Published

What is Prevu? | How does Prevu work? | Prevu fees | Prevu vs. traditional realtors | Buying | Selling | Find Prevu reviews | Top Prevu alternatives

Prevu is a discount real estate brokerage that advertises large rebates for eligible home buyers and a 1.5% listing commission for sellers. Prevu offers these savings by connecting buyers and sellers with its salaried agents who do many — but not all — of the tasks of a full-service agent.

However, as the Prevu reviews below illustrate, this approach may lead to less support and agent choice. Unclear and high minimum fees also mean some customers could actually save more with other discount real estate companies.

👉 Just looking for discount real estate agents near you? Fill out this short form to get matched with top local agents offering a 1.5% listing fee!

Key Takeaways

- With Prevu, eligible buyers receive up to a 2% rebate and sellers get a 1.5% listing rate.

- These savings can come with trade-offs, including a smaller pool of agents to choose from, less personalized service, and more work (especially for buyers).

- With Prevu’s high minimum fees, some may actually save more and get better support from another discount brand or a traditional realtor.

P.S. If you’re just looking for Prevu Real Estate reviews, find them here!

What is Prevu Real Estate?

Prevu Real Estate LLC is a discount real estate company that offers impressive savings for home buyers and sellers, often in exclusive, high-priced markets like those in New York City and Los Angeles.

The centerpiece of Prevu’s benefits is its Smart Buyer Commission Rebates. Eligible home buyers receive a home buyer rebate of up to 2% of their purchase price. In high-priced markets, this can lead to huge savings.

However, note the use of “up to.” According to the savings calculator on Prevu’s website, the full 2% rebate is only available on homes priced at $1.25 million or more.

To remain eligible for this rebate, buyers must do more legwork than they would with a traditional agent. In fact, buyers are on their own when it comes to finding homes at all — Prevu agents only step in once they’re ready to view a property.

Prevu also offers sellers a discounted listing commission rate of 1.5%, compared to the conventional 3% listing commission. Due to minimum listing fees, some sellers might end up actually paying more with Prevu than they would with a traditional agent.

If you’re looking to save on realtor fees, we recommend trying our free agent-matching services. Sellers who work with us will pay a low 1.5% listing fee in exchange for full service and support from a top local realtor.

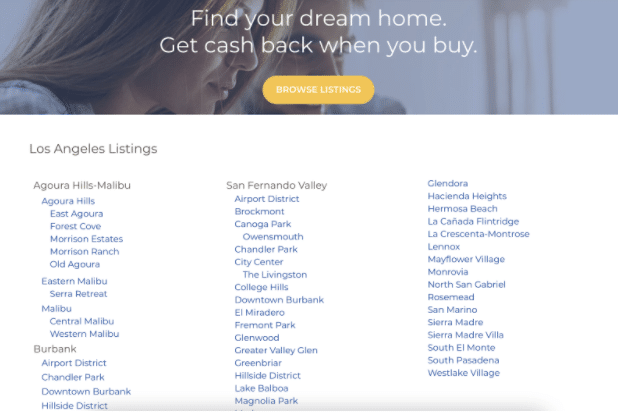

Prevu locations

Prevu operates in a dozen states across the US:

- California

- Colorado

- Connecticut

- District of Columbia

- Florida

- Massachusetts

- Maryland

- New Jersey

- New York

- Pennsylvania

- Texas

- Virginia

- Washington

It serves primarily high-end metros and surrounding suburbs, with almost no coverage outside of major cities. For example, if you live in Pennsylvania and want to use Prevu Real Estate, Philadelphia and its suburbs are the only areas the company serves.

How does Prevu work?

Like many other low-commission real estate companies, Prevu uses the lure of large home buyer rebates and low listing fees to attract customers. It offsets this cost-cutting approach by:

- Reducing the number of tasks Prevu agents manage, especially for buyers

- Minimizing operating costs with a team of salaried versus commission-based agents

- Handling three times as many customers per agent compared to a traditional realtor

- Restricting its operations to markets with expensive homes that net large commissions, even after passing savings onto customers

With this approach, Prevu is able to offer one of the largest buyer rebates out of all discount real estate companies, and a 1.5% listing fee for sellers. There are trade-offs though, for both buyers and sellers, as we’ll discuss.

