Published

Selling your house can be a stressful, complicated process. It takes time and careful planning to avoid common first-time seller mistakes, and to achieve your desired goals.

We’re here to help. Our guide breaks down how to sell your house in 12 steps, to educate you on the process and prepare you for your big sale.

While our guide walks you through every step in the home sale process, it’s not intended to be a substitute for local advice from a licensed real estate professional.

For more specific advice on how to sell a house in your local market, we recommend consulting a real estate agent. We can match you with top local agents who charge a 1.5% listing fee. Sellers save $7,000 in commission fees, on average.

How to sell your house in 12 steps

We spoke to several real estate agents and experts on the steps required to sell a home. Here’s our advice.

- Decide how you plan to sell

- Decide when to sell

- Determine an asking price

- Calculate your expected earnings

- Prepare your home for sale

- List your home

- Review offers and negotiate

- Sign an offer

- Get ready for inspections

- Close on your home sale

- Calculate capital gains tax

- Review your agent

1. Decide how you plan to sell

It’s one of the biggest financial decisions of your life: Should you hire a real estate agent, try to sell your home for sale by owner (FSBO), or sell fast to a cash buyer?

Here’s a breakdown of your options, and tips on how to decide.

Option 1. Sell with a real estate agent

If your goal is to make the most amount of money, hire an experienced listing agent with a proven track record.

Agent-listed homes sold for a median price of $318,000 in 2020, while FSBO listings sold for $260,000, according to the National Association of Realtors.

One reason why: Experienced listing agents often have multiple active listings, and get tons of phone calls from interested buyers.

“We talk to 100 buyers a week or more,” says Nathan Clark, a real estate broker with Your Home Sold Guaranteed Realty, based in Smithfield, RI.

“99% of the time a buyer calls in on a house listing, they don’t buy it – but they do end up buying another house,” he says.

How to sell your house with a realtor: Next steps

Free agent matching services, like ours, match you with full-service realtors from top brokerages in your area, so you can contact and interview real estate agents ASAP.

Some companies also provide built-in commission savings. You can get matched to a quality listing agent at a 1.5% commission rate (vs. the typical 3% rate).

Option 2. Sell your house without a real estate agent

Selling for sale by owner (FSBO) means you won’t have to pay listing agent commission, saving you thousands.

However, you’ll need to handle all of the tasks that an agent normally does, including:

- Advertising your home online.

- Negotiating with buyers.

- Filling out paperwork and legal disclosures.

While you avoid paying a listing agent commission, statistics show that you’ll likely sell for less than if you just hired an agent.

🛑 FSBO warning: It comes with legal risks!

You must understand your legal responsibilities as a seller, from filling out disclosure forms to handling earnest money deposits and transferring title at closing.

Failure to fill out a property disclosure form is a big legal risk facing FSBO sellers, says Kristyn Grewell, a realtor based in Oklahoma City, OK.

“Some FSBO sellers aren’t even aware of their disclosure requirements, and failure to disclose could lead to a lawsuit,” Grewell says.

A good real estate agent is well-versed in disclosure requirements and will provide you with all of the required disclosure forms.

How to sell your house FSBO: Next steps

Read our guide on how to sell FSBO, and how to list your home for sale with a flat-fee MLS service.

We also highly recommend speaking with an experienced agent or attorney for more guidance.

Option 3. Sell to a cash buyer

Selling to a cash buyer (real estate investors or iBuyer companies) is the fastest way to sell your house. You can get an offer within days, and close within 1-3 weeks.

But that speed and convenience will cost you: cash buyers typically pay between 50% to 75% of a home’s fair market value, so a $500,000 home may only fetch up to $375,000 in a sale.

Consider a cash buyer only if speed and convenience are more important to you than max profit. In a strong seller’s market, you can probably get a better deal elsewhere.

How to sell your house to a cash buyer: Next steps

Here are more resources to help you sell your home to a cash buyer ASAP.

- Learn how to sell your home fast.

- Research the top iBuyer companies to find the best option for you.

- Check out reviews of Offerpad and Opendoor, two of the most well-known and highly regarded iBuyers.

- Learn how to find a realtor in your market. Speak with a licensed real estate agent or broker for free advice (even if you don’t plan on using them).

2. Decide the best time to sell

Ultimately, you need to sell when it makes the most sense for you.

But if you have the luxury of choosing a time to sell, agents say that Spring and Summer will get you the best results. A few likely reasons why:

- Buyers tend to shop for homes when it’s getting warmer outside. It’s no fun to take home tours or attend open houses in the freezing cold!

- Kids finish the school year between May and June, making it an easier time for families to make a big move.

- The Spring and Summer seasons have the most amount of daylight, making late-evening home tours an option.

- Buyers usually don’t go house shopping during the winter holidays.

However, some agents, including Grewell, prefer to list homes in the winter when there are fewer active listings.

“Inventory is the lowest, and less competition benefits the seller,” says Grewell.

Ask your agent or a local real estate professional for more specific advice on when to sell your house.

» MORE: When is the best time to sell a house?

What’s the best day of the week to list your house?

Homes listed on a Thursday go under contract faster than homes listed on any other day of the week, according to Zillow analysis.

Clark’s team in Rhode Island says the numbers show that they get the most phone calls from buyers when listing homes on a Thursday.

“I think people go to work Monday, work hard on Tuesday and Wednesday, and then start thinking about what houses to look at on Thursday,” he explains.

Sunday and Monday are the worst days of the week to list your home, taking seven days longer to sell compared to homes listed on a Thursday, according to RealTrends data.

