Published

Is the Redfin Refund right for me? | Redfin Refund vs. other buyer rebates | Savings calculator | Is there a catch? | Where are Redfin rebates available?

❗ Editor’s note

Redfin has reportedly shut down the Redfin Refund, its buyer rebate program.

Sources indicate that Redfin started phasing out its commission rebate program in August 2022.

We recommend reaching out to your local Redfin office to find out if the company still offers rebates in your area.

What is the Redfin Refund?

The Redfin Refund is a home buyer rebate program that offers a closing cost credit to eligible buyers.

Some home buyer rebates can provide good overall value to buyers, but it’s important to make sure you find a great agent. Although Redfin doesn’t provide quite as much personalized customer service as traditional agents, most buyers get enough hands-on support to make the refund worth the trade-offs.

But many companies like Redfin offer similar (or better) customer service, along with refunds or cash back.

What’s the best alternative to Redfin’s buyer rebate?

If your local Redfin office doesn’t offer a home buyer rebate, we recommend checking out Clever Real Estate.

Clever matches buyers with top agents from well-known brokerages like Century 21 and Keller Williams. It also offers eligible buyers $250 in cash back after closing, or $500 if you buy and sell with Clever.

Clever Cash Back is available in most states, excluding Alabama, Alaska, Kansas, Mississippi, Missouri, Oklahoma, Oregon, and Tennessee.

💰 Find top buyer’s agents in your area, get cash back when you buy!

Who should use the Redfin Refund?

Redfin can be a good alternative to buying with an agent who doesn’t offer built-in savings. However, the company limits what you can do with the money you save. Redfin typically applies rebates straight toward your closing costs.

That said, it may make sense to buy with Redfin if you’ve already decided to sell with a Redfin agent as well. If you buy and sell a house with Redfin, it’ll reduce your listing fee to 1% from its 1.5% rate — in addition to your buyer rebate. But Redfin isn’t the only discount brand that offers 1% real estate commission rates, so you’ll still likely find more dollar-for-dollar savings with another company.

Where is the Redfin Refund available?

Redfin rebates are available throughout most of the company’s service area, excluding states where buyer’s agent commission refunds are illegal. But there are a few additional locations where Redfin doesn’t currently offer rebates.

✍️ Editor’s note

Conventional home buyer rebates are banned in Alabama, Alaska, Kansas, Mississippi, Missouri, Oklahoma, Oregon, and Tennessee. If you live in one of these eight states, you won’t be eligible for a home buyer rebate from any brokerage.

Find your state in the table below to see if the Redfin Refund is available in your area. Then see which companies offer home buyer rebates near you so you can compare your options and choose the best one.