What are Prevu fees?

When you sell your home with Prevu, you’ll be responsible for paying Prevu’s listing fee and the conventional 2.5–3% for the buyer’s agent.

| Service | Fee |

|---|---|

| Listing Agent's Commission | 1.5% (minimum fees vary) |

| Buyer's Agent Commission | 2.5–3%* |

| Total | 4–4.5% |

As a seller, expect to offer a buyer’s agent commission that’s competitive in your area. Put simply, this commission is a financial incentive to get buyer’s agents to show your home.

Reduce that commission and your home may receive less foot traffic and less competition among buyers. If that happens, you could end up selling your home for a much lower price point — and wiping out any potential savings from offering a lower buyer’s agent commission.

Prevu minimum listing fees

Prevu advertises a 1.5% listing commission, but this number is subject to minimum fees that vary by location. Unfortunately, these fees are not listed anywhere on the company’s website.

Due to Prevu’s hidden fees, some sellers could end up paying more than 1.5% — and even occasionally more than the 3% commission a traditional listing agent would charge.

For example, based on a conversation with a Prevu agent, you’ll face a minimum fee of $12,500 in New York City.

Unless your home sells for more than $415,000, you’ll end up paying a higher commission fee than the standard 3%. You won’t actually reach the advertised 1.5% rate until your home is priced above $835,000.

| Price point | Prevu fee* | Effective rate | Potential savings** |

|---|---|---|---|

| $250,000 | $12,500 | 5% | –$5,000 |

| $450,000 | $12,500 | 2.7% | $1,000 |

| $650,000 | $12,500 | 1.9% | $7,000 |

| $850,000 | $12,750 | 1.5% | $12,750 |

| $1,000,000 | $15,000 | 1.5% | $15,000 |

Again, Prevu works in higher-priced markets for this reason.

You’d be hard-pressed to find a property for less than $600,000 in New York City. However, be aware of these Prevu fees if you’re selling in a surrounding suburb or other lower-priced area.

Prevu vs. traditional realtors

Prevu claims to provide services that are similar to a traditional real estate agent, but at a lower cost. Due to differences in their agent structure, though, this may not actually be the case.

As the real estate agent reviews illustrate below, you could have a great experience with one of Prevu’s in-house agents, or you may experience frustrating delays and less personalized support.

Limited agent choice

When you work with Prevu to buy or sell, you’ll be limited to a much smaller group of its in-house agents. You may find the perfect agent for your needs, but you may not.

No matter which brokerage or company you eventually choose, interview at least two to three agents beforehand. Make sure they prioritize your needs, whether that’s to sell for the highest price or find a move-in ready home ASAP.

Saving money is always a win, but not clicking with your agent could lead to communication issues, pricing disagreements, or other problems.

That’s why we recommend free agent-matching services like ours. With us, you can interview top agents in your area, with no commitment. You’ll have time to find an agent who works best for your needs (and save with 1.5% listing fees!).

Get matched with a top agent, find out how much you can save today!

Prevu agents handle more customers

Prevu can offer big discounts both by focusing on higher-priced markets and by doing a larger volume of business with a smaller team.

According to a company profile, Prevu agents close on 36 properties a year — almost three times more than the average traditional realtor.

This increased workload may not be an issue with a talented agent, but especially if you have a unique or hard-to-sell property, you won’t get the same dedicated support that you’d get with a traditional agent.

Prevu’s salaried agents have different incentives

A traditional agent usually gets paid a percentage of the purchase price on your home only if you close. On the other hand, Prevu agents primarily work on salary so the outcome of your deal won’t affect their compensation.

Prevu agents obviously work hard for their customers, but because of this incentive structure, they may not be as motivated to sell your home quickly or for the highest price.

Prevu agents provide less up-front support (especially for buyers)

Both buyers and sellers do get the benefit of working with a single Prevu agent during most steps of their transaction, like they would with a traditional agent. However, buyers will not get the same level of support from Prevu agents at the start of the process.

