a new home, repairs to the home you’re selling, and overlapping mortgage costs

With a guaranteed home sale and bridge loan to cover your down payment, you can make a more competitive offer on a new home and move in right away. Knock will take over your previous mortgage while you work with an agent to attract buyers to your listing and negotiate the best offer.

With positive customer ratings, a large service footprint, and low fees compared to many alternatives, Knock is one of our top picks for a home trade-in service.

In addition to fronting you up to $35,000 to make your home shine before you list it, Knock gives you the flexibility to choose your own agent — which can give you both savings and peace of mind while navigating a complicated trade-in process.

What is Knock.com?

Knock is a nontraditional lender that offers a unique service to homeowners who are buying their next home. With Knock Home Swap, you can get approved for a mortgage before your old home sells — which most lenders won’t do, due to limits on borrowers’ debt-to-income ratios.

Knock can do this because it offers homeowners a backup offer. If your home doesn’t sell on the open market, there’s still a guarantee that you can sell it directly to Knock.

This certainty allows buyers to make a competitive offer on a new home. In most cases, buyers agree to purchase a new home only if their old home sells first. But this is trickier than it sounds, because lots of details (including your old home sale and financing) will have to line up perfectly. That’s why Knock’s non-contingent, cash-like offers stand out to sellers — and why it’s much more likely to get accepted.

Knock also offers financial assistance to help homeowners cover the many costs of selling a house. If approved, you’ll receive an interest-free bridge loan that can be used to cover:

- The down payment on a new home

- Mortgage payments on your old home until it sells

- Up to $35,000 toward repairs on your old home

Once you move into your new home, Knock can handle any repairs and pay the mortgage on your old property until it sells.

At the end of the process, Knock will deduct its fees — including the balance of your bridge loan — from the proceeds of your home sale.

🏠 Will Knock buy my house?

It’s unlikely that you’ll end up selling your home directly to Knock. The company gives you a backup offer when you sign up, but you can only accept it if your home doesn’t sell on the open market after six months.

If you’re looking for fast cash offers, you need to request offers from cash buyer companies instead. Our team can help by connecting you with competing offers from serious cash buyers in our network Simply tell us about your property, and get buyers’ proposals delivered straight to your inbox. We can also connect you with a free home valuation from a local realtor, so you can compare offers against your home’s potential sale price. See what different cash buyers would pay for your house — with zero obligation to commit.

How Knock Home Swap works

Other than approving your mortgage before your old home sells, Knock Home Swap’s process is similar to a typical home sale:

- Apply online. Knock’s two-step evaluation usually takes around four days. If you’re eligible, you’ll be pre-approved for a home loan to cover the cost of your new home.

- Buy a new home. With Knock’s pre-approval, you’ll make a competitive, non-contingent offer on a new home. After you move in, Knock will pay the mortgage on your old home for up to six months.

- Prepare your old home for listing. Work with Knock and your real estate agent to get your home market-ready by completing repairs and upgrades yourself, or using Knock’s network of contractors. Knock provides an interest-free loan of up to $35,000 for repairs, which must be completed within 45 days.

- List and sell your old home. You can list your home for sale after you’ve relocated, so it’s empty and available for showings any time.

- Settle the bill. Once your home sells, you’ll pay back Knock’s bridge loan, overlapping mortgage payments, and Knock fees.

Note: If you accept a Home Swap bridge loan, Knock will place a lien against your property — so you must repay it in full when your old home sells.

Since Knock.com encourages sellers to list on the open market, you’ll still need a great real estate agent on your side.

Our team can connect you to local real estate agents from trusted national brokerages including Keller Williams, Coldwell Banker, and RE/MAX. With our pre-negotiated listing fees, you’ll get full service while saving thousands in commission!

If you plan to buy a new home, you may be eligible to earn cash back at closing.

What if your home doesn’t sell on the open market?

If your home doesn’t sell on the open market after six months, you’ll have the option of accepting Knock’s backup offer (worth 80–85% of fair market value).

