Published

Looking to sell a house fast in New Jersey but need help understanding the process? Our step-by-step guide breaks it down from start to finish.

We discuss your options for selling a home fast in NJ, how to find and choose the best real estate agent, list your home for sale, negotiate with buyers, sign paperwork, and close.

Here’s our guide to help you better understand and navigate the New Jersey home sale process.

Looking to save on your New Jersey home sale? We pre-negotiate lower listing commission rates for you. Sellers who use our service pay a 1.5% listing agent commission rate, or $3,000, compared to the New Jersey average rate of 2.99%.

Steps to sell a house fast in New Jersey

- Decide how you plan to sell

- Sign a listing agreement

- Determine a list price

- Prepare to list your house

- Market and show your house

- Negotiate with buyers

- Review paperwork and sign

- Conduct inspections

- Close on your sale

1. Decide how to sell

Should you sell your home with an agent, for sale by owner, or to a cash buyer? Here’s how to decide.

Option 1. Sell with a real estate agent

Hiring an experienced, licensed New Jersey realtor is the best way to get a fair price for your home.

Quality and price vary by agent, so you’ll need to do some research to find the best fit for you.

We recommend finding at least 2-3 local seller agents to compare and choose from. Comparing options helps you find the best fit for your situation and could save you thousands on realtor commissions.

To save the most time and money, stick to sources that make it easy to find quality options.

Agent matching services

Agent matching services provide the best way to connect to experienced, local real estate agents, and to achieve commission savings.

How it works: You provide basic info about your home and what you’re looking for in an agent. The service quickly matches you up with top New Jersey real estate agents from top brokerages (like Coldwell Banker, Keller Williams, RE/MAX, and Weichert Realtors.)

Some agent matching services can also potentially save you money on realtor commissions, with no hidden fees.

For example, we pre-negotiate a flat $3,000 or 1.5% listing fee with our network of top agents. That’s much lower than the average New Jersey listing agent commission of 2.59%.

How to compare agents

After finding several top-rated agents to compare, it’s time to set up interviews, meet with agents, and choose one to work with.

We recommend comparing agents’ experience, customer reviews, marketing skills, and commission rate before choosing one.

Option 2. Sell FSBO

Selling your home without an agent may save you on listing agent fees (averaging 2.59% of the home sale price in New Jersey.) So, you’d potentially save close to $13,000 on a $500,000 sale price.

However, if your goal is to sell fast and hassle-free, FSBO probably isn’t your best bet. Selling a house can be a long, stressful process, with a ton of paperwork and legal requirements.

Here are some potential pitfalls:

- You risk costly mistakes during the process. Real estate professionals can help you avoid common mistakes made by FSBOs in the home selling process, like mispricing your listing or missing important paperwork.

- It’s time-consuming. You probably won’t sell your house fast. You’ll need to handle all of the work that your agent would take care of. This includes photography and marketing, buyer showings, contract negotiations, and closing.

- You’ll still likely owe a buyer’s agent commission, which ranges from 2% to 3% of your home’s final sale price.

- There’s no guarantee you’ll save money. Studies show that FSBO properties sell for 6% less than agent-sold homes, or $30,000 less than a $500,000 home. That negates any commission savings you’d earn from selling FSBO.

Still set on FSBO? Check out our guide to selling without a realtor in New Jersey.

Option 3. Sell a house fast to a cash buyer

Your final option: sell your New Jersey house ASAP to a cash home buyer, cash home buying company or “real estate solutions company.”

This is probably your fastest, most convenient option. You can get a near-instant cash offer from an iBuyer company, which can buy houses as is, in as fast as 10 days – much quicker than selling traditionally (60-90 days).

It’s convenient, too. You can sell your New Jersey home in as-is condition, with no pre-listing repairs or improvements required. And there are zero real estate agent commissions to pay.

How it works: Find an iBuyer or cash home buyer. Then fill out a form with your property address and contact information, schedule a day for the company to come to see your house, and get an offer.

So, what’s the catch? You probably won’t get a fair cash offer or make as much money compared to a traditional sale. Cash buyers typically offer between 50%-70% of a home’s market value.

