Published

Redfin vs. the competition | Locations | How does RedfinNow work? | RedfinNow fees | Pros and cons | RedfinNow reviews | FAQ

📌 Important Note

Redfin has ended its iBuying program, RedfinNow. But there are other ways to get quick, all-cash offers on your home:

- Get a free cash offer comparison from Clever Offers

- Sell to an iBuyer

- Sell to a leading cash buyer

For the most competitive cash offers — with no added fees or commissions — we recommend Clever Offers.

Top alternatives to RedfinNow

| Company | Customer Rating | Type | Best for | |

|---|---|---|---|---|

|

Best overall

Clever Offers |

5/5

|

Cash offer network

|

Multiple offers, legitimate cash buyers

|

Compare Offers |

Opendoor |

4.2/5

|

iBuyer

|

Higher offers for homes in good condition

|

Learn More |

Offerpad |

4/5

|

iBuyer

|

Flexible selling options with plenty of perks

|

Learn More |

Service Fee

Customer Rating

Time to Close

Our take

Details

Eligibility

Clever Offers provides a hassle-free way to compare offers from leading investors across the U.S. The 5-star rated company can help you source up to 10 competing cash offers from investors in their network — sparking competition and helping you make a more informed decision. Read our full Clever Offers review.

Pros

- One source for multiple competing offers

- Buyers are screened for experience and proven success at closing deals

- Clever stays with you to ensure a smooth closing and resolve any issues that arise

Cons

- Some offers may be low

- Alternative deal types may have longer closing timelines

- Cash offer options may be limited in some areas

- Clever’s Offers helps you find and compare multiple offers from legitimate cash buyers, ranging from local investors to nationwide iBuyers.

- Buyers are screened for experience, financials, and a track record of recently closed deals.

- In addition to cash offers, you can explore creative financing options like novation and subject-to agreements to help you maximize profit or preserve your credit if you’ve fallen behind on your mortgage.

- You can also request a pricing opinion from a local realtor, so you can compare offers against a realistic sale price.

- Clever offers full support during the selling process, including resolving any concerns or issues that arise with buyers.

- Clever’s service is free to home sellers – buyers pay Clever a small percentage of each deal closed.

- If you opt to list your home instead, you can get exclusive savings through their top-rated agent network.

Locations: Clever Offers is available nationwide.

Purchase criteria: Almost any property is eligible, regardless of condition.

Service Fee

Customer Rating

Time to Close

Our take

Details

Eligibility

Opendoor pays much closer to market value than traditional house flippers while still offering the benefit of fast closings and no repairs. For that convenience, you’ll need to contend with stricter purchase criteria, repair deductions, and a service fee of 5%. Read our full Opendoor review.

Pros

- Pays closer to market value than traditional home flippers

- No need to make repairs or prep your home for sale

- Choose your closing date and change it if needed

Cons

- Final offers can be significantly lower than the initial estimates

- Stricter purchase criteria than traditional home flippers

- Repair deductions and 5% service fee can eat into profits

- iBuyer providing cash offers on homes in 50+ markets across the U.S.

- Initial offers are made within 48 hours of submitting property information online

- Final offer is provided after a brief inspection, which can be done in-person or by phone/video

- Sellers have the option to accept cash offer or list with an Opendoor partner agent, using the cash offer as a backup

- Cash offer comes with a 5% service fee, plus variable repair costs, on top of traditional closing costs

- You can choose a closing date 14–60 days after receiving your final offer

- Listing option comes with a traditional realtor commission of ~6%

- Backup cash offer is good for 60 days

- Option to rent back your home for a daily fee if extra move out time is needed

Locations: Opendoor is currently available in 50+ major markets in AL, AZ, CA, CO, FL, GA, ID, IN, KS, MA, MI, MN, MO, NV, NJ, NM, NY, NC, OH, OK, OR, SC, TN, TX, UT, VA, WA, and Washington, DC.

Offer criteria: Only single-family homes and townhomes built after 1930, valued between $100,000 and $600,000 (up to $1.4 in some markets), and on a maximum lot of 1–2 acres (depending on market). Must be owner-occupied without any serious issues.