While Knock’s backup offer provides peace of mind (and allows the company to approve your new mortgage earlier), finding a buyer on the open market is by far the better option.

Not only will you have the opportunity to receive offers over your listing price, but you’ll also be able to negotiate selling costs including concessions, closing costs, and realtor fees.

How much are Knock Home Swap fees?

| Cost | Knock fees | Listing on the open market |

|---|---|---|

| 🤝 Service fee | 2% | — |

| 💰 Loan fees | $1,450 | 0.5–1% |

| 💁 Realtor commission | 4–6% | 4–6% |

| 🛠️ Repair costs | Varies (up to $25,000 advance from Knock) | 1–2% |

| 🏡 Buyer closing costs | 1–2% | 1–2% |

| 🏡 Seller closing costs | 1–3% | 1–3% |

| 💵 Mortgage payment reimbursement | Varies (0.5–1% estimated per month) | — |

| Total | 9.5–16.25% | 7.5–14% |

Knock charges a 2% service fee, plus an $1,850 administrative loan fee, for its Home Swap service. You’ll also have to pay realtor commission and closing costs, just as you would with any other home purchase.

Knock fees are based on your new home — so let’s say you plan to purchase a $400,000 property. In this example, Knock fees would total $6,450, including a $5,000 convenience fee, before closing costs.

Though Knock frames its service fee as the equivalent of an origination fee you’d pay to obtain a mortgage, most lenders charge just 0.5% to 1% of the loan amount. (For example, if your loan is worth $300,000, you’d pay $3,750 with Knock versus just $1,500 to $3,000 with another lender.) It’s even possible to shop around and avoid origination fees entirely — but not with Knock.

Still, if you decide Knock’s convenience is worth it, a low commission real estate agent can help you offset the cost. Our team has pre-negotiated low listing fees of just 1.5% with top-rated real estate agents near you — helping you save thousands while still getting incredible service.

Your agent can also help you find a new home to purchase — and depending on your location, you may be eligible for cash back after closing!

Other Knock Services

Knock GO (Guaranteed Offer) for home buyers

If you’re simply looking to buy, Knock’s Guaranteed Offer program, Knock GO, can qualify you for a loan to make your offer more competitive to sellers.

With Knock GO, you apply for a mortgage with Knock to make a cash-backed offer without the usual financing and appraisal contingencies attached — removing two of the most common reasons for canceled real estate transactions.

With Knock guaranteeing your offer to the seller, your offer is as good as cash.

Another benefit of Knock GO is appraisal protection. If your appraisal comes in low, and you’re forced to come up with extra cash at closing to make up the difference, Knock will cover up to 3% of the loan amount in closing costs to help you bridge the gap.

Knock GO fees

Unlike the more complex Home Swap, there’s no 2% service fee for using Knock GO. You’ll pay only a $1,850 administrative loan fee to cover Knock’s processing and underwriting costs. Like most real estate transactions, the all agent commission will be paid for by the seller.

While Knock’s flat fee could actually be lower than the typical 0.5–1% loan origination fee (totaling $1,500–3,000 on a house valued at $300,000), you won’t be able to negotiate your rates like you would shopping around with traditional lenders.

Unlock your home’s value with Knock Nest

In addition to Knock Home Swap and Knock GO, the company also offers a program called Knock Nest.

With Knock Nest, you can tap into your old home’s equity by selling it to Knock.com. You’ll receive a cash payment you can use to pay off your mortgage and access your home’s equity, then pay market-rate rent to stay in your old home throughout your home search.

If you change your mind about moving, you can buy your home back from Knock at a predetermined price.

Knock reviews

Knock.com has an average 4.8 star rating across 738 reviews. Though Knock isn’t currently accredited by the Better Business Bureau, it has a B+ rating with a total of ten complaints.

| Review site | Average rating | Total reviews |

|---|---|---|

| Zillow | 4.8/5 | 722 |

| Trustpilot | 3.7/5 | 14 |

| Weighted Average Rating | 4.8/5 | 738 |

Overall, Knock Home Swap reviews praise the program’s convenience, customer service, and transparency. Additionally, customers report that Knock’s bridge loans helped them stand out in competitive markets, thanks to the ability to make cash-like, non-contingent offers.