Need to sell a house fast in NJ? Next steps

- Check out the best iBuyer companies, which pay cash and can close in as fast as 10 days.

- Read our advice on how to sell your house fast without losing money.

- Research top NJ cash buyer companies, like We Buy Ugly Houses and HomeVestors.

2. Sign a New Jersey listing agreement and seller disclosures

If you’re working with an agent, you’ll need to read and sign an NJ listing agreement to get the process started.

The listing agreement details important information about your home sale. Key things to pay attention to include:

- Type of listing agreement. Single agency (most common) means the agent works solely for you and gets paid when the home sale closes.

- Listing commission rate. Make sure the agent’s stated commission rate matches up to what’s on the listing agreement.

- Items that convey with the property. Write down what items or belonging you intend to keep (like appliances, blinds, and light fixtures).

New Jersey agency disclosure requirements

State law also requires agents to provide you with an agency disclosure form, which describes all of the agent’s legal duties to you.

New Jersey has two types of real estate agency agreements:

- Single-agent relationship. The agent or broker represents only one party (either the buyer or seller) and acts as a fiduciary. Brokers usually recommend their clients work under a single agent relationship compared to other options, as it gives their clients the most protection.

- Transaction broker relationship. The agent or broker provides limited representation to a buyer, seller, or both parties in a transaction, and does not act as a fiduciary (meaning they don’t have to act in your best interests).

Note: Dual agency is legal in NJ, which means the agent (or brokerage firm) can represent both you and the buyer in the same transaction while also acting as a fiduciary for both parties.

Dual agency might happen if your listing agent brings a buyer to the table. Some brokerages are less ethical than others in managing this potential conflict of interest, so be careful about agreeing to a dual agency situation.

Contact a local real estate attorney for more advice on NJ listing agreements and required disclosures.

What do New Jersey sellers need to disclose?

Here’s the first page of the standard Seller’s Property Condition Disclosure Statement offered by New Jersey Realtors:

New Jersey sellers are not legally required to fill out a seller’s property disclosure form or a flood disclosure. But you must still notify buyers about any defects that may affect the value of the home or the buyer’s readiness to purchase it.

In New Jersey, the disclosure of material defects on a property should be made prior to executing a contract.

Ask a real estate professional about what they recommend you disclose to home buyers, and how to do so.

Can I sell a house “as-is” in New Jersey?

Yes, as-is home sales are legal in New Jersey. Here’s the relevant language from a standard sales contract:

However, an as-is sale doesn’t exempt you from disclosing any of your home’s known material defects and fulfilling your other contractual obligations.

Federal law also requires New Jersey homeowners to fill out a lead-based paint form on homes built before 1978.

3. Price your home

Your next step is to determine a competitive listing price for your home.

If you’re working with an agent, they’ll provide you with a comparative market analysis (CMA) report. A CMA provides an estimate of your home’s fair value, based on its condition, upgrades, and what similar homes have recently sold for in your area.

Are you selling FSBO? It might be a good idea to get a broker’s price opinion (BPO) for a professional pricing recommendation. A BPO is similar to a CMA, but you have to pay for it if you’re not using an agent.

Pricing your home accurately is crucial. Here are the potential risks and benefits of listing at a high or a low price point:

- Listing at a higher price tends to lead to fewer showings and offers (it could price out or turn off potential buyers.)

- Listing at a lower price should lead to more showings and offers (and could spark a bidding war). But you can also get an offer below your desired sale price.

- Your agent should advise you on the best pricing strategy for your home based on its fair market value, and your goals.

» Get a CMA: Request a free CMA from a New Jersey real estate agent

Should I just get a pre-listing appraisal instead?

Appraisals are usually completed by buyers before closing. But NJ homeowners can technically get a pre-listing appraisal for another pro opinion.

However, appraisals aren’t cheap (they cost roughly $500 in New Jersey), and can be time-consuming (1-2 weeks to complete), so it needs to fit within your budget and timeframe.

Another risk: there’s no guarantee your home value will come in higher with an appraisal compared to your agent’s CMA.

