Published

Do you need to sell a house fast in Georgia? If you’re looking to sell your home with or without the help of a realtor, we’ve got you covered.

Our step-by-step guide breaks it down from start to finish. We discuss how to find an agent, list your home for sale, fill out property disclosures, list a home in “as-is” condition, negotiate with buyers, sign paperwork, and navigate the closing process.

We also break down how you can save money on Georgia home sale costs, including shopping around for real estate agents.

One option is to use our free agent matching service, which pre-negotiates lower listing commission rates for you. Sellers pay a 1.5% listing agent commission – much lower than the average Georgia listing agent commission rate of 2.93%.

9 steps to selling a house in Georgia

- Decide on how to sell

- Sign a listing agreement

- Set a list price

- Prepare to list your house

- Market and show your house

- Negotiate with buyers

- Review paperwork and disclosures

- Conduct inspections

- Close on your sale

1. Decide on how to sell

You have a huge first decision: Should you try to sell your house for sale by owner (FSBO), hire a realtor, or sell to a cash buyer?

Selling without a real estate agent in Georgia

Listing your home without a realtor will save you on listing agent commission, which averages 2.94% of the home sale price in Georgia (saving you $14,700 commission on a $500,000 home.)

Is the hassle of selling FSBO worth the savings in Georgia? Here are some key drawbacks:

- It’s a complicated, time-consuming process. There’s tons of paperwork and legal requirements.

- You risk making costly mistakes during the process. An agent has the experience and knows which pitfalls to avoid.

- You’ll have to handle all of the stuff that an agent would normally take care of. That includes photography, showings, negotiating with buyers, handling inspections and appraisals, etc.

- You likely still owe a buyer’s agent commission (2% to 3%), unless you have a buyer lined up.

- There’s no guarantee you’ll save money. Studies show that FSBO properties sell for around 6% less than homes sold by agents, which negates any commission savings.

Selling with a real estate agent in Georgia

Using an experienced, licensed realtor is a great idea. However, quality and price vary widely by agents.

We recommend comparing your options to find the best realtor for your situation and budget. For the best results, aim to compare 2-3 local sellers’ agents.

The fastest, most efficient way to find quality options is to use an agent matching service (AMS).

How it works: You provide basic info about your home and what you’re looking for in an agent, and the service quickly matches you up with top Georgia real estate agents from name-brand brokerages, like Keller Williams and Century 21.

Some companies can potentially save you thousands on realtor commissions.

For example, through our network of top-performing local agents, we offer pre-negotiated listing fees of just 1.5% (saving you about 50% compared with the average Georgia listing agent commission of 2.94%).

Sell to a cash buyer

If you want to sell your house ASAP, selling to a cash buyer is likely the fastest, most convenient way to sell.

You can get a near-instant cash offer from an iBuyer company, and close in as little as 8-10 days – much faster than the typical 60-90 day timeframe listing on the market.

You won’t have to do any of the work that’s required to sell a home. No need to clean and declutter your house, get it ready for photos, and host buyer showings.

However, you probably won’t get as much money compared to listing your home on the open market – especially in a seller’s market.

Need to sell ASAP? Check out Offerpad, an iBuyer company that can close in as fast as 8 days.

2. Sign a Georgia listing agreement and seller disclosures

If you’ve decided on using an agent, it’s time to read and sign a Georgia listing agreement to get your house on the market.

The listing agreement contains important details of your home sale. Key things to pay attention to include:

- Type of listing agreement: Most agents work under an exclusive right-to-sell listing agreement (single agency). It means the agent works solely for you and gets paid regardless of whether they bring forward a buyer or not.

- Listing commission rate: The agent’s stated commission rate should match up to what’s on the listing agreement. Ask them what the commission includes, and if there are any extra fees.

- Items that convey with the property: If you plan to keep items or belongings in the home like appliances, you’ll need to include them in the contract.

Realtor disclosure requirements

Georgia law requires agents to provide you with an agency disclosure form. The form describes all of the agent’s legal duties to you.