Service Fee

Customer Rating

Time to Close

Our take

Details

Eligibility

Offerpad pays more for homes than traditional house-flippers and also offers great perks, including free local moves and flexible closing windows of 8–90 days. However, customers claim it charges high fees for repairs uncovered during the home inspection. Read our full Offerpad review.

Pros

- You can close in just eight days (15 in FL and GA)

- You can stay in your home for three extra days past your closing date at no charge.

- Sellers get free local moves and a 3-day free extended stay after closing

Cons

- Strict purchase criteria compared to traditional house flippers

- Repair deductions can greatly reduce your final offer

- 1% cancellation fee for backing out after accepting the final offer

- iBuyer making all cash offers on homes in 23 U.S. markets

- Sellers can choose to accept a cash offer or list with an Offerpad agent

- Initial cash offers made within ~24 hours of submitting information online; final offers made after a home inspection

- Flexible closing window of 8–90 days (minimum 15 days in FL and GA)

- Company offers free local moves and 3-day grace period for extra move out time

- Cash offer comes with a 5% service fee and variable repair costs, on top of traditional closing costs

- 1% cancellation fee if seller back out after accepting a final offer

- Listing option comes with standard realtor commission (~6%) and includes free services like deep cleaning, handyman help, and landscape/pool cleanup

- Discounts available for bundled services, such as applying for a loan through Offerpad Mortgage

Locations: Offerpad is available in 24 major markets across AZ, CO, FL, GA, IL, IN, KS, MO, NV, NC, OH, SC, TN, and TX.

Purchase criteria: Offerpad buys single-family homes, condos, townhomes, and homes in gated and age-restricted communities. Must be in good condition, built after 1950, valued at no more than $1 million (depending on market), and on a lot under one acre. Cannot have significant title or structural issues.

If you’re curious what a cash buyer would pay for your house, we recommend starting with a free service like Clever Offers.

With Clever Offers, you can compare up to 10 competitive offers from local, regional, and national cash buyers. Simply tell Clever’s team about your property, and they’ll send you tailored offers from vetted cash buyers in your area.

You can also request a free comparative market analysis from a local agent to compare each offer with your home’s estimated value. With multiple options to choose from, you have more leverage to negotiate — and you’ll be more likely to sell for a price you’re happy with.

Clever Offers is free, and there’s no pressure to move forward with an offer if you don’t like the price. Compare cash offers to find the best deal, and either accept or walk away — no strings attached.

» MORE: The top companies that buy houses for cash

What is RedfinNow?

| Description 2 | Description 2 |

|---|---|

| 🤝 Service fee | 5–13% |

| ⏱️ Time to close | 10–90 days |

| 📍 Locations | 31 cities in AZ, CA, CO, GA, IL, MD, MA, MN, NV, NC, OR, TN, TX, VA, WA |

| 🏡 Eligible homes |

|

RedfinNow is an iBuyer service that buys homes for cash and lets you close in as little as 10 days. It’s worth considering if you need to sell quickly, but the convenience comes at a price.

Like all iBuyers, RedfinNow pays less than what you’ll get on the open market. Its fees are also extraordinarily high — some sellers lose up to 13% of their home price to service fees.

Who is RedfinNow best for?

RedfinNow may be a good option for homeowners who need to sell on an extremely short timeline. But it’s not a great choice if you want to sell your home for what it’s worth.

All iBuyers typically offer less than market value for homes, and RedfinNow’s extremely high fees mean you’ll be left with even less money in your pocket.

Before accepting an offer from an iBuyer, compare it to what other iBuyers are offering and to what a realtor could potentially sell your home for.

The easiest way to compare cash offers from RedfinNow and other companies is through Clever Offers. Clever will walk you through all of your options to sell, whether that’s with an iBuyer, with a cash buyer, or on the open market.

You’ll also get a free home valuation so you’ll know exactly what your house is worth.

How does RedfinNow compare to other iBuyers?

| iBuyer | 💰 Service fees | 🌎 # of cities available in |

|---|---|---|

| RedfinNow | 5-13% | 31 |

| Offerpad | 5% | 25 |

| Opendoor | 5% | 47 |

RedfinNow is one of the three main iBuyers, along with Opendoor and Offerpad. You can expect to pay the same in closing and repair costs with other iBuyers, but the biggest difference between RedfinNow and other major iBuyers is its variable 5–13% service fee — compared with Opendoor’s and Offerpad’s flat service fee of 5%.