If you’re set on selling your home without an agent, we strongly advise you against using home value websites, like Zillow or Realtor, to price your home. Home value websites provide a rough estimate of your home’s potential value and can be off by tens of thousands of dollars.

4. Prepare your home for sale

Now it’s time to get your home ready for showings!

Gather important documents

New Jersey home sales require a variety of documents and records for closing.

Collect as many required documents as you can before your home even hits the market, including:

- Mortgage payoff statement.

- Original sales contract.

- Property survey.

- Flood zone statement.

- Homeowners Association (HOA) forms and guidelines.

It’s also a good idea to gather utility bills, and any home warranties or appliance manuals you might have, in case buyers request them.

Get a pre-listing inspection

A pre-listing home inspection can help you spot issues with your home that could potentially delay (or derail) your sale.

The cost of a home inspection varies widely in New Jersey, depending on the qualifications of the inspector, but generally ranges from $600-$2,000.

An experienced real estate agent should advise you on whether or not a pre-listing inspection is worth the time and money.

Make home repairs and improvements

Based on the results of a pre-listing inspection (and the condition of your home), it could be worth making certain repairs or improvements.

According to real estate agent Matthew Tully, common home inspection issues in New Jersey are related to:

- Cracks in foundation

- Bad roofs or water intrusion from roofs

- Mold buildup in attics

- Flooding or moisture issues in basements

- Radon (levels above 4 picocuries per liter are considered hazardous)

Your agent is in the best position to advise you on which repairs or improvements to make before listing.

Declutter, depersonalize, and clean

Your home doesn’t have to be spotless! But pay careful attention to areas where buyers will notice dirty areas the most, like your kitchen and bathrooms.

Try to depersonalize every room, removing family photos, artwork, and posters — it’s best to keep buyers’ attention on your home during showings.

Finally, look to declutter as much as possible. In particular, your hallways should be clear of any objects, so buyers can easily walk through your home. Consider holding a garage sale, or donating any unused or unwanted items.

Consider home staging

Staging can increase your home’s appeal and lead to a higher sale price, but it’s pricy and may not be necessary.

Home staging costs between $2,500 to $5,000 or more in New Jersey. Actual pricing depends on factors like the size of your home and the number of rooms staged.

Tully advises against home staging at present, saying it’s unnecessary in New Jersey’s hot real estate market. Consult with your realtor for advice on whether or not it’s right for you.

New Jersey home sale calculator

Here’s a calculator to show you what you might earn in a home sale after deducting typical home sale costs, including realtor commission and closing costs.

Realtor commission: New Jersey sellers pay an average realtor commission rate of 5.18%, which is usually split evenly by the listing agent and the buyer’s agent.

While that’s the average rate, you can potentially save thousands by using our agent matching service or negotiating a lower rate with agents.

Closing costs: Sellers pay an average of 1.6% of the home sale in closing costs, which includes common costs in the state, like title service and closing fees, transfer tax, and recording fees.

Mortgage/liens: What you might owe on outstanding mortgage or liens; it’s paid in full at closing by your attorney or title company.

Net proceeds: The amount of money you’d walk away with from your home sale at various price points after deducting commission, closing costs, and mortgages.

» LEARN: Average cost to sell a house in New Jersey

5. Market and show your home to buyers

Now it’s time to actually list your home and host potential buyers!

If you’re using a listing agent, they’ll put a “for sale” sign on your front lawn and post your home for sale on the multiple listing service (MLS): a database most real estate agents use to market and sell properties.

Your agent should also list your home on all popular real estate sites (like Zillow, Trulia, and Realtor), and they might also host an open house to drum up more interest.

If you’re selling for sale by owner, you might want to list your home on the MLS via a flat-fee MLS service, so it reaches buyers’ agents and their clients.

My listing is live: What happens next?

Listing your home for sale can be both exciting and nerve-racking! Here’s what to do next:

Secure your pets

Will you keep your dogs and cats in the backyard or garage during showings, or take them with you? It’s your call!

If you plan to keep pets in your home for showings, you’ll probably need to let buyers know where they’ll be hanging out.

Check out your online listing

Make sure you like all of the photos you or your agent have posted online!