How long does it take to sell a home?

From listing your home to closing, it typically takes between 45 to 80 days or longer to sell a home (not including the time it may take to prepare your home for sale).

Here’s how that timeline breaks down:

- It takes sellers a median of 18 days to receive and accept an offer nationwide, according to Redfin data.

- The average closing-period timeframe ranges from 30 to 60 days, depending on the market.

However, the actual timing depends on your home’s list price, your local real estate market, the type of financing used by the buyer, and what’s typical for your area.

3. Set an asking price

Pricing your home is one of the most important steps in the home sale process.

Experts agree that overpricing a home is a huge risk. It can drive away serious buyers, and cause your listing to sit on the market and go stale, says Clark, the real estate broker from RI.

Overpricing a home may also lead to a low appraisal, so you may have to lower the price anyway, re-negotiate contract terms, or put your house back on the market.

Your best bet is to set a fair, competitive listing price, ideally with the help of a real estate professional.

Clark says that pricing slightly below fair market value is your best chance for a quick sale at favorable terms.

For example, consider listing a $500,000 home between $480,000 to $490,000. “My phone would melt, and you would get a bidding war at that price,” he says.

Pricing your home with an agent

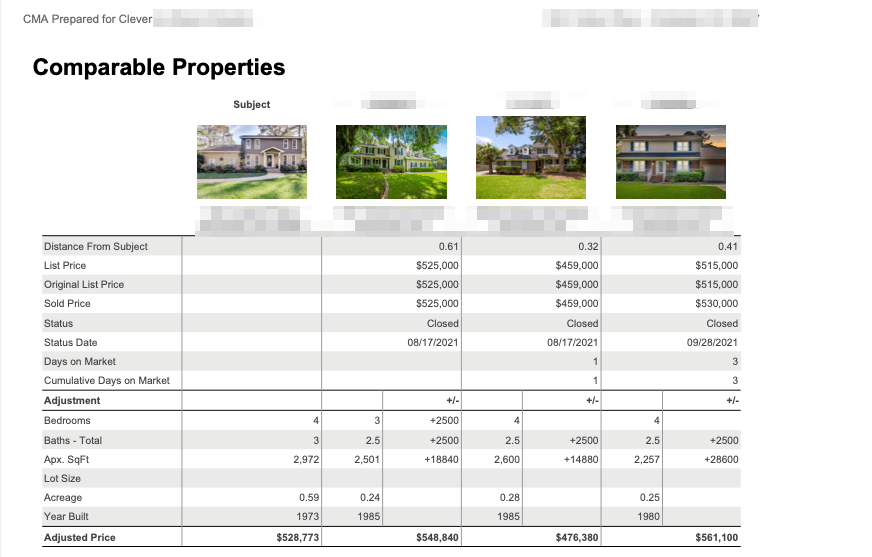

Realtors provide you with a free comparative market analysis (CMA) report to help you set a list price.

A CMA provides an estimate of your home’s fair market value, based mainly on the recent sale prices of similar or “comparable” homes in your area.

Agents usually choose three or more comparable sales and then adjust the sale prices of the homes to account for differences in square footage, rooms, condition, and upgrades.

» MORE: Connect with top local agents for a CMA report

Pricing your home without an agent

Selling on your own? Your options are to rely on automated home value estimators or consider paying for a broker’s price opinion (BPO).

A BPO is very similar to a CMA. It’s a home valuation report based on comparable home sales, and it’s provided by a licensed real estate agent or broker.

The big difference: BPOs will cost you ($150–$250), while CMAs are typically provided by a realtor for free, as part of the listing process. But it’s likely worth the cost for FSBO sellers.

What about an appraisal?

Another option is to get a pre-listing appraisal from a professional appraiser, who can provide an unbiased, third-party home valuation.

Pre-listing appraisals make the most sense on unique properties, or homes with few comparable home sales, according to Clark.

However, appraisals are expensive ($300–$500) and often take 1-2 weeks to complete, so keep this in mind if you’re selling on a tight budget or deadline.

