Published

Selling a house in Florida can be a complicated process, but it doesn’t need to be. If you need some help, we’ve got you covered.

Our real estate experts break down the Florida home selling process from start to finish: from finding and choosing the right real estate agent, to listing your home for sale, negotiating with buyers, signing all the paperwork, and closing.

Our guide also breaks down ways you can save on your Florida home sale. It costs Florida sellers an average of $26,520 to sell a home worth $388,454 (the average Florida home price), according to our data.

Thankfully, you can save money on your major home sale costs by shopping around for agents. Our free agent matching service pre-negotiates lower listing commissions for you. Sellers pay a 1.5% listing fee — about half the typical commission rate.

Selling a house in Florida in 9 steps

- Find and choose a Florida realtor

- Sign a listing agreement

- Determine a list price

- Prepare to list your house

- Market and show your house

- Negotiate with buyers

- Review paperwork and sign

- Conduct inspections

- Close on your sale

1. Find and choose a Florida real estate agent

I recommend finding at least 2-3 local real estate agents to compare and choose from before signing a listing agreement. Comparing multiple options helps you find the best fit for your situation and could save you thousands on realtor commissions.

There are many ways to find a real estate agent in Florida. But we think sellers should stick to sources that make it fast and easy to find quality options.

Agent matching services

Agent matching services match you up to top real estate agents at no cost. It’s the best way to connect with experienced agents who know the Florida real estate market inside out and to save money on commission.

How it works: Provide basic info. about your home and what you’re looking for in an agent, and the service quickly matches you up with top Florida real estate agents from name-brand brokerages – like RE/MAX, Keller Williams, and Coldwell Banker.

Some agent matching services can also potentially save you thousands on realtor commissions.

For example, we pre-negotiate a competitive 1.5% listing fee with our network of top agents – much lower than the average Florida listing agent commission of 2.70%.

How to compare agents

After you’ve found several top-rated agents to compare, it’s time to set up interviews, meet with agents at your house, and choose the best one.

- Experience: We recommend choosing a listing agent with at least 2-3 years of full-time experience. You can find this information on popular real estate websites like Zillow.

- Customer reviews: Look for positive customer reviews from past clients. One or two bad reviews aren’t a big deal, but agents with multiple bad reviews in a short timeframe (3-6 months) could be a red flag. You can vet each agent’s reviews using Zillow’s agent finder tool.

- Marketing skills: Check each agent’s active and closed listings on Zillow, or ask them for listing photo examples. Look for clear, polished photos with good lighting. and compelling listing descriptions that highlight each home’s key features.

- Commission rate: Florida listing agents earn an average commission rate of 2.70% per sale. This doesn’t include paying a competitive buyer’s agent commission (2.5% to 3.0%), which sellers are responsible for in Florida.

- Ask what the agent charges, and what is included in their services.

- Consider using our agent matching service, which has pre-negotiated a flat 1.5% ($3,000 minimum) listing commission rate with agents in its network.

2. Sign a Florida listing agreement and seller disclosures

It’s time to read and sign a Florida listing agreement! (Here’s advice on how to fill out and complete one).

The listing agreement details important information about your home sale. Key things to pay attention to include:

- Type of listing agreement: Most agents work under an exclusive right-to-sell listing agreement (single agency). It means the agent works solely for you and gets paid regardless of whether or not they bring the buyer to the table.

- Listing commission rate: The agent’s stated commission rate should match up to what’s on the listing agreement.

- Items that convey with the property: Note if you plan to keep items or belongings in the home like appliances – you’ll need to write that down in the contract.

Florida agency disclosure requirements

This form describes all of the realtor’s legal duties to you. Here are the type of agreements:

- Single-agent relationship. The agent or broker represents only one party (either the buyer or seller) and acts as a fiduciary. I usually recommend my clients work under a single-agent relationship compared to other options, as it gives my clients the most protection.

- Transaction broker relationship. The agent or broker provides limited representation to a buyer, seller, or both parties in a transaction, and does not act as a fiduciary. This means they don’t have to act in your best interest, making it a less desirable option for home sellers.

- Dual agency is illegal in Florida, so the agent can’t represent both you and the buyer in the same transaction while also acting as a fiduciary for both parties. A dual agency might happen if your listing agent brings a buyer to the table.