Double-check your listing description. It should describe all of your home’s main features and selling points, and have good grammar and punctuation.

Consider posting your listing on social media. Get the word out to family and friends, and consider sharing the listing on local Facebook groups.

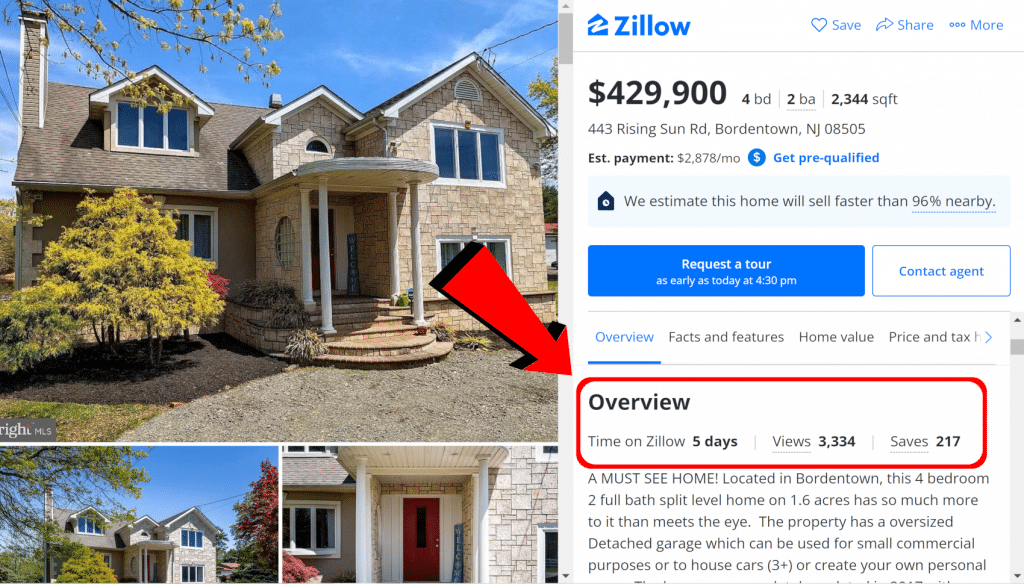

Keep an eye on your listing activity. Check how many people have viewed and saved your listing on Zillow and compare that to other local listings to see how it’s performing.

This information can be found under “overview” on your listing’s Zillow page (example below).

What should I know about home showings?

You may get buyer feedback from buyers through the ShowingTime app, via email, or from your agent. Feedback can provide valuable insights into your home’s price and condition from the buyer’s perspective.

However, buyer feedback isn’t always positive. Buyers may point out what they didn’t like about your home, what your home lacks, and if they think your home is overpriced.

Try to take their feedback to heart: if multiple buyers offer the same feedback, you might be able to use the feedback to improve your listing

6. Negotiate with buyers

Hopefully, you’ve received multiple offers within just a few days or weeks of going live!

The offer should contain the buyer’s offer price, if they’re asking you to pay for any of their closing costs, the type of financing used, an estimated closing date, and an offer expiry date.

There are three ways sellers and their listing agent can respond to a buyer’s offer:

- Accept the offer. If the offer has everything you’re looking for — price, terms, and timing all look great — then you might just want to accept it without countering, especially if no other offers are on the table.

- Counter the offer. Most of the details of an offer to purchase your home are negotiable, including the home’s sale price and closing date. It could make sense to counter an offer if you’re confident you’d receive another good one if the buyer declines it.

- Ignore the offer. There’s no need to respond to a lowball offer or one that doesn’t meet any of your criteria — especially if you have stronger offers on the table (or you’re confident others will come in.

Remember, if you counter an offer and the buyer accepts it, you’re technically under contract.

How long does it take to sell a Jersey house?

Timing depends mainly on your home’s desirability, and how well you’ve priced your home (higher-priced homes often take longer to sell).

Houses in New Jersey took an average of 76 days to sell in 2021, slightly less than the national average of 78 days, according to Realtor.com data. That included 41 days to get an offer plus the typical 35-day closing period.