Agents typically meet with would-be buyers to understand their budget and goals so they can help with their property search. Prevu doesn’t offer this. As a buyer, you’re on your own to look for homes.

Buying with Prevu

As noted, the process of buying with Prevu will be similar to other brokerages, save for the initial search and its buyer rebate program.

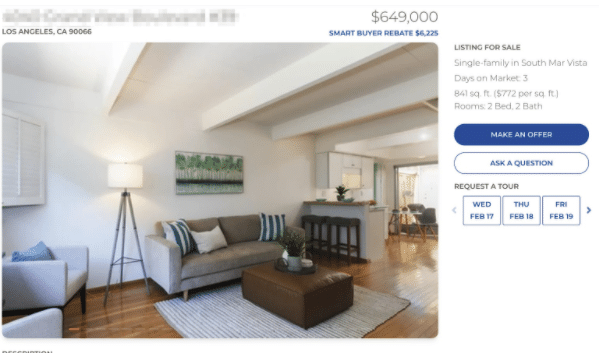

If you’re interested in buying a home in an area with Prevu real estate agents, you’ll start by browsing listings on Prevu.com.

Unfortunately, Prevu’s search tool doesn’t make the browsing process easy. You must provide contact details to view listings matching a few search parameters. Don’t want to provide contact info? You’ll have to browse by state, then city, and neighborhood.

Once you find a listing, Prevu provides an estimated Smart Buyer Rebate in the top right above the listing.

From there, you’ll have the option to ask a question, request a tour, or make an offer. Only then will you actually connect with a Prevu buyer’s agent to help you through the rest of the process.

What is Smart Buyer Rebate?

If you work with Prevu to buy a home that’s not listed by a Prevu agent, you could get up to 2% of your agent’s commission back as a rebate. Prevu’s Smart Buyer Rebate is one of the best benefits this discount brokerage offers.

In high-end markets, a 2% rebate is a lot of money. For example, a buyer rebate in NYC, where homes regularly sell for above $1 million, could net you thousands of dollars after closing.

However, buyer rebates are complex and subject to many restrictions. And Prevu’s rebate program adds to the complexity with a number of eligibility requirements.

- You’ll only receive the full 2% rebate on residential homes priced at $1.25 million or more (see following table)

- Some types of purchases — such as short sales or new constructions — aren’t eligible

- As noted, you won’t be eligible if the property is listed by a Prevu agent

| Price point | Rebate percentage | Potential savings* |

|---|---|---|

| $500,000 | 0.5% | $2,500 |

| $750,000 | 1.3% | $10,000 |

| $1,00,000 | 1.75% | $17,500 |

| $1,250,000 | 2% | $25,000 |

| $1,500,000 | 2% | $30,000 |

Again, buyer rebates are complicated and subject to state-level and lender regulations. Learn more about how buyer rebates work.

Selling with Prevu

When selling with Prevu, your listing agent will typically manage the same types of services a traditional agent would, such as:

- A valuation of your home’s worth, such as a CMA

- Professional pictures and a virtual 3D home tour

- A listing on the local Multiple Listing Service (MLS), which pushes to major real estate websites, like Redfin and Zillow

- Open houses

- Showings

- Negotiation with buyers

- Closing support

Prevu’s Smart Seller Service allows home sellers to list their properties for a 1.5% commission in select markets. Note that this doesn’t include the 2.5-3% commission you’ll pay to the buyer’s agent. Nor does it account for Prevu’s minimum fees in certain markets.