4. Calculate your potential net proceeds and sale costs

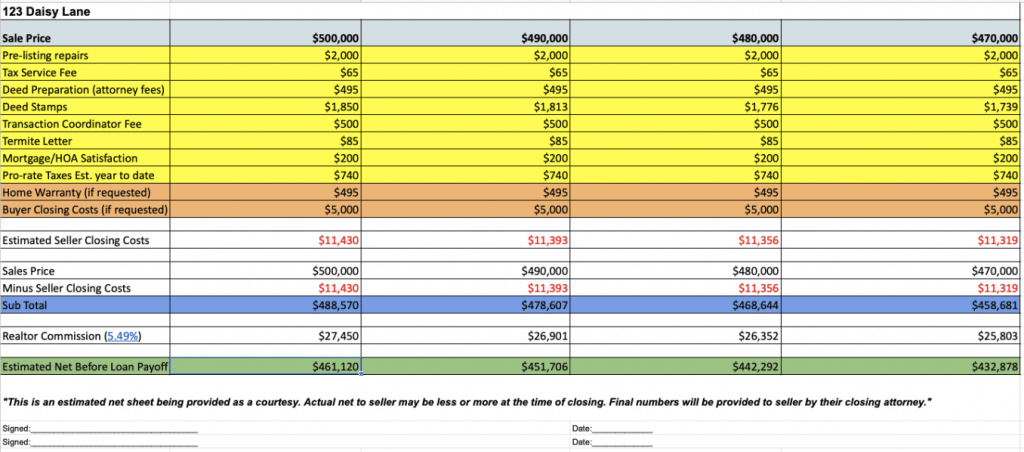

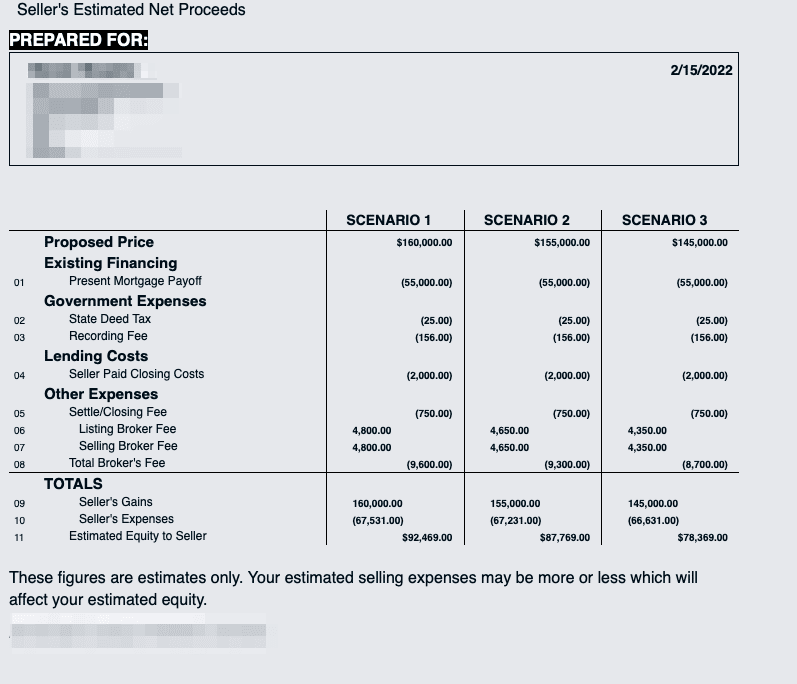

Wondering how much money you might make in your home sale? Request a free seller’s net sheet from your agent.

A net sheet calculates your estimated net proceeds by deducting realtor commission and your estimated closing costs from your targeted sale price.

Here’s an example of what a seller’s net sheet looks like in South Carolina:

Here’s an example from a real net sheet in North Carolina:

A seller’s net sheet usually includes:

- A range of potential sale prices (high to low), based on the results of an agent’s CMA report, BPO, or appraisal.

- Optional pre-sale expenses, like a home inspection, staging, and repairs.

- Common seller closing costs, such as title insurance and deed stamps.

- Potential buyer-requested expenses, like buyer closing costs or a home warranty.

- Realtor commissions (5% to 6% or more of the home’s sale price).

- Your estimated net proceeds before paying off any outstanding mortgages and liens.

A net sheet usually does not include capital gains tax or moving expenses.

What seller closing costs will I owe?

Seller closing costs can range from 1% to 3% of the sale price (not including realtor commission). Actual figures depend on your market and negotiated sales contract.

When combined with realtor commissions (5%-6%), total home sale expenses typically range from between 6% to 9% or more of its sale price.

Seller closing costs vary widely depending on your market. For example, costs average approximately .80% in California and 1.70% in Florida.

What are common seller closing costs?

Here are a few potential costs you might encounter.

- Title fees. The cost to hire a title company or attorneys to transfer home ownership to the buyer and to handle your closing.

- Deed stamps. The cost your local government charges to record your deed and transfer of title.

- Prorated property taxes. Your share of the annual property taxes (you owe for the days you’ve owned the property, split with the buyer).

- Transfer tax and recording fees. Paid to local governments, to transfer the property’s legal ownership.

- Buyer closing costs. Home buyers may ask you to pay part or all of their closing costs if it’s negotiated in the contract.

- Homeowner’s association (HOA) fees. The cost to transfer HOA membership to the buyer (if your home is located in an HOA neighborhood).

Contact a real estate agent for more help calculating your potential closing costs and net proceeds.

5. Prepare your home for sale

Gather relevant documents

It’s a good time to gather any documents that may be requested by a home buyer, including:

- Utility bills.

- Home warranties.

- Repair receipts.

- Flood insurance records.

- Homeowners association documents and contact information.

- Appliance manuals.

It’s best to have these documents on hand now, so you don’t have to go scrambling for them later on when you’re under contract (and on a tight deadline!)

Get your home inspected

Do you think your home may have a serious issue that could keep it from selling or blowing up a deal? Consider getting a pre-listing or pre-sale home inspection to find out for sure.

Ask your agent for inspector recommendations, or find a good inspector on HomeAdvisor. Pre-sale inspections typically cost a few hundred dollars ($300–$400).

Make home repairs

If the inspector does find a serious issue, you can hire a contractor to take care of it before a buyer discovers it during a showing, or on their home inspection report.

Or maybe part of your home just needs a fresh coat of paint, or some landscaping to improve its curb appeal (get this work done before photos are taken).

Get a deep cleaning

Deep cleaning is more thorough than regular cleaning. It gets rid of all of the dirt, dust, and grime in your home, making it really shine for photos and showings.

Pro deep cleaning services cost between $200 to $400, according to Fixr. Actual costs vary based on factors like your market and the size and condition of your home.

Pay extra attention to your bathrooms and kitchen – the most important rooms for most buyers.