- It’s best to avoid dual agency when selling a home given the potential conflict of interest it can create since the agent is representing both sides.

Contact a local real estate attorney for more advice on Florida listing agreements and required disclosures.

What do Florida sellers need to disclose to potential buyers?

Sellers must notify buyers about any defects that may affect the value of the home or the buyer’s readiness to purchase it. You can do so using a property disclosure form.

The disclosure of material defects on a property should be made prior to executing a Florida sales contract.

Ask your real estate attorney or agent about what they recommend you disclose to home buyers.

3. Price your home

Your next step is to determine a competitive listing price for your home.

Online home value estimators can provide you with a quick ballpark estimate of your home’s potential value, based on your property’s key features, recent home sales, and active listings, neighborhood data, and local market trends.

However, real estate agents should provide you with a comparative market analysis (CMA) report. A CMA is based on a visual inspection of your property and estimates your home’s fair value based on its condition and upgrades.

A CMA is a great tool to help you and your agent set a fair listing price for your home. But it’s just a recommendation: you can always list for more (or less) than the CMA valuation, or get a second and third opinion.

Is a CMA free in Florida?

Most Florida realtors will perform a CMA for free as part of their initial listing presentation or interview.

Unlike in some states, Florida real estate laws don’t require agents to offer CMAs for free, but they usually do, unless you’re selling “for sale by owner” and just need a professional pricing recommendation.

What if I don’t agree with the agent’s valuation?

Get aligned with your agent on pricing before signing a listing agreement. But if you’re in disagreement on the price after you’ve signed, there are some potential solutions.

Talk to the agent to better understand how they arrived at their valuation. It’s possible they missed one or more of your home’s key features or underreported your square footage, which may be holding back its value.

If the agent still insists on their valuation, ask them if there are any minor repairs or improvements you can make to increase your home’s value before listing.

If you’re still in disagreement, it might just be worth trying to get out of your contract and find another agent.

» Get a CMA: Request a free CMA from a Florida real estate agent

Should I just get a pre-listing appraisal instead?

Appraisals are usually conducted by the buyer during the home sale process. But Florida home sellers can technically get an appraisal before listing your home for sale to guide your pricing.

However, pre-listing appraisals aren’t cheap ($300 to $380 for an appraisal in Florida). There’s also no guarantee your home value will come in higher with an appraisal compared to your agent’s CMA, so keep this in mind before moving forward.

If you’re set on selling your home without an agent, we strongly advise you against using a home value estimator, like Zillow or Realtor, to price your home.

Home value websites provide a rough estimate of your home’s potential value and can be off by tens of thousands of dollars.

4. Prepare your home for sale

After you’ve signed with an agent and decided on a list date, it’s time to get your home ready for showings!

Gather important documents

Most Florida home sales require a variety of documents and records for closing, including your mortgage statement, homeowners and flood insurance records, homeowners association (HOA) documents, and property taxes.

Download recent utility bills, and find any home warranties or appliance manuals you might have, in case the buyer requests them.

Get a pre-listing inspection

You can get a home inspection ($300-$400) if you suspect your home has an issue that could potentially delay (or derail) your sale.

It can potentially help you spot and fix issues with your home before those issues surface on a buyer’s home inspection.

An experienced agent can advise you on whether or not a pre-listing inspection is worth your time and money.

Make home repairs and improvements

Based on the results of a pre-listing inspection (and the condition of your home), it could be worth making certain repairs or improvements.

Common home inspection issues in Florida are related to:

- Water damage from storms, plumbing leaks, or leaky roofs.

- Deferred maintenance on HVAC units.

- Worn-out flooring.

However, your agent is in the best position to advise you on which repairs or improvements to make before listing.

Declutter, depersonalize, and clean

Now is the perfect time to sell, donate, or throw away unused or unwanted items, and re-organize your home before showings.

Make sure all areas of your home are spotless and pay careful attention to areas where buyers will notice dirty areas the most, like your kitchen and bathrooms.

Aim to depersonalize every room, removing family photos, artwork, and posters – it’s best to keep the buyer’s attention on your home, not your belongings.

Consider home staging

Staging can increase your home’s appeal and lead to a higher sale price, but it doesn’t make sense for every seller.