On the sale of a $500,000 home, RedfinNow’s charges could mean $40,000 more in fees than other iBuyer companies for basically the same service.

You can request offers from multiple iBuyers to compare them, as long as they are available in your area. RedfinNow, like all iBuyers, tends to only be available in major metropolitan areas.

» MORE: The best iBuyer companies of 2023

RedfinNow vs. Offerpad

Offerpad is the second-largest iBuyer in the United States. Overall, we think Offerpad offers better value — especially in terms of speed and lower fees — than RedfinNow does.

That said, RedfinNow does have some advantages over Offerpad. It is available in more markets — 31 vs. Offerpad’s 25 markets — and generally has less stringent criteria for which homes qualify. While every iBuyer has strict criteria for purchases, homes that are older or require repairs are somewhat more likely to qualify for RedfinNow than Offerpad.

But Offerpad wins in terms of fees and time to closing. It generally has lower fees than RedfinNow, with Offerpad charging a service fee of 5% compared to RedfinNow’s 5–13%.

Also, Offerpad offers faster closings than RedfinNow. The closing date with Offerpad can be in as little as eight days (depending on market), compared to RedfinNow’s 10–90 days.

If you’re looking to sell fast, but without having too much of your final sale price eaten up by fees, Offerpad is your best bet. Just keep in mind that your home will need to qualify and you’ll have to live in a market where Offerpad operates.

RedfinNow vs. Opendoor

Opendoor is the largest iBuyer in the United States and operates in more markets — 47 — than RedinNow does (at 31). If you’re looking to sell to an iBuyer, you have a much greater chance of Opendoor being available to you than RedfinNow.

As with Offerpad, Opendoor’s fees of about 5% are also much better than RedfinNow’s 5–13%.

But Opendoor is also far more restrictive about which properties it will buy. Older homes and homes that are in need of repairs have a much harder time qualifying for Opendoor than for RedfinNow.

RedfinNow’s closing window of 10–90 days is also more flexible than Opendoor’s 14–60 day window. If you have a specific timeline for when you want to sell, that flexibility makes RedfinNow a better option.

RedfinNow reviews summary

RedfinNow has a number of negative reviews from customers who were offered significantly lower prices due to errors in the company’s initial valuation. Redfin is not accredited by the Better Business Bureau and has a C– rating overall.

Where does RedfinNow buy homes?

RedfinNow used to operate in 47 metro regions nationwide, including:

- Atlanta

- Boston

- Chicago

- Nashville, TN

- Phoenix

- Washington, D.C.

However, in a company memo dated November 9, 2022, Redfin announced the closing of its RedfinNow subsidiary.

If you’re looking for companies similar to RedfinNow, we’ve ranked the six best companies that buy houses for cash.

How does RedfinNow work?

RedfinNow makes it easy to sell your home in six steps:

| Description |

|---|

| 1. Request an initial cash offer. Enter your home address on the RedfinNow website and click “Get My Offer.” |

| 2. Receive your initial offer, which is also usually the final cash offer. Get your cash offer a few days after submitting the request. Redfin uses its valuation model to determine what your home is worth. |

| 3. Accept the cash offer. If you like the initial offer, sign the form Redfin sends over and choose a closing date within 10 to 90 days later. |

| 4. Schedule an inspection. Redfin sets up inspections to determine if your home is structurally sound. These could include a general home inspection as well as specialized ones, as needed. |

| 5. Receive the inspection report. The report will detail any problems with the home as well as the estimated cost of repairs. RedfinNow deducts repair expenses from the final cash offer — but you have the option to cancel the sale if you disagree with the estimates. |

| 6. Close the deal. In most states, you can close in as few as 10 days, following a title search and final walk-through. On the actual day of closing, you’ll sign the sale documents at the office of an attorney or title company to formally transfer the title and complete the sale. |

What homes does RedfinNow buy?

RedfinNow has strict criteria for purchases. Generally, RedfinNow makes offers on single-family homes, condos, and townhomes that were built after 1930.