Determine if home staging is right for you

Home staging involves redecorating or rearranging furniture to “set the stage” for buyers. It can help buyers visualize themselves living in your home, and make it easier to sell.

Staged homes tend to sell faster than non-staged homes and can increase your sale price by up to 20%, according to NAR.

However, professional staging is expensive ($1,608 nationwide, according to HomeAdvisor), and it may not be necessary for your home.

Hire a professional photographer

High-quality, professional photos, with natural light and wide-angle views, help your online listing stand out vs. its competitors.

In fact, 89% feel photos are the most important features of a property listing, according to NAR.

Meanwhile, homes with professional photos sell for 47% more than other listings, according to Redfin.

Find out if photos are included in your agent’s commission rate if they cost extra, and if they’re using a professional (or taking the photos themselves).

Add videos for more engagement

Videos on real estate listings grew in popularity during the pandemic, as buyers felt less safe touring homes in person, says Grewell.

Expect a better listing performance with videos, as they get 5X the inquiries than those without one, according to NAR’s Real Estate Video Marketing guide.

The video can be as simple as giving buyers an inside look at your property or highlighting one or more of its main selling features.

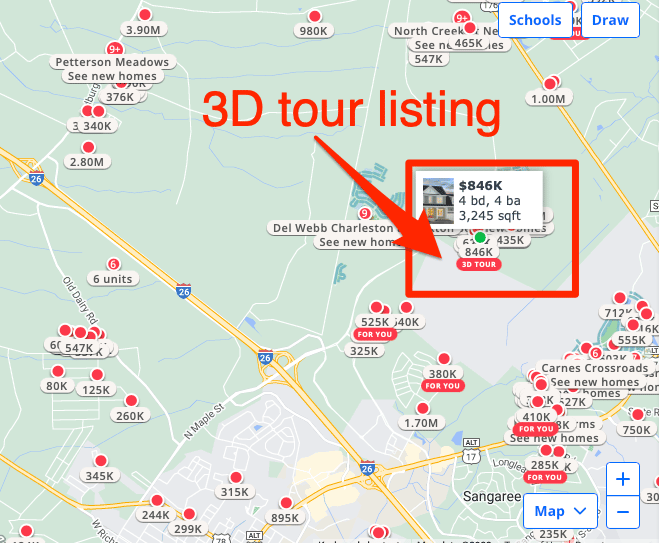

Consider 3D virtual tours

Zillow says its listings with a 3D tour or walkthrough get 43% more page views and 55% more saves.

Some pro photographers offer videos and a 3D tour as an add-on service. If they don’t, one option is to hire a freelance videographer on a site like Upwork or Fiverr.

For tech-savvy, DIY home sellers, consider buying a virtual tour real estate kit to turn your smartphone into a 360-degree camera.

6. List your home, and host potential buyers

Your real estate agent puts a “for sale” sign on your front lawn or sidewalk right before going live, and sets up a lockbox (with a spare key inside), to provide showing access.

Here’s what happens next.

Post your listing on the MLS

Your agent posts your home’s listing on the multiple listing service (MLS): a database most realtors use to market and sell properties.

Only 18% of FSBO sellers were listed on the MLS in 2020, according to NAR.

That’s a huge mistake: the MLS is the main tool realtors use to find homes for sale. Experts agree that posting it there should help you sell your home faster, and at a higher price.

Most MLS services also automatically post listing data to hundreds of other real estate websites, including top sites like Zillow, says Grewell.

If you’re selling FSBO, consider hiring a flat-fee MLS company to get your home listed on the MLS to reach more buyers.

Check out your home’s photos

First impressions are everything. Your home’s listing photos may either attract or turn off potential buyers.

Consider these statistics:

- 87% of home buyers rely on photos to make a purchase decision, according to NAR.

- 84% of buyers won’t even consider a home that doesn’t have listing photos, according to Trulia.

Make sure you like all of the photos used by your agent and let them know if you don’t! Photos can usually be re-taken, edited, or changed out easily.

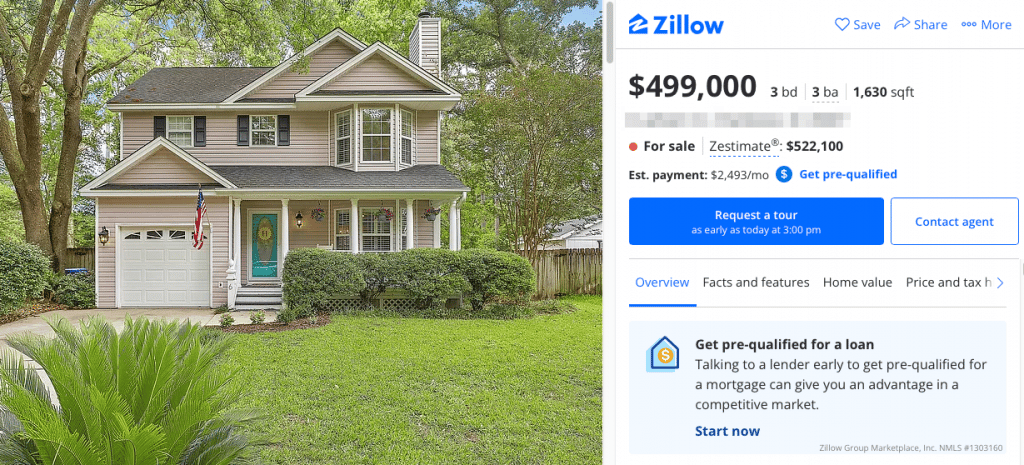

Here’s an example of what a good listing photo looks like. It was clearly shot on a sunny day, and you can see the entire curb view of the house:

Now here’s a photo taken from an FSBO listing on Zillow. It’s blurry, and looks like it was taken from an iPhone:

Which home would interest you more as a buyer? Probably the first one.