More recent figures from Realtor.com show that homes in New Jersey spent a median of 54 to 78 days on the market in the state’s five largest cities.

| City | Median days on market |

|---|---|

| Toms River | 54 |

| Elizabeth | 63 |

| Jersey City | 68 |

| Newark | 75 |

| Paterson | 78 |

Talk with your agent to discuss expectations on when you might receive an acceptable offer after going live.

Price is important, but it’s not everything!

The highest sale price offer is not always the best offer you’ll receive. Besides price, other factors to consider include:

- Buyer closing costs: Is the buyer asking you to cover part or all of their closing costs? This will impact your total net proceeds at closing, so run the numbers carefully (and ask your agent for an updated net sheet).

- Earnest money: Earnest money is usually between 1% to 3% of the home’s purchase price. A larger earnest money deposit gives the buyer more “skin in the game,” meaning they have more to potentially lose by backing out of the deal.

- Timing of sale: Is the buyer willing and able to close on the sale within your desired timeframe?

- Home sale contingency: Does the buyer need to sell a house in order to buy yours? It might not be worth the risk of the buyer’s other sale not closing — especially if you have stronger offers on the table.

Your realtor is in the best position to advise you on how to compare offers and negotiate with buyers.

7. Review paperwork and sign an offer

Once you’ve decided to accept an offer and you’ve talked it through with your agent, it’s time to review the contract and sign!

Once all parties have signed, your home is under contract and you’re just a month or two away from closing on the sale.

Nationwide, it takes an average of 57 days to close on a home purchase, according to Ellie Mae’s 2021 origination insight report. That figure varies according to the market and the details of the sale, but in New Jersey, closings are often scheduled for 30 to 45 days after the sale agreement has been signed.

What’s in a New Jersey purchase and sale agreement?

The complete form is available on the New Jersey Realtors website, but you need to be a member of the association to log in. A watermarked version is also available.

Here are some key items the buyer’s offer to purchase form should contain:

- Basic details: The buyer and seller’s full legal names, and your home’s address

- Purchase price: How much the buyer is offering to purchase your home, including the initial deposit, additional deposit, mortgage, and balance of the purchase price

- Manner and date of payment: Who receives the initial deposit (listing broker, participating broker, buyer’s attorney, title company, or other) and when it will be paid

- Additional deposit and escrow details

- Financing information: Principal amount, and what loan type the buyer is using to finance the purchase (VA, FHA, section 203(k), conventional, or other)

- Items included in sale: Specifies various items that are included in the property, such as fixtures, and states that all appliances are in working order

- Adjustments at closing: Specifies the costs that the seller agrees to pay, such as preparation of the deed, realty transfer fee, lien discharge fee, and half of the title company charges

8. Conduct inspections, appraisals, and closing walk-through

Home inspection

New Jersey contracts typically provide buyers with a 5- to 14-day inspection contingency or “due diligence” period, during which time they can conduct a home inspection.

Don’t worry: this step is a totally normal part of the home sale process. In fact, the vast majority of home buyers (87%) have a home inspection contingency nationwide.

A home inspection is a limited, “non-invasive” visual inspection of the home, which means the home inspector can’t move any objects in your home to complete their inspection.

Sellers usually don’t get to see the buyer’s home inspection report. But the buyer might ask you to fix any defects or serious issues discovered in the inspection (or negotiate a lower price or closing credit).

Check with your agent to learn what you’re obligated to fix and the best way to move forward following the home inspection.

Termite inspection

Termites are active across New Jersey, and a termite inspection and Wood Destroying Insect Report (WDIR) are mandatory for home purchases involving a mortgage or VA loan.

Depending on your sale contract, you may or may not be on the hook for the cost of a termite inspection (typically $100—$250), so check with your agent for more information.

Appraisal

Lenders often require buyers to get an appraisal to determine the home’s fair market value and to be certain that the home is worth its purchase price.

The appraiser visits your home to take interior and exterior photos, and notes any features or upgrades that may add value. They compare your home to recent sales in your area, using this information to generate an opinion of value.

You’ll get notified if your home’s appraised value comes in lower than the buyer’s purchase price — in which case you may have to re-negotiate the price with the buyer. Talk to your agent for advice on dealing with a low appraisal.

