Published

If you’re selling a house in South Carolina but need some help, we’ve got you covered.

Our step-by-step guide breaks it down from start to finish. We discuss selling for sale by owner (FSBO) vs. hiring a realtor, an overview of SC property disclosure requirements, the required SC real estate forms, and how the closing process works.

We also break down how you can save money on your major home sale costs, including shopping around for real estate agents.

For example, our free agent matching service pre-negotiates lower listing commission rates for you. Sellers pay a 1.5% listing agent commission ($3,000 minimun) – much lower than the South Carolina average of 2.80%.

9 steps to selling a house in South Carolina

- Decide how you want to sell

- Sign a listing agreement

- Determine a list price

- Prepare to list your house

- Market and show your house

- Negotiate with buyers

- Review paperwork and sign

- Conduct inspections

- Close on your sale

1. Decide how to sell: Hire an agent, FSBO, or a cash buyer?

This is a huge first decision. Here’s how to weigh your options.

Option 1. Sell with a real estate agent in South Carolina

Hiring an experienced South Carolina listing agent is a no-brainer. Listing agents are responsible for helping you navigate every step in the sales process.

A good agent is easily worth their price tag: They can get you a higher sale price on your home, while also eliminating much of the stress involved in a real estate sale.

However, quality varies by the agent. I highly recommend comparing multiple agents to find the best fit for your situation, and to compare rates and service.

Use an agent matching service

It’s smart to meet with a few top agents before setting up interviews. Some of my clients have interviewed 5 or more listing agents before deciding, but 2-3 agents are probably enough.

We can match you up to multiple South Carolina real estate agents quickly and potentially save you thousands on realtor commissions.

We pre-negotiate a competitive 1.5% listing fee with our network of top local agents (much lower than the average South Carolina listing agent commission of 2.92%.)

You simply provide your information and explain what you’re looking for in an agent, and the service matches you up with realtors from name-brand brokerages (like Keller Williams and Re/Max.)

Option 2. Sell without a real estate agent in South Carolina

Selling FSBO saves you on the listing agent commission. In South Carolina, it averages 2.92% of the home’s sale price. So, you could save $14,600 on a $500,000 home sale.

However, South Carolina sellers are still responsible for paying the buyer’s agent commission, which ranges from 2% to 3% in the state.

Drawbacks to FSBO

- FSBO properties sell for around 6% less than homes sold by agents.

- There’s tons of paperwork and legal requirements in South Carolina (trust me, I’m an agent!).

- It’s hard to accurately price your home without getting help from a realtor. I’ve seen far too many underpriced or overpriced FSBO homes in Charleston during my time as an agent.

- You’ll need to handle photography, showings, inspections, appraisals, and more. It could take up weeks of your time. Realtors have most of these processes automated already.

- You’ll probably want to hire a flat fee MLS company to get your home noticed.

- You’re in charge of online marketing, so you better have a good camera and photo editing software on hand!

Bottom line: FSBO in South Carolina only makes sense if you have prior experience selling homes, or if you’re selling to someone you know (and don’t need to list).

For most sellers, it simply takes too much time and carries too much risk (and stress), to be a good option.

A better option for saving on realtor commissions is to work with our agent matching service, which pre-negotiates 1.5% listing fees with its network of top local agents.

Option 3. Sell to a cash buyer

Do you need to sell ASAP? Selling to a cash buyer is probably the fastest, most convenient method for you.

Instead of having to list your home, wait for an offer to come in, and go through a 30-45 day closing process, you can get a near-instant cash offer from an iBuyer company, and close within a week or two.

Just don’t expect to get as much money compared to listing your home on the open market. iBuyers offer between 50% to 75% of your home’s fair value and come with service fees (5% or more of the sale price).

Bottom line: Only consider if you absolutely need your SC home sold ASAP and don’t care about taking a hit on price.

2. Sign a South Carolina listing agreement and seller disclosures

It’s time to read and sign a South Carolina listing agreement to get your house on the market!

The listing agreement has important details of your home sale. It includes the following information:

- Type of listing agreement: Most SC agents work under an exclusive right-to-sell listing agreement (single agency). It means the agent works solely for you (I’ve only used this type of agreement during my 3 years working as an agent.)

- The terms of your sale: Your home’s initial listing price, and what you agree to pay to the listing agent.

- Contract expiry date: In South Carolina, most exclusive right-to-sell agreements last for 180 days (your home will probably sell before the contract expires.)