Read your agent’s listing description

Your home’s listing description describes all of your home’s best selling points. It should paint a vivid, captivating picture of what it feels like to live in your home.

Some expert tips:

- Highlight your home’s key features. Mention any special or unique features that make your home stand out from its competitors, like a renovated kitchen, brick fireplace, inground swimming pool, etc.

- Avoid negative terms. Red flag phrases include “needs TLC,” “fixer-upper,” or “motivated seller.” They give home buyers the impression that you’re willing to accept a lowball offer.

- Include a call to action. Tell the reader what they should do next if they like your home. For example, “book your showing today, because this home won’t last long!”

Get ready for showings

Buyer’s agents and their qualified buyers will be taking tours of your home soon!

Decide what to do with your pets during showings. Most sellers either put pets in the garage or backyard or take them out of the house – it’s entirely your call.

Are you listing your home on a Thursday or Friday? If so, it’s a good time to plan a trip out of town.

Here’s why: Getting out of your house for the weekend means your agent can book the maximum amount of buyer showings, and host multiple open houses, uninterrupted.

7. Review and negotiate offers

How long will it take to sell my house?

Sale timing depends mainly on the strength of your local housing market, your marketing strategy, and your home’s list price.

It took sellers 17 days to receive and accept an offer nationwide in April 2022, according to NAR’s existing home sales data.

That 17-day timeframe doesn’t include the closing process, which can add another 30 to 45 days or more to your home sale.

How will I receive offers, and what does it include?

Most buyers submit an offer through their real estate agent.

The buyer’s agent then emails the signed offer to your realtor, who looks it over and then forwards it to you with their feedback or comments.

Besides an offer price, the buyer’s signed offer should include:

- Closing costs. In some markets, it’s common for sellers to pay part or all of a buyer’s closing costs.

- Estimated closing date. How soon the buyer can close on the home sale (usually 30-45 days out)? Timing may depend on the buyer’s financing, like if their lender needs more time to underwrite the loan.

- Items that convey with the property: The buyer may ask for some personal property to stay with the house, such as appliances, blinds, and light fixtures.

- Pre-approval letter. The buyer’s agent should email a copy of their pre-approval. It shows the buyer is likely to secure the financing needed to purchase your home.

- Proof of funds. If the buyer is paying all cash, they should provide a proof of funds letter, such as a copy of a bank account.

I received an offer. What are my options?

First, check with your agent to see when the offer expires (it should be clearly stated in the offer). You don’t have to decide until the expiry date.

After talking it over with your family and realtor, here are your options.

1. Accept the offer. If the offer meets all of your criteria (the price and terms all look great), then you can accept it without making a counteroffer. This may be a good choice if no other offers are on the table, and if you’re unlikely to get one soon.

2. Counter the offer. Most items on the offer are negotiable – not just the buyer’s offer price. Consider countering an offer if it doesn’t meet all of your criteria, if you have backup offers, or if you’re confident you’ll get another good offer if the buyer declines it.

3. Reject the offer. You can respectfully decline the offer if it’s too low, or doesn’t meet your criteria. Your agent should send over a notice of rejection form to the buyer’s agent, notifying them of your decision. The buyer can always submit another offer.

How does a realtor help me at this stage?

The offer and negotiation stage is where an experienced realtor can add serious value. Pro agents know how to negotiate to get you the best price and terms possible.

Your agent will also walk you through each offer, carefully explaining each offer’s terms and contingencies, so you know what needs to get done to close on the sale.

Finally, your realtor can help you decide on which offer is the best one to go with and make sure you don’t miss any important information.

8. Sign an offer

Your agent usually sends the offer digitally to your email, through software like DigiSign or DocuSign.

Look out for an email that says “Please DocuSign: Offer to Purchase.” Your agent might also leave you a note with instructions on how to read and sign the documents.

It’s easy to skim through an offer and sign it fast – especially when you’re on a tight deadline, and signing docs digitally.

Take your time, reading each page as if it was a physical document. It’s best not to miss any important details, or sign a page without fully understanding all of the terms and conditions.

Breaking down buyer contingencies

Your home sale might be contingent on the fulfillment of certain conditions, which often include:

Financing

The buyer may need to secure a loan by a certain deadline.

If the buyer doesn’t get approved by the deadline, they can usually back out of the deal without forfeiting earnest money or facing a penalty. Buyer financing is the biggest obstacle in most real estate transactions.

“Call the buyer’s lender to see how in-depth they’ve verified their information – such as their credit score and debt-to-income ratio,” Clark says.

Home appraisal

If the buyer is getting a mortgage, the sales contract is usually contingent upon your home being valued by a professional appraiser.

If the appraisal comes in lower than the sale price, you may need to reduce its price to its appraised value or re-negotiate terms with the buyer.

Home inspection

87% of all real estate contracts come with a home inspection contingency, according to NAR.

Also called a due diligence period in some states, it gives buyers the right to inspect your home within a certain time period (7-14 days).

Buyers can usually cancel the contract or negotiate repairs based on the results of a home inspection, and what’s stated in the contract.

Repair requests are typically centered around issues that impact the home’s safety or livability, such as mold, roof and plumbing leaks, or electrical issues – not cosmetic items.