However, a few reviews cite poor communication, inadequate home repairs, and closing delays caused by Knock.

🔎 JUMP: Back to the top of the page

Knock.com positive reviews

In this instance, Knock’s customer service was so strong that it won over a customer who was initially skeptical.

For another customer, Knock Home Swap made a long distance move comparatively stress-free — particularly because its bridge loan had zero interest.

Similarly, another customer found Knock Home Swap seamless and easy from start to finish.

In fact, the convenience of Knock’s bridge loan was so valuable that some reviewers felt it entirely justified Knock’s convenience fee.

Knock.com complaints

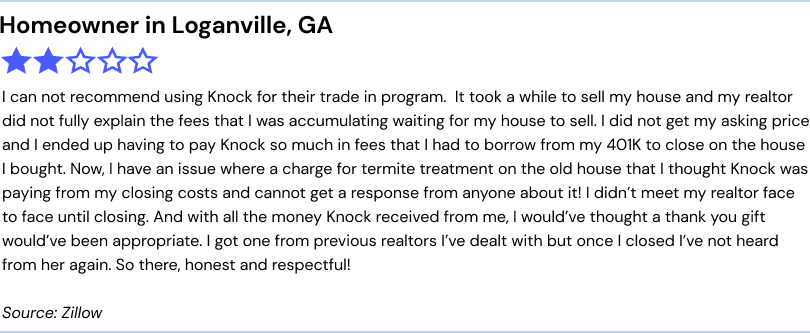

Though most Knock.com reviews are positive, some sellers had regrets about working with the company instead of a traditional lender.

For example, confusion over Knock’s business model left one customer in a financial bind.

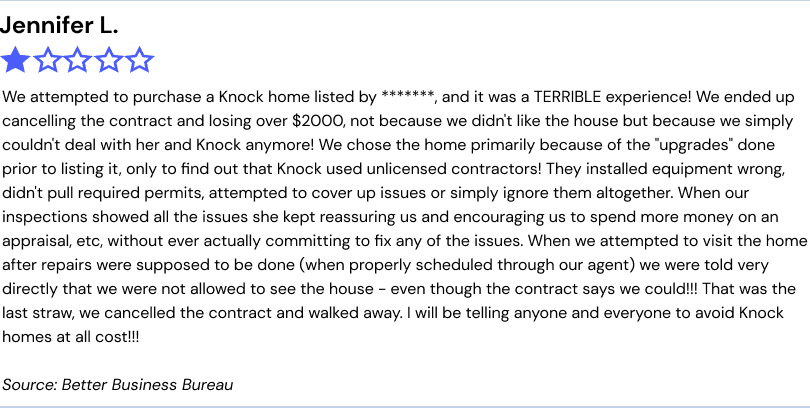

Other customers who purchase homes from Knock have been disappointed in the quality of repairs.

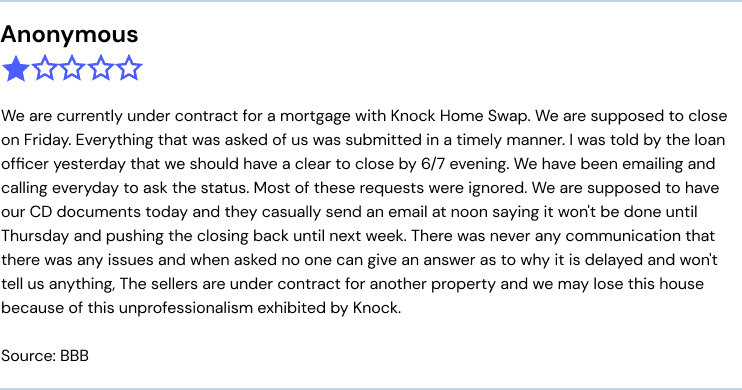

A few customers have also noted last-minute delays in the underwriting process that undermined their ability to close on a new house.