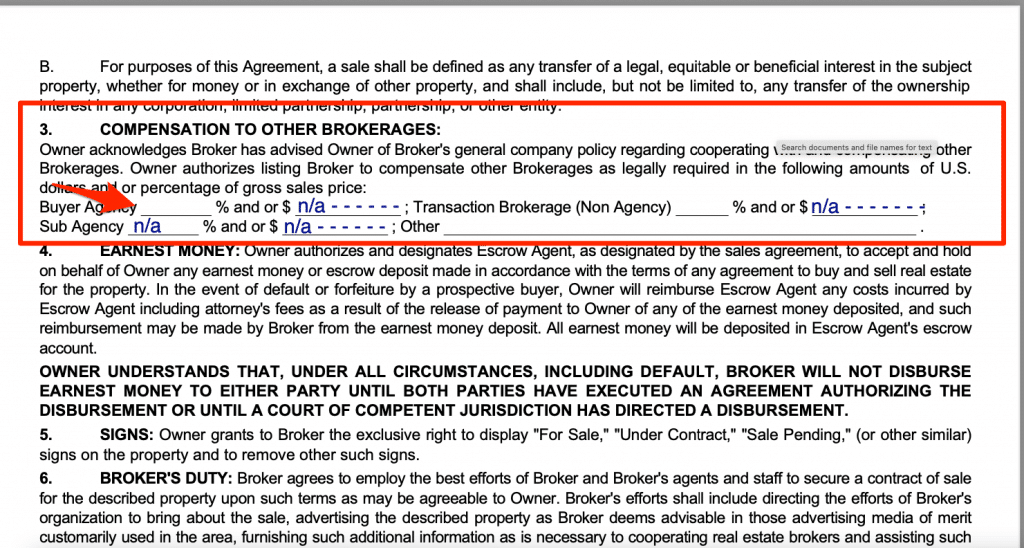

- Compensation to other brokerages: The commission rate you agree to pay to the buyer’s agent (it typically ranges from 2% to 3%). I recommend offering a competitive buyer’s agent commission (2.5% to 3%) to potentially attract more showings.

- Surveillance: You agree not to use audio and video surveillance in certain areas of your home (like bathrooms) during buyer showings, and agree that the broker may disclose surveillance to buyers.

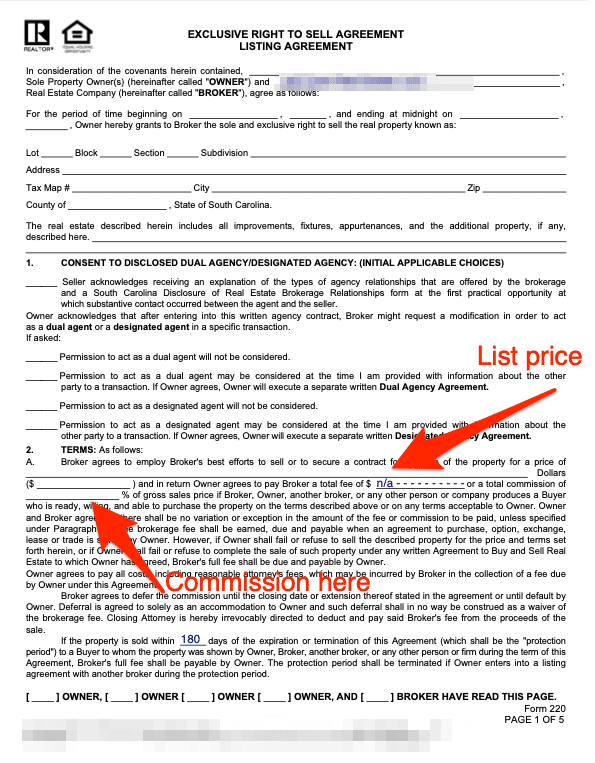

What an SC listing agreement looks like

The listing agreement contains 5 pages.

The first page has important contract information, including your home’s initial list price, and your listing agent’s commission rate (paid when they sell your home.)

On page 2, you’ll find the “compensation to other brokerages,” which is the commission rate you’ll pay to a buyer’s agent.

Buyer commission rates are not set in stone, but most sellers offer to pay between 2% to 3%. Ask your agent for more guidance.

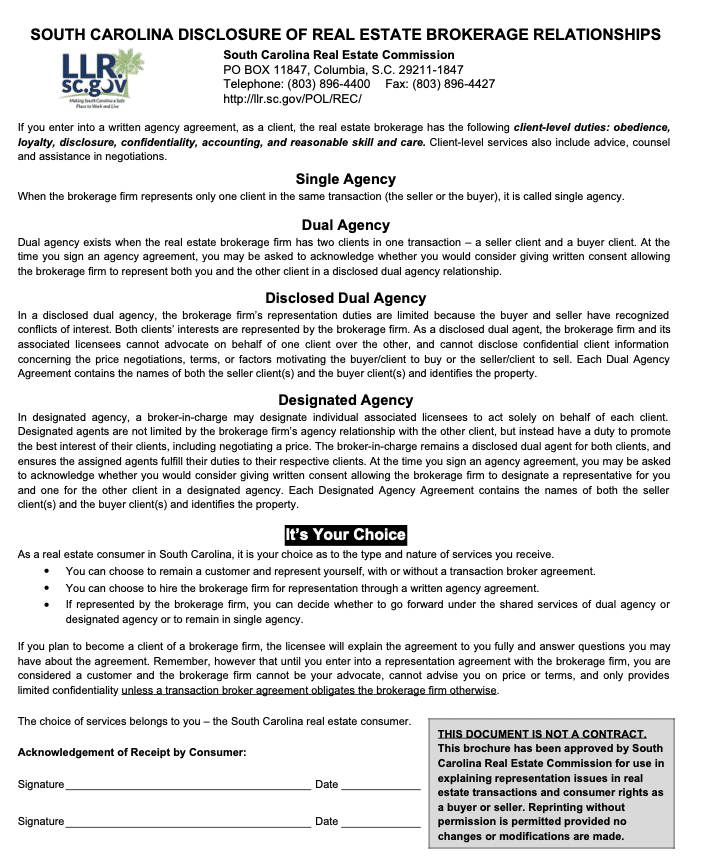

Realtor disclosure requirements

South Carolina law requires agents to provide you with the South Carolina Disclosure of Real Estate Brokerage Relationships form.