Buyer’s home sale

The buyer might need to sell their current home in order to purchase yours. If that’s the case, they’ll probably include a home sale contingency.

If they can’t find a buyer for their home within a specific timeframe, they might be able to get out of your contract without penalty (such as forfeiture of earnest money).

Earnest money

The buyer may need to submit earnest money (1% to 3% of the home’s purchase price) based on the terms of the contract.

Earnest money protects you in case the buyer backs out of the deal (for reasons not covered in the contract).

The deposit is often submitted within 1-3 days of offer acceptance. It’s held in an escrow account by a title company or attorney until closing, at which time it’s applied to the purchase.

What does “under contract” mean?

Once you and the buyer have read and signed all pages, you’re officially “under contract.”

Your home sale status changes from “active” to “pending” or “active-contingent” on the MLS and real estate websites.

Active-contingent means the home sale will close if certain conditions are met – like the buyer obtaining financing, or completing their due diligence period.

9. Get ready for buyer inspections, appraisal, and walk-through

What to know about the home inspection

The buyer’s home inspection is usually completed a week or so after offer acceptance. Their agent should contact you or your agent to set up a good time and date for the inspection.

The buyer might ask you to fix a serious issue discovered in the report. If that happens, make sure your agent requests a copy of the report to see what the issue is.

Check with your realtor to learn more about your obligations, including which items you may be required to fix under the sales contract.

Termite inspection

Termites and other wood-destroying insects are common in the South, Southeast, West, and Southwest parts of the country.

Depending on your contract, you may or may not be responsible for a termite inspection or CL100 report, which typically costs between $75 – $150.

The inspector visits your home to check for any signs of termites in and around your home, while also measuring moisture levels in your basement or crawl space.

You may be responsible for treating active termites or repairing termite damage, depending on the contract.

What about the buyer’s home appraisal?

Lenders often require buyers to get an appraisal to determine the home’s fair market value and to be certain that the home is worth its purchase price.

Appraisers usually visit your home to take interior and exterior photos, noting any value-adding features or upgrades you’ve made.

Final walk-through

The final walk-through usually happens a day or two before closing.

Buyers and their agents will spend 20-30 minutes walking through each room in the house. Here’s what they’re checking for:

- If all of your belongings have been cleared out.

- Confirmation that you made their requested repairs.

- Appliances and lights are all in working order.

- Signs of any potential leaks, mold issues, or electrical problems.

Why do pending or contingent sales fall through?

About 7% of all contracts in April 2022 were terminated before closing, according to the National Association of Realtors®’ Realtors Confidence Index.

Here are the most common reasons a real estate contract was terminated in April 2022.

| Reason | Percent of contracts |

|---|---|

| Home inspection issue | 26% |

| Other | 24% |

| Issues obtaining financing | 18% |

| Appraisal issue | 12% |

“The No. 1 issue we see right now is financing,” Clark says. “Maybe the buyer is pre-qualified, but the lender missed something – or a negative mark comes up on their credit report. It happens.”

10. Close on your home sale

You’ve almost made it to the finish line! Here’s what typically happens in the days or weeks leading up to your closing date.

Review and sign a closing disclosure (CD)

Your agent should send over this document a few days before closing. The CD lists every cost to be paid at closing, as well as your estimated net proceeds. Check the numbers carefully!

Hand over your spare keys

Give your realtor or closing attorney any house keys or garage door openers if you haven’t yet – the buyer will need them!

Set a reminder for your closing

You should have received an invite for closing from your agent, title company, or attorney. Put it on your calendar and ask your agent for a reminder.

Keep in touch with your agent

Closing delays are pretty common in real estate, whether it’s due to title-related issues, a low appraisal, final walk-through problems, or inaccurate numbers on a CD.

Don’t lose touch with your realtor, and request constant updates.

💰When do I get paid?

Once you and the buyer have signed closing documents, your home sale is official!

Your closing agent or attorney may wire your net proceeds directly to your bank account, usually within 24-48 hours of closing.

However, your money might take a few days or longer to become available in your account, depending on your bank.

For more details on how and when you’ll get paid, speak with your agent, attorney, and bank.

11. Calculate your potential capital gains tax

You may owe some taxes if you bought your home within the past two years and it has risen in value.

- If you owned your home for one year or less: You may owe short-term capital gains taxes, which are taxed at the ordinary income rate (10% to 37%, depending on your income).

- If you owned it for more than one year: Your profits may be taxed as long-term capital gains (up to 20%).

However, if you’ve owned your house for at least two of the past five years and meet certain criteria, the first $250,000 profit on your home sale is tax-free ($500,000 if you’re married and file taxes jointly).

The IRS also lets you add certain repairs and improvements to your home’s cost basis, which reduces any tax you may owe from your sale.

How to calculate capital gains tax on home sale

Step 1. Determine your adjusted cost basis, which is the home’s original purchase price, plus the cost of repairs and improvements you’ve made since acquiring the property.

For example, a home that cost $300,000, with $50,000 in repairs, would have an adjusted cost basis of $350,000.

Step 2. Add up the total cost of realtor commission and fees from your home sale. You can find this information on your closing disclosure document.

Step 3. Subtract your home’s adjusted cost basis, and the cost of realtor commission and fees, from its sale price.

Here’s an example of a home that sells for $400,000, with an adjusted cost basis of $350,000 and $20,000 in realtor commission and fees.

| Sale price | $400,000 |

| Adjusted cost basis | $350,000 |

| Commission and fees | $20,000 |

| Total capital gain | $30,000 |

Speak with a tax professional for further guidance on capital gains taxes.