Your agent can make or break your home sale

In a complex real estate transaction, you want an agent who’s on top of things. If you’re looking for an incredible agent to guide you through the buying process, our team can help!

Our partner agents come from top-rated brokerages and save their clients an average of $7,000 by working for a pre-negotiated listing fee of just 1.5%. Our free agent matching service helps you find the best agent for the job, with no obligation to commit.

💰 Find top local agents, get a 1.5% listing fee

Where is Knock Home Swap available?

So far, Knock is available in around 70 metro areas across 15 US states.

| State | Metro areas |

|---|---|

| Arizona | Phoenix, Prescott, Tucson, Yuma |

| California | Bakersfield, Los Angeles, Orange County, Riverside/Palm Springs, San Bernardino, San Diego, Santa Barbara, Ventura |

| Colorado | Colorado Springs, Denver, Boulder, Ft. Collins, Greeley |

| Florida | Bradenton, Cape Coral/Fort Myers, Deltona/Daytona Beach/Ormond Beach, Fort Lauderdale, Jacksonville, Lakeland/Winter Haven, Miami, Naples/Marco Island, North Port/Sarasota, Orlando, Palm Bay/Melbourne/Titusville, Port St. Lucie, Punta Gorda, Sebastian/Vero Beach, Tampa, The Villages, West Palm Beach |

| Georgia | Atlanta, Athens/Clarke County, Gainesville, Dalton, Rome |

| Illinois | Chicago |

| Maryland | Baltimore |

| Michigan | Ann Arbor, Detroit, Flint, Monroe |

| Minnesota | Duluth, Minneapolis-St. Paul |

| North Carolina | Charlotte, Raleigh-Durham, Burlington, Hickory |

| Oregon | Albany-Lebanon, Corvallis, Eugene-Springfield, Portland-Vancouver-Hillsboro, Salem |

| South Carolina | Charleston, Columbia, Greenville, Spartanburg |

| Tennessee | Knoxville, Memphis, Nashville |

| Texas | Austin, Dallas-Fort Worth, Houston, San Antonio, Sherman-Dennison |

| Washington | Longview |

If you live in one of Knock’s service areas, you can apply for a loan directly at knock.com. Knock offers conventional, jumbo, and VA loans and generally wants to work with sellers who:

- Plan to sell and purchase their primary residence (not a vacation home or rental property)

- Plan to buy or sell a condo, townhome, or single-family home

- Are selling a home without major issues or complications (water damage, foundation issues, distressed property, bank-owned, etc.)

» Not eligible for Knock.com? Read on to learn about other options!

Top Knock.com Alternatives

Knock.com vs. Orchard

Knock isn’t the only company that offers a home trade-in service. Orchard (formerly Perch) has a Move First service that’s very similar to Knock Home Swap.

Like Knock, Orchard offers an equity advance on your current home to cover the down payment on a new one, letting you move in right away while it lists and sells your home. Orchard also provides interest-free funding to make repairs and a guaranteed backup offer if your home doesn’t sell within 120 days.

However, Orchard fees are structured differently — and include representation from Orchard’s in-house team of agents. You’ll pay:

- A 5–6% brokerage fee, based on the cost of your new home

- 1.9% program fee to use Orchard’s equity advance

- Typical closing costs of 1–2%

- Variable repair costs for your old home

Knock’s fees are technically lower (2%, plus a $1,450 administrative loan fee), but you’ll need to pay a separate agent commission of 4–6% when selling, on top of the usual closing costs of 1–2%.

All-in, it’ll cost anywhere from 7–10%, plus $1,450 in loan fees, to sell through Knock Home Swap. On a trade-in of two homes valued at $600,000, that equates to ($42,000–60,000).

Trading the same two $600,000 homes using Orchard would cost 8–10% ($48,000–60,000), plus deductions for any home repairs made prior to listing.

While Knock gives you the freedom to work with any real estate agent you like — meaning you could potentially negotiate a lower commission — Orchard.

Trade In

- 6% service fee

- Backup offer from Orchard

- Full listing service

Orchard makes it easier to finance the purchase of a new home before you sell your old one, but they’ll only purchase their home directly from you if it doesn’t sell on the open market after 30 days. If you want the freedom to choose your own agent, another trade-in service may be a better option.