Home staging is expensive, costing between $2,000 to $6,000 or more in Florida, but pricing depends on the size of your home, the number of rooms staged, and your local market.

Consult with your realtor for advice on whether or not home staging is right for you.

How much money can I make on my Florida home sale?

Our calculator shows you what you might earn in a home sale after deducting typical home sale costs.

Realtor commission. Florida sellers pay an average realtor commission rate of 5.40% – usually split evenly by the listing agent and the buyer’s agent.

While the average Florida rate is 5.40%, you can potentially save thousands by using our agent matching service or negotiating a lower rate with agents.

Closing costs: Florida sellers pay an average of 1.6% of the home sale in closing costs, which includes common costs in Florida, like title insurance and documentary stamp tax.

It does not include other potential costs, such as home staging and relocation expenses.

Net proceeds. What you’d walk away with from your home sale at various price points after deducting commission, closing costs, and mortgages.

5. Market and show your home to Florida buyers

Now it’s time to actually time to list your home and host potential buyers!

Your listing agent will put a “for sale” sign on your front lawn and post your home for sale on the multiple listing service (MLS): a database most real estate agents use to market and sell properties.

Your home should be listed on all popular real estate sites (Zillow, Trulia, Realtor, etc).

If you’re set on selling without an agent, consider using a flat fee MLS company to get your home listed.

» MORE: The best flat-fee MLS companies in Florida

My listing is live: What happens next?

Listing your home for sale can be both exciting and nerve-racking! Here’s what to do next:

- Have a plan in place for your pets. I’ve had sellers keep their pets in the backyard or garage during showings, while others removed them from the home entirely. It’s your call – not the buyers! If you plan to keep pets in your home for showings, you’ll probably need to notify buyers (ask your agent for advice on how to do this).

- Check out your listing on Zillow and other popular sites. Make sure you like all of the photos used by your agent (contact them if you don’t).

- Double-check the agent’s listing description. It should describe all of your home’s main features and selling points, and have good grammar and punctuation.

- Consider posting your listing on social media. Get the word out to family and friends, and consider sharing the listing on local Facebook groups.

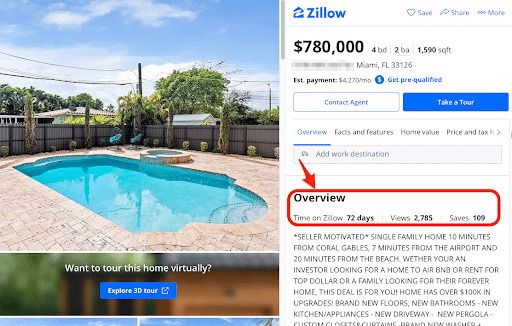

- Keep an eye on your listing activity. Check how many people have viewed and saved your listing on Zillow. You can compare that to other local listings to see how it is performing. This information is found under “overview” on your listing’s Zillow page (example below).

How are showings booked?

Most agents use a mobile app called ShowingTime to help manage showing appointments.

The app allows buyers to request showings digitally, while sellers can view and approve (or deny) any showing requests (and agents are notified of all activity).

You may start to get showing requests within just a day or two of going live, although it could take longer depending on your home’s price, condition, and local market.

What happens during showings?

You’ll need to leave your home so the home buyer and their agent can tour your home – buyers and sellers rarely have direct contact, and only communicate through agents.

Your house key might be left in a lockbox where the buyer’s agent can access it, and the agent often gains entry by using a one-time code.

Showings typically last between 15 to 45 minutes, depending mainly on the size of your house and how fast the buyer can walk through it.

Let your agent know if you have any special showing requirements like if you want buyers to take off their shoes before entering, if the lights should be left on (or turned off) after showings, or if any part of the house should be closed off.

What happens after showings?

The ShowingTime app or your agent will notify you when the showing is complete and you can return home.

You may get showing feedback from buyers through the ShowingTime app, via email, or from your agent. Feedback can provide valuable insights into your home’s price and condition from the buyer’s perspective.

Hopefully, you’ll also receive a call from your agent saying that the buyer loves your home and is interested in putting an offer in.

📝 Pro tip: Listen to home buyer’s feedback!

Buyer feedback isn’t always positive, and bad feedback can sting. Buyers may point out what they didn’t like about your home, what your home lacks, and if they think your listing is overpriced.