» MORE: How to avoid capital gains tax when selling a house

12. Leave your agent a review, and keep in touch!

Leaving your agent a review isn’t required. But if your realtor did a great job, leaving them a positive Zillow, Facebook, or Google review is a nice gesture.

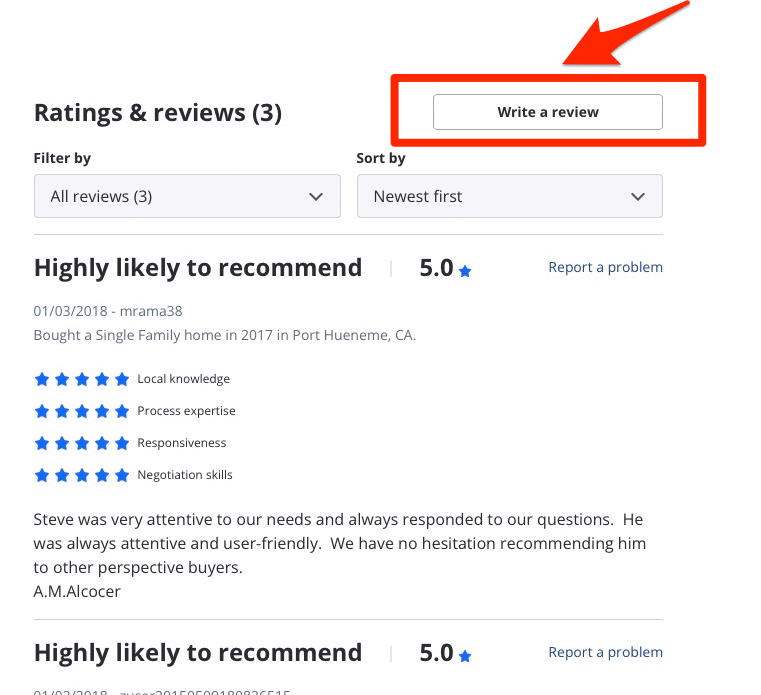

How to leave a Zillow review

Find your agent’s profile on Zillow’s website. You’ll need to log in or create a free account.

Then simply click their profile, and scroll down to “ratings & reviews” where you’ll find a “write a review” button.

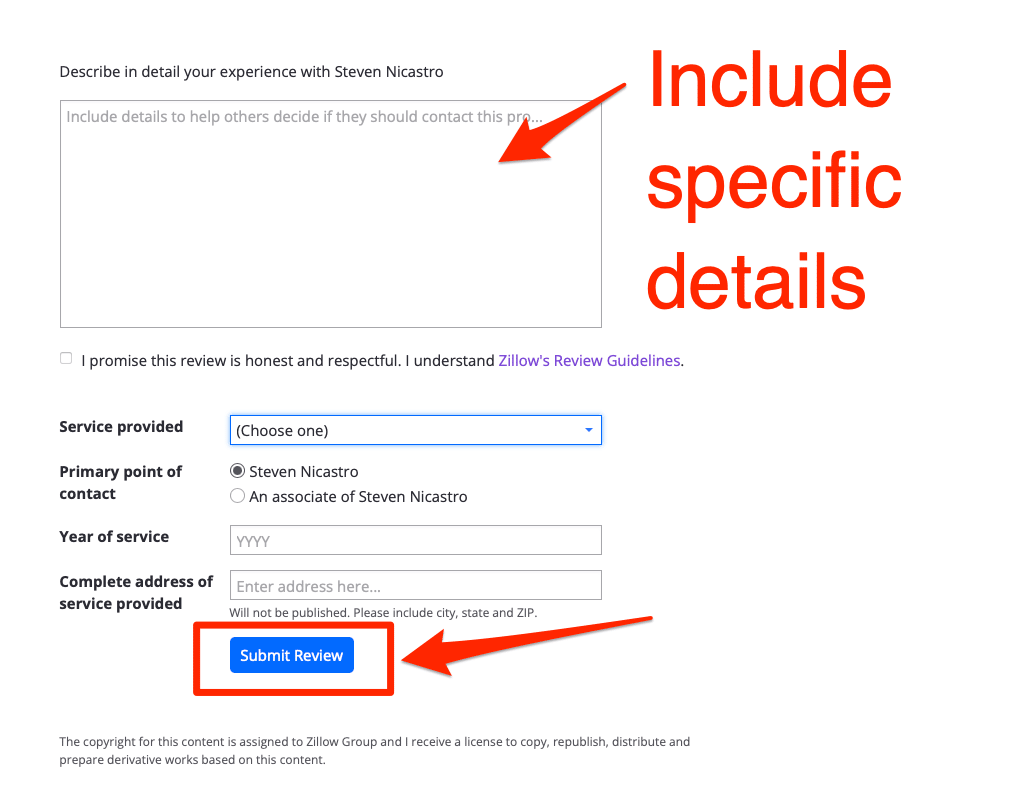

You can leave individual star ratings for knowledge, expertise, responsiveness, and negotiation skills, and leave a comment.

Enter the service provided (“listed and sold a home or lot/land”), the year of your home sale, and the address, then hit “submit review” at the bottom of the screen.

How to sell your house: State-by-state breakdown

Looking for state-specific information, like the required forms and disclosures needed to sell a house? We’ve published a series of articles breaking down state requirements.