Pros

- Leverage the equity in your current home to buy a new home

- Avoid paying two mortgages at once

- Sell directly to Orchard if you can’t sell on the open market

Cons

- Have to work with Orchard’s agents

- Only available in 11 metros

- High fees — 6% service fee plus closing costs and repayment or old mortgage

Orchard is currently available to home buyers and sellers in 11 metro areas across 7 states: CO, GA, MD, NC, OR, TX, VA.

Knock.com vs. iBuyers

Knock.com is different from the typical iBuyer company that makes cash offers on homes to resell them for a profit.

Below, we break down the key differences between Knock Home Swap and leading iBuyers.

| Criteria | Knock Home Swap | iBuyers |

|---|---|---|

| 🏡 Selling your home | List on the open market, with a backup offer after six months | Get an instant cash offer |

| 💰 Sale price | Fair market value (or more!) | Slightly less than fair market value |

| 🚚 Buying a home | Get approved for a new mortgage before your old home sells | Not involved in new home purchase |

| 🤝 Real estate agent | Work with real estate agent who negotiates on your behalf | No support from real estate agent |

| 💵 Mortgage payments | Interest free loan for overlapping mortgage payments, repairs, and other costs | Line up your home sale and purchase to avoid overlapping costs |

While iBuyers offer flexible closing timelines — usually one week to several months — that can help you line up your home sale with a new home purchase, you’ll have to navigate the transaction on your own — and you’re very unlikely to earn as much money as you might on the open market. You’ll also have to contend with iBuyers’ pricey fees (often 5% or more) and lack of room for negotiation.

By contrast, Knock Home Swap allows you to get the maximum profit from your home sale by fronting you up to $35,000 to make upgrades before you sell.

You’ll be able to make a competitive offer on a new home, then work with a real estate agent of your choosing to list and market your old home.

Should you sell your home to Knock.com?

| ✅ Pros | ❌ Cons |

|---|---|

| Increase the odds of landing your dream home with a competitive, cash-like offer | No opportunity to shop around for the best mortgage rates |

| Get an interest-free loan for overlapping mortgage payments and repairs | Backup offers are only worth 80-85% of your home's fair market value |

| Move first, then prepare and list your home on the open market | Home Swap loans place a lien against your old home and must be repaid in full for your sale to be final |

Overall, Knock.com reviews suggest the service is a convenient solution for the tricky timeline home sellers face while coordinating a new home sale.

Working with Knock may be a good option if:

- You’re hoping to move quickly, and you don’t want to wait to sell your current home.

- You’re buying in a competitive market and losing out to all-cash offers

- You have very particular needs for a new home and may not be able to find one quickly after your current home sells.

However, it may not be the best route to take if you want to keep selling costs low.

Are Knock Home Swap reviews mostly positive or negative?

Knock Home Swap reviews skew positive, with customers rating the service an average 4.8/5 stars on Zillow. We recommend reading reviews from Knock customers — and also choosing a great real estate agent to help with your sale. Compare top-rated low commission real estate companies and save!

How much does Knock Home Swap charge?

Knock Home Swap fees include a 2% convenience fee and a $1,450 administrative fee, plus the usual closing costs and real estate commission you'd pay in a typical sale. Learn more about realtor commissions (plus how to save thousands on fees).

Recommended reading

What Companies Offer the Lowest Real Estate Commission Fees? Plenty of companies promise to help you save on commission — but with some, you’ll sacrifice on customer service. Our in-depth research found the best low commission companies on the market.

Top iBuyer Companies: Interested in selling your home to an iBuyer? Read our guide to compare the leading iBuyers.

We Buy Ugly Houses: The Good, the Bad, and the Ugly: You’ve seen their signs on the side of the road, or nailed to telephone poles. But how much do you really know about “We Buy Ugly Houses”? This guide details everything you might want to know about how they operate, and why you should (or shouldn’t) use them.

Leave a Reply