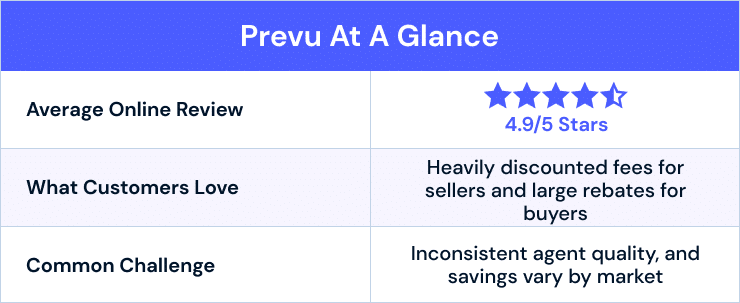

Prevu reviews: Pros, cons, and areas of concern

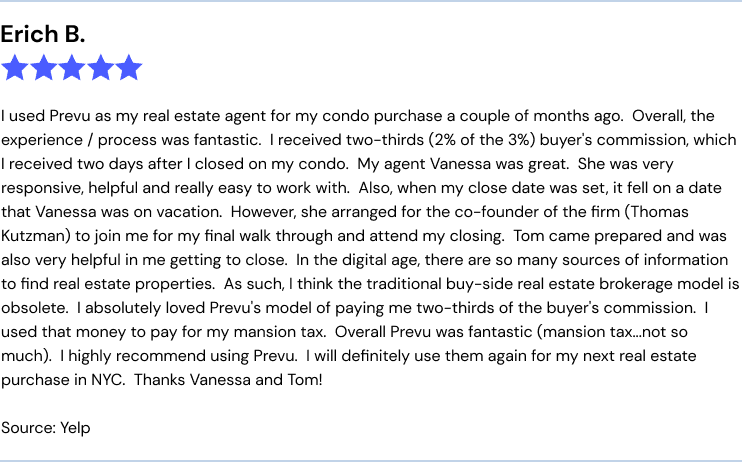

As the following Prevu Real Estate broker reviews highlight, customers have very mixed results when working with this discount brokerage firm.

Some customers report great service, with agents who were invested in their transaction, and substantial savings. Others, however, experienced communication issues or were surprised that fees were higher (or rebates smaller) than they anticipated.

It’s important to weigh these Prevu pros and cons carefully to decide if this company is the best choice for you, or if another discount service provides greater value.

Pro: Large buyer rebates, in certain situations

Prevu’s rebate is up to 2% of the commission paid to the buyer’s agent. When purchasing expensive properties, this can help you save tens of thousands of dollars.

It’s worth remembering that buyer rebates are complicated due to state-level restrictions and lender requirements (hence the “up to” 2% language). According to the savings calculator on Prevu’s website, eligible buyers will only receive a 2% rebate on homes valued at $1.25 million or more.

That makes Prevu’s rebate appealing if you’re in a high-end market. For example, getting an NYC commission rebate of 2% is more common than in other areas, since homes in New York City often sell for over $1.25 million.

Pro: Reduced seller’s commission of 1.5%

Instead of the traditional 3% listing commission, you’ll generally pay a 1.5% rate when you list your home with Prevu. This can provide substantial savings if you have a high-value home.

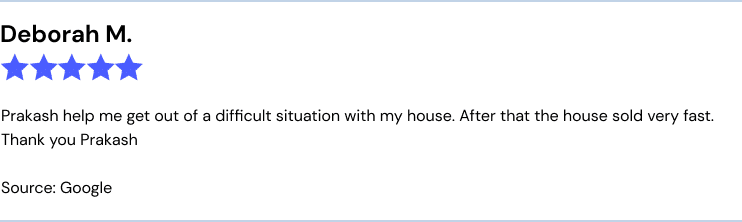

As this Prevu review shows, many sellers loved that Prevu helped them sell their home quickly, in addition to commission savings.

Con: Unclear fees and rebates

Unfortunately, not all Prevu sellers pay a commission of just 1.5% of the listing price. Due to minimum fees, sellers of lower-priced properties will end up paying more than 1.5% — and sometimes even more than the conventional 3% rate.

Prevu also doesn’t disclose its minimum listing fees by location. If you’re considering Prevu, make sure to talk to an agent in your area so you know how much you’ll actually pay.

Further, buyers who are excited by Prevu’s buyer rebate program may be disappointed to learn that its promise of 2% back only extends to homes that are $1.25 million or more. In high-end areas, other companies offer similar rebates. For example, in NYC, a broker commission rebate of up to 2% is available with broker NestApple.