Here is the type of real estate agency agreements in Georgia:

- Single agent relationship. The agent or broker represents only one party (either the buyer or seller) and acts as a fiduciary. A single agent relationship gives you the most protection compared to other options.

- Designated agency. A real estate broker can have two of its agents represent clients in the same transaction. But each agent is prohibited from disclosing any information that’s requested to be confidential.

- Dual agency. One agent can represent both you and the buyer in the same transaction. This might happen if your listing agent brings a buyer to the table. Dual agency is legal in Georgia.

- Transaction broker relationship. The agent or broker provides limited representation to a buyer, seller, or both parties in a transaction, and does not act as a fiduciary. It’s a less desirable option since the agent doesn’t have to act in your best interests.

Contact a local real estate attorney for more advice on Georgia listing agreements and required disclosures.

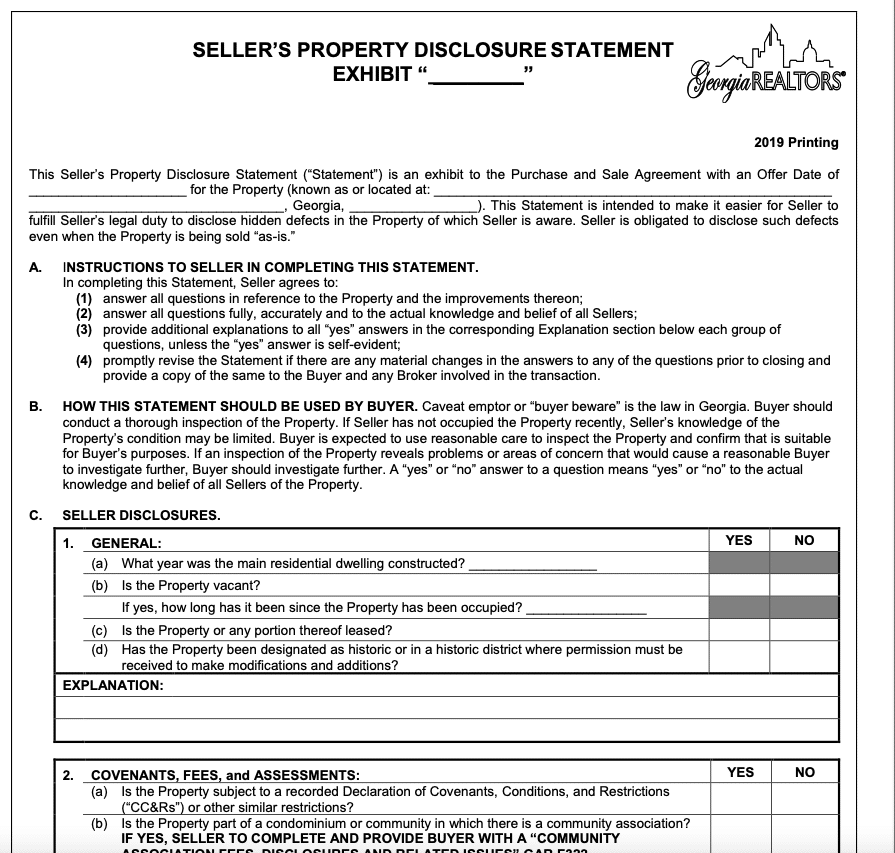

Selling a house in Georgia: What needs to be disclosed?

Georgia doesn’t require its home sellers to fill out a formal disclosure form. But you’ll still need to disclose any of your home’s known material defects.

These may include roofing or plumbing issues, structural additions to the property (e.g. new bedrooms), heating and air conditioning issues, and past storm damage.

To protect yourself from possible legal claims, it may be a good idea to complete a seller’s property disclosure form.

Ask your real estate attorney or agent about what you need to disclose to buyers.

Can I sell a house “as-is” in Georgia?

Yes. You can sell your Georgia home in “as-is” condition, meaning you won’t make any buyer-requested repairs.

Simply tell your realtor that you want to list your home in this language. They’ll include it in the listing description, and let each buyer’s agent know before showings.

3. Price your home

Now it’s time to set a competitive listing price for your home.