RedfinNow purchase criteria

| Description |

|---|

| 💰 Valued between $150,000 and $1.5 million* |

| 🌳 Lot size under .5 acres |

| 📁 Clear title |

| ✅ Good physical condition |

| 🔑 Owner-occupied or vacant |

RedfinNow fees

RedfinNow charges a variable fee of 5–13% of the final sale price — on top of closing costs and repair costs.

RedfinNow fee breakdown

| Description | Fees |

|---|---|

| 💰Service fee | 5–13% |

| ⏱Closing costs | 1–3% |

| 🛠Repair credits | 1–2% |

| Total | 7–18% |

RedfinNow’s variable service fee can be as much as 13% of the purchase price of the home. That’s a LOT to pay for the convenience of a quick sale — on a $500,000 home, as much as $65,000 could be earmarked for RedfinNow!

The costs of using RedfinNow go beyond the service fee. You will also have to pay for any necessary repairs and routine closing costs out of pocket.

How does RedfinNow calculate its service fee?

Unfortunately, RedfinNow does not disclose the service fee by market, so it can be difficult to know whether you’ll pay at the higher or lower end of the range. However, the company considers factors such as risks associated with reselling your home and expenses incurred until the home is resold in setting your rate.

Redfin wants to make sure it can resell the home quickly, so it considers comparable sales and home-buying trends. If you’re in a hot market where properties tend to sell quickly, the service fees should be lower.

The costs associated with owning your home until Redfin finds a new buyer will also influence whether you pay at the high or low end of the 5–13% fee. Some of the expenses Redfin assesses when calculating your fee will include:

- Homeowner’s association dues

- Property taxes

- Potential maintenance

- Home insurance

- Utilities

Should I sell my house to RedfinNow?

Unless you absolutely have to sell immediately, you’ll likely walk away with a lot more profit if you sell on the open market — especially if you list with a low-commission realtor that offers discounted rates.

Our friends at Clever can connect you with a top local agent and pre-negotiate a 1.5% listing fee for you. Clever’s partner agents come from brokerages like Berkshire Hathaway and RE/MAX, and they guarantee full service.

Selling with RedfinNow: Pros, cons, and reviews

✍️ Editor’s note:

In June 2022, Redfin announced that it plans to lay off 10% of its staff as a result of lower demand. While it’s too early to say definitively what this means for you, depending on where those cuts are made, they could impact the quality of your experience with RedfinNow.

Because RedfinNow purchases fewer houses than other iBuyers, it’s difficult to find verified reviews. However, across the few RedfinNow reviews that we were able to find, we noticed a few common advantages and disadvantages:

| Pros | Cons |

|---|---|

| ✅ Speed | ❌ High fees |

| ✅ Convenience | ❌ Lower-than-market-value offers |

| ✅ Certainty | ❌ No negotiation |

| ✅ Flexibility | ❌ Limited availability |

Pros of selling with RedfinNow

Here are the biggest benefits of selling to RedfinNow:

- Speed. In October 2020, homes were on the market for a median of 53 days, according to Realtor.com. With RedfinNow, you can get a cash offer within a few days of making a request and can then close within 90 days. Being able to sell your property more quickly could be a major advantage.

- Convenience. Preparing your home for sale can involve cleaning and making cosmetic repairs, staging the property for open houses, and having dozens of potential buyers visit your home. You can skip all that with RedfinNow and get a cash offer sight unseen.

- Certainty. You’ll know within days if you’re eligible for a RedfinNow offer and what amount the iBuyer is willing to pay. You won’t need to hope and wait around for a buyer — or worry about their financing falling through.

- Flexibility. When you sell to a traditional buyer, you have to agree on a closing schedule that works for both of you. With RedfinNow, you choose the closing date so you can work on your own schedule. And if your sale closes before you’re ready to move out, you can rent the home back from RedfinNow for $100 per day for 29–60 days after the closing date.

Cons of selling with RedfinNow

Here are some of the biggest disadvantages:

- High fees. You’ll have to pay the RedfinNow service fee, which is generally going to be more expensive than traditional real estate commission — up to 13% of the home’s sale price. You will also have to pay for closing costs, typically an additional 1–3%.

- Offers are below market value. Redfin couldn’t profit by paying exactly what your home is worth, so expect an offer to be approximately 5–15% below market value.