Here are your agency options:

- Single agent relationship: The agent or broker represents only one party (either the buyer or seller) and acts as a fiduciary. I often work with clients under a single agent relationship. It gives sellers the most protection compared to other options.

- Dual agency. The agent can represent both you and the buyer in the same transaction while also acting as a fiduciary for both parties. Although it’s illegal in some states, dual agency is legal in South Carolina, although it can raise potential conflicts of interest.

- Disclosed dual agency: Your agent’s representation duties are limited because you and the buyer have recognized conflicts of interest. Your agent cannot advocate on behalf of one client over the other.

- Designated agency: Similar to a disclosed dual agency, except that your agent’s brokerage firm designates separate agents to work on behalf of each client.

Contact a local real estate attorney for more advice on South Carolina listing agreements agency disclosures.

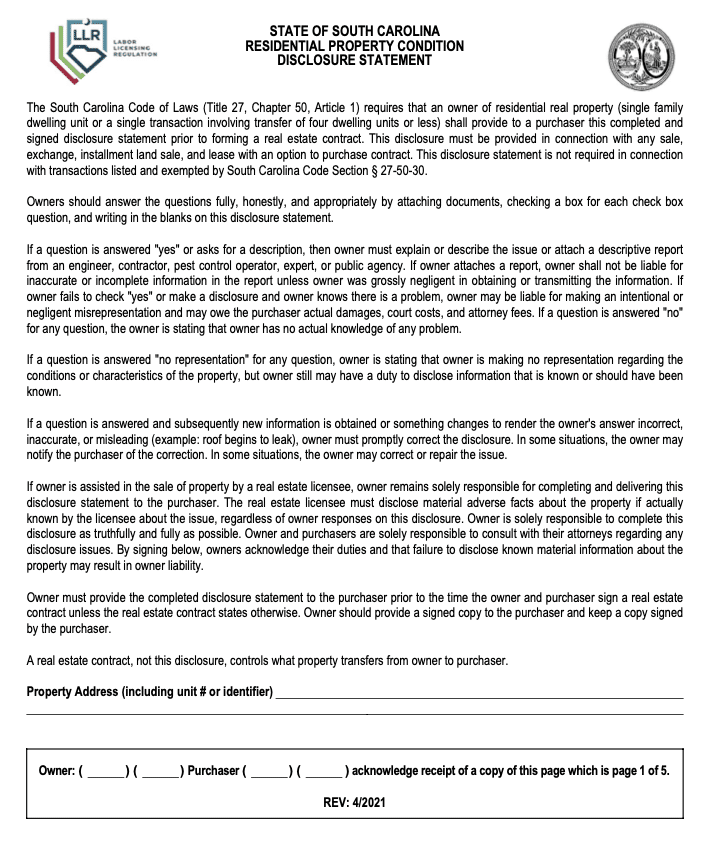

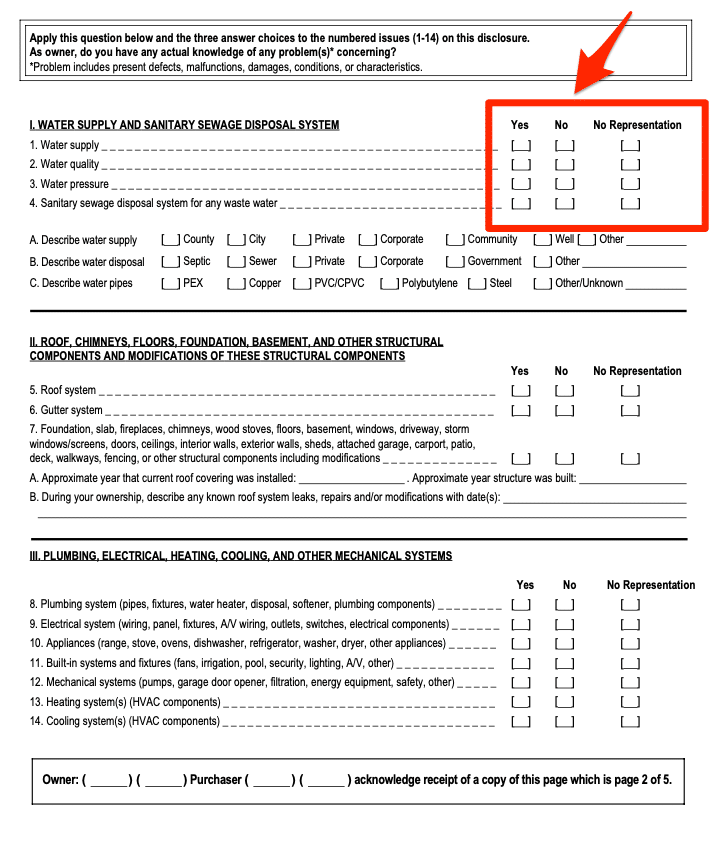

Seller’s property disclosure: What do South Carolina sellers need to disclose?