Home value estimators can provide you with a quick ballpark estimate of your home’s potential value, based on your property’s key features, recent home sales, active listings, neighborhood data, and local market trends.

Your agent should provide you with a comparative market analysis (CMA) report. A CMA is an estimate of your home’s fair value, based on its condition, upgrades, and recent sale prices in your area.

» Request a free CMA from a Georgia real estate agent

A CMA is a great tool to help you and your agent set a fair listing price for your home. But it’s just a recommendation: you can always list for more (or less) than the CMA valuation.

Is a CMA free for Georgia home sellers?

Georgia realtors may provide a free CMA during their initial interview.

You may have to pay for a CMA (or broker price opinion) if you’re selling “for sale by owner” and just need a professional pricing recommendation.

Should I just get a pre-listing appraisal instead?

You can technically get an appraisal before listing your home for sale to get a more accurate valuation.

However, appraisals are expensive ($290 to $365 in Georgia) and can be time-consuming (1-2 weeks to complete), so it needs to fit within your budget and timeframe.

There’s also no guarantee your home value will come in higher with an appraisal compared to your agent’s CMA, so keep this in mind before moving forward.

4. Prepare your home for sale

After pricing your home, it’s time to get prepared for going live! Here’s what to do next.

Gather important documents

Georgia home sales may require a variety of documents and records for closing, including your mortgage statement, homeowners and flood insurance records, HOA documents, and property tax bills.

It’s also a good idea to gather utility bills, and any home warranties or appliance manuals you might have, in case the buyer requests them (I’ve had several buyer clients do so before closing).

Get a pre-listing inspection

Consider a home inspection ($200 to $500) if you suspect your home has an issue that could potentially delay or derail your sale.

A pre-listing inspection can potentially help you spot and fix issues with your home before those issues surface on a buyer’s home inspection.

However, an experienced real estate agent can advise you on whether or not a pre-listing inspection is worth your time and money.

Make home repairs and improvements

Based on your home’s condition and your marketing strategy, it could be worth making certain repairs or improvements.

Common home inspection issues in Georgia are related to:

- Mold and mold spores.

- Water damage from storms, plumbing leaks, or leaky roofs.

- Deferred maintenance on HVAC units.

- Masonite or Louisiana Pacific siding.

- Polybutylene piping.

Your agent is in the best position to advise you on which repairs or improvements to make before listing. In a strong seller’s market, you might not have to make any updates.

Home staging in Georgia

Staging can increase your home’s appeal and lead to a higher sale price. But it’s often not worth the cost and hassle – especially for furnished homes.

Home staging is expensive, costing $741 to $2,664 nationally, according to HomeAdvisor. But pricing depends on the size of your home, the number of rooms staged, and your local market.

Consult with your realtor for advice on whether or not home staging is right for you.

Georgia home sale calculator: How much will I make?

Here’s a calculator to show you what you might earn in a home sale after deducting typical home sale costs, including realtor commission and closing costs.

Georgia realtor commission

Georgia home sellers pay an average realtor commission rate of 5.87%. The cost is usually split evenly by the listing agent and the buyer’s agent.

However, you can potentially save thousands by using our agent matching service, which is much easier than negotiating a lower rate with agents on your own.

Closing costs

Georgia homeowners pay average seller closing costs of .80%, which includes common costs in Georgia, like title insurance and closing fees.

Mortgage/liens

Money owed on your property, which is paid in full at closing by your attorney or title company. Enter in your actual amount, which can be found on your most recent mortgage statement.

Net proceeds

The amount of money you’d walk away with from your home sale at various price points after deducting all home sale costs (commission, closing costs, and mortgages.)

Request a seller’s net sheet from your realtor for a more accurate proceeds estimate.

5. Market and show your home to buyers

Now it’s time to actually list your home and host potential buyers!

For-sale sign: Your listing agent will put a sign on your front lawn to let the local neighborhood know you’re ready for business! It contains your agent’s name and contact information, in case someone’s interested.

Multiple listing service (MLS): They’ll post your home for sale on the local MLS: a database most real estate agents use to market and sell properties. It also blasts your home on popular real estate sites (Zillow, Trulia, Realtor, etc).