» MORE: How do appraisals work?

Final walk-through

The buyer may have the opportunity to do a walk-through of the home a day or two before closing, just to make sure the home is in the same condition since its last viewing.

Here’s what you need to do before their walk-through:

- Clear out your house entirely if you haven’t yet, removing all personal belongings.

- Repair or patch any damaged drywall, paint, or nail holes that might have occurred when you moved out of the home.

- Make sure items included in the sale contract are still there (appliances, light fixtures, etc).

- Do some light cleaning if the home is dirty.

9. Close on your home sale

You’re almost at the finish line! Here’s what to do in the days leading up to your scheduled closing.

- Look out for a closing disclosure: You’ll likely need to sign this form two to three days before closing. It contains every cost to be paid by the buyer and seller and your estimated net proceeds. Double-check all the numbers with your agent, and speak up if the numbers don’t look right.

- Clear out your house entirely: Your home should be completely empty before the buyer’s scheduled closing walk-through. It’s a good idea to do another walk-through yourself before then just in case you missed something.

- Hand the keys to your agent: Your realtor will likely need your house keys and garage door openers to hand over to the buyer’s agent, so the buyer can gain access to the home.

- Find out when and where the closing is scheduled: Most of the paperwork has already been completed on your end. Ask your agent if you need to attend your closing in person, if you can sign any remaining paperwork digitally, or if you need to give your agent power of attorney to close.

- Keep in touch: Buyer closings get delayed quite frequently (there are a lot of moving parts in a real estate transaction), so don’t be surprised if the closing doesn’t happen exactly at its scheduled time. Your agent should keep you updated on closing status 24/7.

💰Final step: It’s time to get paid!

Congratulations! Once you and the buyer have signed all documents, you’ve closed on your home sale.

The home’s sale price will be used to pay out the realtor commissions, and closing costs, and cover any outstanding mortgages or liens owed on the property.

Your net proceeds can usually be wired to your bank account after closing. Contact your agent, attorney, or title company for more details on how and when you’ll get paid.

Next steps after closing

While your home sale is technically complete, there are a few things you might want to do after closing.

Save your home sale documents. It’s best to have both physical and digital copies of the home sale contract for your taxes, and personal records, in case any issues come up after closing.

Calculate your potential capital gains tax. You may or may not owe tax on the sale of your home, depending on how much your home rose in value since you bought it.

The IRS excludes home sale gains of up to $250,000 for an individual and $500,000 for a married couple who have lived in and owned a home for at least two of the last five years.

Contact your tax advisor for more guidance on capital gains tax and if you’ll owe anything.

Notify the U.S. Postal Service and DMV. You may want to set up mail forwarding to your new address via the USPS website (it costs $1.10 to do so).

If you’re staying in-state, the New Jersey DMV also requires residents to update their driver’s license and title/registration within 30 days of changing an address.

If you’re moving out of state, you must surrender any inactive license plates. You can return your plates at any Motor Vehicle Commission (MVC) location.

Consider showing your agent some love: Did your agent do a great job? Take it from us: they’d be thrilled if you left them a positive Zillow review, and referred them to family and friends who are interested in buying or selling a home.

FAQ about selling a home fast in New Jersey

I need to sell my house fast. What is the fastest way to sell a house in New Jersey?

Finding a cash buyer is generally the fastest and most convenient way to sell a house in New Jersey. You can sell your house as-is, get a near-immediate cash offer from an iBuyer company, and close in as soon as 10 days. You just need to find a cash buyer, provide your property address and contact information, schedule a meeting, and get a free cash offer. The catch is that cash buyers typically offer between 50% to 70% of a home's market value.

Another option is to sell with an experienced, licensed New Jersey realtor. You'll probably pocket a lot more money than by selling to a cash buyer, but it will take longer (New Jersey homes take an average of 76 days to sell, including the closing period).

Selling for sale by owner (FSBO) will take you the longest. You'll save on listing agent commission, but it can be a lengthy, stressful process.

Can you sell a home in New Jersey without a realtor?