- No option to negotiate. With traditional buyers, issues such as the purchase price, repairs you’ll pay for, and even who pays closing fees are all up for negotiation. With RedfinNow, the offer is take it or leave it.

- Limited availability. Unless you live in one of the few areas where RedfinNow operates, you won’t be able to sell your home to this iBuyer.

- Poor reviews. RedfinNow has been the subject of customer complaints, including some home sellers indicating they experienced substantial drops in their offer price due to errors in the initial valuation. The operating company Redfin also receives a C– rating from the Better Business Bureau, though many BBB complaints focus on its broader business services rather than its iBuyer program.

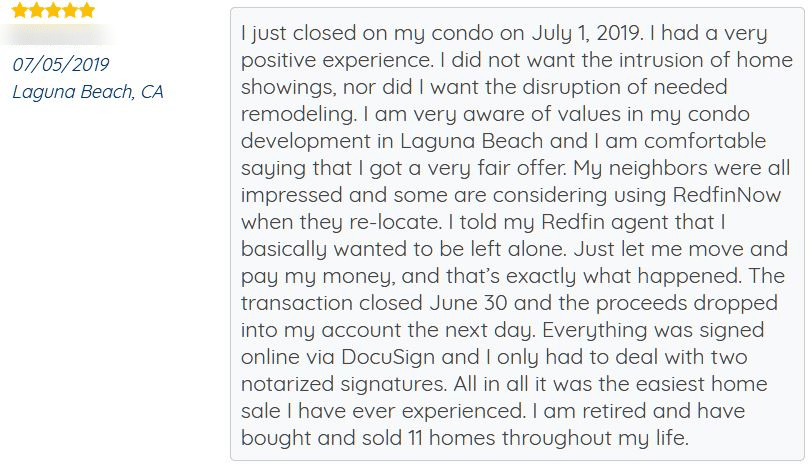

Positive RedfinNow reviews

This seller indicated that the process was convenient and they received the money in their account quickly.

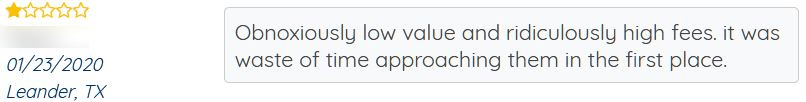

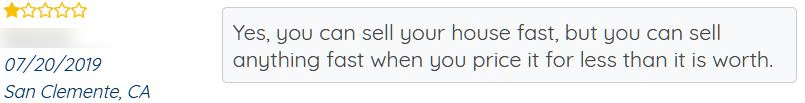

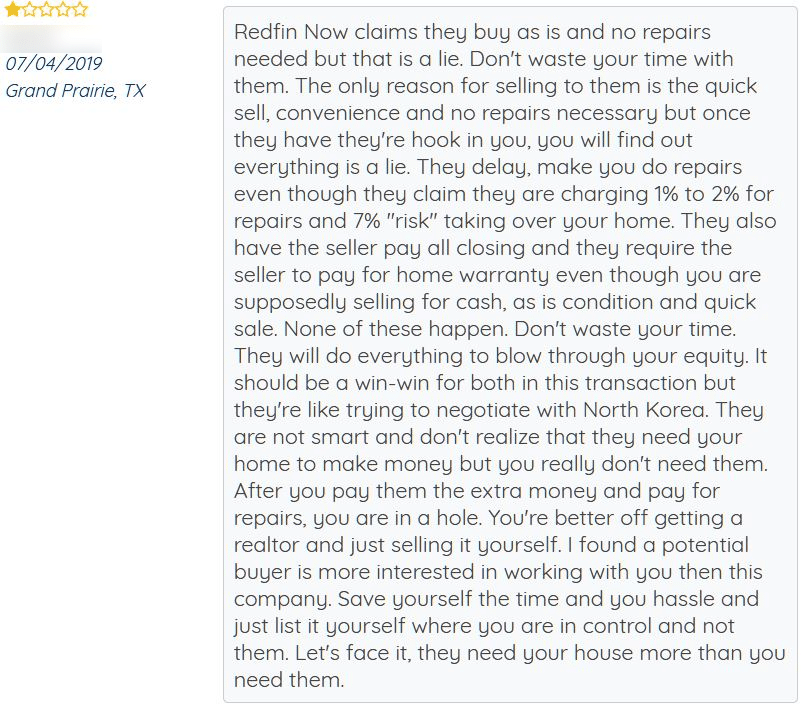

RedfinNow complaints

While some home sellers have had a positive experience, others definitely haven’t. These two sellers both complained about the high fees and the low offers they received for their property.