| State | Is the Redfin Refund available? |

|---|---|

| Alabama | No, Redfin is unavailable in this state |

| Alaska | No, Redfin is unavailable in this state |

| Arizona | Yes, but not in Tucson |

| Arkansas | No, Redfin is unavailable in this state |

| California | Yes |

| Colorado | Yes |

| Connecticut | No, Redfin is unavailable in this state |

| Delaware | No, Redfin is unavailable in this state |

| District of Columbia | Yes |

| Florida | Yes |

| Georgia | No, Redfin is unavailable in this state |

| Hawaii | Yes |

| Idaho | No, Redfin is unavailable in this state |

| Illinois | Yes |

| Indiana | Yes |

| Iowa | No, Redfin is unavailable in this state |

| Kansas | No, Redfin is unavailable in this state |

| Kentucky | No, Redfin is unavailable in this state |

| Louisiana | No, Redfin is unavailable in this state |

| Maine | No, Redfin is unavailable in this state |

| Maryland | Yes |

| Massachusetts | Yes |

| Michigan | Yes |

| Minnesota | Yes |

| Mississippi | No, Redfin is unavailable in this state |

| Missouri | No, Redfin is unavailable in this state |

| Montana | Yes |

| Nebraska | No, the Redfin Refund is unavailable in this state |

| Nevada | Yes |

| New Hampshire | Yes |

| New Jersey | Yes |

| New Mexico | Yes |

| New York | Yes |

| North Carolina | Yes |

| North Dakota | Yes |

| Ohio | Yes, but not in Cleveland |

| Oklahoma | No, home buyer rebates are illegal in this state |

| Oregon | No, home buyer rebates are illegal in this state |

| Pennsylvania | Yes |

| Rhode Island | Yes |

| South Carolina | Yes |

| South Dakota | Yes |

| Tennessee | No, home buyer rebates are illegal in this state |

| Texas | Yes, but not in El Paso, San Antonio, or South Texas |

| Utah | Yes |

| Vermont | Yes |

| Virginia | Yes |

| Washington | Yes |

| West Virginia | No, Redfin is unavailable in this state |

| Wisconsin | No, Redfin is unavailable in this state |

| Wyoming | Yes |

How does the Redfin buyer refund compare to other home buyer rebates?

Redfin is one of only two home buyer refund programs available nationwide. It’s also a well-known brand name that has been around longer than most of its competitors.

While there’s certainly value in working with an established brand, the bottom line is that other companies offer better service and overall value for most buyers.

Clever Real Estate: The best nationwide alternative

Clever Real Estate’s free service is the best nationwide alternative to Redfin because it provides full service to buyers throughout the home buying process.

As a buyer, when you work with Clever you’ll be introduced to top agents from trusted brokerages like Keller Williams and Berkshire Hathaway. You can interview as many real estate agents as you like, which lets you compare your options and find a local agent who’s a great fit for your home buying journey.

As an added bonus, eligible buyers can receive cash back after closing without having to sacrifice the hands-on support of a traditional realtor. With Clever, you’ll enjoy all the service and support you expect from a traditional agent.

» MORE: Find top buyer’s agents in my area!

Regional brokers like Homie may offer the largest commission rebates

Some regional brokerages, such as Homie Real Estate, offer larger buyer’s agent commission refunds than Redfin. But they typically have much smaller service areas.

» MORE: Homie vs. Redfin: Which is better?

Here’s what to look for when you’re evaluating regional or local discount brokerages:

Service trade-offs

Some home buyer rebate programs come with unusual restrictions that could affect your customer experience.

Before you sign with an agent, verify whether there are any additional strings attached to the rebate by asking questions like, “Am I required to use any of the brokerage’s in-house services, like mortgage or title?”

Maximum savings or minimum fees

Most companies have restrictions that limit your savings at certain price points. Prevu, for example, offers one of the largest refunds on the market — but you must purchase a home over $750,000 to receive the full amount.

Before signing with a company, ask for an estimated refund for the price range of the home you’re looking to buy.

How much can I save with the Redfin Refund?

The average buyer who qualifies for the Redfin Refund will save around 0.2% of the purchase price of their home, based on our research.

Here’s the typical Redfin Refund amount for homes in different price ranges:

| Home price | Average savings* | Actual rebate % |

|---|---|---|

| $200,000 | $300 | 0.2% |

| $300,000 | $570 | 0.2% |

| $500,000 | $1,250 | 0.3% |

| $750,000 | $2,175 | 0.3% |

| Average | $1,074 | 0.22% |

Unlike most of its competitors, Redfin doesn’t have a straightforward formula for how it calculates buyer rebates.

We estimated the average Redfin Refund by analyzing 73 property listings in ten different markets across multiple price points.

Our analysis shows that Redfin’s rebate ranges anywhere from 0.06–0.4% of the final sale price of the home.

✍️ Editor’s note

If you buy and sell with Redfin within a year, the company will charge you a 1% listing fee instead of its traditional 1.5%. So you could save an additional 0.5% — in addition to the buyer’s refund if you purchase an eligible home.

» MORE: See how Redfin’s fees compare with other low commission real estate companies

Redfin Refund calculator

Estimate the size of your Redfin commission refund by using the calculator below. Simply select the price of the home you plan to purchase, and the calculator will give you an estimated refund based on our analysis of Redfin’s current listings.

How does Redfin calculate your buyer rebate?