Are you selling without a realtor in Georgia? You might want to list your home on the MLS via flat-fee MLS services, so it reaches buyers’ agents and their clients.

My listing is live: What happens next?

Not sure what to do before showings arrive? Here’s what to do next:

- Decide on what to do with your pets: I’ve had sellers keep their pets in the backyard or garage during showings, while others removed them from the home entirely. It’s your call!

- Check out your listing on Zillow: Make sure you like all of the photos used by your agent (contact them if you don’t).

- Read the agent’s listing description: It should describe all of your home’s main features and selling points and have good grammar and punctuation.

- See if your agent will host open houses: It could drive more interest in your listing and attract buyers.

- Post the listing on social media: Get the word out to family and friends, and consider sharing the listing on local Facebook groups.

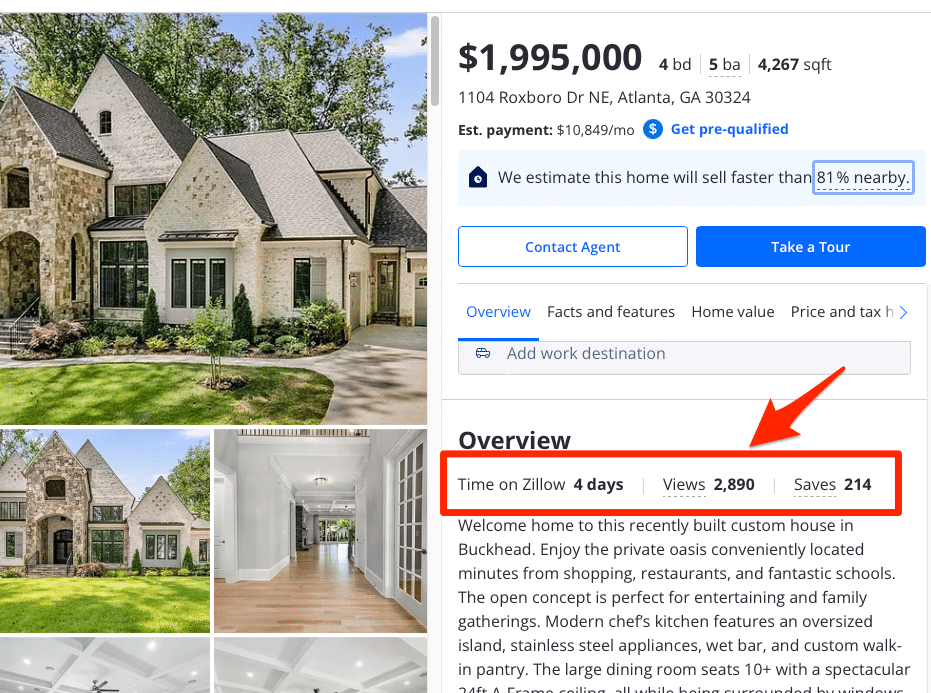

Check how many people have viewed and saved your listing on Zillow and compare that to other local listings to see how it’s performing.

This information can be found under “overview” on your listing’s Zillow page (example below):

What to expect from buyer showings (tips from an agent)

How are showings booked?

Most agents use a mobile app called ShowingTime to help manage showing appointments.

The app allows buyers to request showings digitally, while sellers can view and approve (or deny) any showing requests (and agents are notified of all activity).

You may start to get showing requests within just a day or two of going live, although it could take longer depending on your home’s price, condition, and local market.

What happens during showings?

Leave your home so the home buyer and their agent can tour your home (buyers and sellers rarely have direct contact, and only communicate through agents.)

Showings typically last between 15 to 45 minutes, depending mainly on the size of your house and how fast the buyer can walk through it.

Let your agent know if you have any special showing requirements.

What happens after showings?

The ShowingTime app or your agent will notify you when the showing is complete and you can return home.

You may get showing feedback from buyers through the ShowingTime app, via email, or from your agent. Feedback can provide valuable insights into your home’s price and condition from the buyer’s perspective.

Hopefully, you’ll also receive a call from your agent saying that the buyer loves your home and is interested in putting an offer in.