Check below to see if your state is covered.

| State |

|---|

| Arkansas |

| California |

| Florida |

| Georgia |

| New Jersey |

| New York |

| North Carolina |

| Pennsylvania |

| South Carolina |

| Texas |

How to sell your house: FAQ

What's the first step in selling a home?

The first step to selling a home is to decide how you plan to sell: With an agent, FSBO, or to a cash buyer.

Hire a realtor if your goal is to make as much money as possible. Agent-listed homes sell for 18% more than FSBO listings, and not surprisingly, most home sellers (90%) use an agent.

To save on listing agent commission, use a free agent matching service that pre-negotiates 1.5% commission rates with top local listing agents, saving sellers an average of $7,000.

Can I sell my house without a realtor?

Yes. Approximately 7% of home sellers go the for-sale by owner route to avoid paying listing agent commission, according to NAR.

However, most home sellers actually don't save money FSBO: owner-listed homes sell for 17% less than agent-listed homes, according to NAR data.

Learn why realtor-listed homes tend to sell for more than FSBO listings.

If you're still set on selling without an agent, read our guide on how to sell FSBO, and what you need to know about a flat-fee MLS service.

Can you sell a house with a mortgage?

Yes, you can sell a house even if it has one or more existing mortgages on it. In fact, it's very common.

When you sell your home, money from its sale price is used to pay off existing mortgages, as well as realtor commissions and seller closing costs.

Contact your lender to request a payoff quote, which shows the total amount owed on your mortgage, including any late charges or fees. Your realtor or closing attorney will likely need a copy before closing.

Do I need a real estate attorney to sell my house?

Real estate laws vary by state, and some states require you to use an attorney to sell your house. However, using an attorney in a real estate transaction could make sense even if your state doesn't require it.

Check with an experienced realtor to learn more about your state laws and regulations. If you don't have an agent yet, use a free agent matching service to get connected fast with top-rated, local real estate agents.

How much money will I actually make on my home sale?

Your potential home sale profit depends on your home's sale price, and your estimated closing costs.

To determine your estimated net proceeds, you need to:

- Get a comparative market analysis from a realtor to determine the fair market value of your home, and what it's likely to sell for.

- Request a seller's net sheet from a realtor for an estimate of what you might earn in your home sale, after deducting all closing costs and fees.

Learn how to find a realtor, who can provide you with a CMA and a seller's net sheet.

Average realtor commission typically ranges from 5% to 6%, and home sellers often pay another 1% to 3% in closing costs. However, using an agent matching service could save you thousands on realtor commissions, so we recommend starting your search there.

Why you should trust us

Real Estate Witch’s mission is to provide accurate, actionable, and practical information you can use to make better decisions on your real estate journey.

To complete our guide, we studied and pulled research from the following sources:

- National Association of Realtors (NAR) 2021 Home Buyers and Sellers Generational Trends report

- NAR’s Realtors Confidence Index Survey for April 2022

- NAR’s 2021 Profile of Home Buyers and Sellers

- NAR’s Real Estate Video Marketing: A Complete Guide

- Realtor.com’s Spring 2022 Home Seller Report

- IRS Publication 523: Selling Your Home

- Real Estate Witch’s average commission rates series

- Redfin’s The Trials of a 2021 HomeBuyer

- Zillow’s Consumer Housing Trends Report 2021

- Zillow’s Photographer Marketing Practices for 3D Home Tours

We interviewed several experienced real estate agents to complete our guide, including:

- Kristyn Grewell, a realtor with 15 years of experience, based in Oklahoma City, OK.

- Nathan Clark, a real estate broker with Your Home Sold Guaranteed Realty, based in Smithfield, RI.

- Lorraine Weber, a realtor with Coldwell Banker, based in Long Beach, NY.

We also used research from our steps to selling a home guide series, including interviews with several licensed agents and brokers, including:

- Jose Roberto Samano, broker with eXp Realty in Anaheim, California.

- Matthew Tully, real estate agent with Re/Max Central in Manalapan, New Jersey.

- Rodrick Jackson, real estate agent, investor, and property manager with Spoat, Jackson, & Browne Realty in Fayetteville, North Carolina.

- Richard Romano of Century 21 Cor-Ace Realty, based in Moriches, New York.

About the author

Steve Nicastro is a real estate agent, investor, and personal finance writer based in Charleston, South Carolina. While working as a full-time realtor between 2020-21, Steve closed 19 transactions totaling $6 million in volume, assisting both buyers and sellers.

Before writing for Real Estate Witch, Steve spent more than 6 years on NerdWallet’s content team as a personal finance writer, where his work was published in The Associated Press, USA Today, and US News, among other publications.

How to sell your house: Related links

Selling a House Without a Realtor: Experienced home sellers can cut out listing agent fees by listing a house “for sale by owner” (FSBO). Learn more now.

How to Choose a Realtor: Expert Secrets. Learn how to vet agents, set up interviews, read and sign a buyer’s agency agreement or listing agreement, and pick the best realtor for you.

Clever Real Estate – Must-See Reviews: The Real Estate Witch team reviews the agent-matching service Clever Real Estate. Does its service actually save sellers $7,000 in commission fees, on average, as it claims?

HomeLight Reviews: Why HomeLight Isn’t Really Worth It: We scoured HomeLight reviews and mystery shopped the company to round up all the information you need to know before signing up with HomeLight.

The Best Discount Real Estate Brokers for Every Budget: Find the best discount real estate brokers for every budget in every state. Compare fees and savings to learn which company is right for you!

Leave a Reply