The short answer is that Redfin isn’t clear about how it calculates its refund. We reached out to Redfin to clarify, but it simply said the refund varies from location to location.

Where you live will have the biggest impact on the size of your Redfin commission refund. For example, here’s the refund you might expect to receive for a $350,000 home in three different cities.

| Location | Estimated savings* | Actual rebate % |

|---|---|---|

| New York City | $210 | 0.06% |

| Los Angeles | $630 | 0.18% |

| Atlanta, GA | $1,050 | 0.3% |

No matter where you live, Redfin’s refund is quite a bit lower than its competitors. Other regional options, such as Homie or SimpleShowing, advertise refunds as high as 1–1.5%.

Because Redfin’s methodology isn’t clear, it’s tough to make blanket statements about its refund program. You’ll need to go to Redfin’s website and look at specific homes in your area — then compare against the rates from other programs — to determine whether it’s right for you.

You might find a home in your area that’s offering a highly competitive refund — and in that case, we say go for it! But there’s a good chance that Redfin’s rates aren’t competitive, and most buyers will find better value elsewhere.

📢 How to negotiate realtor fees

You probably won’t be able to negotiate the Redfin Refund. While realtor commission and buyer rebates are technically negotiable, the reality is that Redfin is a national company with a set pricing structure, so it’s unlikely it’ll be willing to negotiate with individual customers. You’ll likely have a better chance negotiating with a local realtor.

» MORE: How to negotiate your real estate commission and save

How to find the Redfin Refund amount for a house

To see which homes are eligible for the Redfin Refund — and to estimate how much you could save on your purchase — you’ll need to examine individual listings on Redfin’s website.

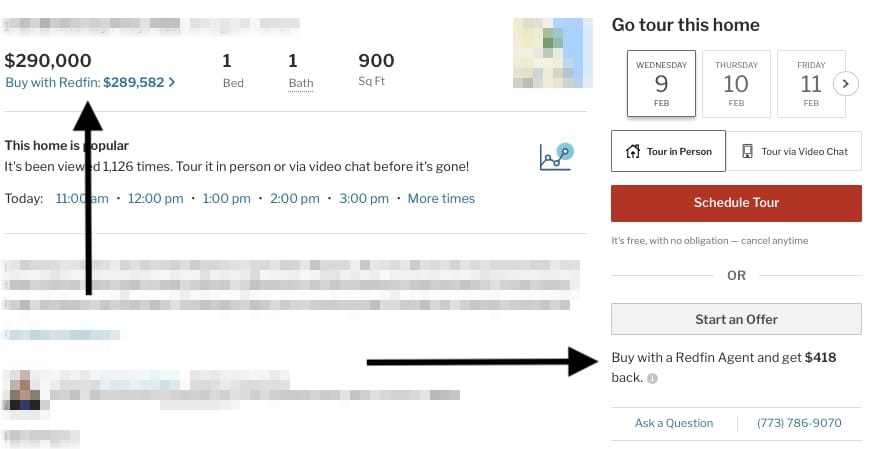

Once you find a home that interests you, look for a “Buy with Redfin” link right below the sale price on the listing. If there’s no “Buy with Redfin” link, the home may not be eligible for a refund.

On eligible homes, you can see the estimated rebate on the right-hand side. You can also click on the “Buy with Redfin” link, and a pop-up window will show you how much the refund is for that particular home.

🏗 Note: New construction properties don’t display a rebate on Redfin’s website — even if they’re eligible. You’ll need to contact a Redfin agent to find out which new construction properties offer a rebate.

How the Redfin Refund works

When you purchase a property that’s eligible for a Redfin Refund, your Redfin agent will share part of the commission they receive from the seller with you.

How to qualify for a Redfin rebate

To qualify for the Redfin Refund, you must:

- Work with a Redfin agent

- Purchase an eligible property in an area where the refund is available

- Receive approval from your lender

Lender approval and what it means for buyer rebates

Most home buyer rebates require lender approval — and sometimes, lenders can even dictate how you spend the rebate.