And this seller had a problem with the iBuyer’s repair requests.

When you work with RedfinNow, you give up your bargaining chips and pass up the chance to get top-dollar for your property — in exchange for being able to sell your property quickly for cash.

In a traditional real estate transaction, you can negotiate with would-be home buyers about repairs, or can choose to sell your property “as is” (and not make any repairs or offer any discounts if problems turn up during an inspection). But when you sell to RedfinNow, you’ll have no leverage — you’ll either have to follow their repair requirements or walk away from the deal.

If you don’t want to make this trade-off, contact Clever today to get matched with a full-service agent who will charge an affordable fee to help you get the best price possible for your home.

FAQ about RedfinNow

Does RedfinNow charge fees?

Yes, RedfinNow charges service fees — and they're VERY high compared with its competitors. RedfinNow fees typically run 5–13%, which is more than twice what Opendoor charges and several times as expensive as selling with a low commission real estate agent.

How does RedfinNow work?

RedfinNow makes instant cash offers on homes in select markets. It makes money by purchasing homes for less than their full market value and then reselling them at higher prices. It also charges sellers expensive fees that could cost up to twice as much as ordinary real estate commission. Learn more about how iBuyers like RedfinNow work.

Is RedfinNow a good deal?

It depends on your priorities. If a quick sale is what matters most, selling to an iBuyer like RedfinNow is generally a better deal than selling to a We Buy Houses for Cash company. However, RedfinNow is looking to resell your home at a profit, so it's not going to pay as much as an ordinary home buyer. Find the best ways to save money when you sell a house.

Should I sell my house to RedfinNow?

RedfinNow may be worth considering if your top priority is selling quickly. But if you want to walk away with as much money as possible, you may have better options. For example, selling with a low-fee brokerage could put thousands of dollars back in your pocket.

Which is the best iBuyer?

Our team of iBuyer experts rank Offerpad as the best iBuyer company in 2023. It’s fast — with closings in as little as eight days — and has great customer service. However, like all iBuyers, it comes with high fees and you may get less for your home than you would on the open market. If you’re looking to save money and sell fast, we recommend checking out our list of the best iBuyer companies.

Can you negotiate with RedfinNow?

No, usually you can’t negotiate with RedfinNow. Its first offer is typically its final offer. However, if you think RedfinNow missed something important — such as a recent renovation — you can request a correction, which may affect the offer. You can also request an offer from one of RedfinNow’s competitors.

How does the RedfinNow home inspection work?

Your RedfinNow home inspection will usually take place within 10 days of accepting RedfinNow’s offer. The home inspection is free, but if the inspection turns up any problems, then RedfinNow may deduct repair costs from your initial offer price. You can either accept the reduced offer or cancel the sale without penalties if you disagree with the estimated extra charges. Learn more about how RedfinNow works.

Related links

Best Companies That Buy Houses for Cash: Cash buyers can help you in a pinch, especially when you need to sell your home fast or as-is. We cover seven cash buyers so you can decide which, if any, is right for you.

We Buy Ugly Houses Review: We Buy Ugly Houses is an iBuyer that provides an all-cash offer for your property, particularly those that are in distress or, as the name suggests, “ugly.” Learn everything you need to know about how We Buy Ugly Houses works, the pros and cons of selling your house to them, and how users have fared when dealing with the company.

Redfin Reviews and Competitors: Redfin allows you to sell your home for a reduced commission or to get a portion of your buyer’s commission back when you purchase a home through one of its agents. You can also search for properties on Redfin or use its iBuyer service. Find out the pros and cons of working with Redfin and learn about the experiences of buyers and sellers who’ve used the popular listing platform.

What Companies Offer the Lowest Real Estate Commission Fees? The days of the 6% real estate commissions are over. A number of companies now connect you with real estate agents who will sell your home for far less. Find and compare 10 services that help you sell your home for less than the standard commission so you can keep more money in your pocket.

Leave a Reply