Con: Limited and inconsistent agent pool

Prevu employs a limited number of in-house agents. And if the agent you’re assigned doesn’t meet your expectations, you may not have other options if you want to continue working with Prevu.

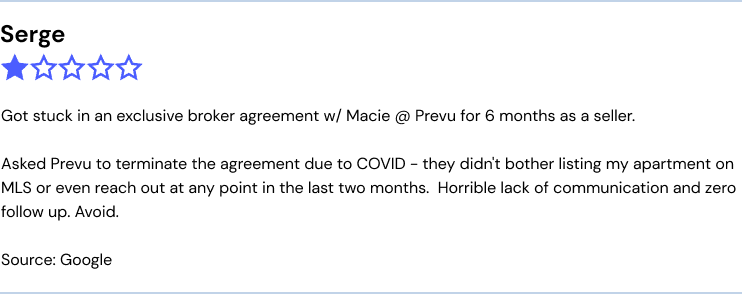

Several realtor reviews complain about inadequate communication and poor marketing of their property.

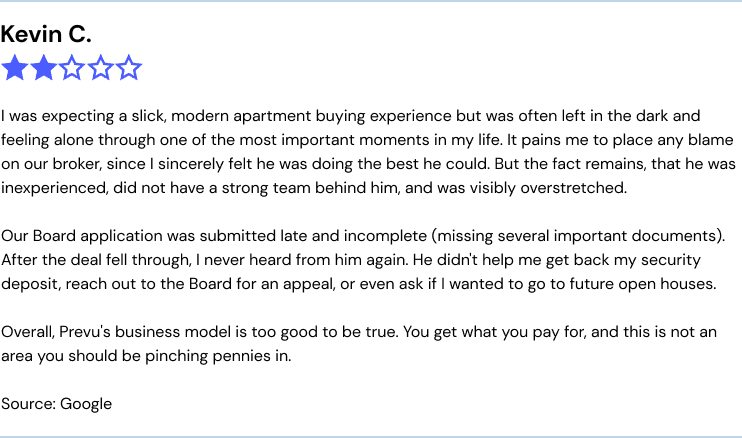

In this review for a real estate agent by a Prevu buyer, the buyer complained of insufficient communication and a lack of support during what should have been an exciting home-buying experience.

Area of concern: Limited savings for lower priced homes

Prevu’s business model is built on helping clients buy and sell homes in higher-priced markets. This enables the company to offer large rebates and low commissions, since the commission they keep is still very high.

Unfortunately, Prevu sets a minimum listing fee for sellers and reduces the commission rebate buyers can receive on lower priced properties.

Put simply, people in lower-priced areas won’t realize many (or any) of the benefits from working with Prevu. BUT they’ll still face the risk of working with the company’s potentially overextended agents.

The best Prevu alternatives to consider

As Prevu real estate reviews show, some customers can save big with this discount real estate company, but others will find little value.

Depending on your needs, you may have a much better experience with one of these Prevu competitors.

| Company | Our Rating | Listing Fee | Availability | |

|---|---|---|---|---|

|

Best for buyers

Prevu |

Our rating

|

1.5%

Min. fee varies

|

CA, CO, CT, DC, FL, MD, MA, NJ, NY, PA, TX, VA, WA

|

Learn More |

Clever Real Estate |

Our rating

|

1.5%

Min. $3,000

|

Nationwide

|

Find Agents |

Redfin |

Our rating

|

1.5%

Min. fee varies

|

26 states and Washington, DC

|

Learn more |

Ideal Agent |

2%

Min. $3,000

|

Nationwide

|

Learn More |

Listing Fee

Our take

Overview

Locations

Clever Real Estate is the best option for most sellers looking to save on realtor commissions. Its 1.5% listing fee is among the lowest of any full-service, nationwide brand. You’ll save thousands on commission while working with a top local realtor from a well-known brokerage, like RE/MAX and Keller Williams. Read the full Clever Real Estate review.

Pros

- 1.5% listing fee is half the typical rate.