🙍 Pro tip: Listen to home buyer’s feedback!

Buyer feedback isn’t always positive, and bad feedback can sting. Buyers may point out what they didn’t like about your home, what your home lacks, and if they think your listing is overpriced.

It can be easy to get offended by feedback, especially if the buyer seems overly critical. But try to take their feedback to heart: if multiple buyers offer the same feedback, you might be able to use the feedback to improve your listing.

6. Negotiate with buyers

With luck, you’ve received multiple offers within just a few days or weeks of going live!

The buyer’s purchase agreement should contain an offer price, if they’re asking you to pay closing costs, the type of financing used, an estimated closing date, and an offer expiry date (typically 24-48 hours after submission).

There are three ways sellers and their listing agents can respond to a buyer’s offer:

- Accept the offer: If the offer has everything you’re looking for – price, terms, and timing all look great – then you might just want to accept it!

- Counter the offer: Almost everything is negotiable, not just your home’s sale price. It could make sense to counter an offer if you’re confident you’d receive another good one if the buyer declines it.

- Ignore the offer: There’s no need to respond to a lowball offer or one that doesn’t meet any of your criteria – especially if you have stronger offers on the table (or you’re confident others will come in.

How long might it take me to get an acceptable offer?

Timing depends on well you’ve priced your home and your local market. Georgia listings are on the market for a median of 35 days, although that figure varies by city, according to Realtor.com.

| City | Median days on market |

|---|---|

| Savannah | 64 |

| Macon | |

| Atlanta | 52 |

| Columbus | 39 |

| Augusta | 84 |

Talk with your agent to discuss expectations on when you might receive an acceptable offer after going live.

Price is important, but it’s not everything!

The highest price offer is not always the best offer. Besides price, other factors to consider include:

- Buyer closing costs: Is the buyer asking you to cover part or all of their closing costs? This impacts your total net proceeds at closing, so run the numbers carefully.

- Financing type: Is the buyer paying all cash or financing the purchase? (Cash deals usually close faster and with fewer hiccups compared to financed deals).

- Earnest money: Earnest money is usually between 1% to 3% of the home’s purchase price. A larger earnest money deposit means the buyer has more to potentially lose by backing out of the deal.

- Timing of sale: Is the buyer willing and able to close within your desired timeframe?

- Home sale contingency: Does the buyer need to sell a house in order to buy yours? It might not be worth the risk of the buyer’s other sale not closing — especially if you have stronger offers on the table.

Your realtor is in the best position to advise you on how to compare offers and negotiate with buyers.

7. Review paperwork and disclosures

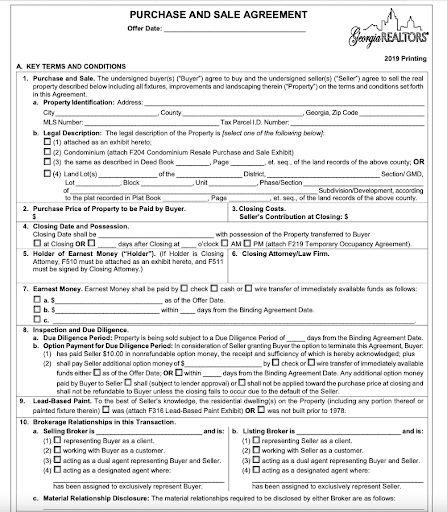

Once you’ve decided to accept an offer and you’ve talked it through with your agent, it’s time to review the contract and sign!

After all parties have signed, your home is under contract and you’re just a few months away from closing.

It takes about 58 days to close on a home sale after accepting an offer nationwide, according to Ellie Mae’s 2021 origination insight report, but it could range from 30 to 60 days or longer.

What’s in a Georgia offer or “purchase and sale agreement”?

- Purchase and sale: Your property’s address and legal description.

- Purchase price: What the buyer is offering to pay for your property.

- Closing costs: The amount you agree to contribute towards the buyers closing costs (if any).

- Closing date and possession: Your expected closing date, and when the buyer can move into the home.

- Holder of earnest money: Where the earnest money is held until closing.