In South Carolina, most sellers need to fill out an SC Residential Property Condition Disclosure Statement before listing a home for sale.

If you have knowledge of any of your home’s problems or defects during your time as a homeowner, you must disclose it here and provide an explanation.

Answer each question with a “yes, no, or no representation” response. For example, if your home has past plumbing issues, you’ll check “yes” and then provide an explanation at the bottom of page 4.

The form also asks you for the estimated age of your home’s major components, such as its roof and HVAC system (You might be able to find your HVAC’s age by locating its serial number on the back of the unit.)

Try to answer these questions to the best of your knowledge, and ask your real estate attorney or agent for more advice on how to fill out your property disclosure form.

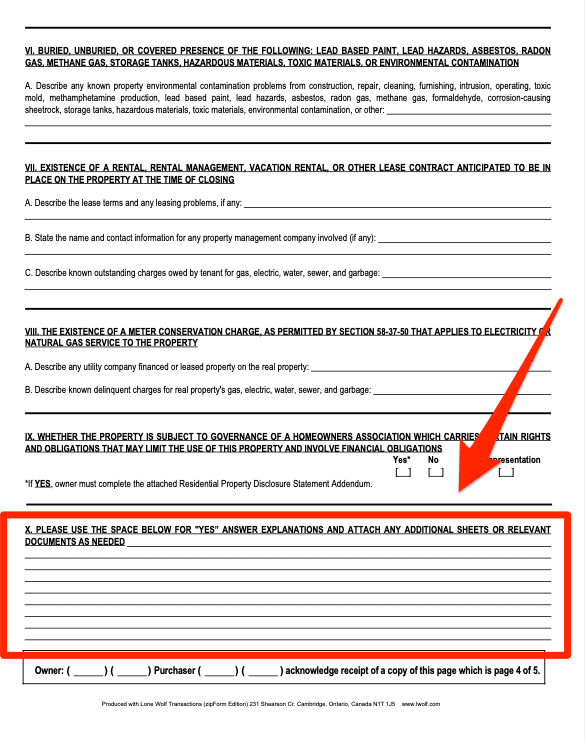

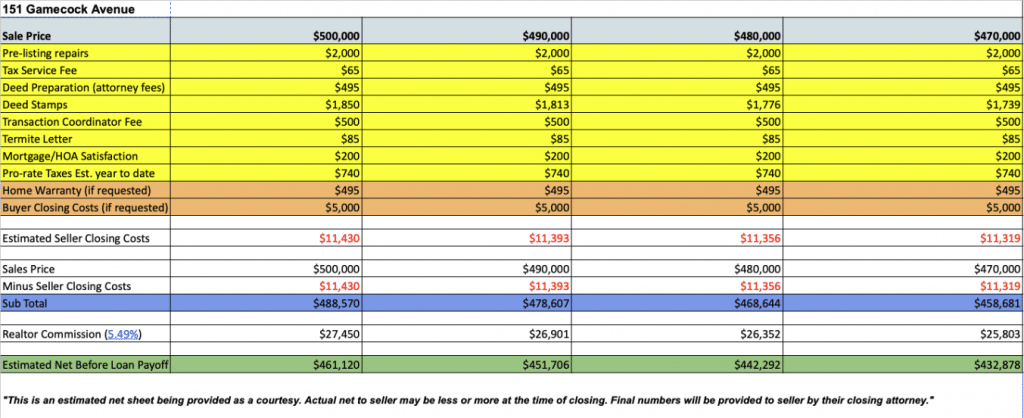

SC Residential Property Condition Disclosure Statement Addendum

You’ll need to fill out this form if your home is subject to a homeowners association (HOA), a condo or townhouse association, or similar organizations that are subject to covenants, restrictions, and fees.

3. Price your home

The next step is to determine a competitive listing price for your home.

If you’re working with an agent, they’ll provide you with a comparative market analysis (CMA) report. It provides an estimate of your home’s fair value, based on what similar homes have recently sold for in your area.

I always provide a free CMA during my initial interview with a potential home seller. It takes 1-2 days to put it together through the MLS.

Make sure your agent gives you credit for your home’s upgrades and renovations and explains how they choose their comparables.

What about an appraisal?

Appraisals are usually conducted by the buyer during the home sale process. But you can technically get an appraisal before listing your home for sale to guide your pricing.

However, appraisals can cost $400 or more in South Carolina and are often time-consuming (1-2 weeks to complete), so it needs to fit within your budget and timeframe.

I’ve never had a client get an appraisal before listing, but I can see it being useful on homes that are really hard to value through a CMA.

4. Prepare your home for sale

Now the fun begins: it’s time to get your home ready for showings!

Gather important documents

Your attorney may require numerous documents and records for closing, including, but not limited to, your mortgage statement, homeowners and flood insurance records, HOA documents, and property taxes.

I usually recommend my clients download their most recent utility bills, too. Some buyers have asked us for the average monthly electric and water bills, so it’s good to have those documents on hand.

Finally, get together any warranties or appliance manuals you might have, in case the buyer needs them.