- Agents have strong sales records and great customer reviews.

- Free agent-finding platform with no obligation to sign with a realtor.

Cons

- Certain add-ons like drone photography and staging may cost extra.

- May not get matched with the specific realtor you want if they’re not in Clever’s agent network.

Clever Real Estate offers a 1.5% listing fee, half of what realtors traditionally charge. But you’ll still get a top local real estate agent, so you’ll save thousands without sacrificing quality.

How it works: After filling out an online questionnaire, Clever matches you with realtors in your area. You can choose to work with one of the agents, request more agent matches, or walk away with zero obligations.

Why we like it: Clever is the perfect balance of savings and quality: You get all the services and support of a traditional agent, but you pay a fraction of the typical price. By comparing agents, you ensure you’re getting the realtor who’s right for you.

Clever is available nationwide.

Listing Fee

Our take

Overview

Locations

Redfin is a well-known discount brokerage that operates in most major cities. The savings are impressive, especially if you buy and sell with Redfin, but some of its agents are inexperienced. And while Redfin’s tech-focused approach comes with some neat features, it also means you may get less hands-on support than you need.

Pros

- You’ll get good savings with a 1.5% listing fee.

- Redfin’s extras, like 3D walk-throughs, can help sell your home.

- If you buy and sell with Redfin, you can get a 0.5% listing fee refund.

Cons

- Agent quality and customer service are not always great.

- Minimum fees are high in some markets.

- You’ll receive less one-on-one support from your agent.

Redfin offers good commission savings, and it’s available in most metro areas. But it comes up short in terms of customer service, plus its high minimum fees negate the savings in some markets.

Redfin uses a team-based model instead of having your agent oversee every part of your sale. This approach makes the process more efficient, which allows Redfin agents to handle a higher volume of customers. But you may face misunderstandings or mix-ups when working with multiple people.

And while some Redfin agents are good, others are new and inexperienced. With relatively few realtors in its network, you run a higher risk of getting stuck with a less-than-stellar realtor when you sell with Redfin.

Redfin is available in major markets in Washington D.C. and the following states: Arizona, Arkansas, California, Colorado, Florida, Hawaii, Illinois, Indiana, Maryland, Massachusetts, Minnesota, Nebraska, Nevada, New Jersey, New York, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, Tennessee, Texas, Utah, Virginia.

Listing Fee

Our take

Overview

Locations

Ideal Agent does a good job of vetting its agents, and it offers decent savings for sellers. But it has a limited service area and a small agent network, which limits your ability to choose the best agent for your situation. Alternative services, like Clever, offer the same service — but with better savings, more coverage, and more agents.

Read the full Ideal Agent review.

Pros

- Matched with top-performing realtors.

- 2% listing fee is a slight discount.

Cons

- Fewer agents makes it harder to compare your options.

- Limited coverage outside of big cities.

- Mediocre savings compared to other brands.

Ideal Agent matches sellers and buyers with traditional agents. The company negotiates 2% listing fees with its realtors and screens them for quality and experience.

A 2% listing fee is decent, but you could save more with the 1.5% that Clever and Redfin offer.

Ideal Agent’s partner realtors are good, but there aren’t very many of them, and they’re mostly located in big cities. There’s no guarantee Ideal Agent will have a realtor in your area, and if they do, you’ll get matched with only one.

Ideal Agent is available nationwide.

Related links

Want to learn more about how you can save on your next home sale or purchase? Read these articles to find out more.

How to Get a Home Buyer Rebate (And Save Thousands): Many discount real estate companies offer commission rebates for buyers. Learn everything you need to know about this process.

What Companies Offer the Lowest Real Estate Commission Fees? Some companies charge more to help you sell your home than others. Find out which are the most affordable options.

Must-See Clever Real Estate Reviews: Clever Real Estate matches you with top agents who charge discounted listing fees. Learn how Clever works and what customers are saying about this company.

Redfin: Reviews, Pros, Cons, Competitors, and Everything Else: Find out what you need to know before you list your home with Redfin or hire one of their buyer’s agents.

Leave a Reply