- Closing attorney: Who you or the buyer have agreed to use as your closing attorney.

- Earnest money: What the buyer is offering to deposit, and the type of funds (cash, check, wire transfer).

- Inspection and due diligence period: How long the buyer has to inspect your property and terminate the agreement.

- Lead-based paint: If you’ve completed a lead-based paint form (required on homes built prior to 1978).

- Brokerage relationships: How the buyer and seller are being represented (either as a client, customer, or under a dual agency or designated agency agreement).

8. Conduct inspections, appraisals, and closing walk-through

Home inspection

Georgia contracts provide buyers with an inspection period (or “due diligence” period), during which time they can conduct a home inspection. The vast majority of buyers (87%) have a home inspection contingency nationwide.

Home inspections usually take 1-2 hours to inspect and report on the overall condition of the home, pointing out potential issues (such as roof and plumbing leaks, mold, etc.)

The buyer may ask you to fix any defects or serious issues discovered in the inspection.

Check with your agent to learn what you’re obligated to fix and how to navigate Georgia real estate laws.

Termite inspection

Termites are common in Georgia, and a Termite and Other Wood Destroying Organism Report (WDO), or CL-100, may be required when buying a home.

You may or may not be on the hook for the cost of a termite inspection ($75 – $150), so check with your agent for more information.

Appraisal

Lenders often require buyers to get an appraisal to be certain that the home is worth its purchase price. It’s typically paid for by the buyer in Georgia.

The appraiser visits your home to take interior and exterior photos. They’ll compare your home to recent sales in your area, and generate a report that provides an opinion of value.

If your home’s appraised value comes in lower than the buyer’s purchase price, you may have to re-negotiate the price with the buyer.

Final walk-through

The buyer may do a walk-through of the home a day or two before closing, to make sure the home is in the same condition since their last viewing.

9. Close on your home sale

You’re almost at the finish line! Here’s what to do in the days leading up to your scheduled closing.

Look out for a closing disclosure

You’ll likely need to sign this form 1-3 days before closing. It contains every cost to be paid by the buyer and seller, the home’s final sale price, prorated property taxes, and your estimated net proceeds.

Double-check all the numbers with your agent, and speak up if the numbers don’t look right.

Clear out your house entirely

Your home should be completely empty before the buyer’s scheduled closing walk-through.

Hand the keys to your agent

Your realtor will likely need your house keys and garage door openers to hand over to the buyer’s agent.

Find out your closing date

Most of the paperwork has already been completed on your end. Ask your agent if you need to attend your closing, or if you can sign any remaining paperwork digitally.

Keep in touch!

Buyer closings get delayed quite frequently (there are a lot of moving parts in a real estate transaction)!

Don’t be surprised if the closing gets pushed back. Your agent should keep you updated on closing status 24/7.

🏦Final step: Get your money!

Once you and the buyer have signed all documents, you’ve closed on your home sale. Congratulations!

The home’s sale price pays off the realtor commission, closing costs, and covers any outstanding mortgages or liens owed on the property.

Net proceeds are usually wired to a bank account after closing. Contact your agent, attorney, or title company for more details on how and when you’ll get paid.

Next steps after closing

While your home sale is technically complete, there are a few things you might want to do after closing.

Calculate your potential capital gains tax

You may or may not owe tax on the sale of your home.

The IRS excludes home sale gains of up to $250,000 for an individual and $500,000 for a married couple who have lived in and owned a home for at least two of the last five years.

Contact your tax advisor for more guidance on capital gains tax and if you’ll owe anything.

Save your home sale documents

It’s best to have both physical and digital copies of the home sale contract for your taxes and personal records. This will also help you calculate potential capital gains tax.

Notify the U.S. Postal Service and DMV

You may want to set up mail forwarding to your new address via the USPS website (it costs $1.10).

If you’re staying in the state, the Georgia DMV also requires residents to update their driver’s license and title/registration within 60 days of changing an address. It can be done online or in person.

If you’re moving out of Georgia, you’re not required to return your Georgia license plates.

Leave a nice Zillow review

Did your agent do a great job? They’d be thrilled if you left them a positive Zillow review, and referred them to family and friends who are interested in buying or selling a home.