Lender approval is necessary because the IRS considers a buyer rebate an adjustment to the purchase price of your home. In other words, a rebate lowers the actual purchase price of your home. Mortgage lenders use the purchase price of your home to calculate your initial loan terms. In some cases, getting a rebate could affect your eligibility for a loan.

If you fail to disclose a rebate to your lender before closing on your home, it could result in your financing falling through or even mortgage fraud. Make sure to ask your loan officer early in the process about their policy on rebates and how it could impact your loan.

Is there a catch to buying with Redfin?

Redfin’s buyer rebate is legitimate. However, when you buy with Redfin, you’ll likely be responsible for picking out homes to tour, and different agents will likely show the homes to you.

If you have a good idea of the type of home you want, and you don’t mind doing more of the legwork yourself, Redfin could be a good choice. But it may not be a good idea if you’re a first-time home buyer, you’re moving to an unfamiliar area, or you prefer more hands-on support from your agent.

Buyers who want to find a home without sacrificing the service and support of a traditional agent may find our free agent-matching service a better option than Redfin. We match you with top agents from local brokerages, and you can interview as many agents as you want until you find the right fit. Eligible buyers can also receive cash back after closing.

🔍 Find top buyer’s agents near me!

When and how will I get the Redfin Refund?

Most of the time, Redfin will automatically apply your rebate to your closing costs. If there’s anything left over, it’ll send you a check after closing — usually within 7–10 days from the close of escrow.

If you’re counting on the refund to cover your closing or moving costs, discuss exact time frames with your Redfin agent up front.

If you’d rather receive your rebate as cash back instead of a closing credit, you’ll need to talk to your agent up front. Redfin claims it will work with sellers to figure out the best way to distribute the refund — but it doesn’t guarantee approval.

FAQ about Redfin rebates

Is the Redfin Refund worth it?

The Redfin Refund may be worth considering if you're already planning to sell your current house with a Redfin agent. But most home buyers will find bigger savings and comparable service with another company. Compare the Redfin Refund against other home buyer rebate programs to find the best fit for you!

Does Redfin have the best home buyer rebate?

No, Redfin does not have the best home buyer rebate. Although Redfin offers more savings than a traditional agent, its average buyer rebate is much smaller than most of its competitors. See which brokerage offers the best home buyer rebate near you!

Is the Redfin rebate taxable?

No, the Redfin rebate is not taxable. The IRS has ruled that home rebates are not taxable income. They're just considered a reduction in your home's overall cost. If your agent mistakenly sends you a 1099-MISC form, ask them to issue a corrected form or attach a statement to your annual tax return explaining the situation.

Do Redfin agents give cash back?

Yes, Redfin agents can offer cash back on eligible purchases, but you'll need to request it up front. If you don't specifically request cash back, Redfin will apply your rebate directly to your closing costs. Learn more about how much you can save with the Redfin Refund.

Methodology

We determined Redfin’s average rebate amount using data from 73 Redfin listings over 10 different locations (New York City, Los Angeles, Chicago, Dallas, Houston, Philadelphia, Miami, Atlanta, Boston, and Washington, DC) and eight price points ($100,000–900,000). We also consulted with real estate data analyst Trent Seigfried to verify the accuracy of our calculations.

Related links

If you’re interested in learning more about buying a home, here are some additional resources.

Here’s How to Get a Home Buyer Rebate (And Save Thousands): What is a home buyer rebate? And what are the top companies that offer rebates to buyers? Learn more and find the best company near you in this complete guide!

What Is a Buyer’s Agent and What Do They Do for Home Buyers? A buyer’s agent is a real estate agent who represents the buyer throughout the real estate process. Learn more about the best way to find and use a buyer’s agent.

Millennial Home Buyer Report (2023 Data): We surveyed 1,000 millennials who were looking to buy a home in the next year to discover the latest trends in homeownership — including the risks they’re willing to take.

How to Find a Real Estate Agent: What You NEED to Know: It can be overwhelming to search for a real estate agent when there are so many options. Here’s a guide to what you should focus on when you’re searching for the right agent.

Leave a Reply