Get a pre-listing inspection

I’ve had some sellers get a home inspection before putting their homes on the market. It’s completely optional.

A pre-listing inspection can potentially help you spot and fix issues with your home before those issues surface on a buyer’s home inspection.

However, I’ve found that it’s often not worth the time and money. Consult with your agent for more specific advice.

Make home repairs and improvements

It could be worth making certain repairs or improvements before listing.

Sometimes I’ll recommend my sellers make small cosmetic improvements before photos and showings. Even just minor paint touch-ups can make a big difference with buyers.

However, your agent is in the best position to advise you on which repairs or improvements to make before listing. In a strong seller’s market, you might not have to make any updates at all (I’ve sold homes completely as-is).

Clean and declutter your home

Your home doesn’t have to be spotless. But pay careful attention to areas where buyers will notice dirty areas the most, like your kitchen and bathrooms.

Definitely keep the hallways clear of objects, to make it easy for buyers to navigate through your home.

It’s also a good idea to depersonalize every room – remove family photos, artwork, and posters. It keeps buyers’ attention on your home.

Consider home staging

Staging can increase your home’s appeal and lead to a higher sale price, but it doesn’t make sense for every seller. It’s expensive and can be an unnecessary expense.

The only time I’ve recommended a client invest in home staging was with an empty, high-end vacation home. It really made a big difference with photos and showings.

Consult with your realtor for advice on whether or not home staging is right for you.

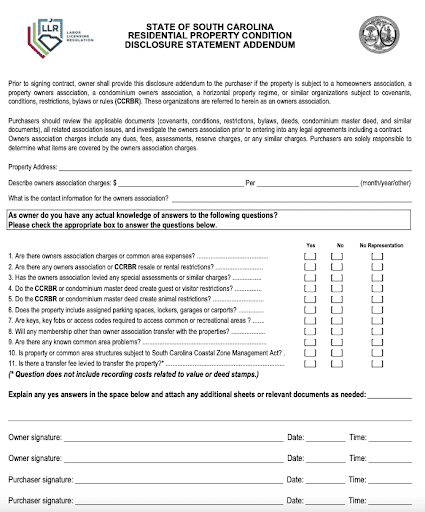

South Carolina seller’s net sheet

You can also request a seller’s net sheet from your realtor. It estimates what you may net in your home sale after deducting all fees and expenses from your expected sale price.

Here’s what my SC seller’s net sheet looks like:

A net sheet usually contains:

- Your home’s estimated sale price.

- Pre-listing expenses.

- Closing costs.

- Realtor fees.

- Estimated net proceeds before loan payoff.

Find a realtor with our agent matching service to get the most accurate net sheet estimate on your South Carolina home.

5. Market and show your home to buyers

Now it’s time to actually list your home and host potential buyers! Here’s what typically happens next:

- Your real estate agent should put up a “for sale” sign on your lawn and a lockbox (with your spare house key) on your front door.

- They’ll post your home on the multiple listing service (MLS): a database most real estate agents use to market and sell properties.

- Your home will appear on popular real estate websites (like Zillow, Trulia, and Realtor) to attract buyers. It may also appear on other real estate websites, like Redfin and Carolina One.

- Your agent might plan an open house for the upcoming weekend.

If you’re selling real estate for sale by owner, consider listing your home on the MLS via a flat-fee MLS service, so it reaches buyers’ agents and their clients.

My listing is live: What happens next?

Listing your home for sale can be both exciting and nerve-racking! Here’s what to do next.

Take care of your pets

What will you do with Fido during buyer showings? I’ve had sellers keep their pets in the backyard or garage during showings, while others removed them from the home entirely.

It’s totally your call – whatever makes it easy for you. Just know that if you plan to keep pets in your home for showings, you’ll need to notify buyers.

Agents can do this through the ShowingTime App, or with a quick phone call or text to agents.

Check out your agent’s photos

Make sure you like all of the photos used by your agent (contact them if you don’t). Photos should look bright, and feel warm and welcoming – not dark and cloudy.