Selling a home in Georgia FAQ

How much do sellers pay at closing in Georgia?

Georgia home sellers are responsible for paying realtor commissions (both the buyer's and seller's agent), as well as seller closing costs.

The total cost to sell in Georgia is 5.87% for realtor commissions and .80% in closing costs. On a $500,000 home sale, that equals $33,350.

However, sellers can potentially save thousands by using an agent matching service that offers built-in savings.

What do sellers need to disclose to buyers when selling in Georgia?

Georgia sellers need to disclose any of your home's known material defects. You can do so by filling out a property disclosure form.

Material defects may include roofing or plumbing issues, structural defects, prior storm damage, and HVAC issues.

Buyers might have a legal case against you if they can prove that you:

- Failed to disclose a previously known issue or defect.

- Lied about a material defect.

- Disclosed the wrong or inaccurate information on purpose (like purposely listing the wrong age of your roof or HVAC system).

Note: This should not be viewed as legal advice. Contact a local real estate agent or attorney for help on how to correctly fill out a property disclosure statement in Georgia.

What documents or paperwork is needed to sell on a Georgia home?

There are numerous legal documents required to sell a Georgia home. They often include the following forms:

- Residential purchase and sale agreement

- Georgia listing agreement and real estate brokerage disclosure form

- Georgia seller's property disclosure

- Termite and Other Wood Destroying Organism Report (WDO), or CL-100

- Buyer's home appraisal

- Homeowners association addendum

- Flood insurance documents (if applicable)

- Lead-based paint disclosure (if applicable)

- Closing disclosure

- Signed deed

- Bill of sale

- Affidavit of title

Ask your realtor or attorney for more guidance.

Do I need an attorney to sell in Georgia?

Yes. Georgia requires sellers hire a licensed attorney to close a home sales transaction, and the attorney must be physically present at the closing, according to a Georgia Supreme Court order.

Why you should trust us

Our mission is to provide accurate, actionable, and practical information you can use to make better decisions on your real estate journey.

To help create this home selling guide, we studied research from the following sources:

- National Association of Realtors (NAR) 2021 Home Buyers and Sellers Generational Trends report

- NAR’s 2021 Profile of Home Buyers and Sellers

- Realtor.com’s Spring 2022 Home Seller Report

- Real Estate Witch’s average real estate commission in Georgia

- Redfin’s The Trials of a 2021 HomeBuyer

- Georgia Real Estate Commission website

- Georgia Association of Realtors

- Realtor’s ABCs of Agency

- HomeAdvisor’s True Cost Guide

We also pulled data from Clever’s 2022 Role of the Realtor survey.

About the author

I’m a real estate agent and investor based in South Carolina.

While working as a full-time agent between 2020-21, I closed 19 transactions totaling $6 million in volume, assisting both buyers and sellers. As an investor, I’ve bought and sold homes in Wisconsin, North Carolina, and South Carolina.

I’ve written dozens of articles and guides to educate homeowners on the home sale process. Before writing for Real Estate Witch, I spent more than 6 years on NerdWallet’s content team as a personal finance writer, where my work was published in USA Today, The Associated Press, and US News, among other publications.

Related Links

The True Cost to Sell a Home in Georgia Revealed. Wondering how much it’ll cost you to sell your home? Our guide breaks down typical realtor commissions and seller closing costs in Georgia.

How to Choose a Realtor: Expert Secrets. Learn how to vet agents, set up interviews, read and sign a buyer’s agency agreement or listing agreement, and pick the best realtor for you.

How to Sell Your House – The Ultimate Guide: Our guide breaks down the process of selling your house from start to finish, to educate you on the process and prepare you for your big sale.

How to Sell a House Without a Realtor: If you know what you’re doing, you can cut out seller agent fees by listing your house “for sale by owner” (FSBO). Learn more now.

Clever Real Estate – Must-See Reviews: The Real Estate Witch team reviews the agent-matching service Clever Real Estate. Does its service actually save sellers $9,600 in commission fees, on average, as it claims?

Leave a Reply