It can be easy to get offended by feedback, especially if the buyer seems overly critical. But try to take their feedback to heart: if multiple buyers offer the same feedback, you might be able to use the feedback to improve your listing.

6. Negotiate with potential buyers

Hopefully, you’ve received multiple offers within just a few days or weeks of going live!

The offer should contain the buyer’s offer price, if they’re asking you to pay for any of their closing costs, the type of financing used, an estimated closing date, and an offer expiry date (typically 24-48 hours after submission).

There are three ways sellers and their listing agents can respond to a buyer’s offer:

- Accept the offer. If the offer has everything you’re looking for – price, terms, and timing all look great – then you might just want to accept it without countering, especially if no other offers are on the table.

- Counter the offer. Most of the details of an offer to purchase your home are negotiable, including the home’s sale price and closing date. It could make sense to counter an offer if you’re confident you’d receive another good one if the buyer declines it.

- Ignore the offer. There’s no need to respond to a lowball offer or one that doesn’t meet any of your criteria – especially if you have stronger offers on the table (or you’re confident others will come in.

Remember, if you counter an offer and the buyer accepts it, you’re technically under contract.

How long might it take me to get an acceptable offer?

Timing depends mainly on your home’s desirability, and how well you’ve priced your home (higher-priced homes often take longer to sell).

Florida listings are on the market for a median of 52 days, although that figure is lower in the cities of Tampa (40 days), Orlando (39 days), and Jacksonville (42 days), according to Realtor.com.

| City | Median days on market |

| Tampa | 60 |

| Orlando | 65 |

| Pensacola | 67 |

| Jacksonville | 65 |

| Miami | 67 |

Talk with your agent to discuss expectations on when you might receive an acceptable offer after going live.

Price is important, but it’s not everything!

The highest sale price offer is not always the best offer you’ll receive. Besides price, other factors to consider include:

- Buyer closing costs: Is the buyer asking you to cover part or all of their closing costs? This will impact your total net proceeds at closing, so run the numbers carefully (and ask your agent for an updated net sheet).

- Financing type: Is the buyer paying all cash or financing the purchase? (Cash deals usually close faster and with fewer hiccups compared to financed deals).

- Earnest money: How much risk is the buyer taking on? A larger earnest money deposit gives the buyer more “skin in the game,” meaning they have more to potentially lose by backing out of the deal. Earnest money is usually between 1% to 3% of the home’s purchase price.

- Timing of sale: Is the buyer willing and able to close on the sale within your desired timeframe?

- Home sale contingency: Does the buyer need to sell a house in order to buy yours? It might not be worth the risk of the buyer’s other sale not closing – especially if you’re selling your home to buy another one, too.

Your real estate agent is in the best position to advise you on how to compare offers and negotiate with buyers.

7. Review paperwork and sign an offer

It’s time to review the contract and sign it!

Once all parties have signed, your home is under contract and you’re just a month or so away from closing on the sale.

In Florida, it usually takes about 35 days to close on a home sale after accepting an offer, lower than the national average of 58 days, according to Ellie Mae’s 2021 origination insight report.

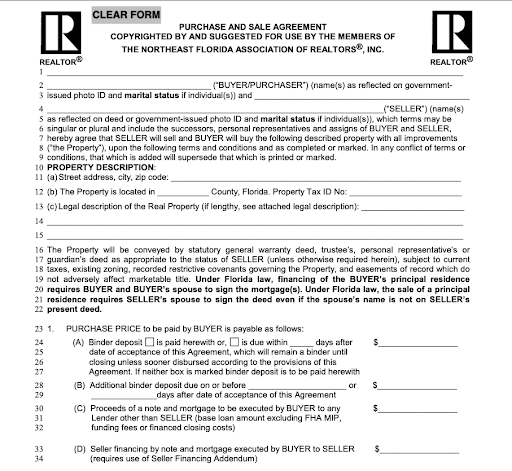

What’s in a Florida purchase and sale agreement?

Here are some key items the buyer’s offer to purchase form should contain:

- Basic details: The buyer and seller’s full legal names, and your home’s address.

- Purchase price: How much the buyer is offering to purchase your home.

- Possession date: The estimated date of closing, when ownership transfers to the buyer.