Double-check the agent’s listing description

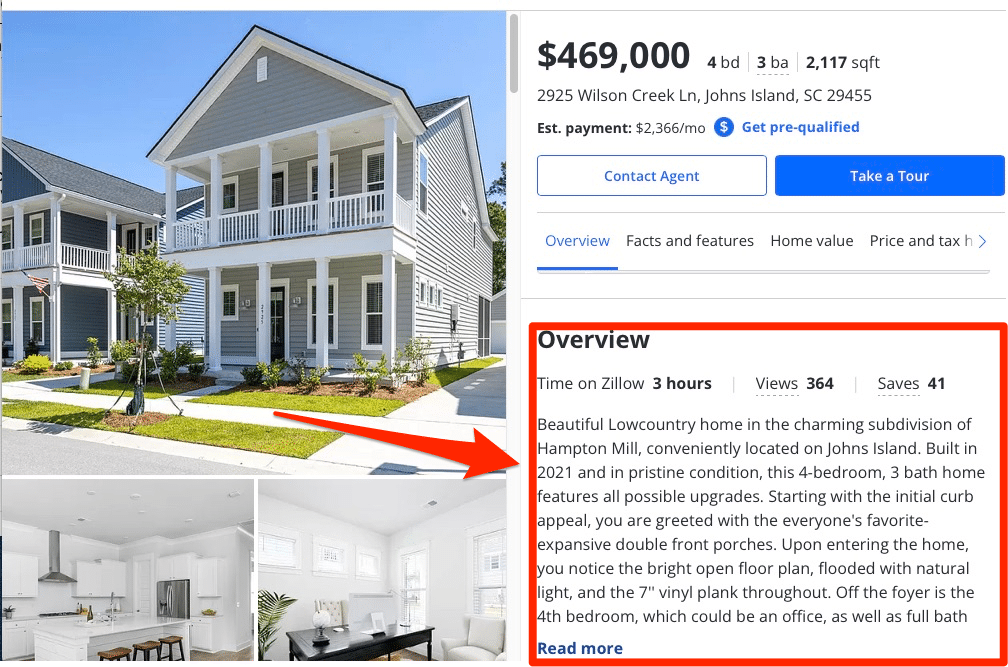

The listing description explains your home’s key features. It should describe all of your home’s selling points, and contain good grammar and punctuation. This can be found easily on Zillow under the “overview” tab

Post your home on social media

You don’t need to post your home on Facebook or Instagram (that’s your agent’s job!). But it might help get the word out to your family and friends.

Posting on a local Facebook for-sale group isn’t a bad idea, either, as long as it’s allowed. For example, the Facebook Group homes for sale, list, and rent in Charleston have over 4,000 members.

Keep an eye on your listing

You can check how many people have viewed and saved your listing on Zillow and compare that to other local listings to see how it is performing.

Like your listing description, this information can be found under “overview” on your listing’s Zillow page.

What to know about SC buyer showings

Most agents use a mobile app called ShowingTime to help manage showing requests and appointments.

The app allows buyers to request showings digitally, while sellers can view and approve (or deny) any showing requests (and agents are notified of all activity).

You may start to get showing requests within just a day or two of going live, although it could take longer depending on your home’s price, condition, and local market.

6. Negotiate with buyers

With luck, you’ve received multiple offers within just a few days or weeks of going live!

The offer should contain the buyer’s offer price, if they’re asking you to pay for any of their closing costs, the type of financing used, an estimated closing date, and an offer expiry date (typically 24-48 hours after submission).

You can accept, counter, or reject the buyer’s offer.

Remember this: if you counter an offer and the buyer accepts it, you’re technically under contract. So be careful if you plan to counter multiple offers (it’s not the best idea!)

How long does it take to sell in South Carolina?

Timing depends mainly on your home’s desirability, and how well you’ve priced your home. Pricing below fair market value usually leads to more showings and offers.

South Carolina listings are on the market for a median of 45 days. However, the time on the market varies by city.

| City | Median days on market |

|---|---|

| Columbia | 41 |

| Charleston | 63 |

| Hilton Head Island | |

| Greenville | 69 |

| Myrtle Beach | 81 |

Talk with your agent to discuss expectations on when you might receive an acceptable offer after going live.

7. Review paperwork and sign an offer

Once you’ve decided to accept an offer and you’ve talked it through with your agent, it’s time to review the contract and sign!

After all parties have signed, your home is under contract and you’re just a few months away from closing.

In South Carolina, I’ve found that it usually takes between 30 to 45 days to close on a home, which is much lower than the national average of 58 days.

What’s in a South Carolina purchase and sale agreement?

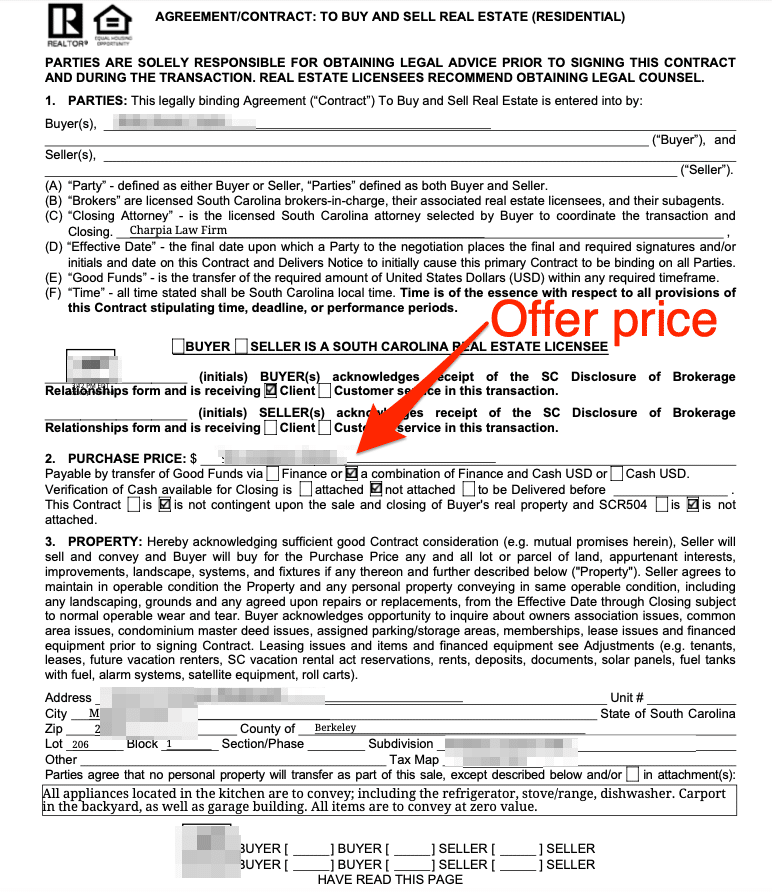

The buyer’s agent will send over an Agreement/Contract: To Buy and Sell Real Estate (Residential) form. Here’s what the first page looks like.