Yes, you can sell for-sale by owner in New Jersey to avoid paying a listing commission of around 2.6%. But you'll need to complete every task an agent would handle, including advertising your home, filling out all of the required paperwork, negotiating with buyers, and closing.

FSBO in New Jersey likely works best for experienced sellers, or if you're planning to sell to someone close to you (such as family or friends) and have assistance from a local real estate attorney to handle all of the paperwork and legal requirements.

If you're trying to save money on your home sale, you likely have lower-risk options, such as a 1% commission realtor or brokerage.

What documents are needed to sell a house in New Jersey?

There are many documents needed to close on a home sale in New Jersey. They include, but are not limited to:

- A fully executed New Jersey residential sales contract

- Deed

- Agreement related to property taxes

- Title insurance documents

- Seller affidavit

- Closing disclosure

- Seller's property disclosure (if applicable)

Check with a local real estate professional for more advice on what legal documents you'll need to close on your home sale.

How do I avoid capital gains tax on a NJ home sale?

You can likely avoid paying real estate capital gains tax in New Jersey. if you’ve owned and lived in your house for more than 2 of the past 5 years, the first $250,000 of the profit on your home sale is tax-free. And if you're married and file your taxes jointly, the first $500,000 of your profit is tax-free. You can also deduct certain repairs and improvements to reduce your cost basis. Learn more about how to avoid capital gains tax when selling a house, and reach out to a tax professional for more advice.

Why you should trust us

Our mission is to provide accurate, actionable, and practical information you can use to make better decisions on your real estate journey.

To help create this New Jersey home selling guide, we pulled information from the following sources:

- National Association of Realtors (NAR) 2021 Home Buyers and Sellers Generational Trends report

- NAR’s 2021 Profile of Home Buyers and Sellers

- Realtor.com’s Spring 2022 Home Seller Report

- Real Estate Witch’s average real estate commission in New Jersey

- Redfin’s The Trials of a 2021 HomeBuyer

- New Jersey Realtors Association

- New Jersey seller’s property condition disclosure statement (2019)

We also interviewed New Jersey real estate agent Matthew Tully of RE/MAX Central, and we pulled data from Clever’s 2022 Role of the Realtor survey and the 2022 Average Commission Rates by State series.

About the authors

Greg Isaacson

I’m a real estate analyst and reporter based in Connecticut. I write articles and guides for Real Estate Witch and Clever Real Estate on a wide range of topics relating to buying and selling a home, with a focus on helping readers save money.

Previously, I authored over a thousand news articles for Commercial Property Executive, Multi-Housing News, and Mingtiandi, covering commercial and multifamily real estate deals and trends in the U.S. and Asia. I have also worked as a commercial real estate research analyst based in Chicago and overseas.

Steve Nicastro

I’m a real estate agent and investor based in Charleston, South Carolina.

While working as a full-time agent between 2020-21, I closed 19 transactions totaling $6 million in volume, assisting both buyers and sellers. As an investor, I own and manage 6 single-family rental properties, and I recently sold a home in North Carolina.

I’ve written dozens of articles and guides to educate homeowners on the home sale process. Before writing for Real Estate Witch, I spent more than 6 years on NerdWallet’s content team as a personal finance writer, where my work was published in USA Today, The Associated Press, and US News, among other publications.

Related links

How to Choose a Realtor: Expert Secrets. Learn how to vet agents, set up interviews, read and sign a buyer’s agency agreement or listing agreement, and pick the best realtor for you.

How to Sell Your House – The Ultimate Guide: Our guide breaks down the process of selling your house from start to finish, to educate you on the process and help prepare you for your big sale.

How to Sell a House Without a Realtor: If you know what you’re doing, you can cut out seller agent fees by listing your house “for sale by owner” (FSBO). Learn more now.

Cost to Sell a House in New Jersey – Seller Closing Costs and More: Our guide breaks down all of the costs of selling a home in New Jersey, including realtor commission, seller closing costs, and optional pre-sale expenses.

Clever Real Estate – Must-See Reviews: The Real Estate Witch team reviews the agent-matching service Clever Real Estate. Does its service actually save sellers $9,600 in commission fees, on average, as it claims?

Leave a Reply