- Earnest money or binder deposit: Money submitted by the buyers, held in a trust or escrow account until closing, at which point it is applied to the home’s purchase price and/or closing costs.

- Personal property: Items to transfer to the buyer, such as appliances or storage sheds.

- Financing information: Conventional, FHA, VA, USDA, cash, or seller financing.

- Closing costs: A list of closing costs the buyer and seller agree to pay.

»LEARN: What does it mean to be under contract?

8. Conduct inspections, appraisals, and closing walk-through

Home inspection

Florida contracts typically provide buyers with a 10 to 15-day inspection period (or “due diligence” period), during which time they can conduct a home inspection.

Don’t worry: this step is a totally normal part of the home sale process. In fact, the vast majority of home buyers (87%) have a home inspection contingency nationwide.

You probably shouldn’t be home for the buyer’s home inspection. There’s a chance the buyer will be attending, along with their agent and inspector. The inspection takes 1-2 hours to complete.

The inspectors look for serious issues, including:

- Roof or plumbing leaks

- Water damage

- Heating and air conditioning failure or poor upkeep

- The presence of termites

- Mold, asbestos, or radon gas

- Insufficient grade sloping and drainage

- Code violations

Sellers usually don’t get to see the buyer’s home inspection report. But the buyer might ask you to fix any defects or serious issues discovered in the inspection (or negotiate a lower price or closing credit). Check with your agent.

Termite inspection

A Termite and Other Wood Destroying Organism Report (WDO), or CL-100, may be required.

You may or may not be on the hook for the cost of a termite inspection ($100 – $150), so check with your agent.

Appraisal

Lenders often require buyers to get an appraisal to determine the home’s fair market value and to be certain that the home is worth its purchase price. The appraisal is usually paid for by the buyer in Florida.

A licensed appraiser may visit your home to take interior and exterior photos, noting any features or upgrades that may add value to the home. They’ll compare your home to recent sales in your area, and use this information to generate a home valuation report.

Both the lender and buyer receive a copy of the appraisal. You’ll get notified if your home’s appraised value comes in lower than the buyer’s purchase price – in which case you may have to re-negotiate the price with the buyer.

Final walk-through

The buyer may have the opportunity to do a walk-through of the home a day or two before closing, to make sure the home is in the same condition since their last viewing.

Here’s what you need to do before their walk-through:

- Clear out your house entirely if you haven’t yet, removing all personal belongings.

- Repair or patch any damaged drywall, paint, or nail holes.

- Make sure items included in the sale contract are still there (appliances, light fixtures, etc).

- Do some light cleaning if the home is dirty.

9. Close on your home sale

You’re almost at the finish line! It’s time for the closing process. Here’s what to do in the days leading up to your scheduled closing.

Look out for a closing disclosure

You’ll likely need to sign this form one to three days before closing. It contains every cost to be paid by the buyer and seller. Double check all the numbers with your agent (including realtor commission, and your home’s final sale price), and speak up if the numbers don’t look right.

Clear out your house entirely

Your home should be completely empty before the buyer’s scheduled closing walk-through. It’s a good idea to do another walk-through yourself before then just in case you missed something.

Hand the keys to your agent

Your realtor will likely need your spare house keys and garage door openers to hand over to the buyer’s agent, so the buyer can gain access to the home.

Find out when and where the closing is scheduled

Most of the paperwork has already been completed on your end. Ask your agent if you need to attend your closing in person, if you can sign any remaining paperwork digitally, or if need to give your agent power of attorney to close.

Keep in touch

Buyer closings get delayed quite frequently (there are a lot of moving parts in a real estate transaction), so don’t be surprised if the closing doesn’t happen exactly at its scheduled time. Your agent should keep you updated on closing status 24/7.

💰Final step: Get your money!

Congratulations: Once you and the buyer have signed all documents, you’ve closed on your home sale!

The home’s sale price pays out the realtor commission, closing costs, and outstanding mortgages or liens owed on the property.

Net proceeds are usually wired to a bank account after closing. Contact your agent, attorney, or title company for more details on how and when you’ll get paid.

Next steps after selling a house in Florida

While your home sale is technically complete, there are a few things you might want to do after closing.

Save your home sale documents

It’s best to have both physical and digital copies of the home sale contract for your taxes, and personal records, in case any issues come up after closing.