Key items on page 1:

- Parties. The buyer and seller’s full legal names.

- Purchase price: How much the buyer is offering to purchase your home (you can counter this).

- Property: Your home’s address and legal information, including lot, block, subdivision, and tax map number.

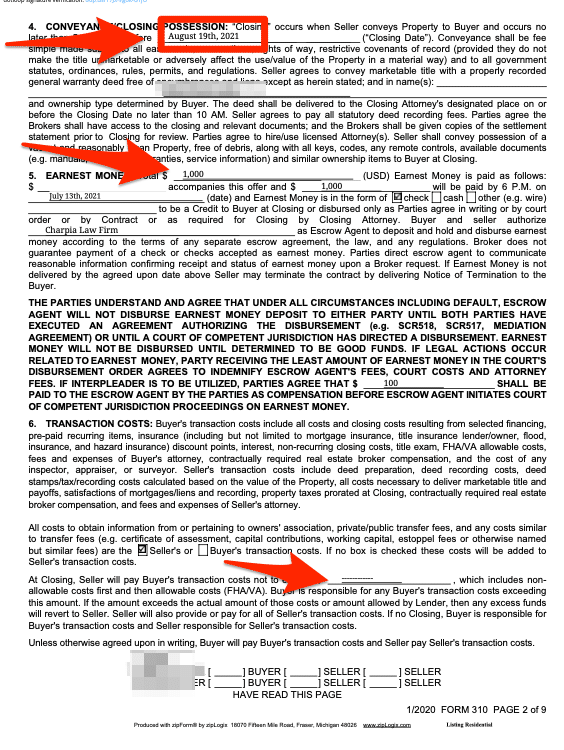

Page 2 (photo above) includes the following:

- Closing/possession date: The estimated date of closing, when ownership transfers to the buyer.

- Earnest money: Submitted by the buyer and held in a trust or escrow account until closing, at which point it is applied to the home’s purchase price and/or closing costs.

- Transaction costs: If the seller or buyer is responsible for paying for the buyer’s closing costs, and how much the seller agrees to contribute. (In a seller’s market, you might not have to pay anything).

The remaining pages include:

- Finance: The type of financing used by the buyer, and their lender’s name.

- Repairs: The type of contract used by the buyer – repair procedure, due diligence, or as-is.

- Inspection rights: If you grant the buyer permission to connect utilities and pay for utilities until closing.

- Appraised value: If the home sale is contingent on the property being valued by an appraiser.

- Wood infestation report: If the property is contingent on a termite inspection, and who pays for the inspection.

Ask your agent to walk you through the SC purchase and sale agreement form if you have any questions.

Who pays realtor fees in South Carolina?

The home seller typically covers both the listing agent and buyer’s agent commission in South Carolina.

The average realtor commission is 5.83% in the state or about $20,400 on a $350,000 home. That commission is usually split evenly between agents.

Is that too much for you? If you don’t have an agent yet, you can use our agent matching service, which charges a listing fee of just 1.5% — about half the standard South Carolina listing commission.

8. Conduct inspections, appraisals, and closing walk-through

Home inspection

South Carolina contracts typically provide buyers with an inspection period (or “due diligence” period), during which time they can conduct a home inspection.

Don’t worry: this step is a totally normal part of the home sale process. In fact, nearly every home I’ve sold in SC has come with a home inspection contingency.

The home inspection usually takes 1-2 hours to inspect and report on the overall condition of the home, pointing out potential issues, like roof leaks or water damage.

Make required repairs

In SC, a buyer might ask you to fix any defects or serious issues discovered in the inspection (or try to negotiate a lower price or closing credit). They can do this if you’ve agreed to a “repair procedure” or “due diligence” type of contract.

Check with your agent to learn what you’re obligated to fix and the best way to move forward following the home inspection.

Termite inspection

Termites are common in South Carolina, and a Termite and Other Wood Destroying Organism Report (WDO), or CL-100, may be required when buying a home.

You may or may not be on the hook for the cost of a termite inspection ($75–$150 depending on the contract, so check with your agent for more information.

Appraisal

Lenders often require buyers to get an appraisal to be certain that the home is worth its purchase price. It’s typically paid for by the buyer in South Carolina (though sometimes the seller offers to cover this cost).

You’ll get notified if your home’s appraised value comes in lower than the buyer’s purchase price — in which case you may have to re-negotiate price and contract terms (assuming the contract is contingent upon an appraisal).

Final walk-through

The buyer may do a walk-through of the home a day or two before closing, to make sure the home is in the same condition since their last viewing.

- Clear out your house entirely if you haven’t yet, removing all personal belongings.