Calculate your potential capital gains tax

You may or may not owe tax on the sale of your home. It depends on how much your home rose in value since you bought it.

The IRS excludes home sale gains of up to $250,000 for an individual and $500,000 for a married couple who have lived in and owned a home for at least two of the last five years.

Contact your tax advisor for more guidance on capital gains tax and if you’ll owe anything.

Notify the U.S. Postal Service and DMV

You may want to set up mail forwarding to your new address via the USPS website (it costs $1.10 to do so).

Are you staying in Florida? The Florida DMV also requires residents to update their driver’s license and title/registration within 30 days of changing an address.

If you’re moving out of Florida, you can return your license plate via mail to a motor vehicle service center.

Show your agent some love

Did your agent do a great job? Take it from me: they’d be thrilled if you left them a positive Zillow review, and referred them to family and friends who are interested in buying or selling a home.

FAQ about selling a house in Florida

How much does it cost to sell a house in Florida?

It typically costs around 7% of your home's sale price to sell a home in Florida. The average realtor commission cost is 5.40%, covering both your agent and the buyer's agent, while closing costs average 1.60%.

However, you can potentially save thousands by working with a low commission rate real estate company or trying to negotiate a lower rate with agents on your own.

Can you sell a home in Florida without a realtor?

Yes, you can sell for-sale by owner in Florida to avoid paying a listing commission (2.7%). But you'll need to do complete every task an agent would handle, including advertising your home, completing all of the required paperwork, negotiating with buyers, and closing.

FSBO in Florida likely works best for experienced sellers, or if you're planning to sell to someone close to you (such as family or friends) and have assistance from a local real estate attorney to handle all of the paperwork and legal requirements to sell.

If you're trying to save money on your home sale and putting your home on the market, you likely have lower-risk options, such as a low commission realtor or brokerage.

What documents are needed to sell a house in Florida?

There are many documents needed to close on a home sale in Florida. They include, but are not limited to:

- A fully executed Florida residential sales contract

- Deed

- Agreement related to property taxes

- Title insurance documents

- Seller affidavit

- Closing disclosure

- Seller's property disclosure (if applicable)

Check with a local real estate professional for more advice on what legal documents you'll need to close on your home sale.

Why you should trust us

Our mission is to provide accurate, actionable, and practical information you can use to make better decisions on your real estate journey.

To help create this Florida home selling guide, we pulled information from the following sources:

- National Association of Realtors (NAR) 2021 Home Buyers and Sellers Generational Trends report

- NAR’s 2021 Profile of Home Buyers and Sellers

- Realtor.com’s Spring 2022 Home Seller Report

- Real Estate Witch’s average real estate commission in Florida

- Redfin’s The Trials of a 2021 HomeBuyer

- The Northeast Florida Association of Realtors website

- Institute of Florida Real Estate Careers online courses

- The Florida Senate’s Statutes Section 278 (authorized brokerage relationships)

We also pulled data from Clever Real Estate’s 2022 Role of the Realtor survey and 2022 Average Commission Rates by State series.

About the author

I’m a real estate agent, investor, and personal finance writer based in South Carolina.

While working as a full-time agent between 2020-21, I closed 19 transactions totaling $6 million in volume, assisting both buyers and sellers. As an investor, I own and manage 6 single-family rental properties throughout the Carolinas.

I’ve written dozens of articles and guides to educate homeowners on the home sale process. Before writing for Real Estate Witch, I spent more than 6 years on NerdWallet’s content team as a personal finance writer, where my work was published in USA Today, The Associated Press, and US News, among other publications.

Related links

How to Choose a Realtor: Expert Secrets. Learn how to vet agents, set up interviews, read and sign a buyer’s agency agreement or listing agreement, and pick the best realtor for you.

How to Sell Your House – The Ultimate Guide: Our guide breaks down the process of selling your house from start to finish, to educate you on the process and help prepare you for your big sale.

How to Sell a House Without a Realtor: If you know what you’re doing, you can cut out seller agent fees by listing your house “for sale by owner” (FSBO). Learn more now.

Clever Real Estate – Must-See Reviews: The Real Estate Witch team reviews the agent-matching service Clever Real Estate. Does its service actually save sellers $9,600 in commission fees, on average, as it claims?

Leave a Reply