- Repair or patch any damaged drywall, paint, or nail holes that might have occurred when you moved out of the home.

- Make sure items included in the sale contract are still there (appliances, light fixtures, etc).

9. Close on your home sale

You’re almost at the finish line! Here’s what to do in the days leading up to your scheduled closing.

Look out for a closing disclosure

You’ll likely need to sign this form two to three days before closing. It contains every cost to be paid by the buyer and seller and your estimated net proceeds. Double-check all the numbers with your agent, and speak up if the numbers don’t look right.

Find out when closing is scheduled

Most of the paperwork has already been completed on your end. Ask your agent if you need to attend your closing, or if you can sign any remaining paperwork digitally.

Keep in touch!

Buyer closings get delayed quite frequently (there are a lot of moving parts in a real estate transaction). Don’t be surprised if the closing doesn’t happen exactly at its scheduled time! Your agent should keep you updated on closing status 24/7.

💰When do I get paid?

Once you and the buyer have signed all documents, you’ve closed on your home sale. Nice job!

The home’s sale price pays off the realtor commission, closing costs, and covers any outstanding mortgages or liens owed on the property.

Your net proceeds might be wired to your bank account after closing. Contact your agent, attorney, or title company for more details on how and when you’ll get paid.

Next steps after selling a house in South Carolina

Save your home sale documents

Keep both physical and digital copies of the home sale contract for your taxes and personal records.

Calculate your potential capital gains tax

The IRS excludes home sale gains of up to $250,000 for an individual and $500,000 for a married couple who have lived in and owned a home for at least two of the last five years.

Contact your tax advisor for more guidance on capital gains tax and if you’ll owe anything.

Contact the U.S. Postal Service and DMV

You may want to set up mail forwarding to your new address via the USPS website (it costs $1.10).

If you’re staying in South Carolina, you can change your SC address online, at an SCDMV branch, or by mail.

If you’re moving out of state, surrender your license plates at your nearest DMV.

Leave a review for your realtor

Did your agent do a great job? They’ll be thrilled to see a positive Zillow review and to receive a referral. Call out specific things you were happy with in your review.

Selling a house in South Carolina: FAQ

What are typical closing costs for a seller in South Carolina?

Seller closing costs in South Carolina average 0.90% of your home's final sale price. That figure includes typical closing costs paid for by sellers, like title service and transfer taxes.

However, it does not include realtor commission, which averages 5.83% in South Carolina, and covers the listing agent and buyer's agent.

To save on realtor fees, use a discount broker to connect with a top SC real estate agent for a low listing fee of 1.5% ($3,000 minimum).

What is a SC real estate disclosure form?

A SC real estate disclosure form is called a residential property disclosure statement. State law required you to provide buyer's with this form before entering into a sales contract.

If you have knowledge of any of your home's problems or defects during your time as a homeowner, you must disclose it here and provide an explanation.

In SC, you're also required to fill out an addendum form if your home is subject to HOA or regime fees.

Learn more about SC property disclosure requirements here and contact a local real estate professional for more help.

What are the required SC real estate forms?

Required South Carolina real estate forms usually include:

- South Carolina Exclusive Right to Sell Listing Agreement

- South Carolina Disclosure of Real Estate Brokerage Relationships

- SC Residential Property Condition Disclosure Statement

- SC Disclosure Statement Addendum

- Ratified Agreement to Buy and Sell Real Estate

- Seller's closing disclosure

- Appraisal

- A cleared CL-100 (termite inspection)

- Signed deed

- Bill of sale

- Affidavit of title

Ask your realtor or a licensed real estate attorney for more guidance.

What are SC property disclosure exemptions?

Section 27-50-30 of The residential Property Condition Disclosure Act says certain SC sellers are exempt from filling out a property disclosure. That includes:

- Foreclosures and estate sales.

- Real property sold at auction.

- Properties sold between spouses in a divorce.

- A home that was never inhabited by the seller.

- Vacation time-sharing plan.

Check with your agent or real estate attorney for more specific advice on your legal requirements.

Do I need an attorney to sell a house in SC?

Yes. In South Carolina, you usually need a real estate attorney to help you close. SC attorneys are responsible for title search, handling loan documents, hosting closing, recording buyer and seller documents, and disbursing transaction funds (earnest money and sale proceeds).

The buyer is usually responsible for hiring an attorney. However, SC home sellers can still hire their own attorney for legal advice and expertise, if desired.

Related links

How to Choose a Realtor: Expert Secrets. Learn how to vet agents, set up interviews, read and sign a buyer’s agency agreement or listing agreement, and pick the best realtor for you.

How to Sell Your House – The Ultimate Guide: Our guide breaks down the process of selling your house from start to finish, to educate you on the process and help prepare you for your big sale.

How to Sell a House Without a Realtor: If you know what you’re doing, you can cut out seller agent fees by listing your house “for sale by owner” (FSBO). Learn more now.

What Does it Cost to Sell a House? Our guide breaks down all of the costs of selling a home, including realtor commission, seller closing costs, and optional pre-sale expenses.

Clever Real Estate – Must-See Reviews: The Real Estate Witch team reviews the agent-matching service Clever Real Estate. Does its service actually save sellers $9,600 in commission fees, on average, as it claims?

Leave a Reply